Bitcoin falling below key resistance for only the fourth time in it’s history

CryptoSlate’s Analysis of Bitcoin (BTC) Realized Price and Cost-Based Cohort Reveals Current Bear Market Transition Could Turn to Bull Market by End of Q1 2023 I made it

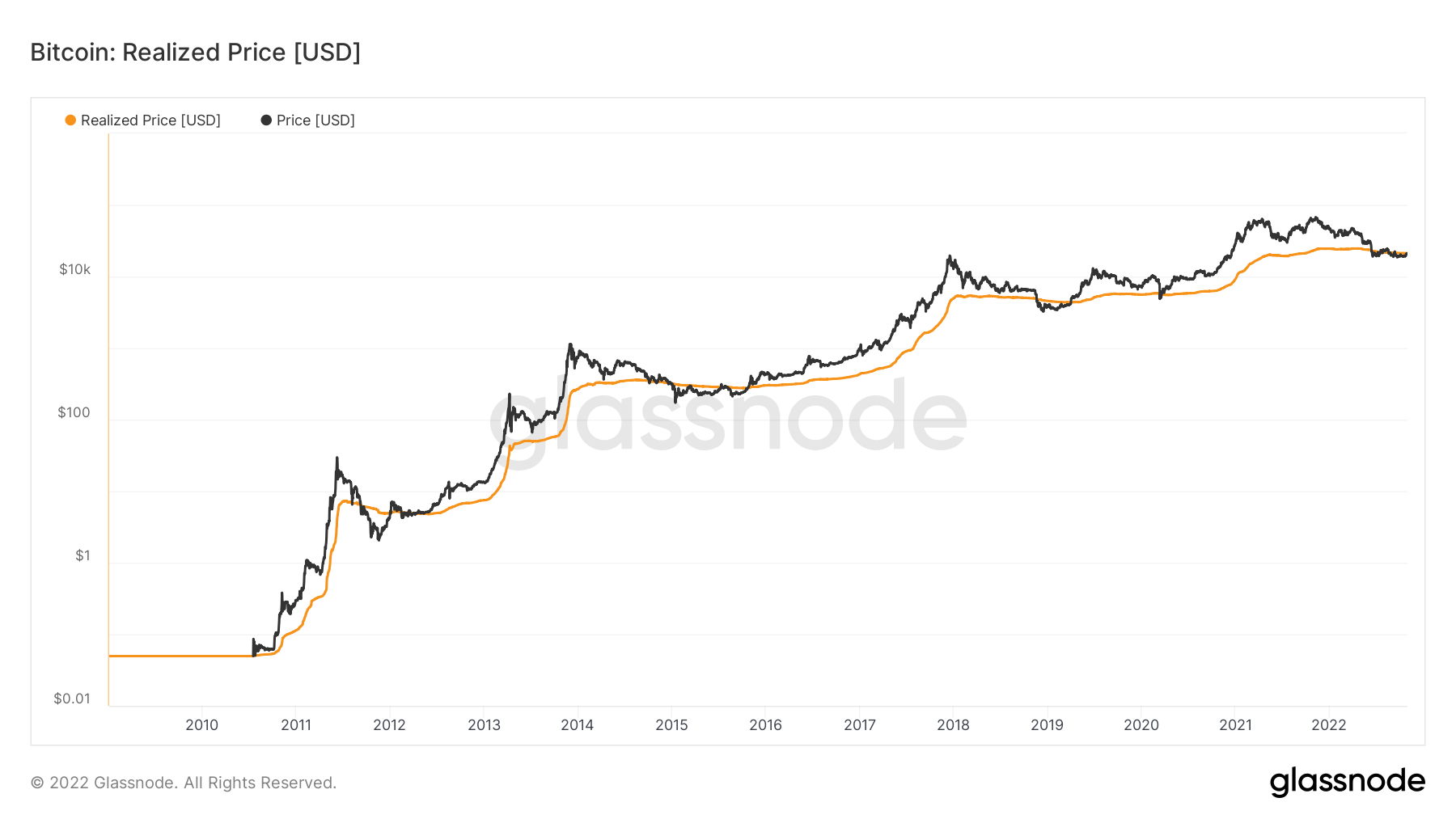

realization price

The realized price is calculated by dividing the realized cap by the current supply.

The realized cap metric is slightly different from market cap. Market capitalization uses the current price of the asset, while realized cap uses the price when it last changed. Instead of taking daily closing prices, we consider different parts of the supply at different prices.

Specifically, it is calculated by valuing each unused transaction output (UTXO) based on the price when it was last moved.

When Bitcoin’s real price fell below $20,000, it also fell below its realized price and has been fighting to overcome it. At the time of this writing, Bitcoin is trading at around $20,430, with a realized price just above $21,000.

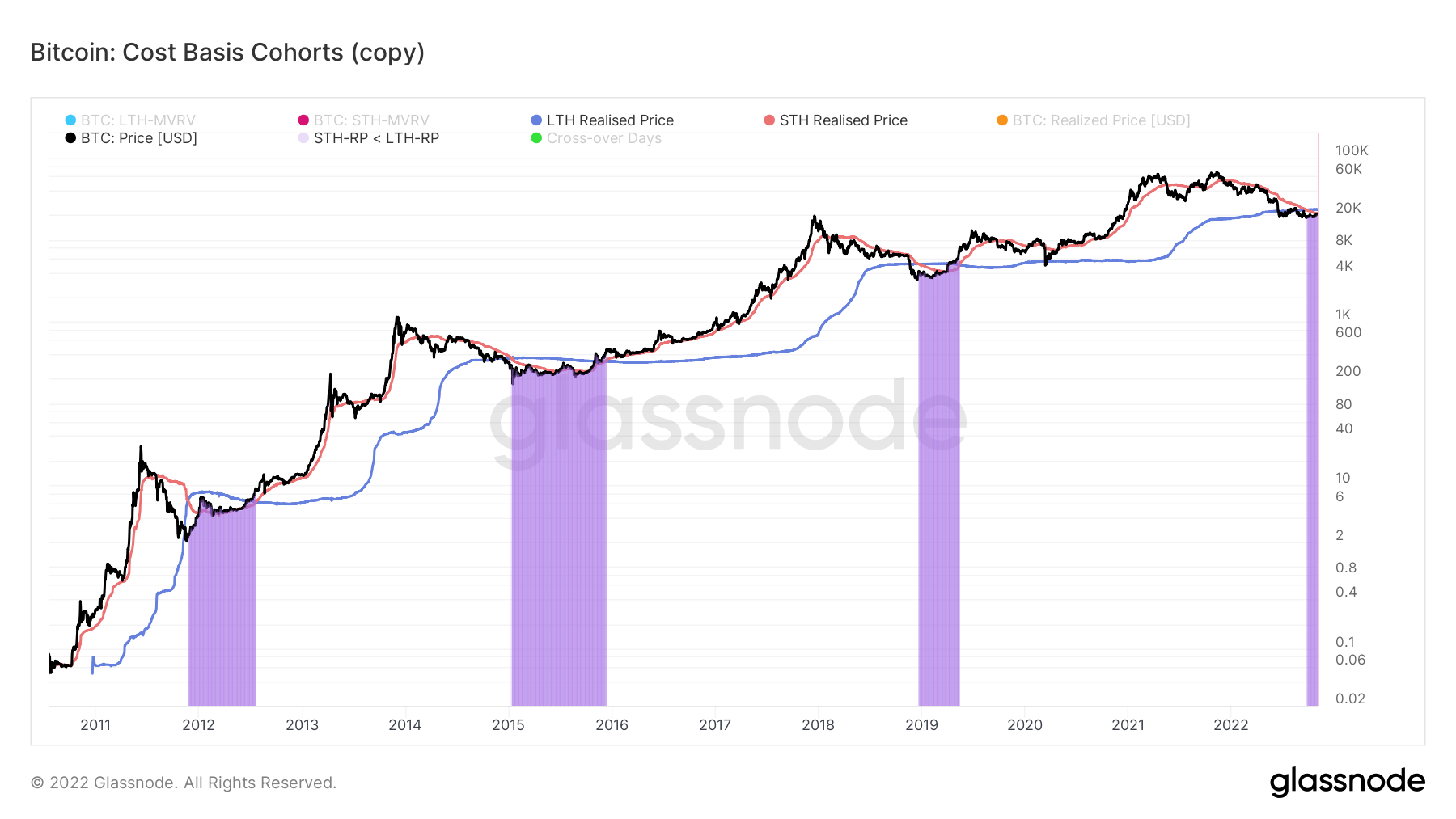

Cost-based cohort

The realized price reflects the total price of each coin when it was last used on the chain. Therefore, realized prices for short-term holder (STH) and long-term holder (LTH) cohorts can be calculated to reflect the total cost basis for both groups.

When calculated, the cost basis ratio of LTH and STH reflects the ratio of realized prices of LTH and STH. When this metric appears as an uptrend, it indicates a bear market setting where STH is losing at a higher rate compared to LTH. If the downtrend line is drawn, it reflects the bull market sentiment that LTH will run out of his holdings and he will transfer to STH.

The cost basis ratio reflects that a deal is greater than 1.0 when the LTH cost basis point is higher than the STH. The indicator has previously signaled that the market has reached the final stage of bear market capitulation.

Bitcoin’s cost-based cohort chart shows that the current price fell below the realized prices of STH and LTH on September 23rd and remains below them as of November 3rd.

Such a signal has only occurred three times so far. This is reflected in the purple area in the chart below.

With each incident, the price of Bitcoin surged to new all-time high (ATH) levels.

Bitcoin price looks set to break current resistance in the 6-month to 1-year range — the most optimistic analyzes show it at the end of the first quarter of 2023.