Why crypto bailouts are a double-edged sword

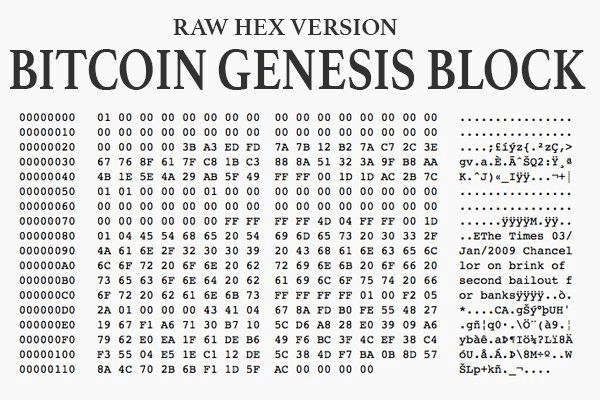

When it comes to economic transmission, we seem to be in a complete circle. Exposure to bad assets and derivatives, primarily led by subprime mortgages, caused the global financial crisis of 2008. The resulting bank bailout is $ 500 billion Bitcoin’s Genesis block was so controversial that it embedded the relevant headline as a warning:

Fast-forwarding towards today, Bitcoin has succeeded in leading a decentralized transfer of digital assets that at some point had a market capitalization of over $ 2.8 billion. Things have calmed down since then, but it’s clear that digital assets are well established.

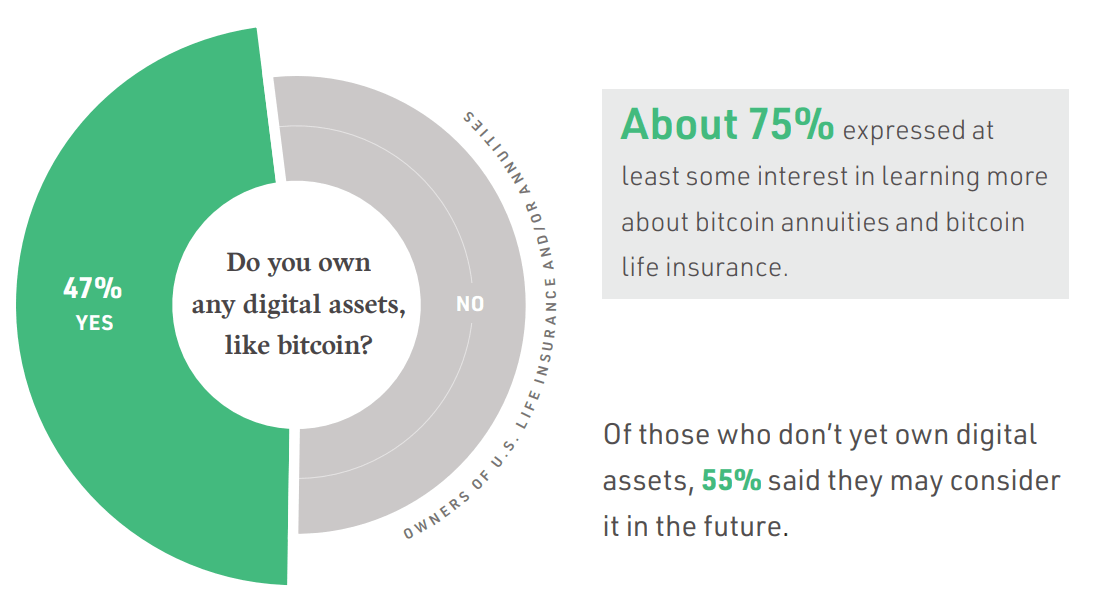

Bitcoin is Legal tender To be potentially included Life insurance policy.. According to NYDIG (New York Digital Investment Group) Investigation The majority of digital asset holders conducted last year were looking for such an option.

On the road to this adoption, Ethereum lags behind Bitcoin and creates an ecosystem of dApps with general purpose smart contracts. It is the foundation of decentralized finance (DeFi) that replaces many of the processes found in traditional finance.

dApps covered everything from games to lending and borrowing. Unfortunately, despite the automated and decentralized nature of Finance 2.0, financial transmission has sneaked up. The Terra (LUNA) meltdown was an important accelerator that continued to burn the blockchain outlook.

Terra’s fallout is still in progress

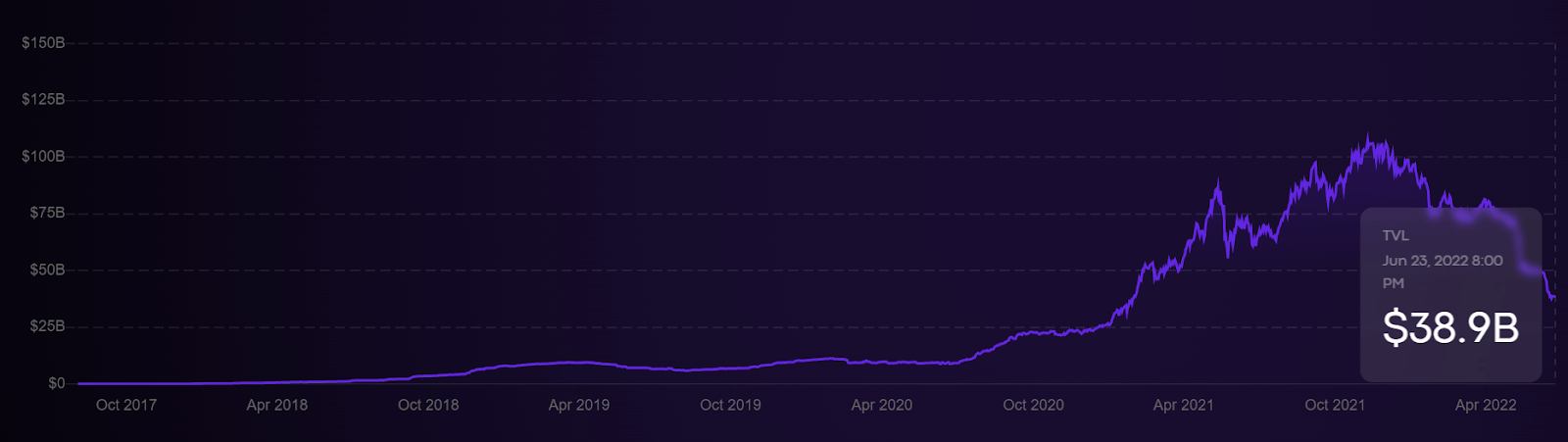

May of this year marked the largest cryptocurrency wipeout in history, as evidenced by the reset of TVL to levels not seen since January 2021.The market capitalization share of DeFi before the collapse was stable at 13%, which is higher than the total of Solana and Cardano. Ironically, the central bank finally ignited.

The Fed’s rate hikes have triggered market sales and led DeFi to bearish territory. The bear swiped at the price of LUNA, which was collateralizing Stablecoin in Terra’s UST algorithm. With the pegs lost, Over $ 40 BillionMelted with Terra’s high-yielding staking platform Anchor Protocol.

The catastrophic event sent a shock wave throughout the crypto space.Reached Ethereum (ETH), which was already suffering Delay due to long-awaited merge.. Second, market participants who relied primarily on yield exposure to both assets through farming approached bankruptcy, as Lehman Brothers did in 2008.

- Celsius Network has relied on ETH Liquid Staking (stETH) Shut down the drawer.. The cryptocurrency lending platform had AuM worth $ 11.8 billion in May.

- Three Arrows Capital (3AC), a $ 10 billion crypto fund with exposure to both stETH and Terra (LUNA) Currently facing bankruptcy After liquidation of $ 400 million.

- BlockFi, a crypto lender similar to Celsius but without its own token, Finished 3AC position..

- Voyager Digital Daily withdrawals are limited to $ 10,000.. Cryptographic brokers have lent a significant amount of money to 3AC via 15,250 BTC and 350 million USDC.

As you can see, when the chain reaction begins, it creates a spiral of death. For the time being, each platform has managed to forge some bailout transactions. Voyager Digital hit the credit line with the value of Alameda Ventures $ 500 million To fulfill the liquidity obligations of our customers.

BlockFi uses FTX exchange $ 250 million Revolving credit line.With more ambitious moves, Goldman Sachs is reportedly trying to pull up. $ 2 billion Acquires Celsius Network. There are two conclusions to draw from this confusion:

- There is an industry-wide consensus that crypto remains here in terms of digital assets themselves, derivative transactions, and smart contract lending practices. Otherwise, the interest in bailout would not have been so rapid.

- DeFi’s roots are pointing upwards. Currently, restructuring and integration are in progress. In other words, the implementation of centralization by large exchanges and large commercial banks is increasing.

But if the transmission continues in the unexpected direction of the market sold out, is it a place for government intervention? Needless to say, this goes against the very foundation of cryptocurrencies with an emphasis on “cryptocurrency”.

Even the IMF wants crypto to succeed

IMF President and WEF Contributor Christalinage Orgieva I got it It’s a shame if the crypto ecosystem fails at the Davos Congress in May 2022:

“It offers us all faster service, much lower cost, and more inclusion, but only if we separate apples from oranges and bananas.”

Recently, Hester Peirce, Commissioner of the US Securities and Exchange Commission (SEC) I agreed Then halfway. She said that crypto wheat needs to be separated from the rice husks.

“If things are a little difficult in the market, discover who is actually building something that can last long and long, and what’s gone.”

Not only does she mention the difficulties if the platform fails, but she also lays off and freezes employment.The past few weeks have been flooded with crypto layoffs from every corner of the world: Bit Panda Miniaturization Approximately 270 people, Coinbase 1,180 people (18% Of its workforce, to name just a few), 100 Gemini, and 260 Crypto.com.

Meanwhile, FTX CEO Sam Bankman-Fried believes it is his duty to support the crypto space under development.Cryptographic millionaire think Given the responsibilities imposed by central banks, the pain of cryptocurrencies is inevitable.

“We feel that we have a responsibility to seriously consider intervening to stop the infection, even if it is at a loss for ourselves.”

This applies not only to Fed-induced asset readjustments, but also to barbaric hacking. Last year, when hackers drained $ 100 million from Japan’s Liquid Exchange, SBF signed a $ 120 million refinancing agreement and eventually acquired it completely.

In addition, it keeps in mind many traditional things Stockbrokers such as Robin Hood We also adopted digital assets. In fact, today it’s not easy to find a popular stockbroker that doesn’t offer access to the digital assets of your choice. The power invested in the crypto ecosystem far outweighs the occasional temporary interruptions under extreme market conditions.

Bailout Evolution: From Big Government to Big Money

At the end of the line, you need to wonder if DeFi itself is a pipe dream. For one thing, it’s hard to say that every lending platform is truly decentralized. Second, only centralized megacorporations retain deep liquidity to withstand potential market stress.

Similarly, as rear-view mirrors diminish decentralization, people trust those institutions to be “too big to fail.” This applies to FTX and Binance as well as to Goldman Sachs. Fortunately, powerful institutions, from WEFs to large crypto exchanges and even large investment banks, want blockchain assets to succeed.

While these bailouts and potential acquisitions do validate the technologies and capabilities that drive digital assets, they can be a step in the wrong direction from a decentralization perspective.