Why the SEC should stay away from crypto (Part I)

With the recent Securities and Exchange Commission indictments against Coinbase and Binance bringing the debate over digital asset classification to a boiling point, the United States must immediately introduce intelligent, progressive and specific digital asset regulation.

The SEC indictment shows that the SEC is incapable of properly regulating digital assets.

The lawsuit includes a list of over 15 digital assets that the SEC claims have passed the Howie test and are securities.To make the case successful, SEC Chairman Gary Gensler told CNBC,

“We have to show [the tokens listed by the exchanges] is a security and must be properly registered. ”

However, when considering the securities purportedly listed by the exchange, there is no mention of the Terra Luna black swan collapse (aside from references in the Binance lawsuit). Binance still lists LUNA as well as classic tokens. LUNC, meanwhile Coinbase listed LUNA (wLUNA) is wrapped and still available via Coinbase Wallet. Terra Luna’s failure wiped out tens of billions of dollars from the cryptocurrency market capitalization, leaving retail investors with huge losses.

The SEC has also brought up token trading on FTX as part of its claim that Coinbase is wrong.in the lawsuit, SOL’s listing on FTX.US is being offered as part of the evidence that Solana is a security. Almost the same section is included in the Binance lawsuit.

At this time, FTX and its executives had a very high-profile presence on Capital Hill, and that SBF and its associates had personal or working relationships with several members of the U.S. government, including Mr. Gensler. is well known to have built The failure of this exchange has resulted in huge losses for U.S. customers, an embarrassing record of many government officials snuggling up with alleged fraudsters, and the unpleasant reality of having to deplete large amounts of campaign funds. left.

US fails to regulate cryptocurrencies

Coinbase has publicly sought guidance on digital asset regulation for years. “The SEC is an institution that we have really struggled with over the last few years,” Coinbase CEO Brian Armstrong said in a Twitter space earlier this year, suggesting the firm’s resoluteness not seen elsewhere. .

Armstrong explained that Coinbase had tried to contact the SEC to discuss the regulatory situation, but to no avail until the SEC specifically requested a visit to Coinbase last year. Coinbase has had “30 meetings in the last nine months” with the SEC, which was supposed to culminate in a meeting where feedback was given.

However, Armstrong claimed he canceled the meeting the day before the SEC was scheduled to meet and sent a Wells notice to Coinbase the following week. Nine weeks later, the company sued the exchange for multiple securities law violations.

References to Digital Assets in Congressional Records

while there was considerable increase Congressional activity on digital assets over the past few years has recorded more than 1,065 mentions of the term. Nonetheless, real progress on digital asset regulation has been excruciatingly slow.

Digital assets mentioned in the Senate for the first time hearing A 2000 paper titled “Utah’s Digital Economy and Future: Peer-to-Peer and Other Emerging Technologies” likened them to “databases.”

digital assets was also mentioned Statement by the Energy and Commerce Subcommittee on Commerce, Trade and Consumer Protection at a Congressional Hearing in 2001. “Protecting digital assets and preventing unwanted digital intrusions protects the integrity of individuals and, in some cases, nations,” said John Schwartz, president and CEO of Reciprocal, Inc. It is equivalent to protecting.”

Schwartz was talking about digital files such as mp3 audio and mp4 video, but this is the first time he officially mentions the term, which is now making headlines.

The term was not frequently cited each year until 2019, when references to digital assets surged to 21, including bills. Managed stablecoins fall under securities law and the Keep big tech out of financial law.

By 2022, there will be 598 mentions of the term “digital assets,” including 22 bills, 14 congressional hearings and over 500 congressional calendar mentions. This year, 2023, with only 68 cases ever mentioned, the collection of parliamentary calendars is the biggest cause of the decline, down from 501 to just 8.

Usage trends of digital assets

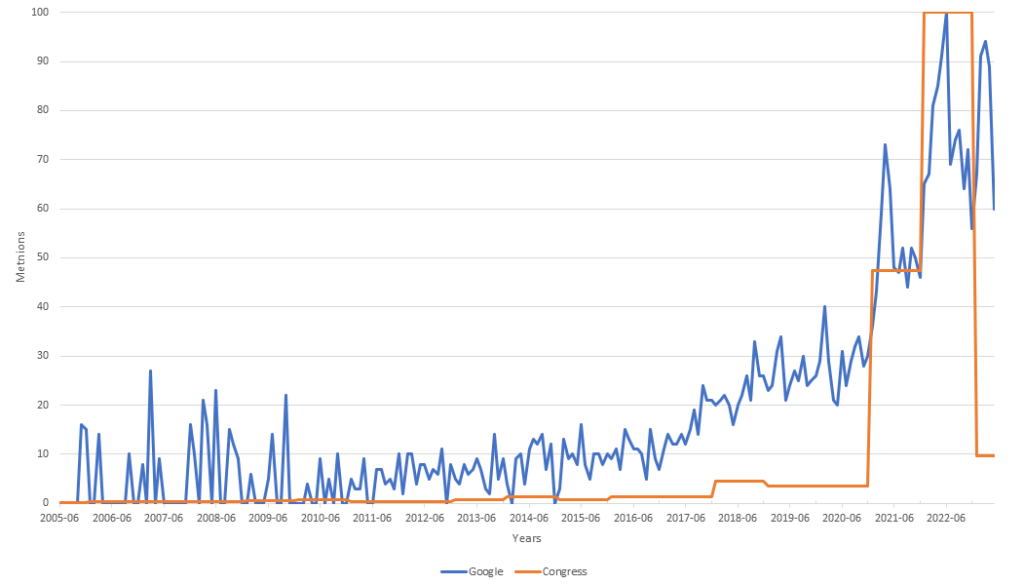

I compared mentions of “digital assets” in Govinfo.gov’s congressional and federal databases to search volumes for the same term on Google from 2005 to the present.

The normalized graph below shows that interest from Google Search has increased since around 2017, but it took until 2020 for the US government to record increased use of the term.

In charts, data is scaled to a common reference point, making it easier to compare and analyze different data sets. Notably, when Google Search traffic rises above 60, the number of mentions of “digital assets” in official public records drops dramatically, temporarily to just 9.7.

Interest from Google Search appears to peak in 2021 and form a double top below the high in early 2023. If this were a stock or token chart, global technical analysts would suggest that such a move is a bearish indicator. .

Moreover, Congressional attention has just fallen off a cliff, with mentions dropping from 598 in 2022 to just 58 six months later in 2023.

why?

Has the conversation about digital assets moved from official public records to backchannels and social media? Was the surge in 2022 related to the urgent need to define digital assets?

If so, why are companies (publicly) soliciting guidance on digital asset regulation being sued by the SEC?

Part 2 of this three-part feature explores the impact of the SEC’s actions and explores alternative approaches to cryptocurrency regulation that may benefit the industry and its investors.

follow crypto slate Post on Twitter or join our Telegram channel to be notified when Part 2 is available.