WBTC supply declined 15% in February

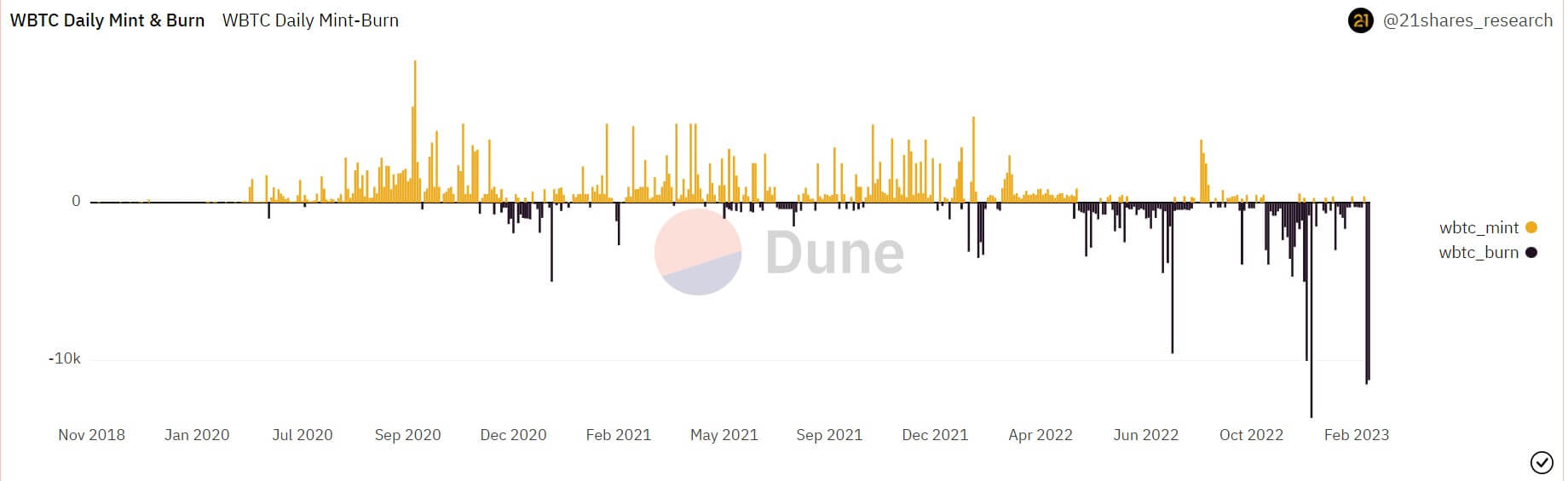

Wrapped Bitcoin (WBTC) supply on Ethereum fell by 23,384 — about 15% — to February 153,164 — Lowest level since March 2021according to the sand dune analytical data.

According to the asset’s order book, there were 10. transaction including WBTC — 8 were burns and the remaining 2 were cumulative mints of 798.72 WBTC by imToken.

Cryptocurrency lender Celsius bankruptcy — a major WBTC whale — was responsible for a large number of burns.office burnt 22,732 WBTC ($533 million over two days via FalconX).

The lender’s redemption is reminiscent of the burn recorded in December 2022, when the cryptocurrency market was still going strong from the FTX collapse.

At the time, there were concerns that the collapse of cryptocurrency exchanges would have a significant impact on WBTC reserves.

WBTC is an Ethereum-based token that reflects the price performance of Bitcoin and is pegged 1:1 with the flagship digital asset. WBTC gained popularity during the 2022 bull market when supply peaked at 285,000. At the time, BTC was trading around $48,000.

At WBTC’s current price, its market capitalization stands at $3.63 billion, a far cry from its peak of $13.03 billion. of crypto slate data.