Wintermute hacked of $160M, SEC claim jurisdiction over Ethereum transactions

Some of the biggest news in the cryptoverse on Sept. 20 included Wintermute losing $160 million in hacking a DeFi operation, and Ethereum developers announced that the Shanghai upgrade would not unlock staked ETH. Confirmed, Experts That The SEC Can’t Claim Jurisdiction Over Ethereum Transactions, MicroStrategy will purchase an additional 301 Bitcoins for $6 million.

CryptoSlate Top Stories

Wintermute Reveals $160 Million Hack in DeFi Operations

Hackers attacked around 90 crypto assets belonging to major market maker Wintermute. His DeFi business at the company lost more than $160 million in the incident.

Wintermute CEO Evgeny Gaevoy said the market making fund is safe as CeFi and OTC operations were not affected by the hack.

Ethereum Vanity Address Exploit May Cause Wintermute Hack

Blockchain security firm Certik has confirmed claims by the Ethereum community that vanity address exploits may have been the root cause of the Wintermute attack.

Here’s what we know so far: @wintermut_t Exploit 👇

It records that $162,509,665 was stolen.

This exploit is likely due to the compromise of the private key via a brute force attack on the Profanity wallet.

Be vigilant! pic.twitter.com/zVRd3e5TbS

— CertiK Alert (@CertiKAlert) September 20, 2022

1nch contributor k06a points out that Wintermute’s address has 7 leading zeros, so it could have only taken 50 days to brute force hack the address using a 1,000 GPU mining rig Did.

Ethereum developers confirm Shanghai upgrade won’t unlock staked tokens

in a chat with crypto slateEthereum developer Micah Zoltu has asserted that the Shanghai upgrade will not allow withdrawals of staked ETH tokens, but will focus on reducing gas fees.

Zoltu added that there is no specific timeline for enabling withdrawals, as Ethereum core developers have yet to discuss how to unlock staked ETH.

Experts Claim SEC Cannot Claim Jurisdiction Over Ethereum Trading

Ethernodes data It shows that about 43% of Ethereum validator nodes are operated from the United States.

Crypto experts disagree with the SEC on the issue, saying it is an unacceptable precedent that the crypto community must fight.

Voyager asks Alameda Research to repay $200 million loan

Alameda Research said in July that it would be happy to repay the loan and get back the collateral “any time I work for Voyager.”

The appointed time is here, as Voyager has filed a motion demanding that Alameda repay a $200 million loan. Voyager also agreed to release Alameda’s $160 million collateral.

Vitalik Buterin argues that highly decentralized DAOs are more efficient than corporations.

Vitalik argues that Decentralized Autonomous Organizations (DAOs) are more efficient than traditional enterprises when they incorporate enterprise elements while maintaining the spirit of decentralization.

To design effective DAOs, Vitalik suggested that protocols should learn from companies how to make timely decisions and respect political sovereigns when designing succession systems.

MicroStrategy buys an additional 301 bitcoins for $6 million

MicroStrategy, led by Michael Saylor, surpassed its asset holdings by purchasing 301 Bitcoins at a cost of $6 million.

So far, MicroStrategy has accumulated a total of 130,000 BTC and plans to inject up to $500 million to buy more.

US Treasury demands public comment on curbing crypto-related crime

The Treasury Department has called on the public to provide feedback to guide its approach in drafting regulatory bills aimed at curbing illicit fundraising made using cryptocurrencies.

The Treasury Department is also open to learning how blockchain analytics tools can be applied to improve AML/CFT compliance processes.

Crypto Promoter Ian Ballina Labels SEC Claims “Flirty,” Rejects Settlement

The SEC filed a lawsuit against Ian Varian for promoting the SPRK token in 2018. The commission classified the tokens as unregistered securities and said that Ballina improperly formed an investment pool to resell the tokens.

Ballina said he has refused to settle with the SEC over what he considers to be “frivolous” charges.

research highlights

Status of Ethereum Derivatives Market After Merger

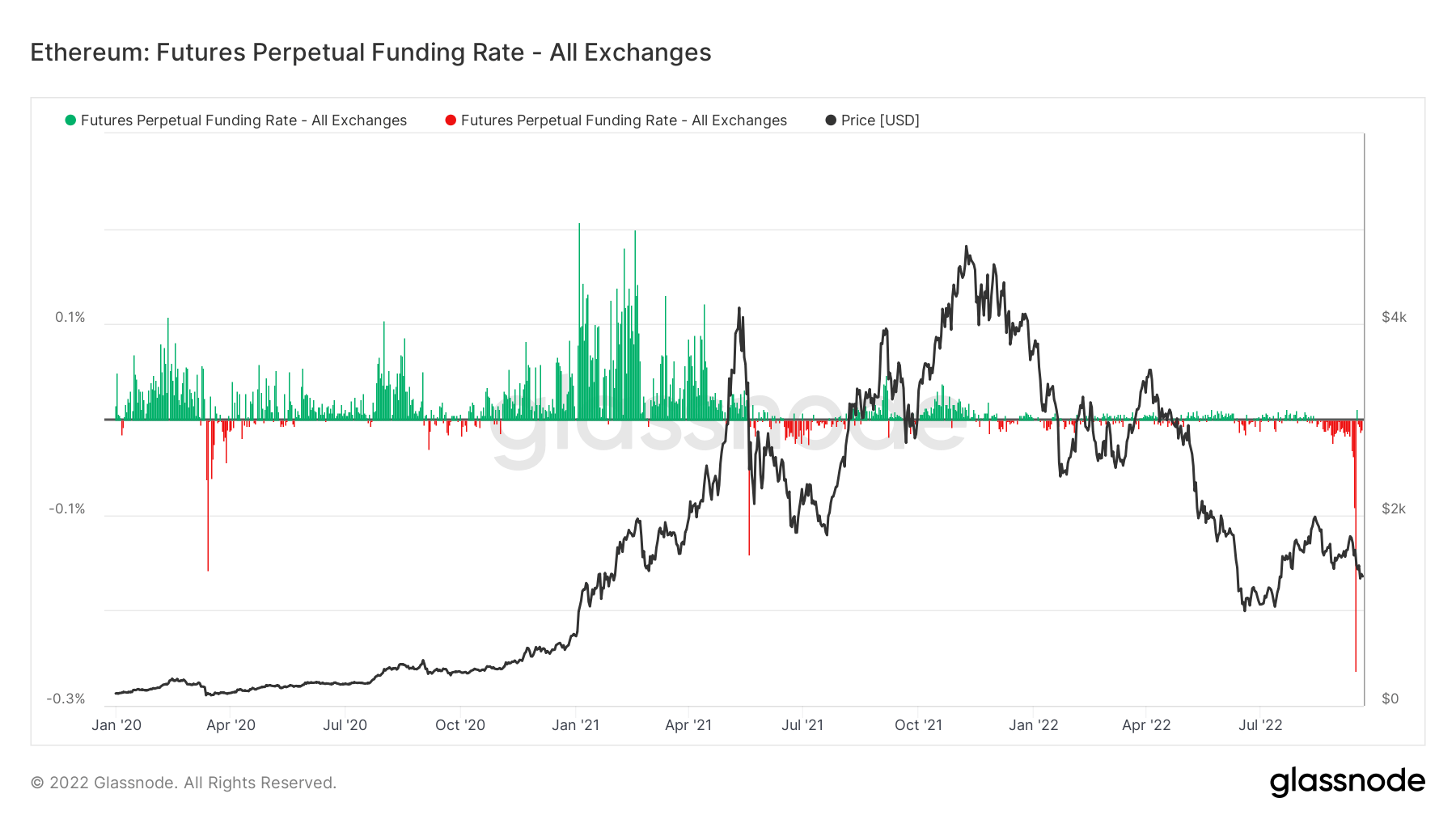

crypto slate An analysis of Ethereum futures perpetual funding rates and open interest reveals that while speculation about a merger has ended, investors are still open to long-term investments.

ETH traders were paying around 1,200% to short Ethereum, according to funding rate data, but ETH has fallen more than 20% over the past seven days.

At the time of writing, the trend has reversed, suggesting that short-term speculation is over and traders are looking to reinvest.

News around Cryptoverse

Robinhood Offers USDC to Users

USDC was listed today as the first stablecoin on Robinhood’s stock trading platform. The move demonstrates the company’s commitment to expanding its crypto trading business model.

crypto market

Over the past 24 hours, Bitcoin has broken below the $19,000 support level, registering a -3.19% decline to $18,913. Over the same period, Ethereum fell -3.95% and traded at $1,324.