Bitcoin halving pattern suggests price will cross above higher, realized value

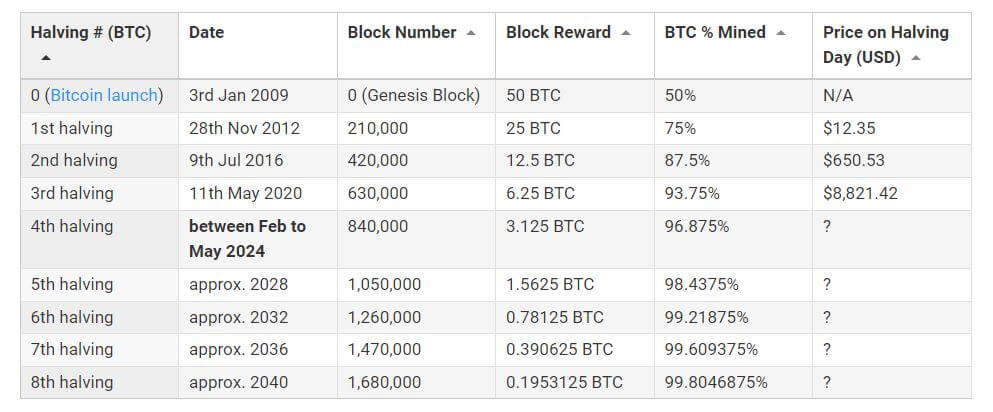

A Bitcoin halving is an event in which a miner’s block reward is halved. This happens roughly every four years, depending on when a total of 210,000 blocks have been mined since the last halving start date.

As a result, the number of new tokens entering circulation slows down, fewer tokens enter the supply, and Bitcoin becomes scarcer over time.

This process continues until the final half-life 2136 When the mining reward is cut to 0.00000001 BTC.

Where are we in the current Bitcoin Halving?

The third and subsequent halvings are well underway. March 25, 2024about 75,000 blocks remain to be mined before reaching that point.

Based on this movement estimate, the number of days since the last half-life of May 11, 2020 is 1,414. Previous halving time:

- First half-life: Nov 28, 2012 to Jul 8, 2016 – 1,318 days.

- Second half-life: 07/09/2016 to 05/10/2020 – 1,401 days

The price of the halving has so far registered an increase above that of the previous halving, supporting the theory that BTC’s scarcity drives the price.

But is it the full story?

realization price

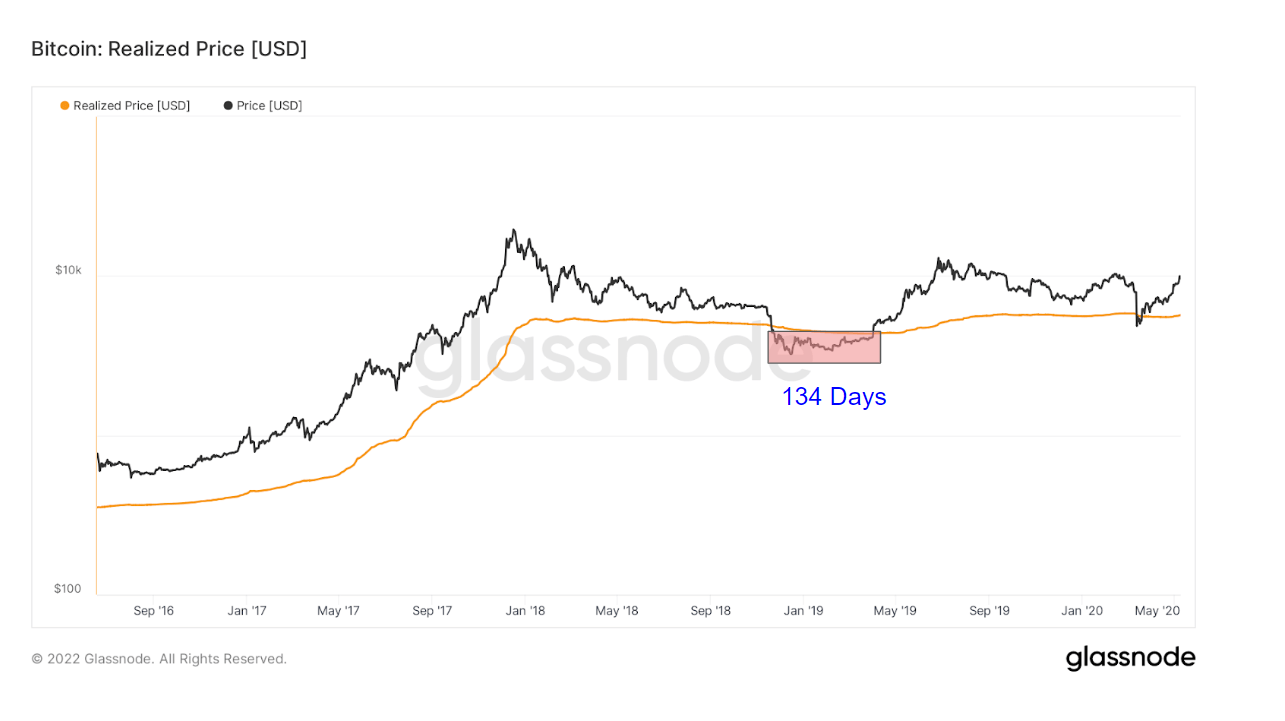

Realized price is calculated by taking the total realized market capitalization and dividing it by the number of Bitcoins in circulation. In other words, the realized price is a proxy for the actual market price and measures how much the entire market paid for BTC on average.

Traders see realized prices as on-chain support and resistance price levels. An actual price above the realized price indicates that the overall market is profitable and is considered a sell indicator (bearish).

In contrast, an actual price below the realized price indicates that the overall market is suffering losses and is considered a buy (or bottoming) indicator (bullish).

On-chain analysis of Glassnode data reveals that the periods of realized price below actual price continued until each halving go-live date.

The first halving saw BTC fall below the realized price for 299 days before the next halving occurred in July 2016, about seven months later.

In the second halving, BTC stayed below its realization price for 134 days (and also briefly in April 2020) before the next halving occurred in May 2020, about 12 months later.

As we count down to the third halving, the realized price is below BTC for the past 168 days. The actual price of BTC is currently below the realized price of $21,000, suggesting that the actual price of the card is increasing, as has happened in previous cases.