65% of Bitcoin’s circulating supply has not moved in the last 12 months

The idea that an active market is healthy is not always true. The amount of activity seen on a particular network can definitely indicate how stable that network is, but the lack of activity can also indicate an upcoming bullish trend.

For example, consider the Bitcoin network.

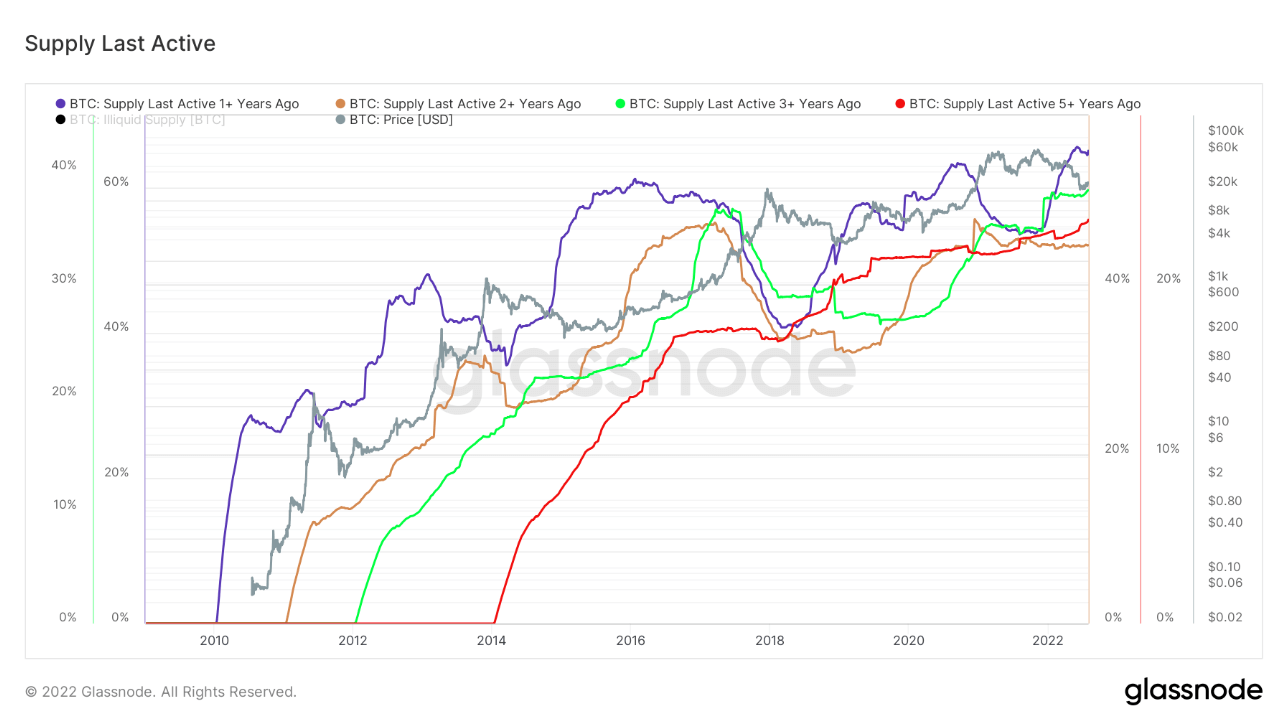

Bitcoin’s price drop has not affected the majority of circulating supply.According to data from glass nodemore than 65% of Bitcoin’s circulating supply, or about 12.35 million BTC, has not moved in at least a year. This is a significant increase from supply that has been inactive for at least 2 years, and a significant increase from supply that has been inactive for at least 3 years.

According to Glassnode data, 8.55 million BTC (45% of circulating supply) has not moved for at least two years, while 7.22 million BTC (38% of circulating supply) has not moved for three years.

Zooming out further to supply that has not moved in over five years, we can see that it is heading towards an all-time high of 4.37 million BTC, or 23% of supply.

This shows an interesting trend — investors are holding coins even during bull markets and crypto winters. Bitcoin’s ATH rally in November 2021 has not reduced the percentage of bitcoins held over a year, nor has the ongoing bear market. The data suggests that investors are looking down on their time preferences and are holding the coin thick and thin.