$248M stablecoins flow out of Coinbase as community refutes exchange liquidity issues

Rumors surfaced Friday night that Coinbase could face liquidity issues Leaked An email indicating that the affiliate program will be suspended.Business insider report They received the following email.

“This was neither an easy decision nor an easy decision, but due to the crypto market conditions and the remaining outlook for 2022, Coinbase will not be able to continue to support incentive traffic to the platform.”

Some have used Twitter to argue that this decision represents a liquidity issue for the top US exchanges. Kurt Wuckert Jr. of Coin Geek Tweet The suspension of affiliate programs, coupled with other decisions Coinbase has made in the past few weeks, means that a “liquidity crisis” is imminent.

Coinbase leak

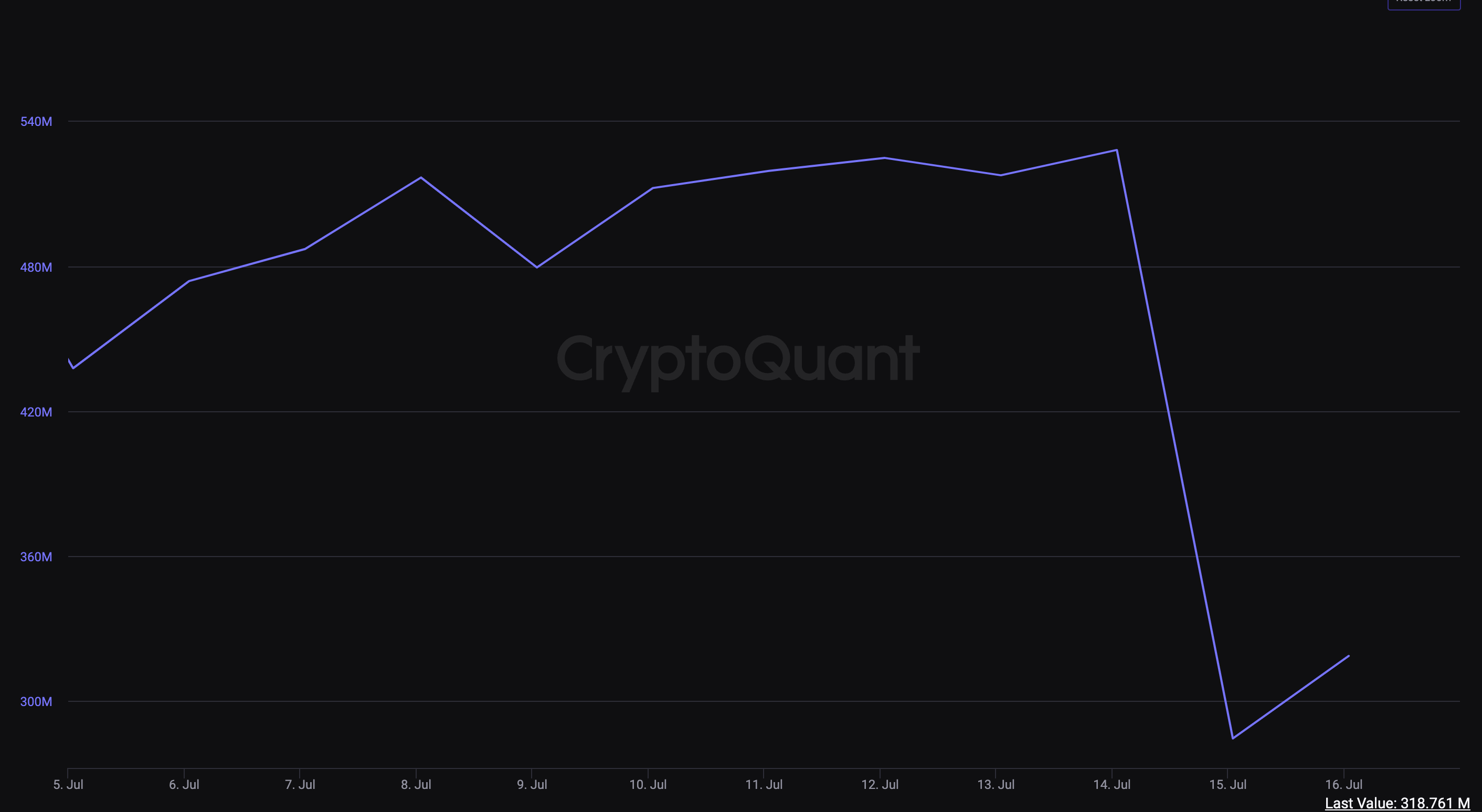

On July 15, about 50% of Coinbase Pro’s stablecoins left the exchange, according to CryptoQuant’s on-chain data. The total amount is about $ 248 million. Stablecoin outflow rates were significantly higher on Coinbase than on other exchanges such as Binance. During the same period, only about 1% of Stablecoin’s reserves left Binance, but the token value was similar at just under $ 300 million.

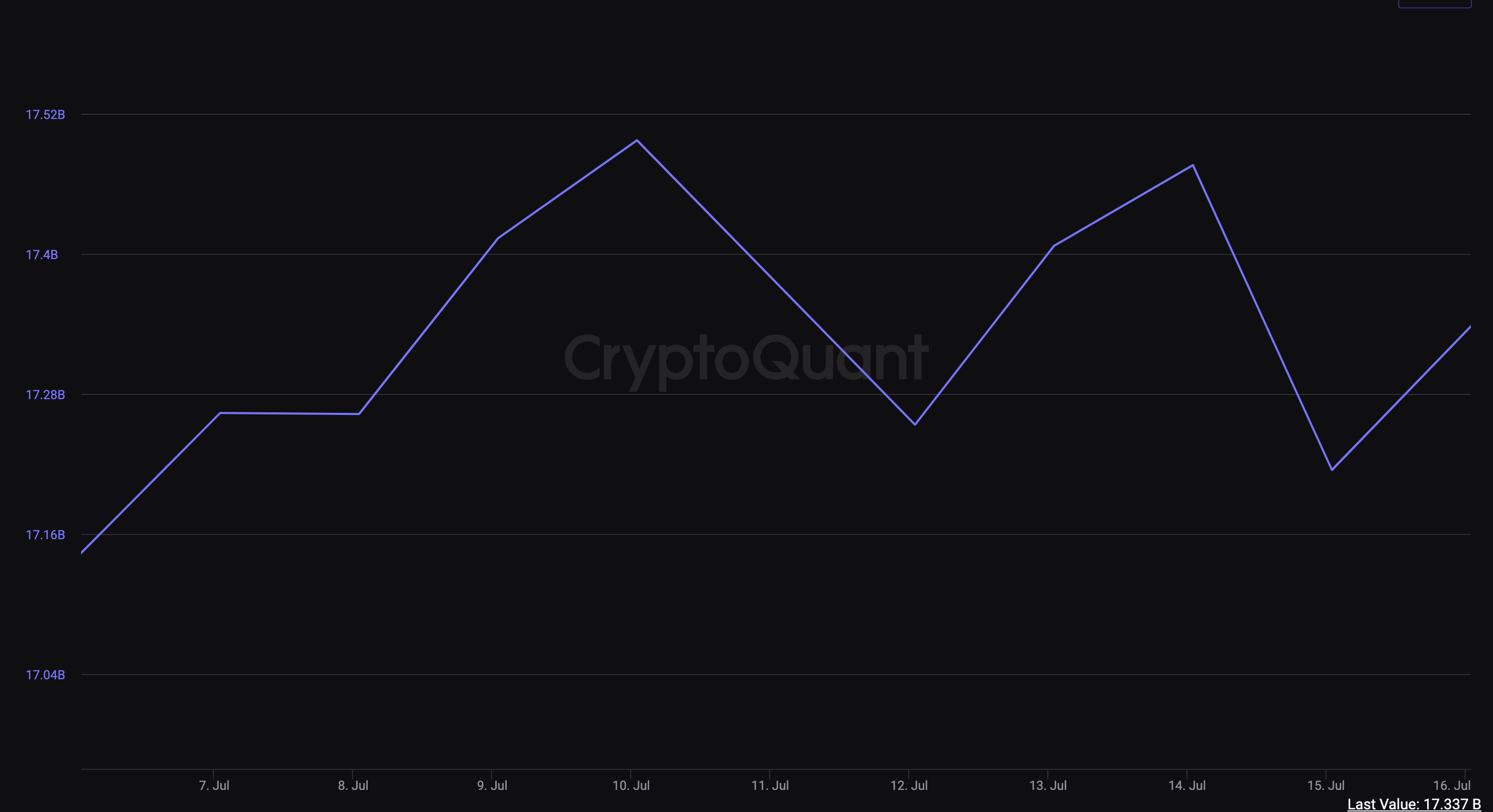

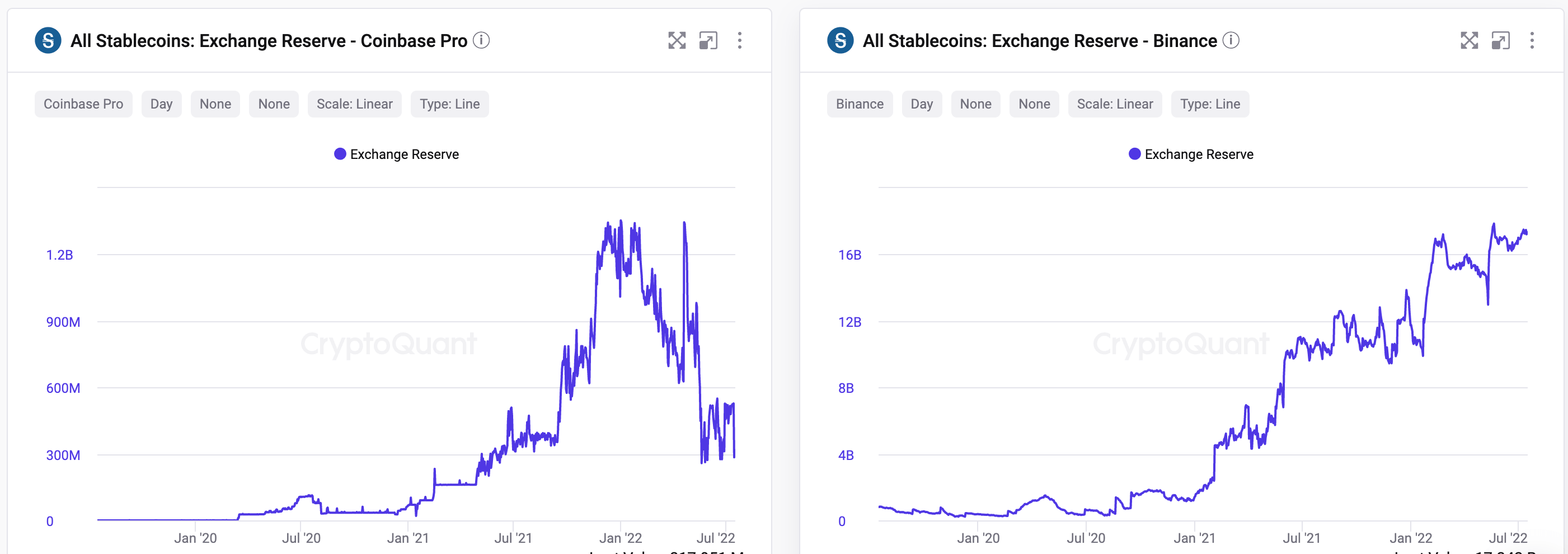

Comparing the value of Stablecoin on two exchanges, the decrease in Stablecoin held by Coinbase is in contrast to Binance. Stablecoins peaked at around $ 1.2 billion in Coinbase in January 2022, but is currently worth only $ 284 million. In Binance, the value has been on the rise since 2019.

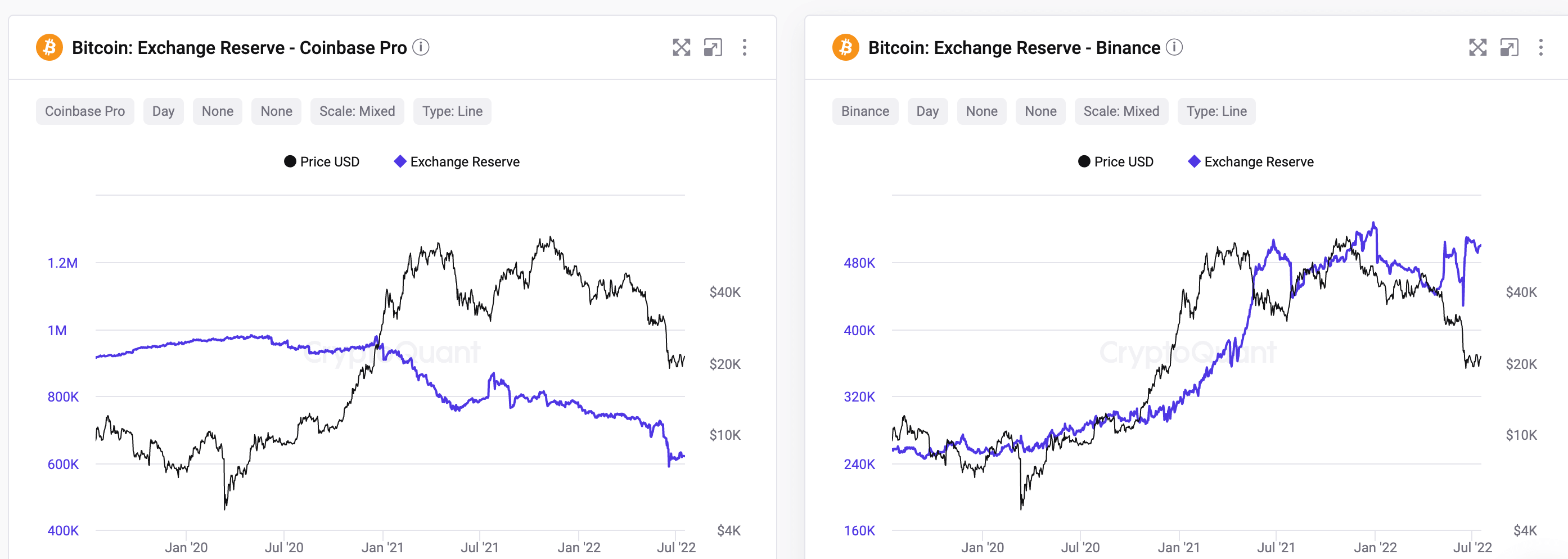

Comparing the Bitcoins held by each exchange, the data isn’t that dramatic, but it still depicts a worrying situation. Coinbase’s Bitcoin reserves are steadily declining, while Binance is increasing over the same period.

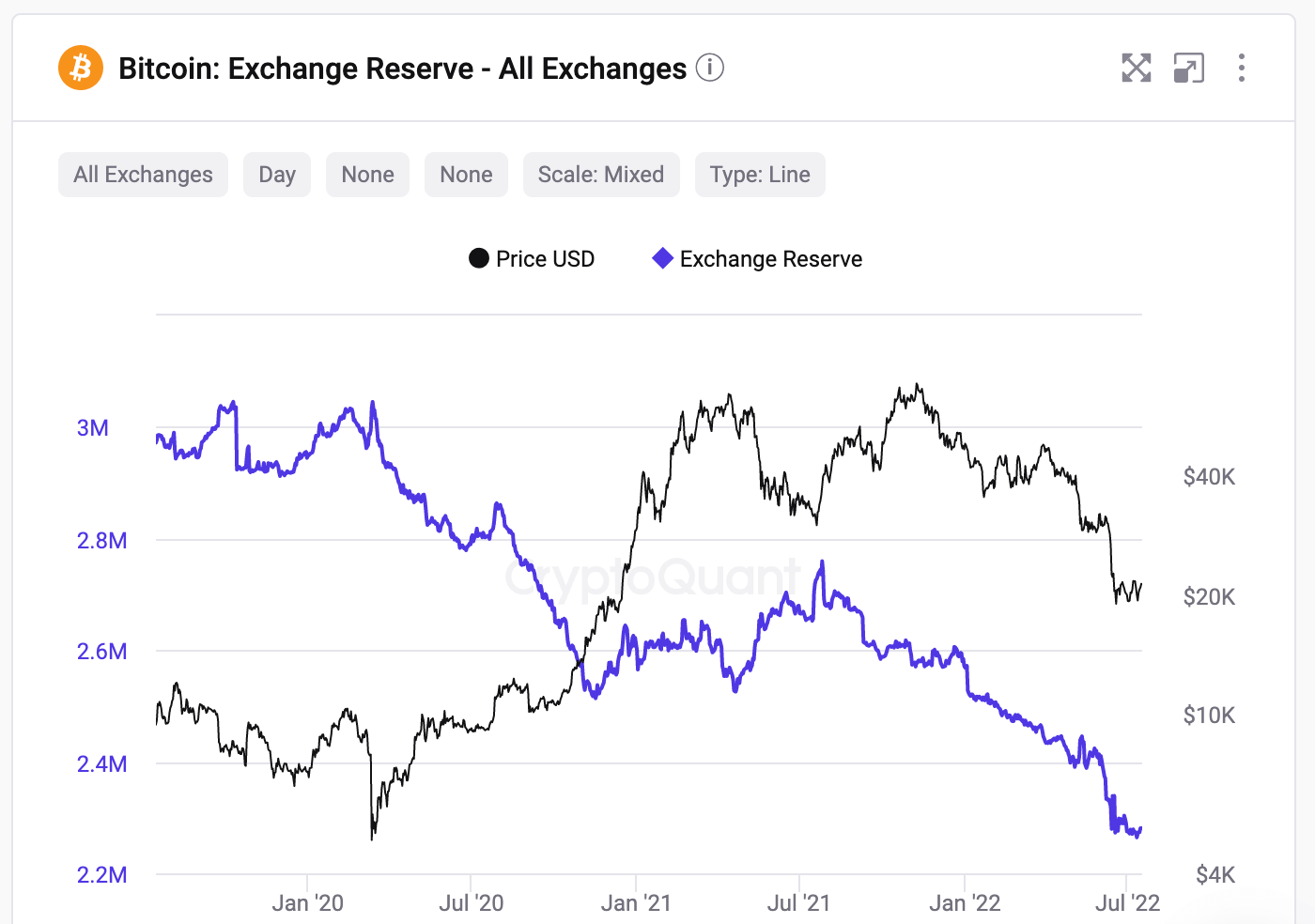

If all the exchanges tracked by CryptoQuant are included, the Coinbase graph will appear to follow industry-wide trends. The downtrend in Bitcoin at Coinbase may be due to the growing popularity of using cryptocurrencies in unmanaged (unhosted) wallets.

Community protects Coinbase

In rumors of a crisis at Coinbase, some industry experts have called on people to suggest that exchanges are having problems. Kraken’s Dan Held tweeted, “Coinbase has no liquidity crisis,” but NJ Skobene, the developer responsible for Coinbase’s affiliate program, confirmed that removing the program was not a warning sign. ..

As the guy who literally launched the affiliate program in 2019, shutting it down has nothing to do with liquidity.

— NJ skoberne (@howdoyousaynejc) July 16, 2022

Cryptocurrency YouTube Jungle Inc also tweeted that Coinbase has “$ 6 billion in cash” and a significant cryptocurrency reserve. But his confidence began and ended with the same post that confirmed that he had removed all funds from the exchange. After Voyager and Celsius went bankrupt already this year, it may seem that the risk of holding an exchange is increasing.

Coinbase has 6 billion cash and a large cryptocurrency reserve. They are ok!

That said, I transferred everything. 🍾🍾🍾

— Jungle Inc 💥 SteadyLads 💥 # MMG (@jungleincxrp) July 16, 2022

On July 12, Coinbase co-founder Brian Armstrong tweeted that he was “still adapting” to the growth the company achieved in 2021. Will this growth destroy one of the most trusted exchanges in the world? If so, it will definitely have a knock-on effect on other parts of the industry. Currently, Coinbase’s cost-cutting strategy does not seem to be extreme given the decline in Bitcoin prices since January.

Coinbase grew 1 ton in 2021, but we are still adapting to that growth. One of the crazy parts of our industry is the potential for growth of 300-500% or -50% in a particular year. It makes it very difficult to plan and culturally absorb so many people during the up period.

— Brian Armstrong – barmstrong.eth (@brian_armstrong) July 12, 2022