What does retail investors aggressive Bitcoin purchase mean for the market?

Bitcoin (BTC) whales sale While retail investors are simultaneously accumulating coins throughout 2022, they are actively increasing their wealth.

Bitcoin whales are defined as holders of more than 1,000 BTC and retail traders are defined as holders of 1 BTC or less.

of crypto slate A previous study highlighted that retail investor BTC holdings doubled from 1.5 million to 3 million since 2018. Whales, on the other hand, have seen BTC holdings drop from around 10 million to 9 million within the same timeframe.

Is this bullish or bearish for the market?

Several market analysts have mixed views on what this means for Bitcoin. However, most agree that selling whales usually suggests a bearish signal for the price of BTC.

In most cases, the behavior of these holders has a large impact on the price. Since whales have the most supplies, dumping increases available supplies and indicates a decline in beliefs that may influence others to exit the position.

On the other hand, it also has its advantages. This is a more decentralized Bitcoin network. The more people who hold BTC, the more resistant the asset will be to whale investor actions.Martin Said This scenario would have been perfect, but it could take a long time to achieve.

Another analyst, Seth Michael Steele Said:

“Whales are selling, but retailers are buying!!! It looks backwards, but this is good for making more distributions among investors. Bitcoin Watching the shrimp pick up the whale’s slack is beautiful!

Meanwhile, recent selling and accumulation may indicate that Bitcoin is nearing the bottom of this bear market cycle. Usually when small entities are accumulating more actively than smaller entities, a bottom is approaching.

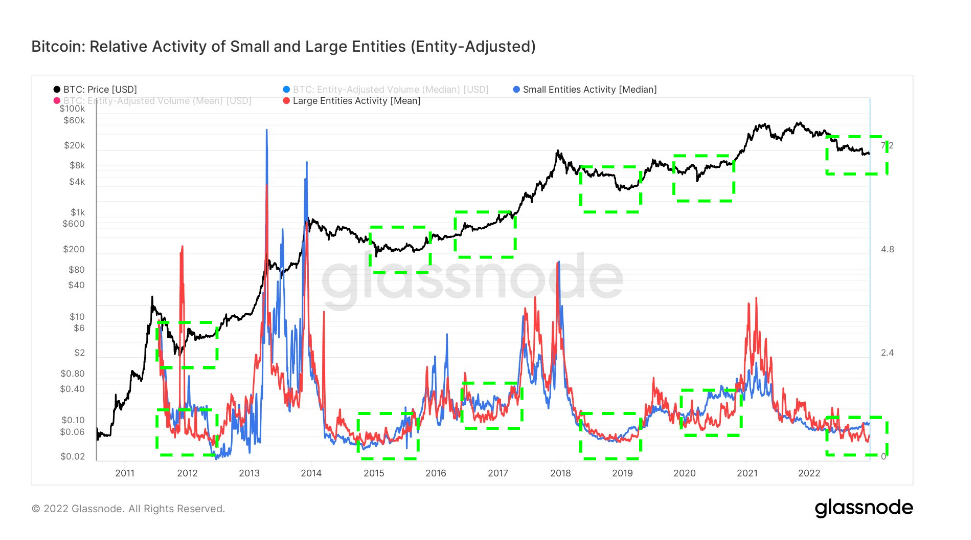

of crypto slate Glassnode’s analysis of the relative activity of small and large entities since 2012 showed that the market bottoms out whenever retail activity outstrips whale activity. took place in 2012, 2015, 2017, 2019 and 2020.

In all the cases highlighted, retail investor activity increased and marked the bottom of the market. The chart shows that the same pattern has started repeating in 2022.