Bitcoin long-term holders remain bullish despite losses

Bitcoin’s (BTC) year-long decline has left several holders suffering unrealized losses, including long-term holders (LTH) who have held the coin for at least six months.

However, CryptoSlate’s analysis of Glassnode data shows that this investor group remains bullish on the flagship digital asset.

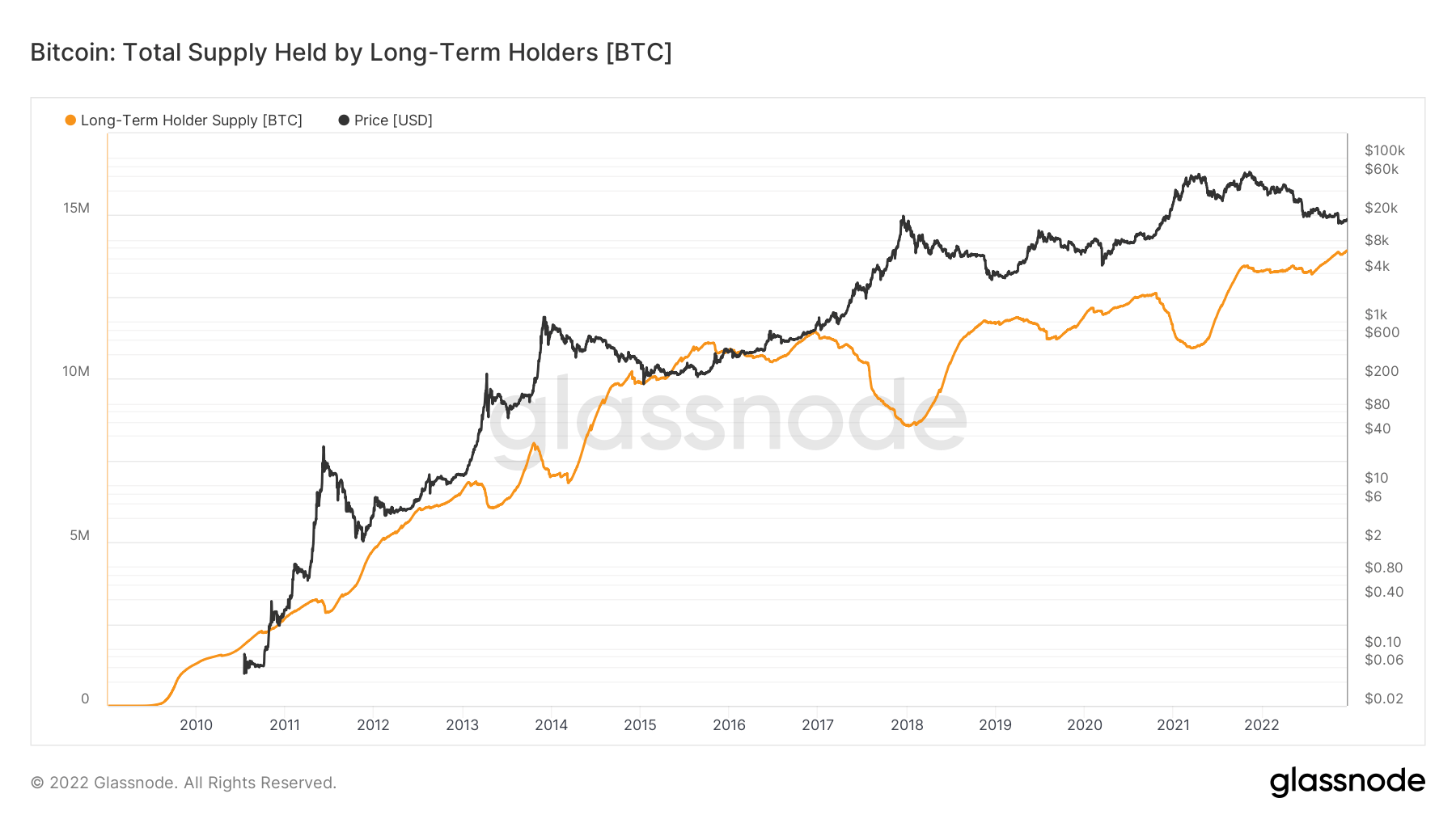

According to Glassnode data, the cohort holds a record 13.8 million bitcoins. This group is also considered smart money in the Bitcoin ecosystem as it is usually accumulated in bear markets and sold in bull markets.

For context, long-term holders added about 1 million BTC to their holdings in November. This is because his LUNA crash in May caused prices to drop significantly, allowing traders to accumulate assets. Those who bought bitcoin at the time are now part of this cohort because they have held it for the last six months.

Long-term holders of ATH despite capitulation in November

On the other hand, the recent collapse of FTX caused a slight surrender among the LTH, leading to a slight drop in LTH supply in early November. Nevertheless, the Glassnode data chart below shows that long-term holder supply is still at an all-time high.

For many, it’s bullish because investors haven’t surrendered.Ark Investments Shares This lookas it said, data points show a “long-term focus and high confidence despite recent events” in the cohort.

6 million BTC held in the red by long-term holders

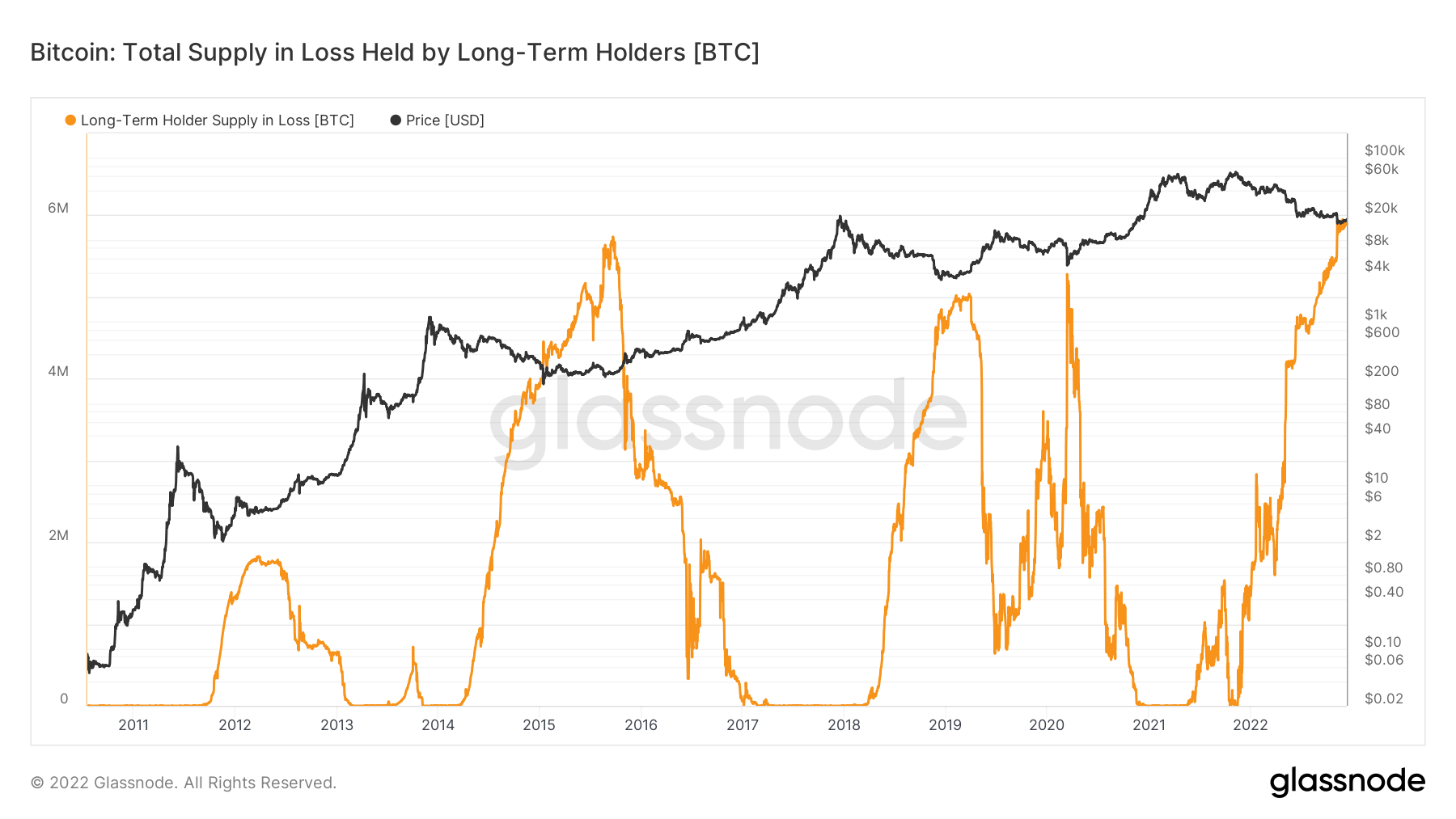

Glassnode data analyzed by CryptoSlate shows that long-term holders may be holding bitcoin.

According to the data, around 6 million BTC held by long-term holders are currently losing money, the highest ever.

The last time the group posted unrealized losses was in 2015, 2019 and 2020, when they exceeded 5 million BTC.

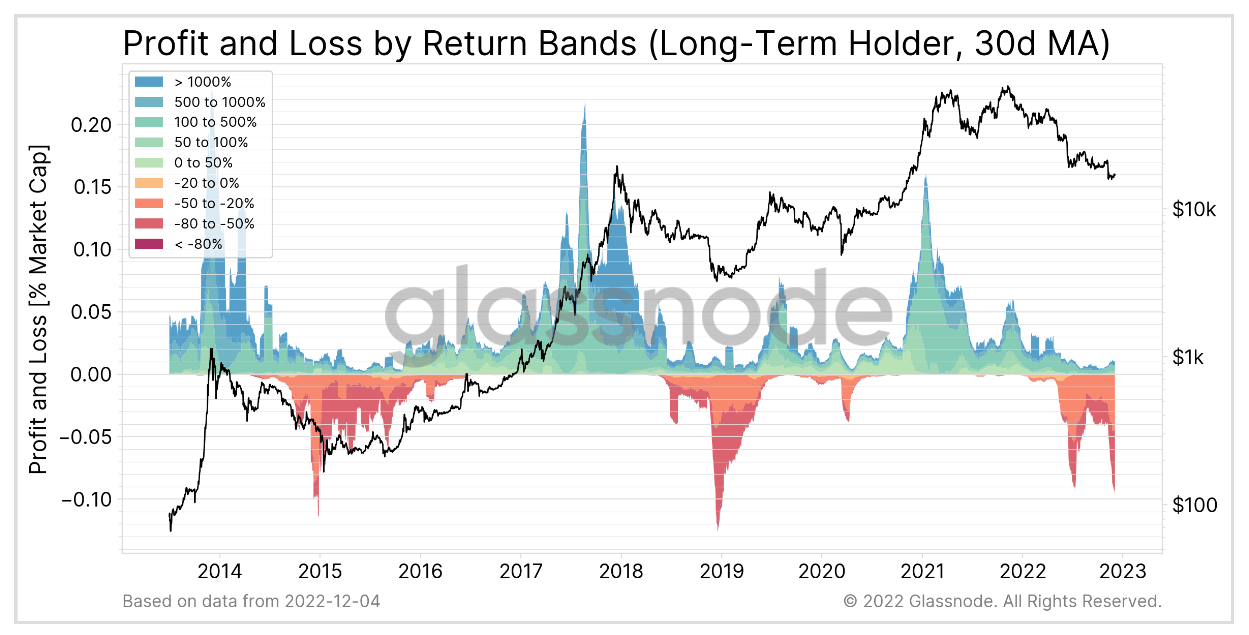

Long-term holders in this cycle recorded the two biggest losses

Further analysis by CryptoSlate showed that long-term holders posted two of their biggest ever losses during this market cycle.

Long-term holders in this cycle lost 0.09% of BTC’s market cap per day in June and November, when the industry reeled from the Terra ecosystem collapse and FTX crash, according to Glassnode data. . This was only surpassed by losses recorded in 2015 and 2019.

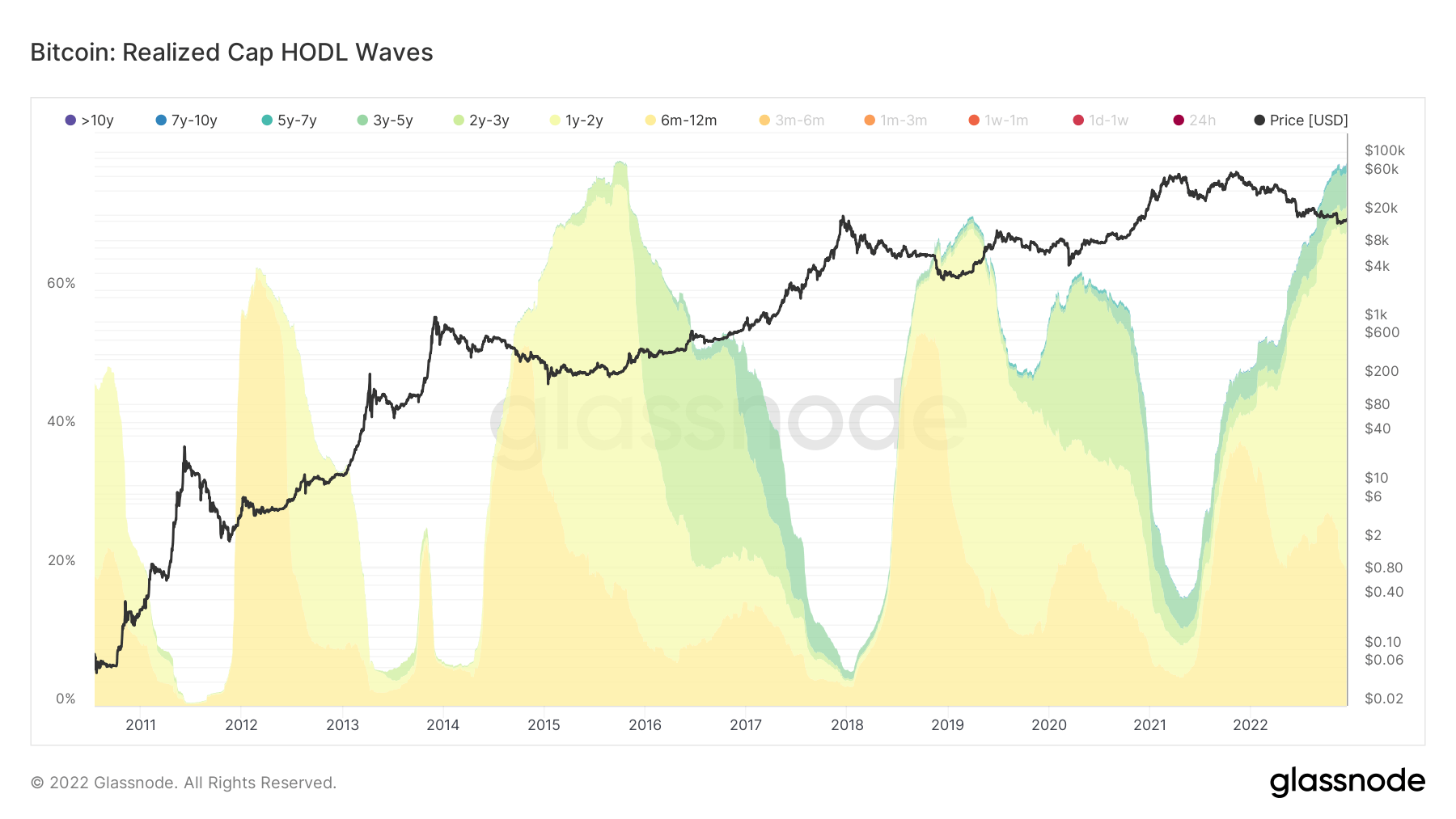

Despite these massive losses, 78% of the total BTC supply is still held by long-term holders, similar to 2015 bear market levels.