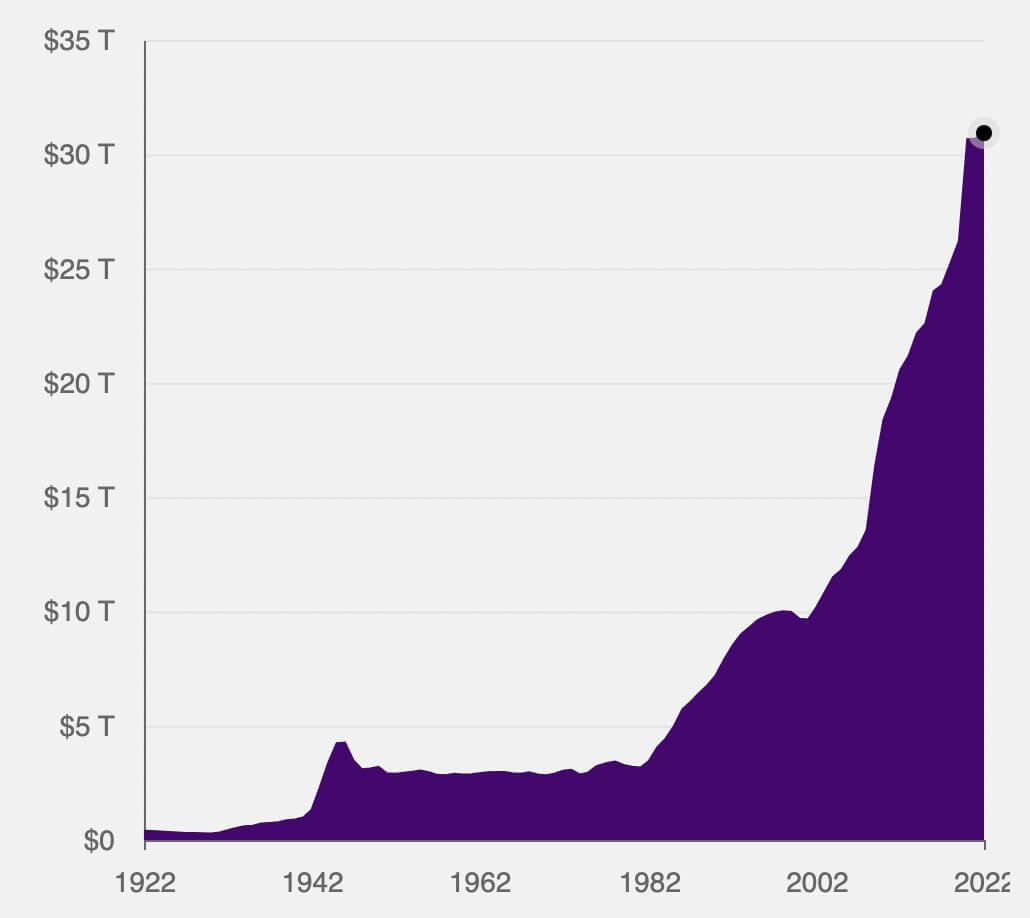

US debt surpasses $31 trillion

The U.S. national debt surpassed an all-time high of $31 trillion this month.

More than $11 trillion of debt has been added in the last decade alone, $5 trillion of which was a direct result of the debt disbursement initiated by the Biden administration in 2020.

$5 Trillion, According to the Board on a Responsible Federal Budget include With the $1.9 trillion stimulus package signed by President Biden, several new spending initiatives approved by Congress, and a student loan debt forgiveness plan, price About $400 billion.

Many economists argue that some debt is needed to stimulate growth, but current national debt exceeds all thresholds seen so far. The world’s leading economies are in deficit, with debt to GDP ratios currently at 137%. Her $31 trillion the US owes far more than her $25 trillion GDP this year.

Economists expect the budget deficit to rise over the next three years, despite government efforts to reduce the budget deficit in fiscal 2022. This is largely due to higher interest costs due to rising interest rates, which many believe will further increase the national debt.

When a significant portion of the debt matures, they will have to be replaced with additional borrowing, and interest rates will compound. If he replaced $31 trillion of debt with an interest rate of 3.2%, the interest burden would be $1 trillion a year.

Current economic conditions mean the US will need to borrow more money to pay back interest. The deficit will continue to rise as government spending is rapidly outstripping tax revenues. The economic decline heading into recession has already hit the market hard, wiping out billions of dollars in profits. Losses suffered by retail investors represent a reduction in capital gains taxes, and losses suffered by institutional investors reduce the overall amount of corporate tax collected by the government.

The problem started well before 2020, even though the COVID-19 pandemic has exacerbated it. Rising debt has hung on the US economy since the late 1990s and exploded in 2007 when the Great Financial Crisis began. Aggressive quantitative easing (QE) was needed to resolve the wreckage left by overleveraged financial institutions, laying a solid foundation for a new recession.