15M BTC goes into self custody

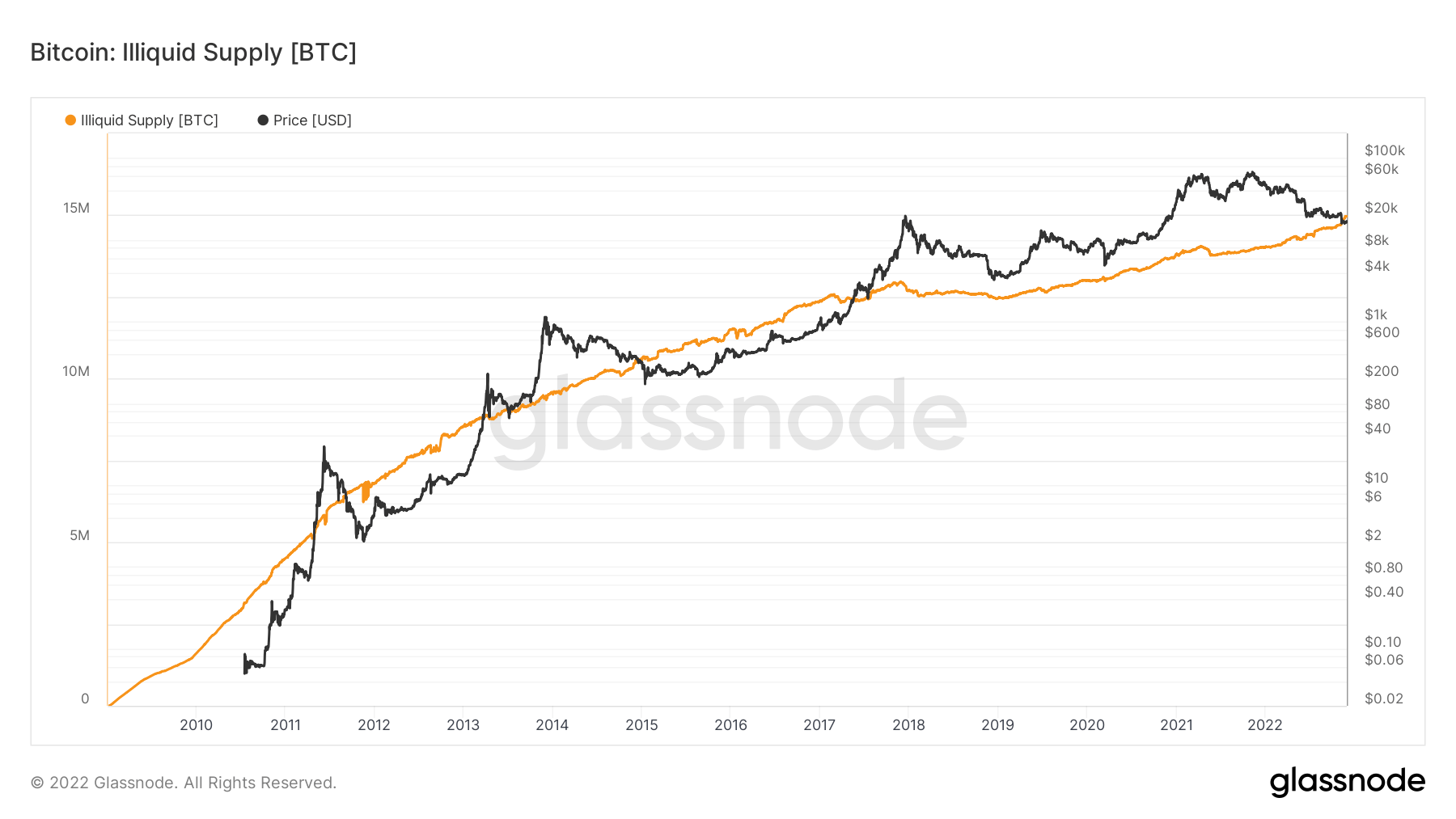

According to Glassnode on-chain data analyzed by Cryptoslate, nearly 78% of total Bitcoin in circulation is illiquid, and less than 22% of all BTC mined has moved and exchanged hands.

Indicators show that investors are pulling digital assets off exchanges and storing them in custodial wallets to avoid selling.

Cryptoslate has dug into Bitcoin supply indicators to gauge Bitcoin’s long-term prospects after weeks of market turmoil and uncertain macroeconomics. Our analysis reveals that more Bitcoin has become illiquid, despite having been in downside trading for most of 2022.

The illiquid supply is an important crypto data set, meaning only a few weak hands (a quarter of total BTC supply) can sell their holdings and apply bearish pressure. .

On the other hand, it also means that large buyers get more BTC from whales, institutions and strong hands.

The chart below shows Bitcoin’s move towards illiquid supply since 2010, with the amount of BTC in illiquid hands being roughly three-quarters of the total circulating supply.

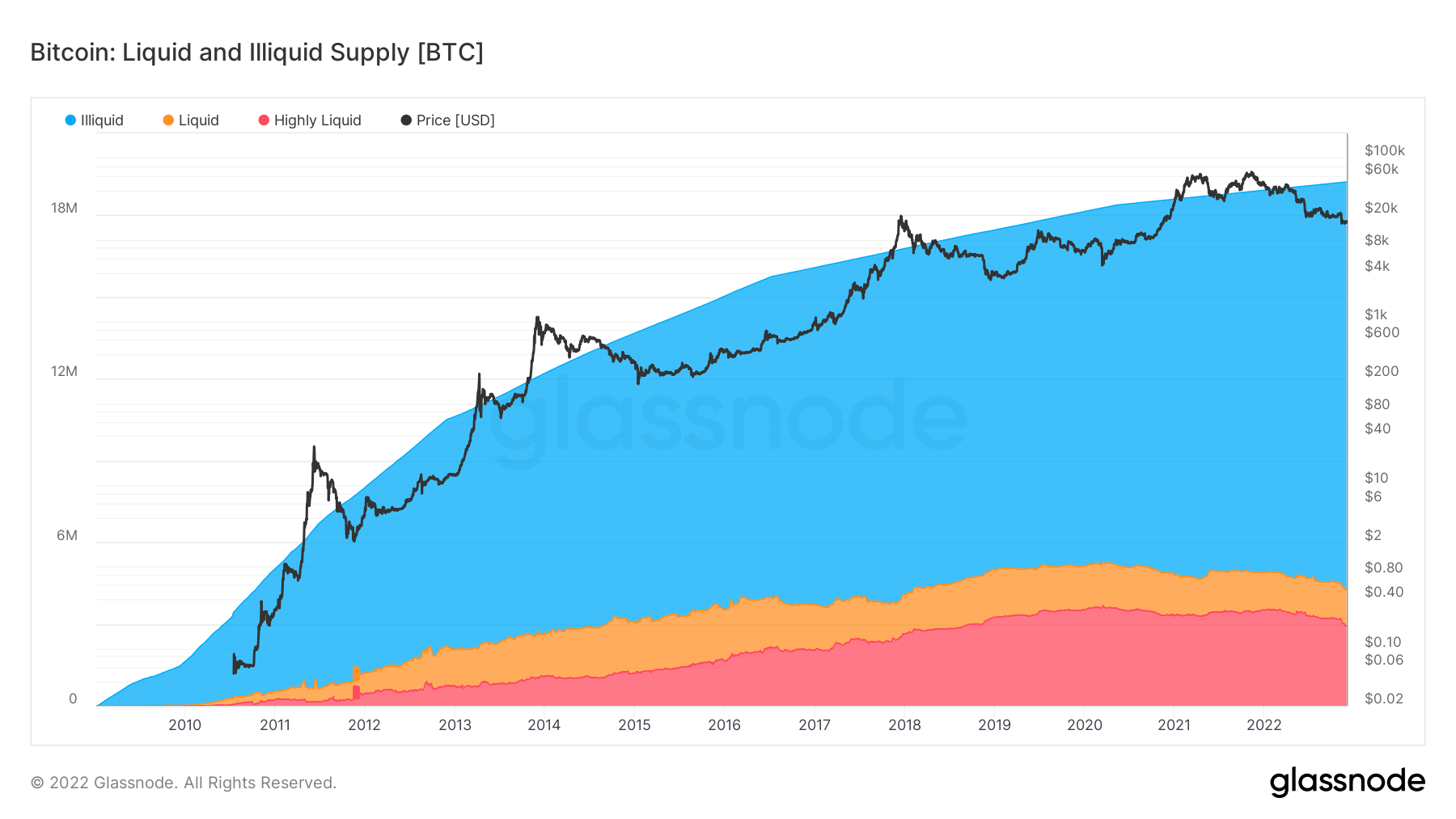

Think of illiquidity as the point where Bitcoin moves to a wallet with no spending history. Think of liquidity, on the other hand, as the point at which BTC moves to wallets with spending history, such as hot wallets and exchanges.

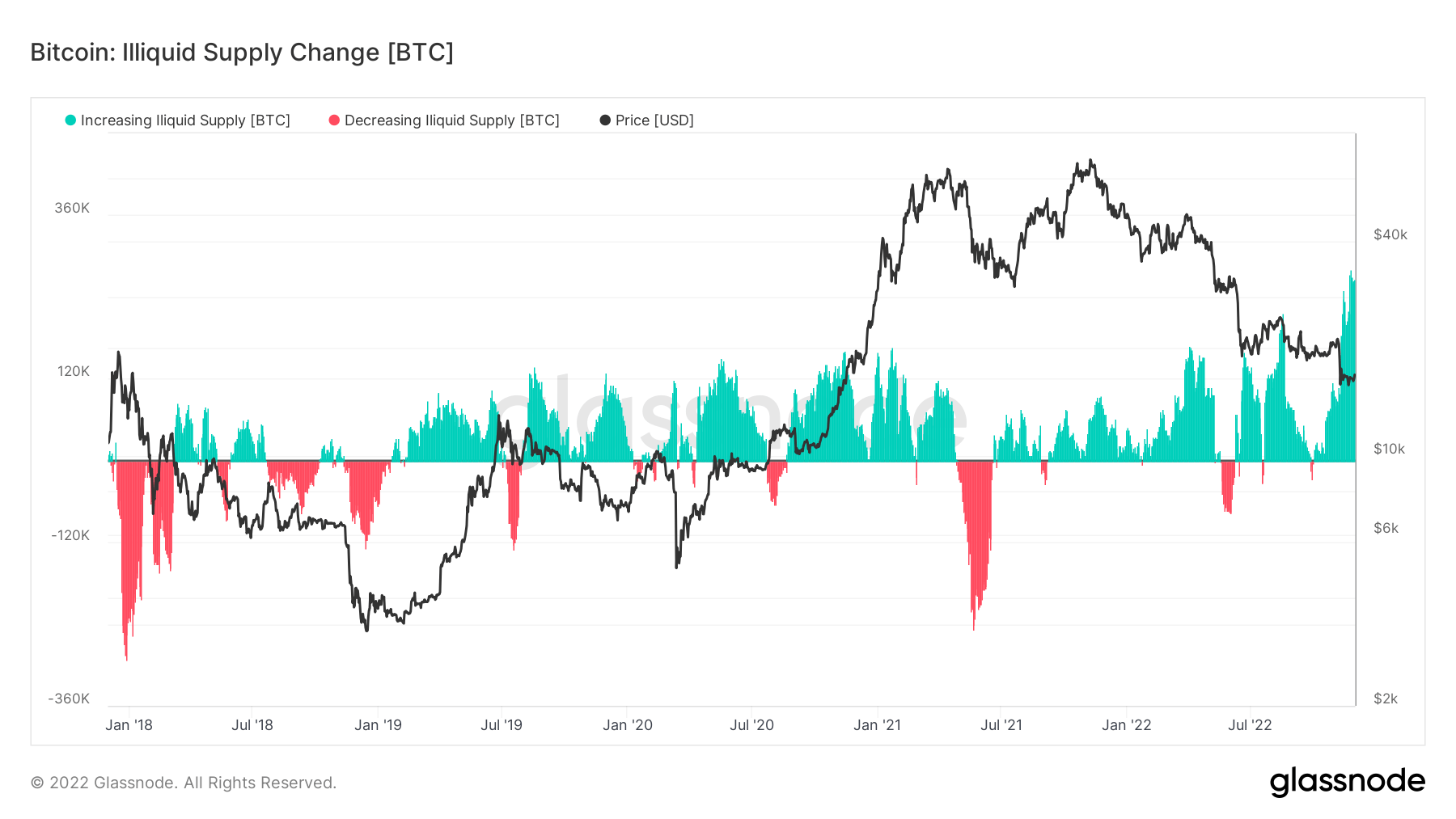

The above indicators suggest that more BTC is moving to cold storage, suggesting a prevalence of hodling and accumulation. Even better, as shown in the chart below. Declining liquid supplies indicate a subside in major selloffs and surrenders.The same Glassnode data shows that Bitcoin recorded the fastest rate of change

The same data by Glassnode records the fastest rate of change of BTC moving to long-term holders in the last five years, also called illiquid supply change. Therefore, it suggests that long-term holders have stopped using Bitcoin and are now in the accumulation phase.

A whopping 15 million BTC coins are not for sale, but only 4.3 million BTC coins are in circulation at all times and fall into the high/liquidity category. The majority of these coins are held by short-term investors or traders. Thus, placing the Bitcoin supply shock at the same level as when the price was at his $53,000 mark means that short-term holders have lost out to long-term holders.

In fact, the growth rate of liquid supply has slowed in the last few months. This can be attributed to a more bullish long-term outlook, and growing concerns about the safety of funds stored on exchanges and hot wallets.

The chart above shows the volume of liquid BTC assets and liquid BTC assets, showing that the current figures are 3 million and 1.3 million coins respectively. Amid the current market turmoil, it is clear that both liquid and liquid supply are trending downward.