Why are short-term holders HODLing instead of taking profits?

Broff is concerned that bitcoin’s price level holding above $30,000 will see a noticeable shift in market behavior, especially for short-term holders.

Short-term holders (STH), i.e. holders who have held Bitcoin for less than 155 days, play an important role in market analysis. Their actions often provide insight into market sentiment and potential price movements.

They are usually more sensitive to price changes and tend to buy and sell based on recent market movements. This can lead to increased volatility as their trading activity can cause sharp price movements.

For example, when short-term holders start to hold, sell-side pressure in the market can be eased, making the price environment more stable.

With the recent Bitcoin price jump from $26,000 to over $30,000, STH is mostly profitable. This is evident from the short-term holders return on expenditure (STH-SOPR) indicator. SOPR is a metric that calculates profit margins for coins moved on-chain, providing insight into whether holders are selling at a profit or at a loss. STH-SOPR has a clear focus on short-term holders.

Since June 20th, STH-SOPR has been trending above 1, indicating that short-term holders are on average moving their coins to make profits. This indicator he peaked at 1.033 on June 21st and then trended downward, reaching 1.006 on July 11th. This suggests that STH is still profitable, but margins are declining.

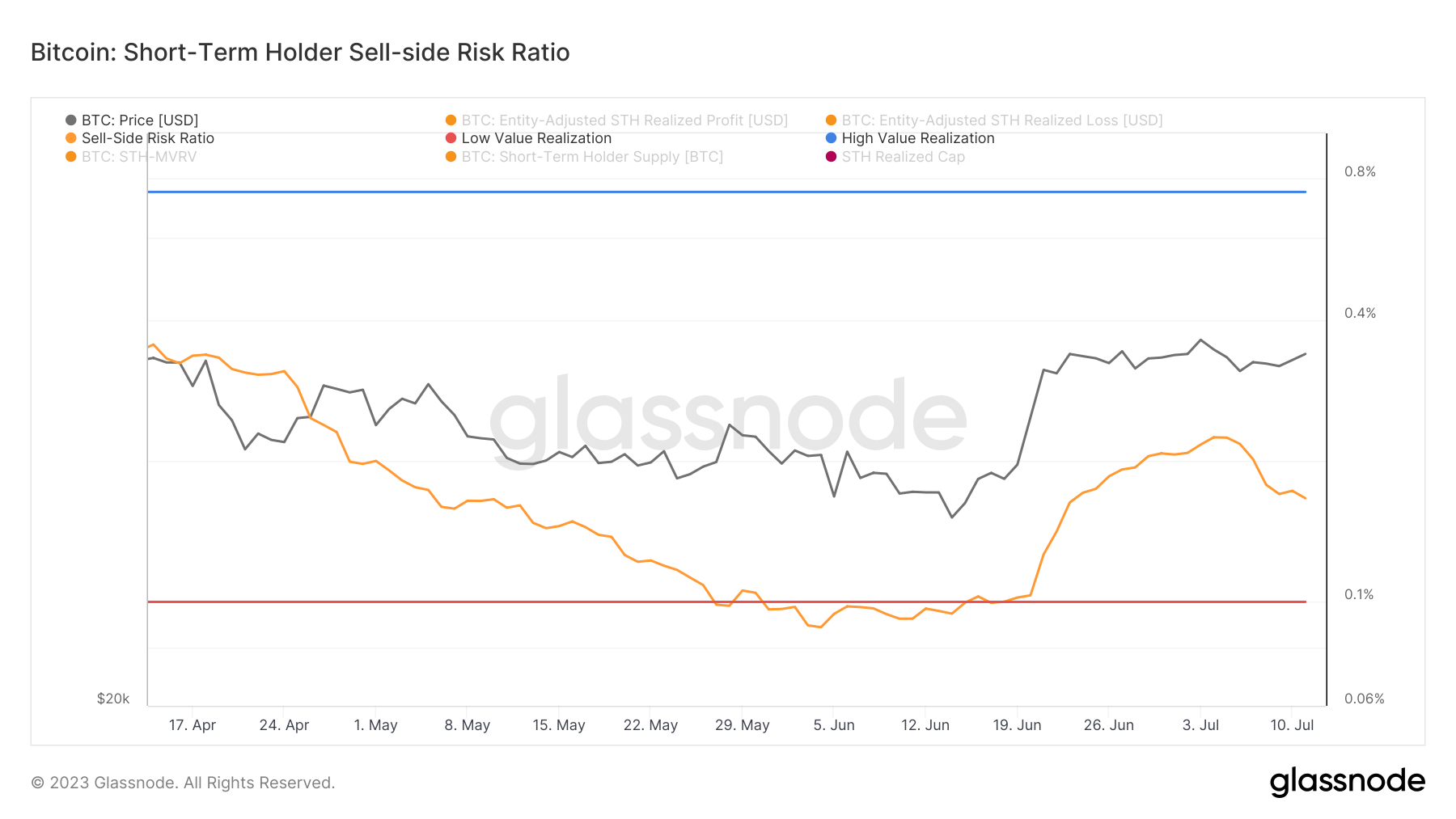

Meanwhile, data from on-chain market analytics platform Glassnode shows that the sell-side risk ratio for short-term holders is declining. The sell-side risk ratio quantifies the aggregate sell-side risk in the market by comparing the total USD spent by investors each day to the total realized capital of short-term holders. Higher values typically indicate aggressive profit taking, while lower values coincide with a market consolidation phase or bear market.

The ratio started rising on June 21st and peaked on July 5th. Since then, the ratio has fallen sharply, indicating a decline in sell-side pressure from short-term holders.

Combining these two metrics paints an interesting picture. While profit margins for short-term holders are falling, so too are sell-side pressures. This could suggest that short-term holders are choosing to hold on to bitcoin even though profits are dwindling.

This action could stabilize the market and lay a solid foundation for future price increases.

The post Why short-term holders are holding without taking profits? First appeared on CryptoSlate.