BendDAO reaches near new all-time highs on Mutants, BAYC and Azuki loans

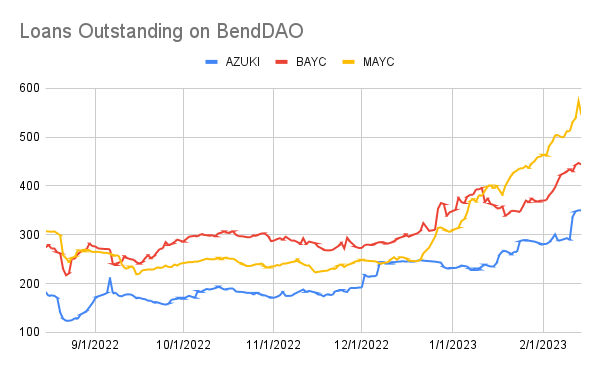

BendDAO, the largest NFT lending platform by market capitalization, hit an all-time high last month on the back of 4,399 personal loans, mostly Azukis, Mutants and BAYC.

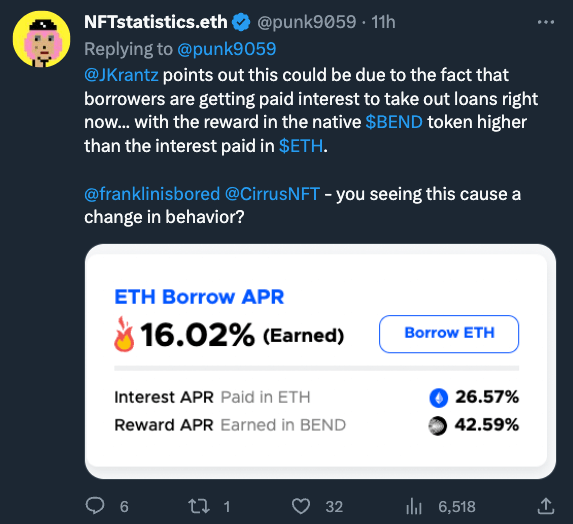

Twitter user @JKrantz speculates that the sudden all-time high may be due to borrowers paying higher interest rates by using native BEND tokens to make loans in NFTs. .

Over the past 30 days, BEND has increased by 377.5%. Some say this is why loans are flocking to the platform as it can generate a very high rate of return on assets if the borrower accepts native BEDN tokens via his ETH.

BendDAO is considered a “peer-to-pool” lending protocol.Recently, new NFT lending sites such as pwn.xyz It’s springing up. Unlike BendDAO, pwn.xyz has no price oracle, instead allowing borrowers and lenders to set the terms of their loans themselves. The current version also charges no fees (BendDAO currently charges a fee equal to 30% of the total interest income collected on NFT loans).

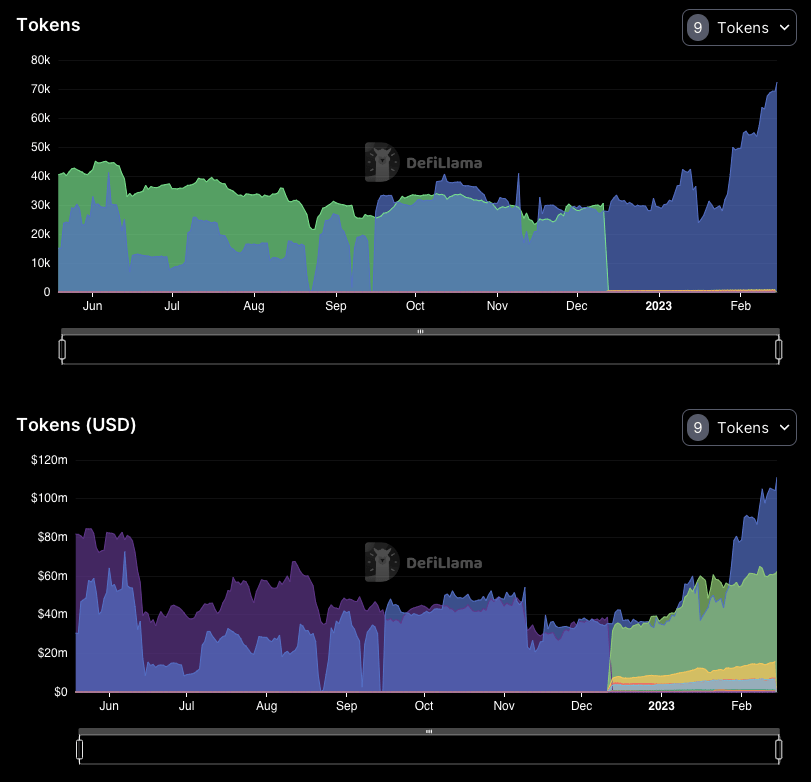

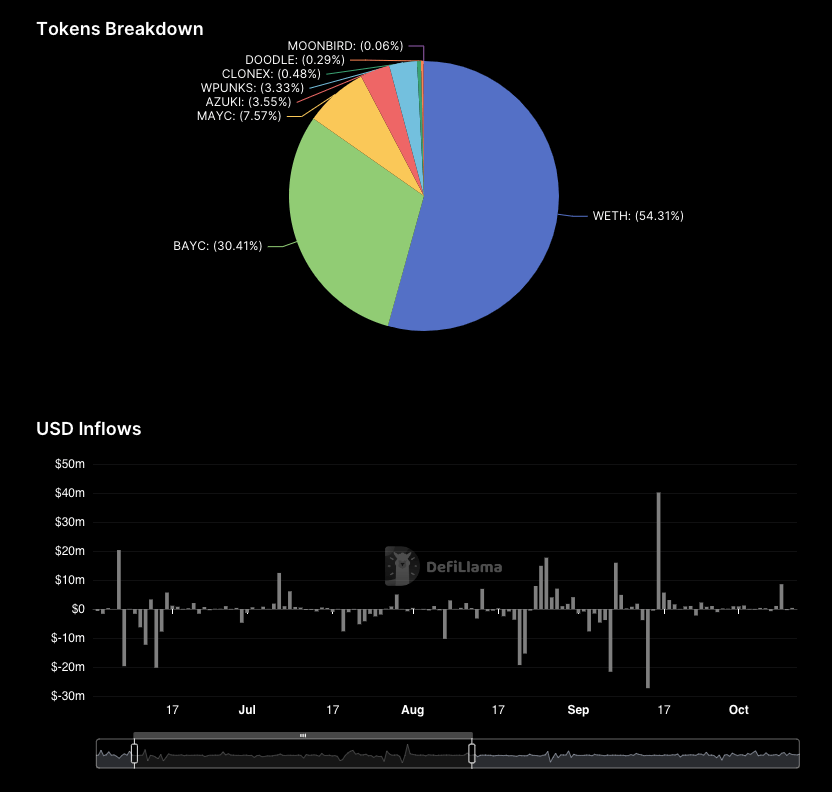

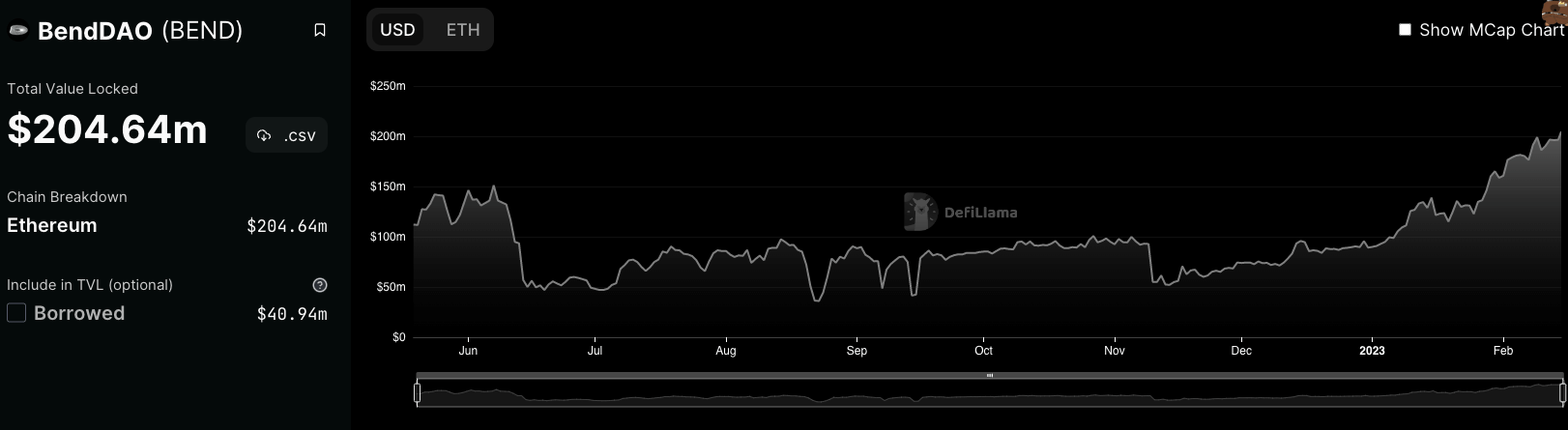

BendDAO is by far the largest NFT lending protocol by market cap. Currently, more than $200 million of his assets are locked on the company’s platform, which is more than four times his combined assets of his competitors.

BEND is currently trading at $0.0265.

The surge in protocol activity follows a month in which large loans were recorded in the NFT lending industry.

In January, BendDAO saw ATH in terms of monthly loan volume and number of loans. A total of 17.9K ETH, worth about $28 million, spread across a total of 4,399 loans.

The good, the bad, and the ugly of the NFT lending protocol

In August 2021, BendDAO survived a bank run where 15,000 ETH was withdrawn from contracts within 48 hours.

It could have been disastrous news for bendDAO, given the number of debt-laden NFTs with no bids listed on the platform.

Lenders of large NFTs like BendDAO could face a situation when the overall market slows down and lenders join the race to collect funds on the lowest priced NFTs.

In such cases, collection of funds may not be possible.

However, the opposite is also possible. The lender may be given an asset that increases significantly in value over the life of the loan. And in the event of default, lenders may end up with NFTs worth far more than what was secured.

The sector as a whole continues to perform well.

in January, crypto slate reported that NFT Lending posted its highest overall monthly trading volume throughout January 2023. Outside of his market leader BendDAO, other platforms such as NFTfi, X2Y2 and Arcade accounted for another $44.8 million in the month.