Analysis of crypto transaction fees suggests exchanges prefer to move in Bitcoin

Cryptocurrency exchanges can generate revenue in a variety of ways, including lending to margin traders, clearing fees, and on/off ramping fees. However, the core revenue stream will continue to charge fees on transactions.

There are multiple types of transactions and therefore many types of transaction fees. Comparing the different transaction fees on the Bitcoin and Ethereum chains, the data suggests that exchanges prefer to use the former to transfer value internally.

transaction fee

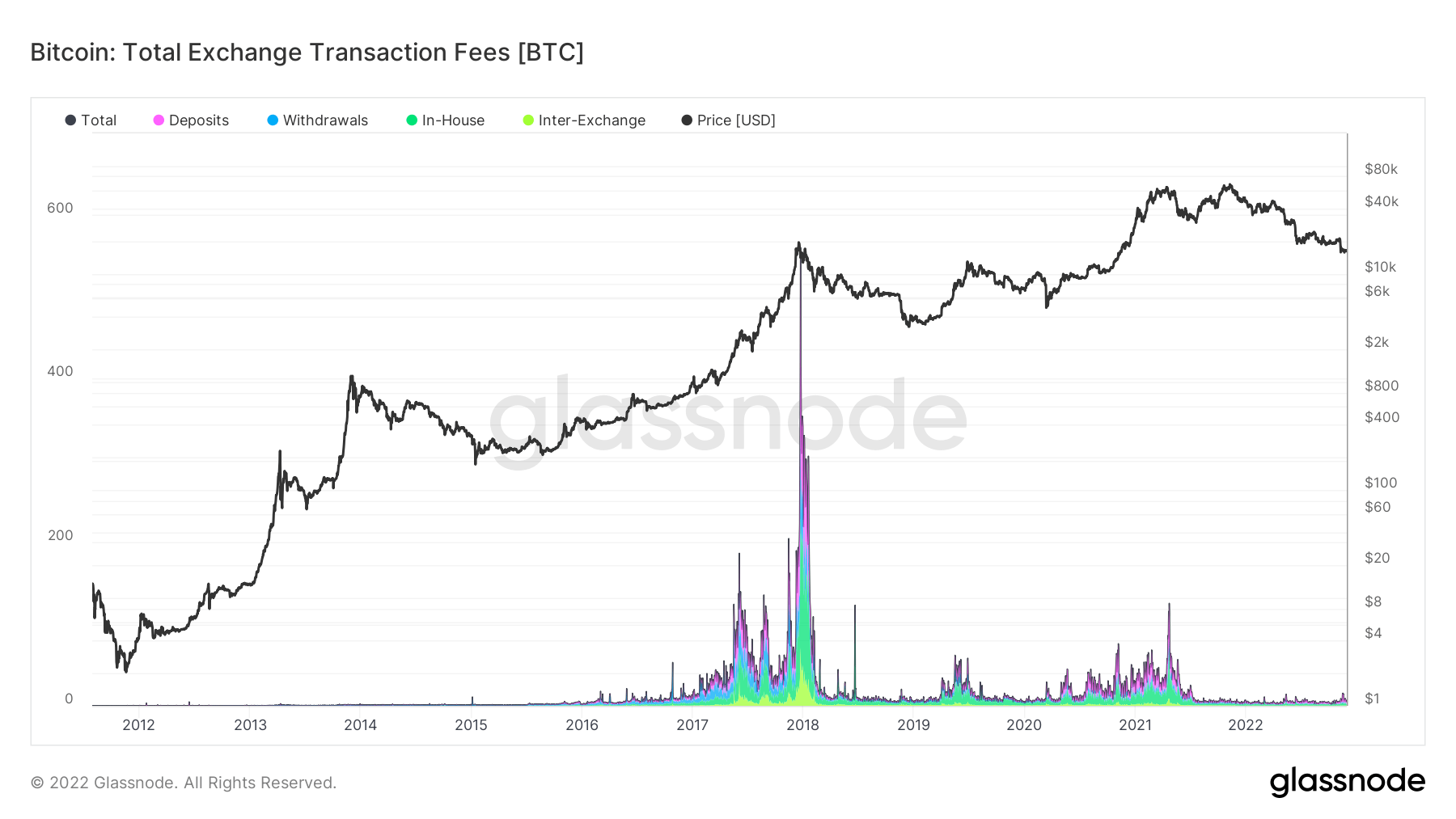

On-chain data provided by Glassnode and analyzed by crypto slate It showed an irregular history of fees earned by exchanges on bitcoin transactions.

The chart below shows that fees surged significantly towards the end of 2017 as BTC reached its previous cycle peak of $20,000.

The 2021 bull market saw another spike in fees in April 2021, albeit significantly lower than the 2017 bull market, as BTC approached $65,000.

Curiously, the most recent bull market top of $69,000 in November 2021 was not accompanied by another spike in fees, suggesting relatively little exchange activity compared to April 2021. I’m here.

After April 2021, Bitcoin transaction fees have dropped significantly and remain truncated.

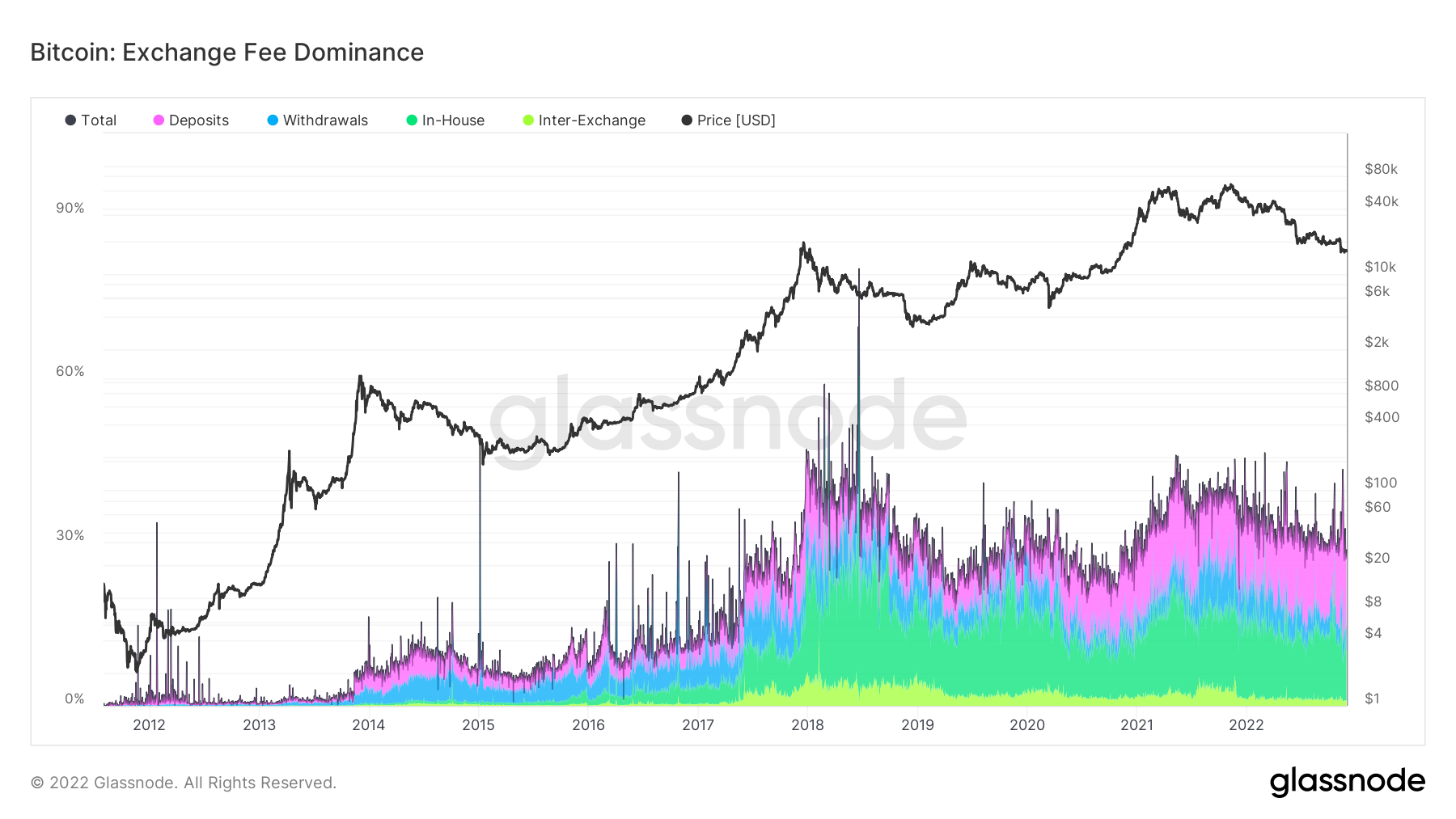

Bitcoin: Exchange Fee Advantage

The Exchange Fee Dominance metric is defined as the percentage of total transaction fees paid related to on-chain exchange activity. This is further broken down into the types of transactions that earned a fee, as follows:

- Deposit: A transaction that includes an exchange address as the recipient of the funds.

- Withdrawals: Transactions that include an exchange address as the sender of the funds.

- In-house: Transactions involving a single exchange address as both the sender and receiver of funds.

- Inter-Exchange: Transactions that contain the addresses of (different) exchanges as both sender and recipient of funds.

The chart below shows that Bitcoin transaction fees account for 36% of all exchange revenue streams related to BTC. This is further split.

- Deposit – 21%

- Withdrawal – 4%

- In-house – 10%

- Interexchange – 1%

Over the past five years, the Deposits and In-House categories have grown exponentially.

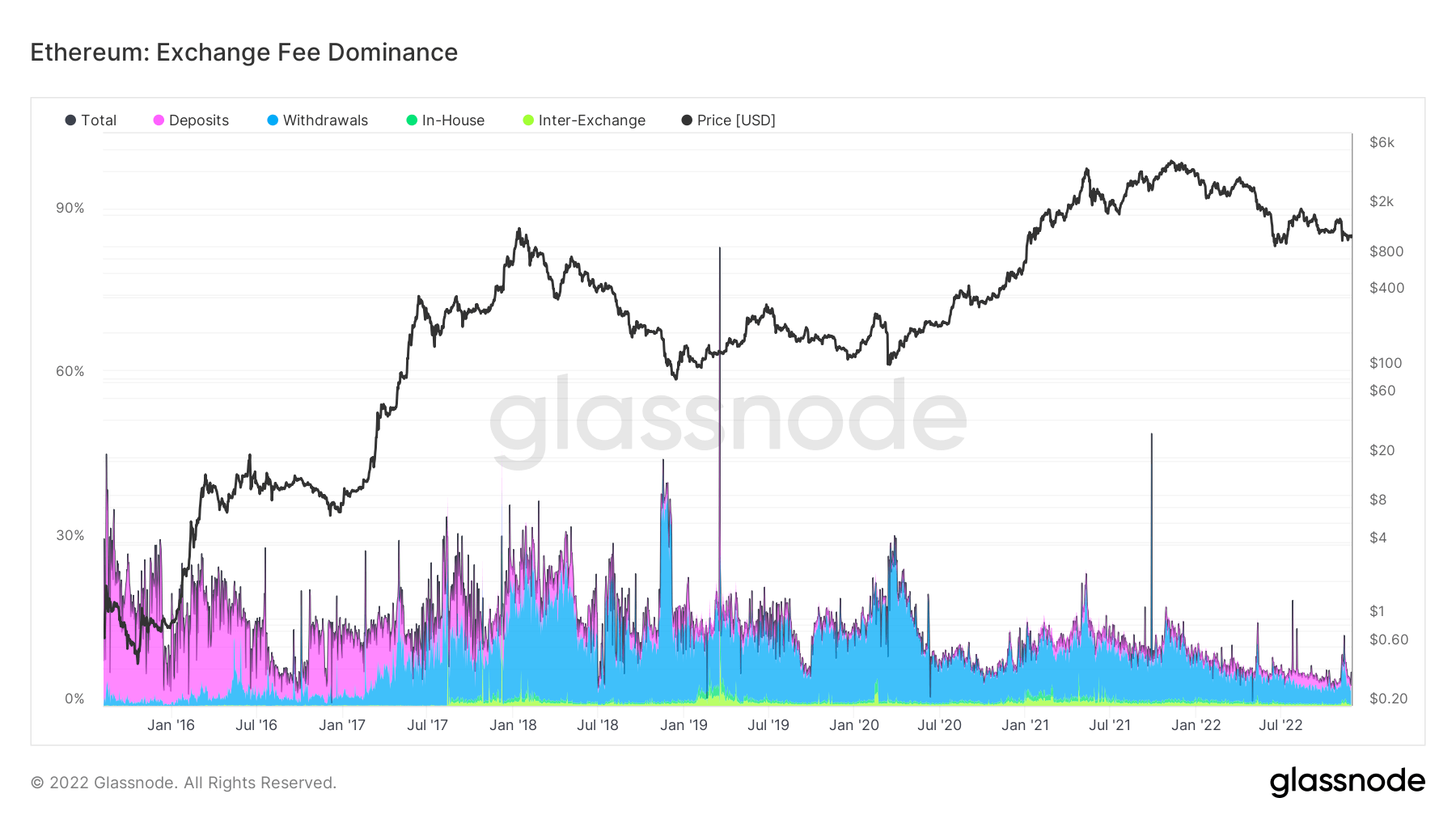

Ethereum: Dominance in Transaction Fees

An analysis of Ethereum’s exchange fee dominance paints a completely different picture. Currently, Ethereum transaction fees account for his 5% of the exchange’s revenue streams related to ETH.

Withdrawals constitute the most important category of transaction fee types since July 2017.

The relatively low in-house fees compared to Bitcoin suggest that exchanges prefer not to use ETH when transferring funds between internal wallets.