Yield Farming Sector up 8% according to CryptoSlate data

Yield farming platforms and protocols have surged 8% over the past 24 hours, with the sector’s market capitalization now exceeding $10 billion.

What is Yield Farming Coin?

The Yield Farming Token Sector refers to a subset of the decentralized finance (DeFi) ecosystem focused on providing incentives for users to provide liquidity to various DeFi protocols.

Yield farming tokens are typically governance tokens that provide holders with voting rights and a portion of the fees generated by the protocol. These tokens can be earned by staking or providing liquidity to various DeFi platforms. This allows users to earn a return on their investment.

The rise has not necessarily come from mid-cap tokens such as Uniswap and Aave, which have risen 3.7% and 4.3% respectively.

Low-cap tokens like Landshare are much more numerous.

house flipping on chain

The sector’s rise appears to be largely led by the newly launched project Landshare, a token fully integrated with the Binance smart chain, which has surged +44% over the past 24 hours.

The project allows tokenized real estate assets to be flipped on-chain. It is a platform that integrates DeFi and real estate investment capabilities, allowing direct exposure to on-chain assets such as tokenized assets and crowdfunding house flipping.

Badger DAO accelerates

Another low-cap token that has surged in the last 24 hours is Badger DAO. This is a project aimed at building the products and infrastructure needed to accelerate Bitcoin as a Kora.A teral that spans other blockchains.

Badger’s price is up +6.75% over the last 24 hours with a market cap of $72 million and Badger’s token price is currently $3.79.

On February 22nd, Badger DAO introduced eBTC. It is a decentralized Bitcoin powered by Ethereum staking.

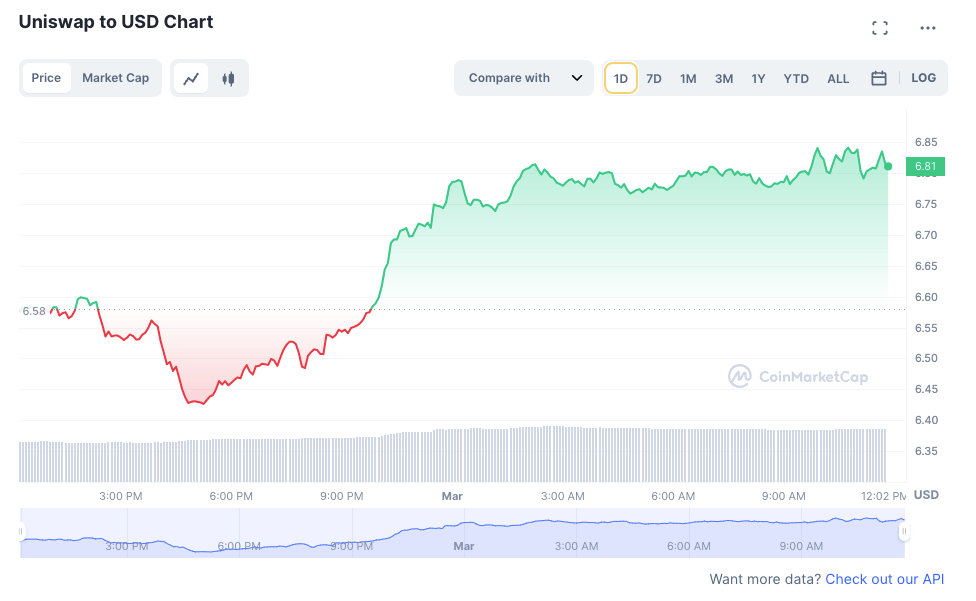

Uniswap Rise

Uniswap is a decentralized cryptocurrency exchange that runs on the Ethereum blockchain and uses an automated market-making system. It has its own governance token called UNI and is considered a prominent player in the world of decentralized exchanges.

Uniswap currently trades at USD 6.81 and the token is up 3.31% over the past 24 hours, with a current market cap of USD 5 billion and ranks 18th on CoinMarketCap.

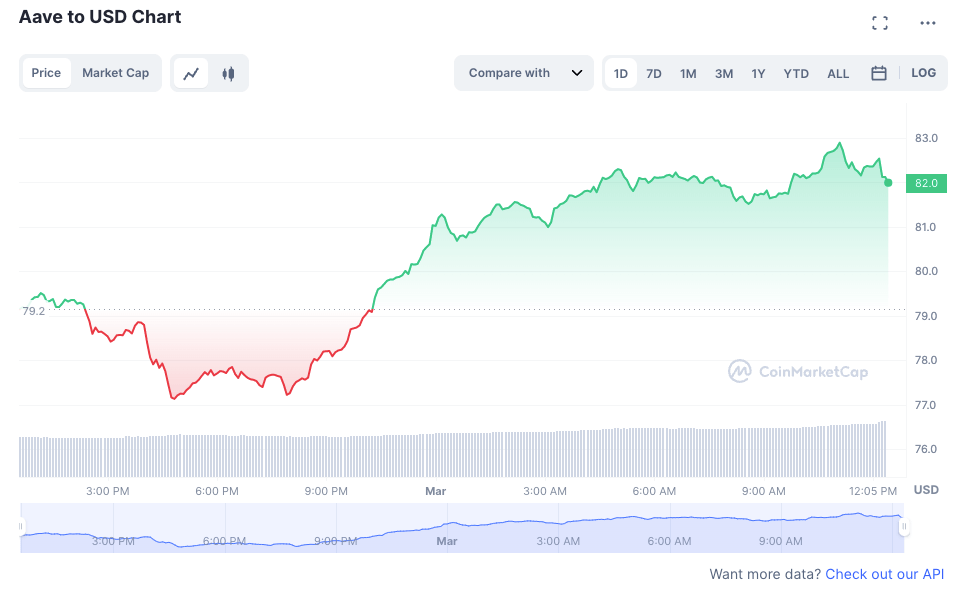

also got av

Another yield farming token, Aave, was also launched today. Aave is a decentralized financial protocol that allows users to lend and borrow cryptocurrencies by depositing their digital assets into a liquidity pool, and allows borrowers to obtain flash loans using crypto as collateral.

Aave’s current trading price is US$82.32 with a 24-hour trading volume of US$82,338,720. Tokens increased him by 4.26% in the last 24 hours.

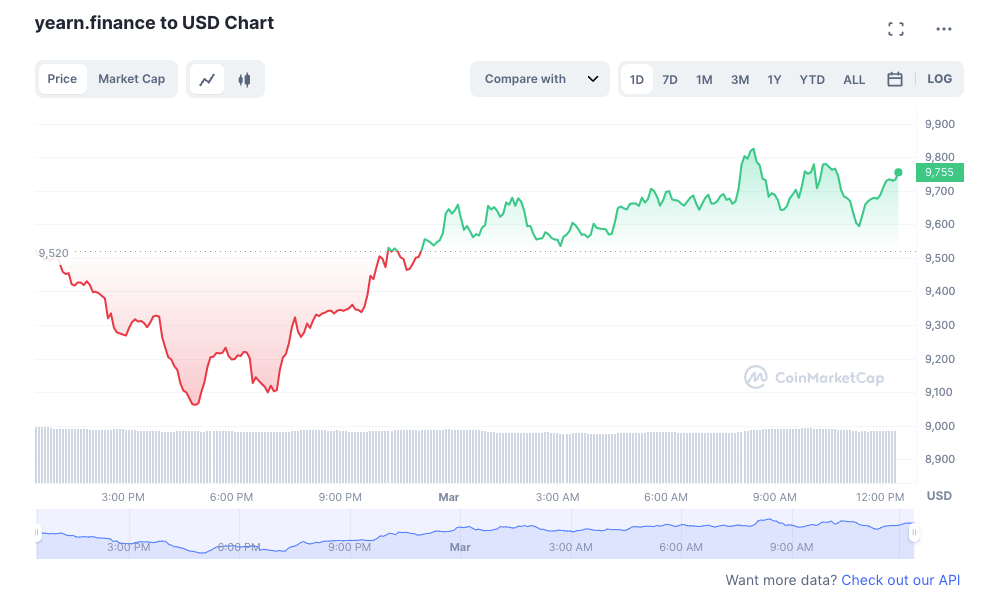

Yearn Finance makes a modest profit

yEarn.finance is a DeFi lending protocol built on Ethereum and an aggregator service designed for DeFi investors, leveraging automation to help maximize profits from yield farming. The platform aims to simplify his complex DeFi landscape for investors who are less tech savvy and who seek a more focused approach than professional traders.

yearn.finance is currently at USD 9,735.50, has increased 2.86% over the last 24 hours. It currently has a market cap of $356 million, making it the 116th most popular token by coin market cap.