US economic indicators point towards contraction as unemployment stays at historic lows

Global Financial Crisis vs. 2023

It looks like the U.S. economy is starting to shrink. However, a recession is not on the horizon for the foreseeable future. Comparing recessions to past times may be true for human psychology, but it will definitely be different. But the Federal Reserve will most likely continue to raise rates until something serious happens.

We had the banking crisis, which is fundamentally different from 2008. In 2008, there were mortgage defaults, which had the knock-on effect of significantly lower home prices. At the same time, the bank had heavy losses on its balance sheet. The SVB was radically different, with depositors panicking about severe unrealized losses in Treasury portfolios.

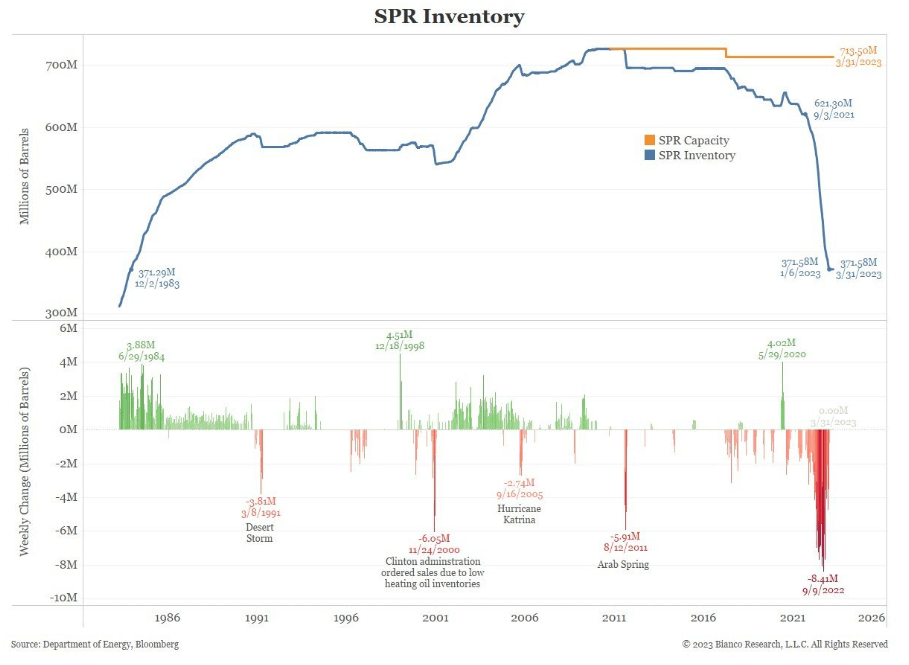

OPEC+

Earlier in the week, OPEC+ announced cuts of more than 1 million barrels per day from next month, and 2 million barrels per day from October. CryptoSlate analyzed the impact of these cuts. It’s not just this pure signal of demand collapse. And while it has lowered its strategic oil reserves, it has left the Biden administration in trouble by failing to increase reserves when prices rise above. Crude WTI (NYM$/bbl) he closed at $80 a barrel, but some analysts expected triple digits and he fell to $67.

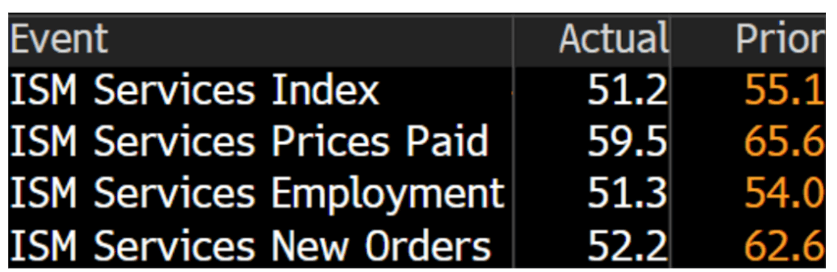

US manufacturing downturn

March’s ISM manufacturing survey continued its decline, staying within the contraction zone at 46.3, below expectations. Additionally, the JOLTS data printed 9.93 million versus the expected 10.5 million. This was the lowest since April 2021. All parts of his PMI in ISM services also continued to decline. New orders fell from 62.6 to 52.2.

Record-low unemployment rate

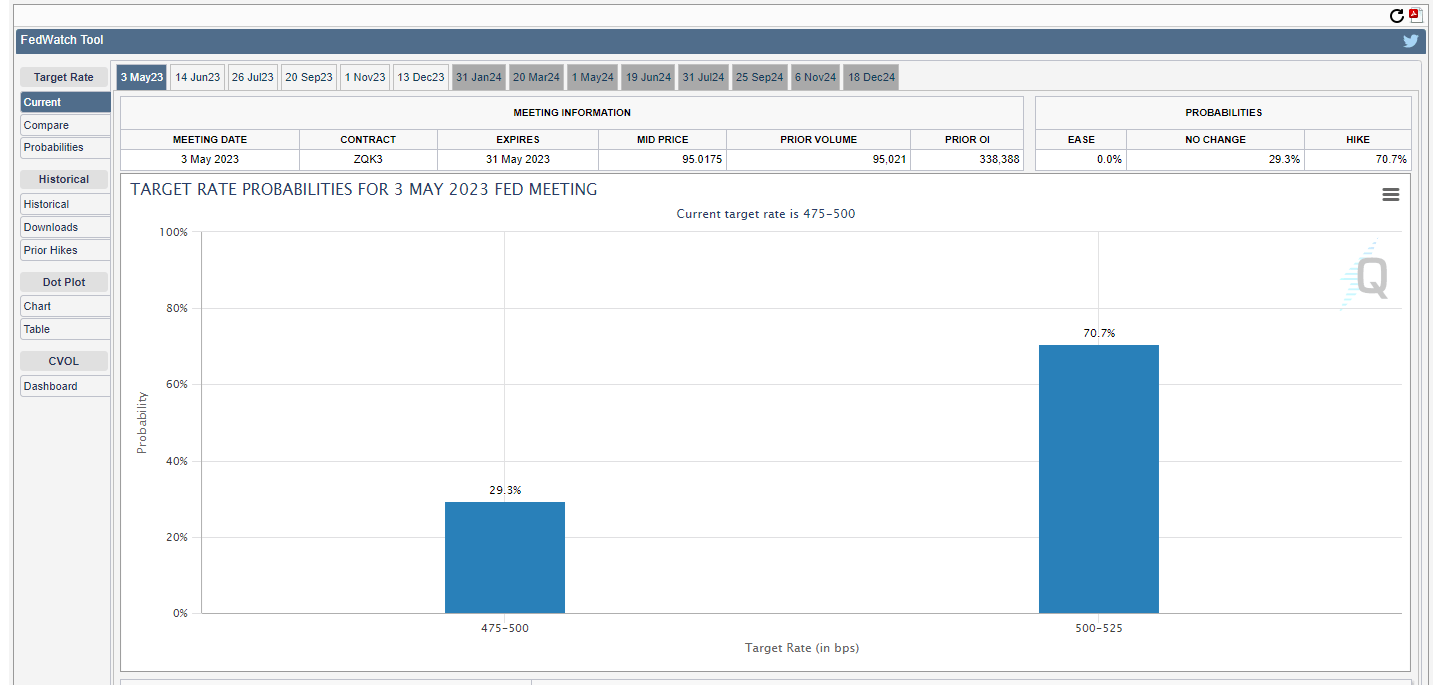

Surprisingly, the unemployment rate fell from 3.6% to 3.5%. At the same time, the U.S. Bureau of Labor Statistics Employment Report 236,000 Added non-farm jobs for the month of March. Economists had expected 239,000 jobs.

As a result, the odds of another 0.25 rate hike at the May FOMC meeting have reached 69%. This pushes the federal funds rate above 5%.

Federal Agency Balance Sheet Updates

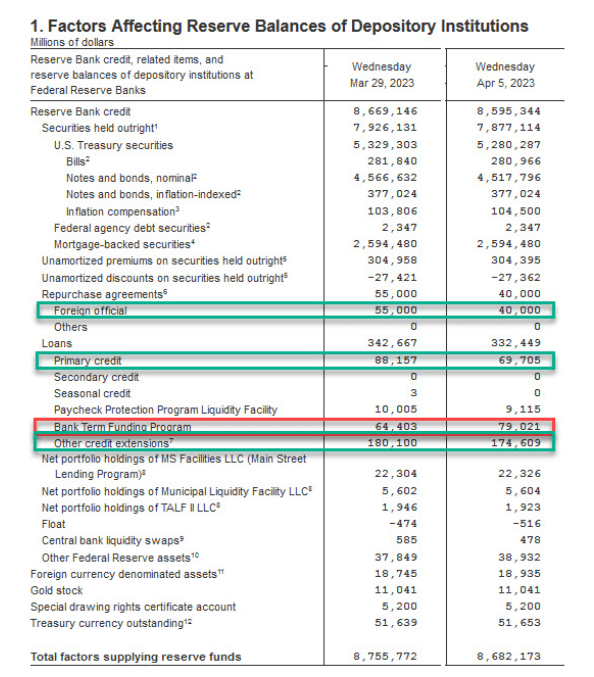

Thursday afternoon’s clock on the Federal Reserve’s balance sheet is now about to become the main event, with the Fed’s balance sheet down $74 billion this week and nearly $100 billion in the past two weeks. The Federal Reserve’s balance sheet is now shrinking faster than it did before the SVB collapsed.

This points to a smaller number of banks and distressed assets requiring Fed assistance. In addition, BTFP loans increased from $64.4 billion to $79 billion as the use of the Federal Reserve discount window decreased from $88.2 billion to $69.7 billion.

It’s safe to say that this was not a round of quantitative easing, but a short-term emergency loan that would be repaid.

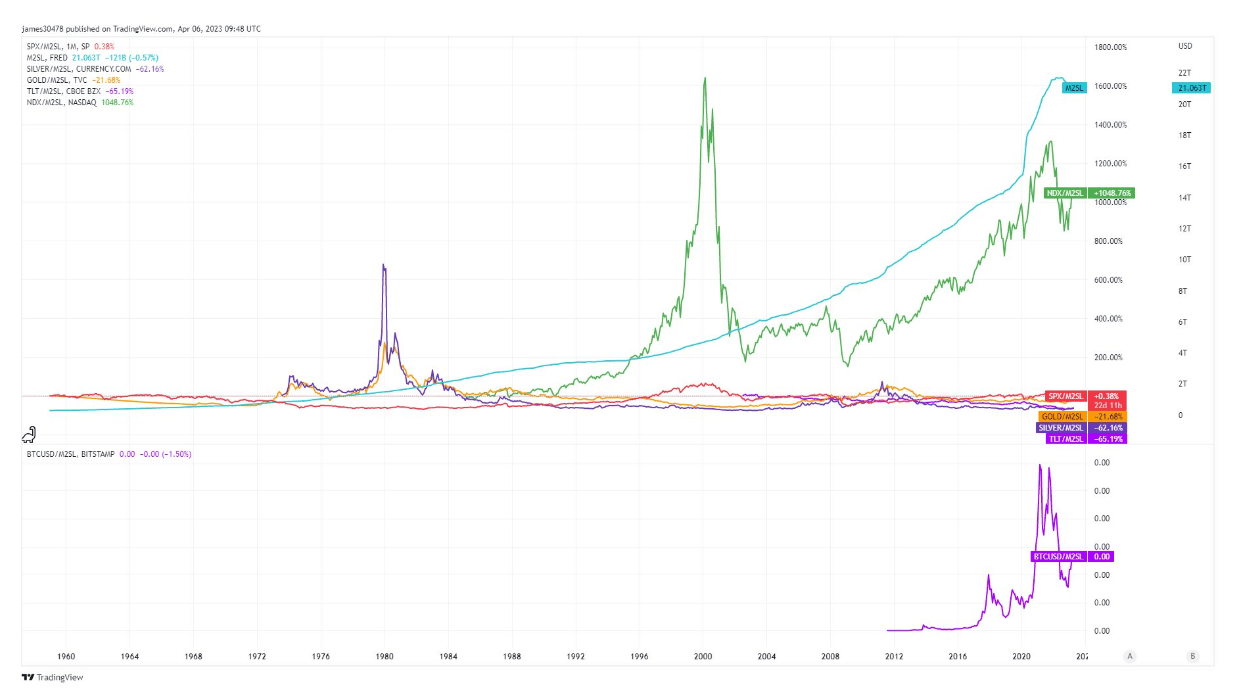

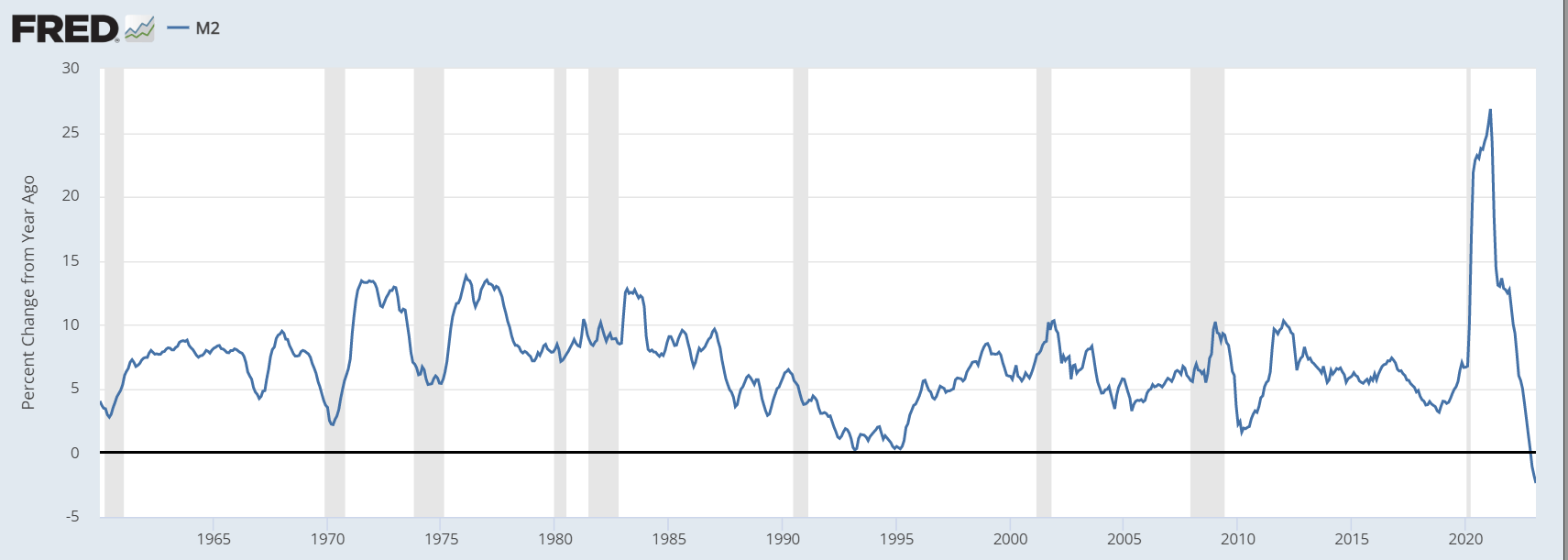

But the key issue here is quantitative tightening and the liquidity outflow from the system. We witnessed the fastest tightening cycle ever. The money supply, as measured by M2, fell 2.5% from last year, the sharpest deterioration since the 1929 Great Depression.

Even a small contraction in the money supply can cause major economic problems and lead to bank runs. You would think that banks would cut lending and start holding more cash, which could trigger a credit crunch. There is no doubt that lending standards will become stricter.

Bitcoin vs M2

In the short term, it is very difficult to give definitive answers about credit crunches, recessions and whether Bitcoin will exceed a certain price target. We favor Bitcoin because it is an asset that allows us to ignore everything and focus on the bigger task at hand. Assets without counterparty risk do not suffer from the potential for TradFi asset contagion.

The long game is that the money supply will continue to expand. The balance sheet expands and inevitably all assets bloat.

CryptoSlate analyzed major assets and the M2 money supply. It is clear that he is the only winner in this game. The illusion of printing money makes you think you are getting richer. However, in reality, you can’t even stay afloat.

Bitcoin remains the number one asset for preempting currency devaluations.