Bitcoin, risk-on assets under short-term pressure as macro narrative flips

Bitcoin and other risk-on assets are under near-term pressure as the macro narrative turns from recession to persistently entrenched inflation.

sticky inflation

Markets are bracing for an impending recession. But current macro analysis suggests that a recession may not come, at least in the short term. Instead, analysts expect a period of sticky and entrenched inflation.

On February 24, the U.S. Bureau of Economic Analysis (BEA) released personal consumption expenditure (PCE) data for January, showing the actual rate at 4.7%, well above the expected rate of 4.3%.

PCE Like the Consumer Price Index (CPI), it measures the price of goods and services, but differs in that, as in the CPI, the data is sourced from businesses rather than consumers.

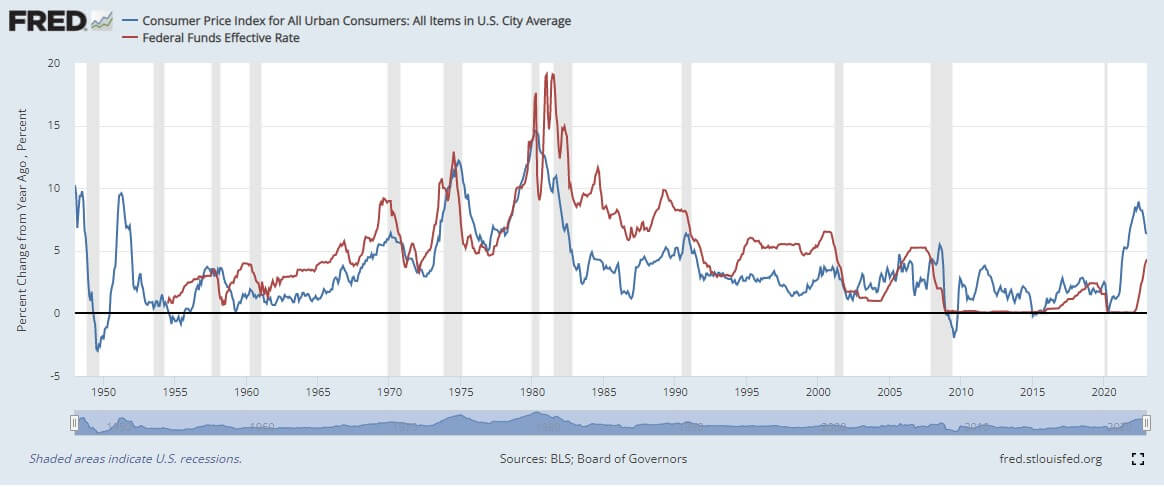

The year-on-year CPI data contradicts the PCE data, as they show inflation is declining, but the U.S. labor market is poised for 50-year low unemployment and soaring wage growth. It remains hot, suggesting that inflationary pressures remain.

This outcome could add to the Fed’s hawkishness, which has said its main goal is to bring inflation down to 2%.

Second, if rising inflation becomes the dominant narrative, there could be price pressure on Bitcoin and other risk assets as disposable income is squeezed to keep up with commodity prices.

Federal funds interest rates are on the rise

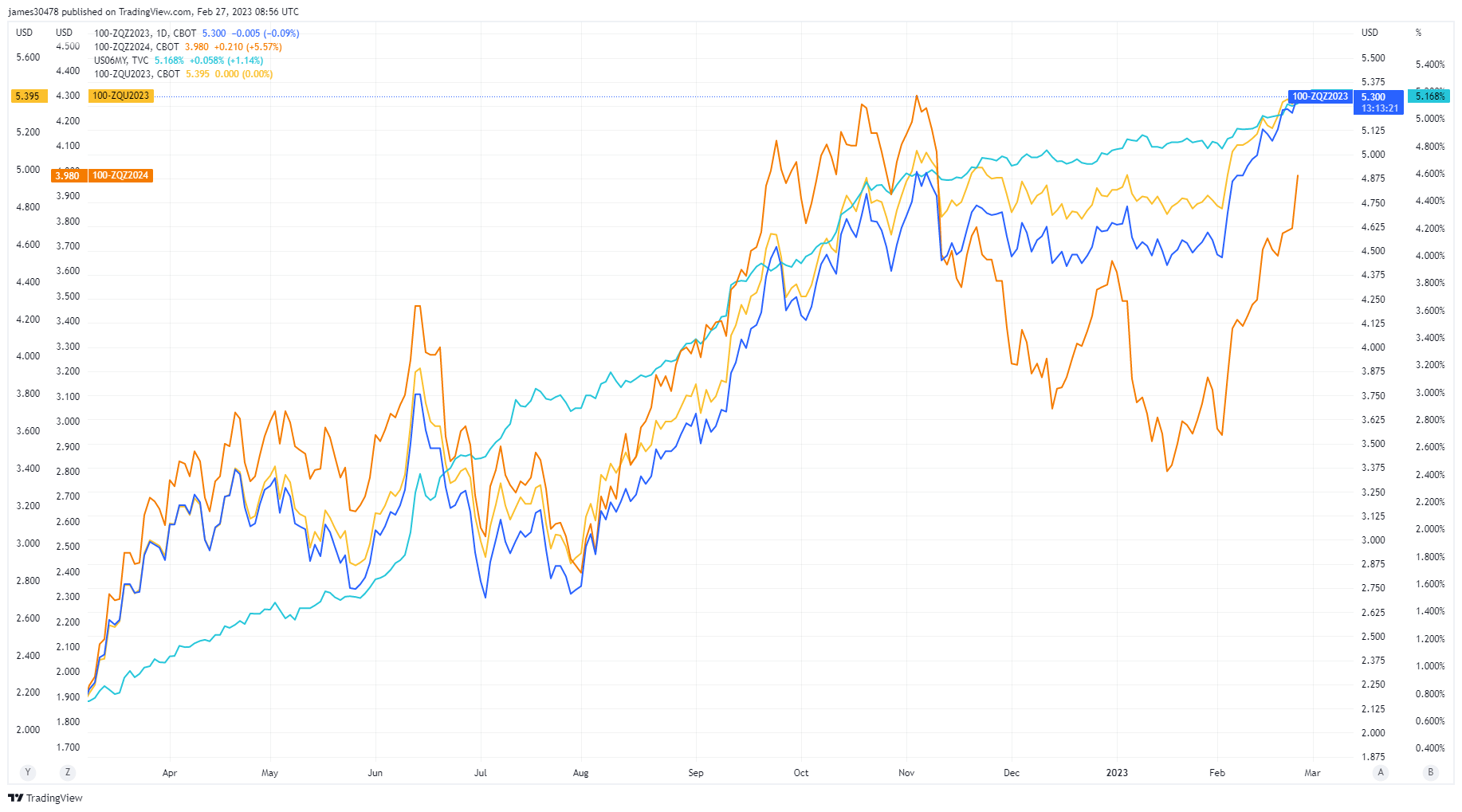

Federal Reserve futures data previously showed growing confidence within the interbank lending market. But recent developments indicate that this narrative has been turned upside down.

fed funds futures Refers to derivatives based on the Federal Funds Rate. This is the lending rate charged by the bank (to other banks) for overnight lending.

The chart below shows the September 2023, December 2023 and December 2024 Fed Funds futures adjusted higher. High interest rates across the board show that banks are not confident in lending to other banks. This means that interbank borrowing will become more expensive.

Similar to continued inflation, higher Fed rates will put downward pressure on risk-on assets as banks limit borrowing to limit exposure.

keep rate longer

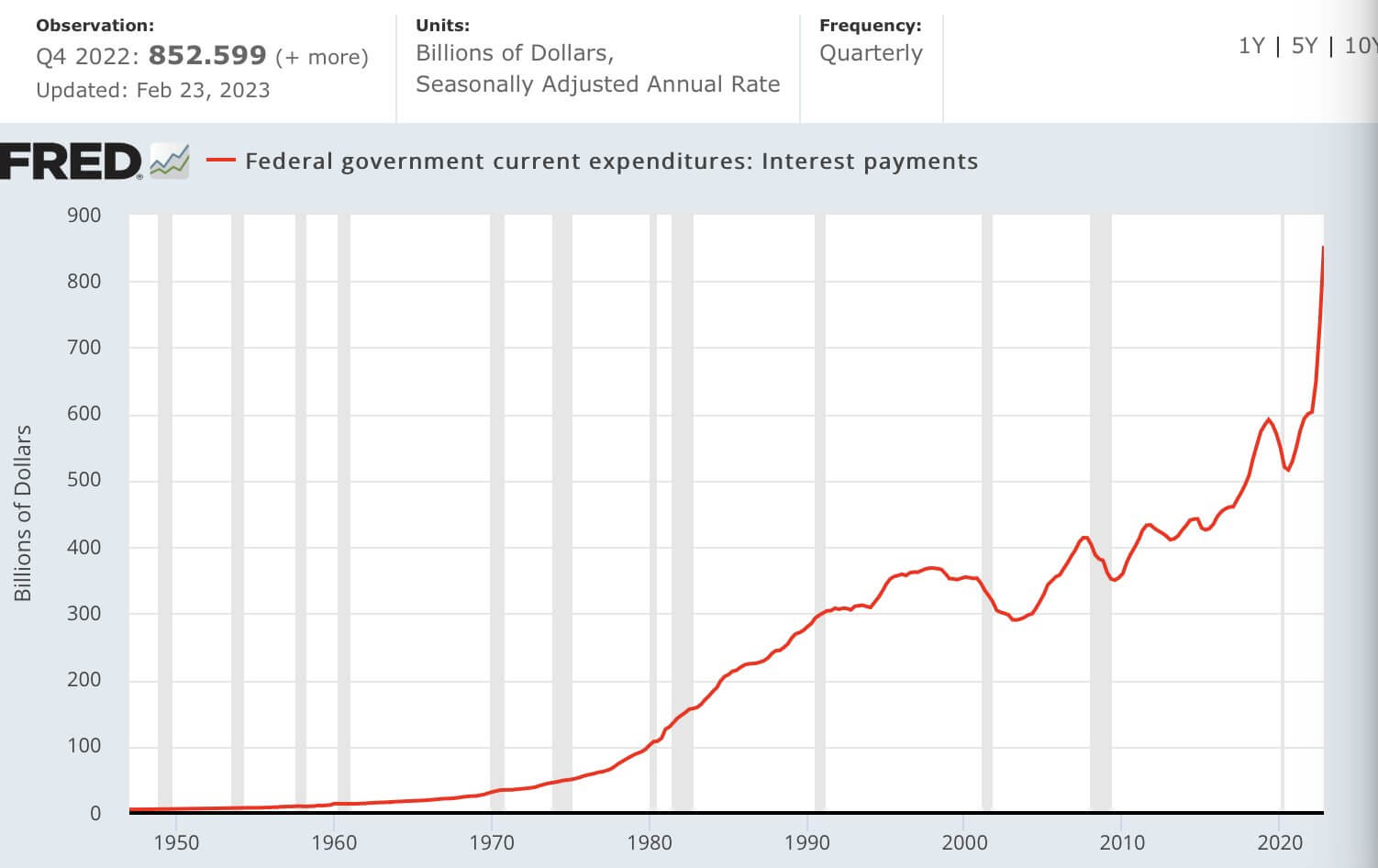

Interest paid on federal debt is approaching $1 trillion. The chart below shows that interest payments have nearly doubled since 2020.

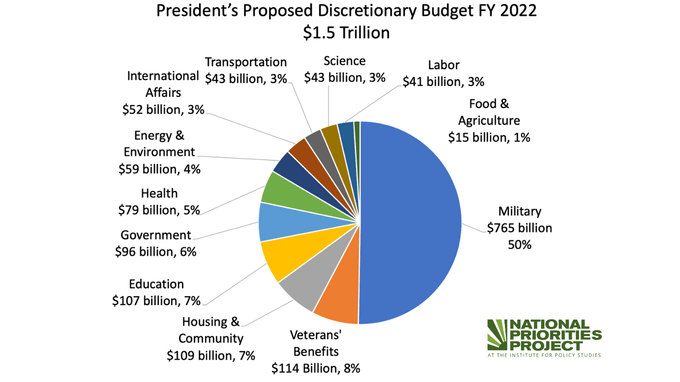

Fifty percent of the $1.5 trillion discretionary budget for 2022 was spent on the military, with the next most important portion at 8% allocated to veterans benefits totaling $115 billion.

Holding interest rates longer makes it more difficult to repay existing debt. This puts the Fed in a difficult position regarding achieving 2% inflation.

The updated forecast final interest rate is now 5.25% -5.50%, with 75 basis points of headroom from current interest rates.

The next FOMC meeting is scheduled to end on March 22nd. Currently, 70% of his economists are in favor of a 25 basis point hike, while the remaining 30% expect a 50 basis point hike.

Meanwhile, risk-on assets, including Bitcoin, are facing near-term downward pressure as inflation and declining risk appetite among banks create headwinds for higher prices.