What’s changed in GameFi in the last month?

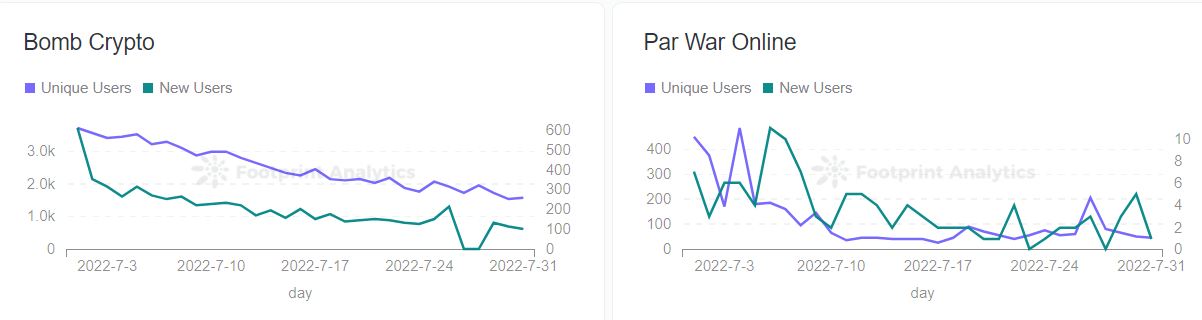

During the previous bull market, hundreds of games were launched to play and earn money, but as the market declined, only a few were able to maintain a stable user base. revealed in July.

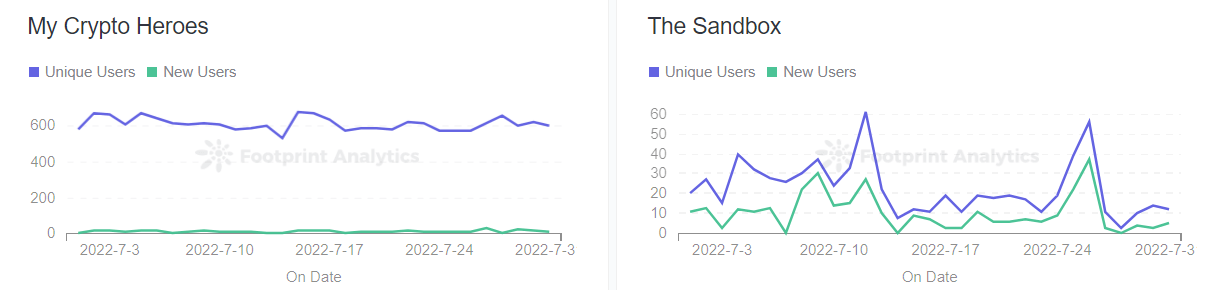

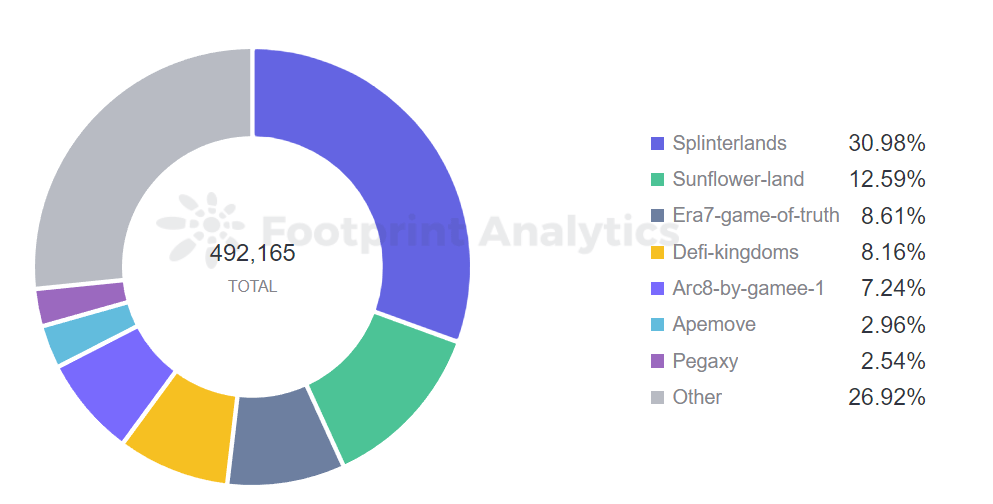

But the trying market conditions also highlighted a handful of titles that stood out. Splinterlands is one of his projects that retains users due to its low barrier to entry, simple gameplay and fast combat speed. Axie Infinity also continued to introduce new features to regain momentum.

Footprint analysis data shows GameFi Sector Overall Performance in July.

- The total number of users decreased by 21% month-on-month, and the growth of new users was slow.

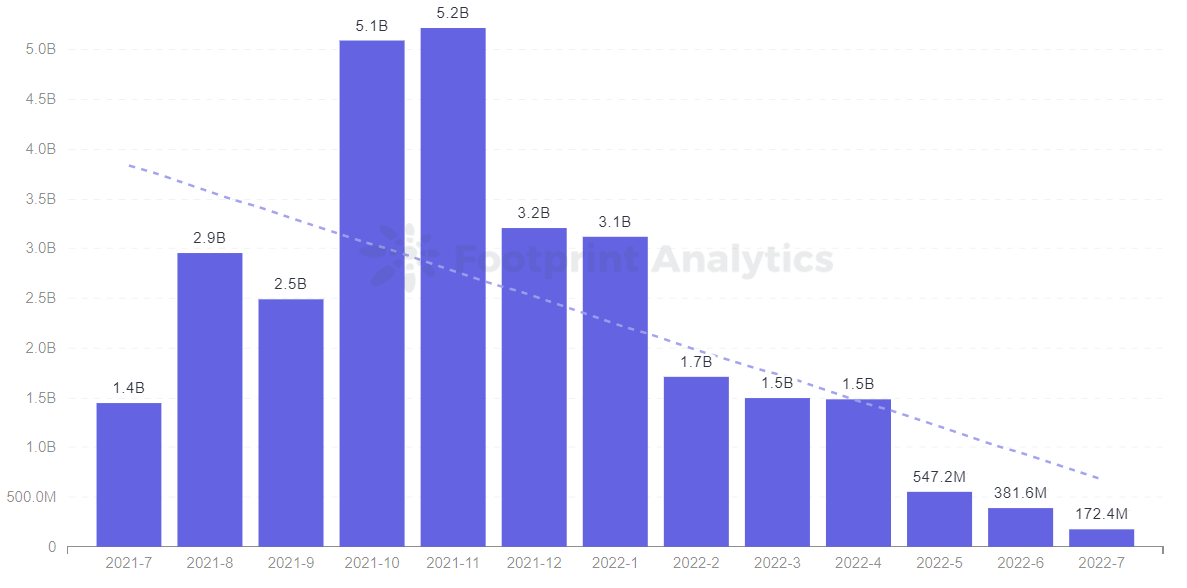

- Transaction activity decreased 55% month-over-month and 737% year-over-year.

- Month-over-month growth in the number of projects was less than 2%.

- VC funding increased 17% month-over-month and 126% year-over-year.

Overall Market Analysis of GameFi Market

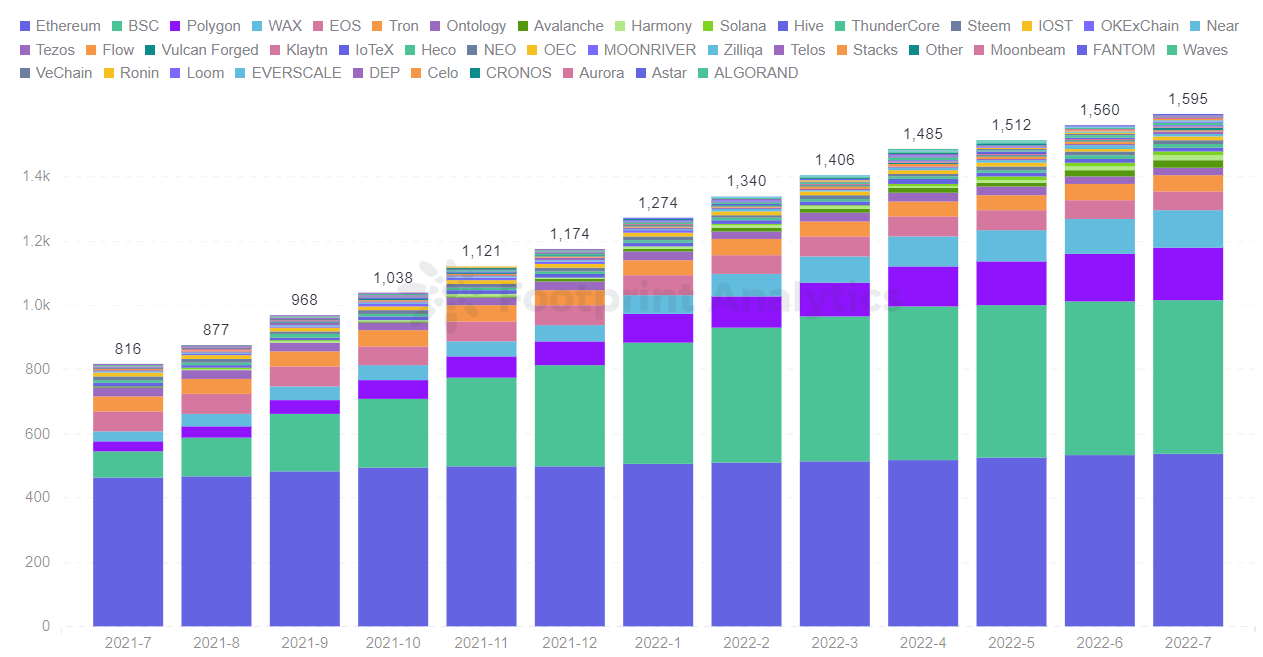

GameFi Projects Growing Less Than 2%, BNB New Project Growth Slowing

Fewer than 80 GameFi projects were launched for the third consecutive month ending July 31st. As can be seen from the graph, all chains saw stagnant growth (although Polygon and WAX increased slightly).

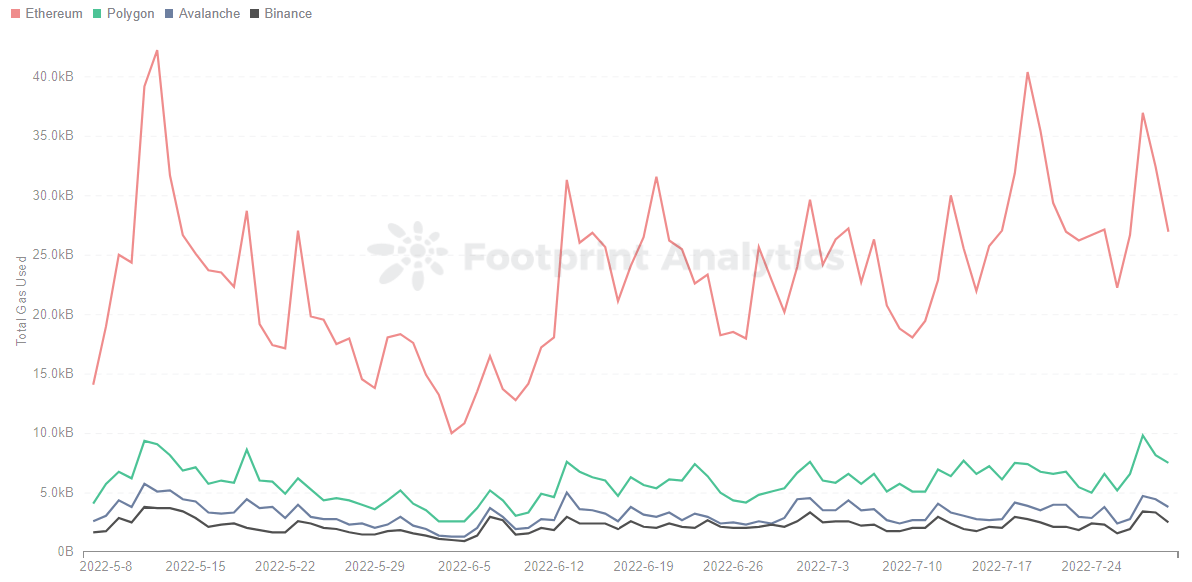

Gamers pay more attention to game playability and smoothness of network experience, and have very high requirements for network. With the Ethereum chain, you have to pay high gas fees every time. Encountering on-chain congestion issues can result in a very bad experience for players. Therefore, these issues are a priority for development teams creating new projects.

New projects on Ethereum are facing high fees and congestion, with more projects migrating to BSC (now BNB) after July 2021.

this led BNB It attracts a ton of games that are failing to retain users.

Compared to both chains, Polygon presented a faster solution with a cost per transaction about 1/10,000 that of Ethereum and a transaction speed of up to 7000 tx/s.

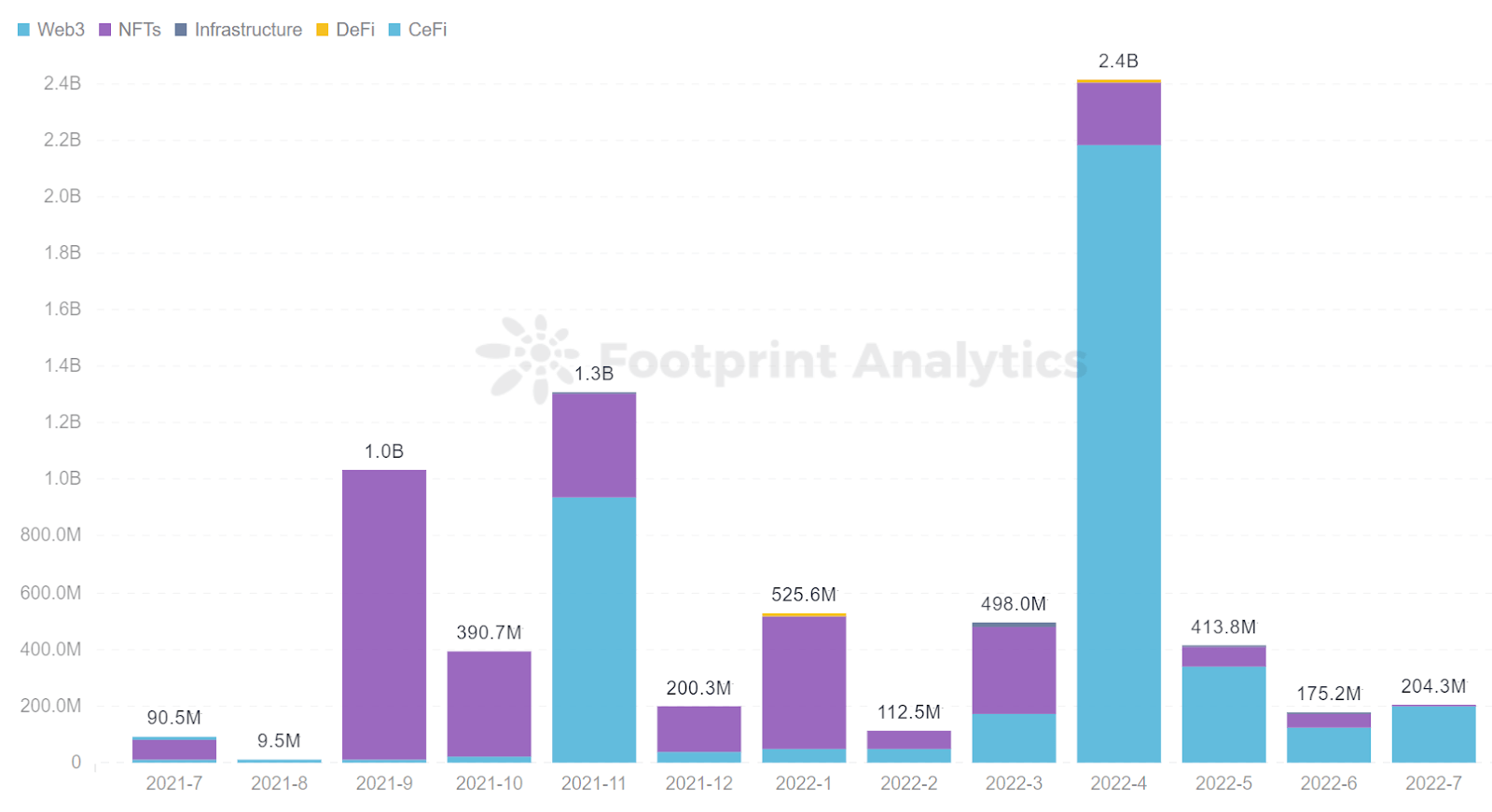

GameFi Web3 category accounts for 98% of GameFi’s total funding

The rise of the Web3 concept in blockchain has introduced newer scenarios and requirements to the gaming industry.

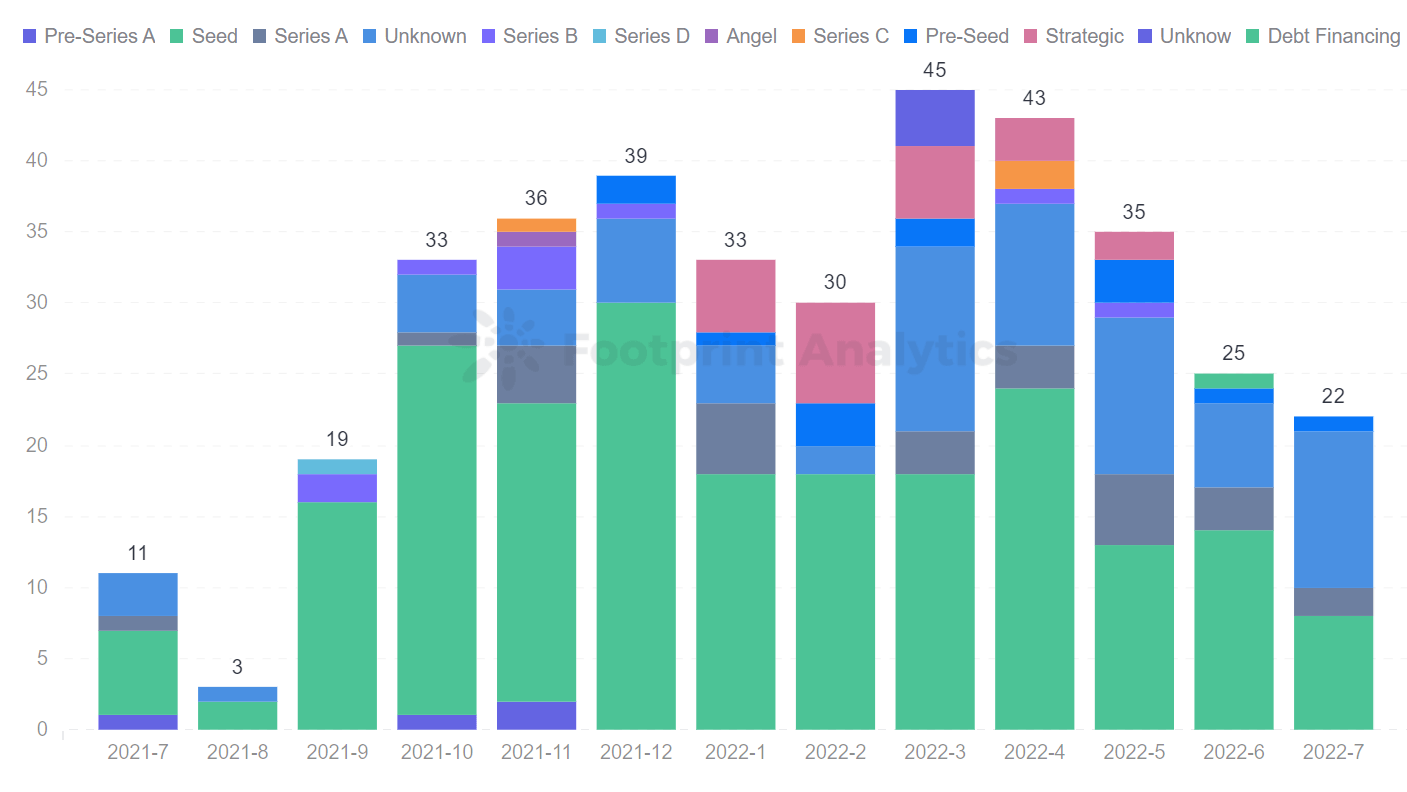

Compared to June, GameFi’s fundraising activity gradually recovered in July, increasing by 17%. Regarding the funding category, with the development of blockchain technology, more and more investment funds are being invested in Web3-type GameFi, of which Web3-type funding accounts for 98%.

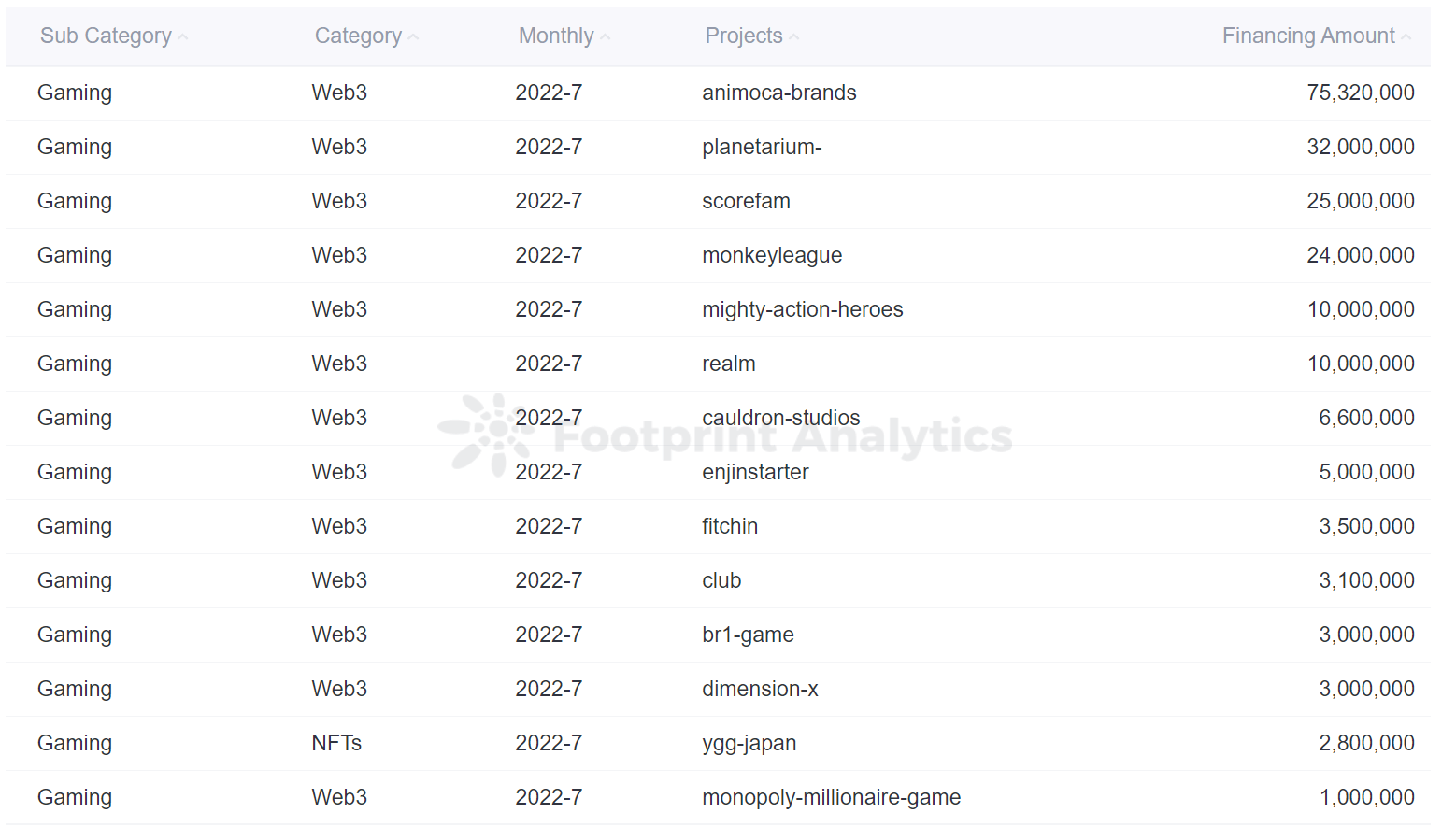

Web3 has been in the public eye since last November. It wasn’t until April that Web3 began to catch the attention of the cryptocurrency market. And recently, Animoca Brands announced the completion of his $75.32 million funding round. This is his second funding announcement following his $358.8 million on Jan. 18. The company’s focus on Web3 aims to address existing interoperability issues in the metaverse industry and realize the vision of an open metaverse.

A total of 22 projects received funding in July. The investment round has been active for many months in the seed stage and is complemented by other rounds. Judging by the number of active users of the project, star sharks When cryptomins not exceed 3 months. Therefore, according to the current project development trend, VC investment funds still remain in new projects.

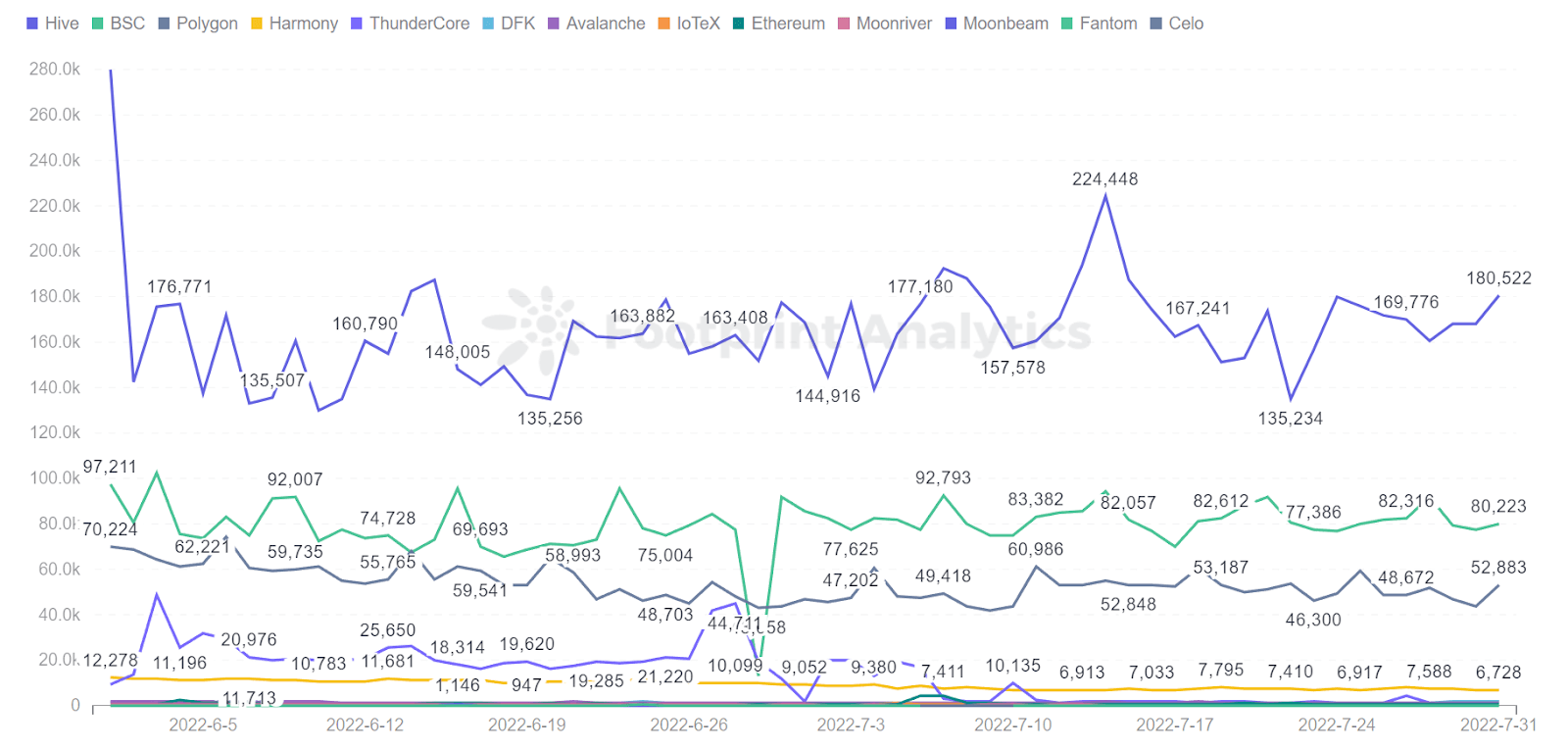

Splinterlands gamers make up the majority of Hive users

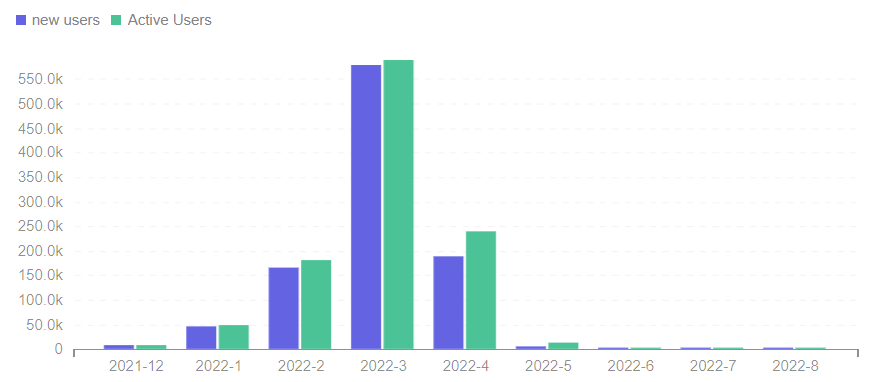

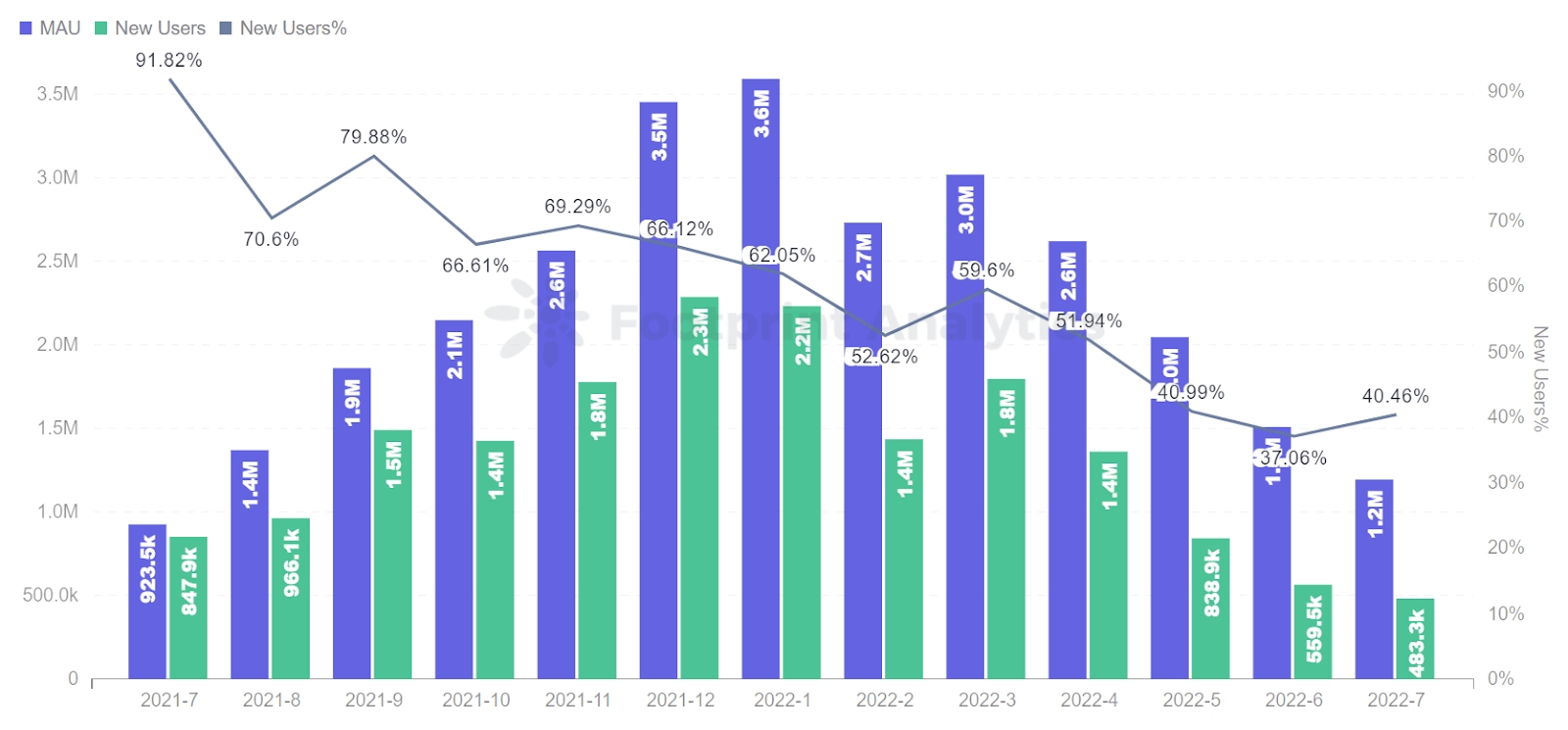

According to Footprint Analytics, the total number of monthly users is 1.19 million, of which 483,000 are new users and 710,000 are old users. Earlier this year, the developer attracted millions of users through various game genres and styles. And they continue to experiment with them across a wide range of games. Users can profit if they can catch a bull market, but they will be in trouble if they encounter a bear market.

The overall subscriber base fell from 3.59 million players in January to 1.19 million players in July (-69%). GameFi’s pain points are:

- Lack of originality due to an economic model based primarily on extraction, production and reproduction.

- Some games require players to invest in game tokens before they can play, and users insist on recovering their capital.

- Infinite Inflation Model, Governance Tokens, and In-Game Tokens Falling in Price, Affected by the Bear Market. Their game cannot get rid of the death spiral.

As a result, most P2E games today require the entry of new players to maintain economic stability.

Axie Infinity and Splinterlands are two examples.

Splinterlands has been a relatively hot game since its launch. In terms of percentage of new users in July, Splinterlands has the highest percentage of all projects.

In contrast to Axie infinity prior to March, you needed real money to buy pets P2E (estimated at around $110 in currency prices at the time) to get into the game and be truly profitable. will be displayed). However, the cost is high for the average player, and the payback period increases as market trends change. However, Splinterlands has a lower barrier to entry as he only needs $10 to enter the game.

In general, the Axie infinity development team ignored interesting designs when designing the game, and released the Origin version at the end of March, adding cards and free attributes. And in early July, the virtual land pledge feature was launched. We want you to experience the fun of the game, not just earn money.

Axie infinity’s fate is changing

Based on GameFi’s monthly transaction volume, last year’s transaction volume increased only from October to November, and the overall transaction volume gradually decreased from December, reaching its lowest level in July. This process of change is very similar to the implication of new projects where large numbers of players are attracted to trading and seem to leave when they get tired of playing.

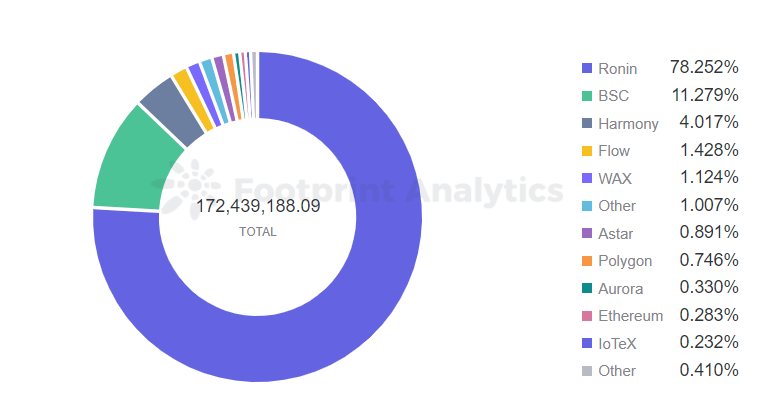

Despite the decline in the GameFi trading market, Ronin was able to buck the downward trend in mainstream blockchain transaction volume and overtake BSC to retake the number one spot. This is largely due to the launch of the virtual land pledge feature in his Axie Infinity He game on-chain, contributing to the AXS price increase and gradual improvement in transaction volume.

Overview

In previous bull markets, many new play-to-earn games were released, but only a few managed to maintain a stable user base. Simple gameplay and fast combat speed keep users coming back. And Axie Infinity never stopped innovating, adding new features and regaining its place.

At the same time, more money flowed into the Web3 project in July, with the goal of solving more problems for P2E games.

July event review

NFT & GameFi

- NFT Certifier optic Closes $11M Seed Round Led by Pantera Capital and Kleiner Perkins

- Yuga Labs’ NFT series has generated over $5 billion in total sales and nearly $150 million in royalty income.

- Video game giant Square Enix plans to drop Final Fantasy VII NFT collection in 2023

- STEPN Announces Second Quarter Earnings, Begins Quarterly GMT Buybacks and Burns

- Solana-based MonkeyLeague game developer raises $24 million

Metaverse & Web3

- BAI Capital completes initial US$700 million funding, focusing on Web3, Metaverse and other areas

- Web3 Music Platform’s Audius Community Vault Attacked, Losing $18.5 Million in AUDIO

- The Web3 Foundation has announced the 14th batch of its funding program. 36 projects were shortlisted

- Magic Eden launches venture unit to invest in web3 gaming startup

- Disney Launches Startup Accelerator Program Focused on NFTs and Metaverse

DeFi & Tokens

- Curve to Launch Over-Collateralized Stablecoin

- Decentralized Crypto Exchange Hashflow Raises $25 Million At $400 Million Valuation

- Despite Recent Liquidations and Massive Outflows, BTC Has Managed to Float Above $2 Million

- Polygon (MATIC) flips this token to become the most traded crypto among ETH whales.

- Stablecoin Market Cap Falls, BUSD and DAI Valuations Jump, Fiat Tokens Account for 70% of All Crypto Trading

network and infrastructure

- Polygon Announces zkEVM Scaling Solution for Web3 Adoption

- Vitalik Buterin Talks Ethereum’s Future “Merge” and “Surge” at EthCC in Paris

- Matter labs plans zkSync 2.0 mainnet launch in October

- Terra-based projects start spilling over to Polygon after Terra’s collapse

- Solana and Avalanche poised to profit as the crypto market enjoys new tailwinds

institution

- Three Arrows liquidators seize $40 million as asset probe widens

- SEC Lists 9 Crypto Tokens As Securities Following Coinbase Insider Trading Accusations

- Tesla sold 75% of its BTC holdings

- Blockchain.com cuts 25% of workforce amid crypto bear market

- Crypto.com integrates Google Pay to let users buy cryptocurrencies

World wide

- Reserve Bank of India commits to ‘phased introduction’ of central bank digital currency

- South Korea Postpones Crypto Tax After Terra LUNA Crash

- Ghana ranked as the world’s second highest default risk country

- Australian Regulator Tries to Automatically Take Down Crypto Fraud Sites

- Bank of Russia Says Stablecoins Are Unsuitable for Payments

This work, footprint analysis community

August 2022, Vincey Data Source: Footprint Analysis – GameFi Report for July 2022

The Footprint Community is a place to help data and crypto enthusiasts around the world understand and gain insights about Web3, the Metaverse, DeFi, GameFi, or other areas of the emerging blockchain world. Here you’ll find vibrant and diverse voices who support each other and move the community forward.