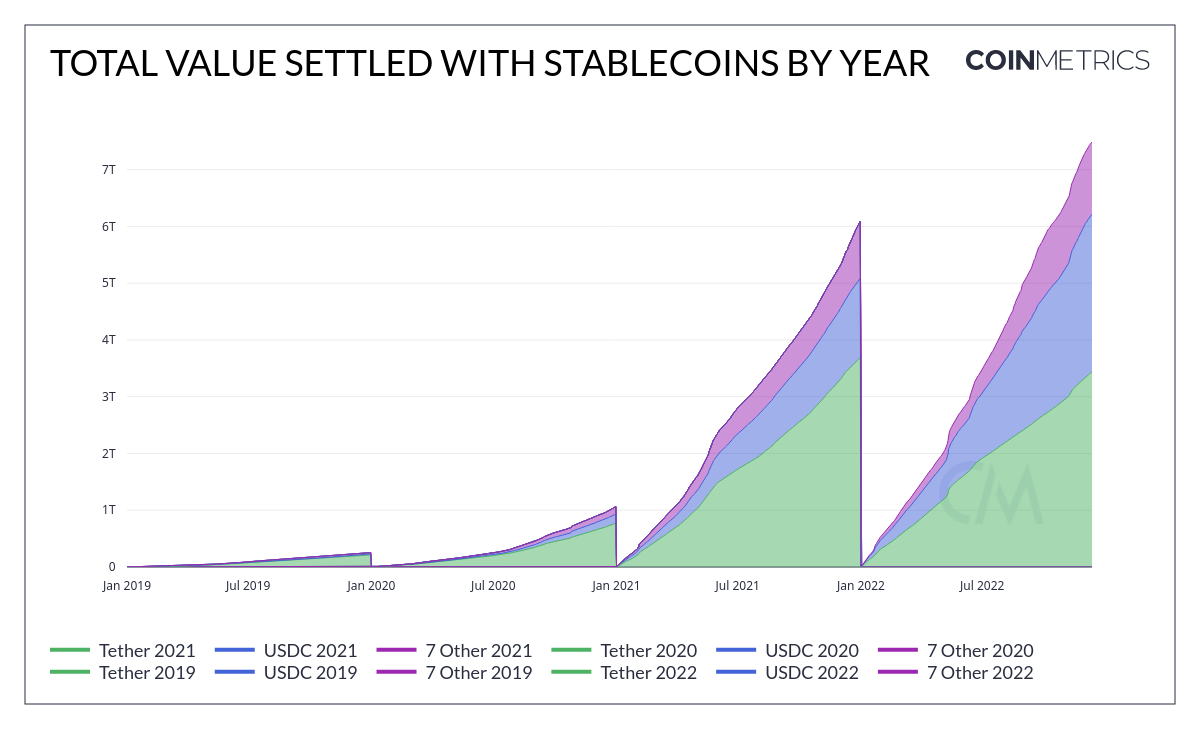

Adoption grows as more than $7T settled with stablecoins in 2022

The ongoing bear market has done little to curb the rise in stablecoin usage. On the contrary, dollar-pegged coins like USDT and USDC have seen a parabolic increase in market capitalization this year and have become the de facto settlement currencies of the cryptocurrency industry.

Following the demise of Terra and its algorithmic stablecoin UST, two stablecoin giants have taken over the majority of stablecoin volume.

according to data According to CoinMetrics, more than $7 trillion in value will be settled in stablecoins by 2022. This is up significantly from his $6 trillion settled in 2021 and his $1 trillion settled the year before.

Some analysts predict that the value settled in stablecoins could reach $9 trillion by 2023. That’s second only to Visa, which processes about $12 trillion in value annually. Others believe that the on-chain volume will surpass not only Visa but also all four major card networks combined: Visa, MasterCard, American Express and Discover.

However, even if payment volumes remain flat next year, they will individually outperform almost all other major payment providers, including Mastercard, American Express and Discover.

Mastercard, the world’s second-largest card issuer, has processed nearly $2.2 trillion in value so far in 2022, well below the combined payments of the seven largest stablecoins. increase. For example, American Express settled nearly $1 trillion worth of value this year, while Discover he settled less than $200 billion in transactions.