Bitcoin shines through banking failures, bailouts

macro highlight

- US inflation too high for rate cuts, but broadly as expected

- The ECB raised another 50bps and raised the deposit facility rate to 3%.

- Silicon Valley Bank files for Chapter 11 bankruptcy

- Credit Suisse and First Republic Bank will continue to receive liquidity

- Fed Begins Stealth Quantitative Easing as Balance Sheet Expands

Bitcoin highlights

Stealth QE and Rescue

stealth relief

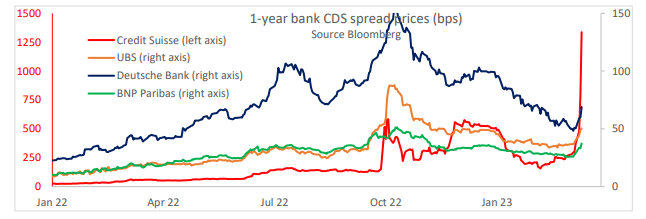

Credit Suisse seized the liquidity lifeline put in by the Swiss National Bank, borrowing up to CHF 50 billion, equivalent to 6.25% of Switzerland’s GDP. Credit Suisse’s stock has fallen about 20% this week as default swaps continue to fail.

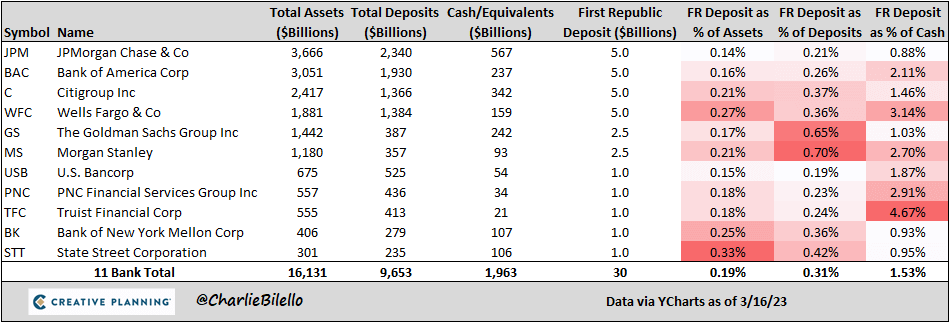

Credit Suisse wasn’t the only lifeline provided. First Republic Bank (FRB) shares fell 78% last month. News broke that 11 big banks are pledging his $30 billion to help his Fed. However, the stock continued to fall heading into Friday’s session.

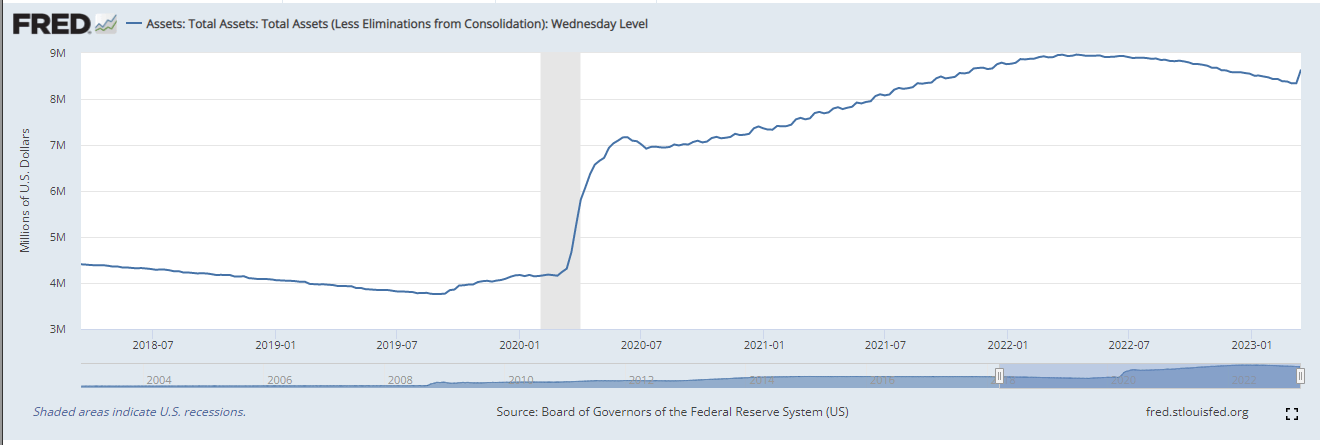

Stealth QE

This week, the Fed’s balance sheet surged by more than $300 billion to $8.69 trillion, erasing half of the Fed’s quantitative tightening over the past year.

The increase in the balance sheet is due to Program BTFP. Simply put, this allows institutions to exchange low-value assets for full cash. Additionally, the Fed’s discount window parabolically reached $148 billion this week, its highest level since 2008.

balance sheet growth

- Approximately +$148.3 billion – net discount window borrowing.

- Approximately +11.9 billion USD – New Bank Term Funding Program

Subtotal: $160.2 billion

- Approximately +$142.8 billion – bank loans seized by the FDIC Total:

This total = $303 billion

ECB Hikes 50bps, Ignores Forward Guidance

The ECB increased by 50bps for the third time in a row, raising the deposit facility rate to 3%. Just six months ago, the deposit interest rate was 0. Lagarde and his ECB are sticking to their “commitment to fight inflation”, which is “projected too high for the long term”.

Forward guidance was removed and there was no understanding of future developments, but instead reiterated that “increasing levels of uncertainty reinforce the importance of data-dependent approaches.” rice field.

Focus on next week’s FOMC

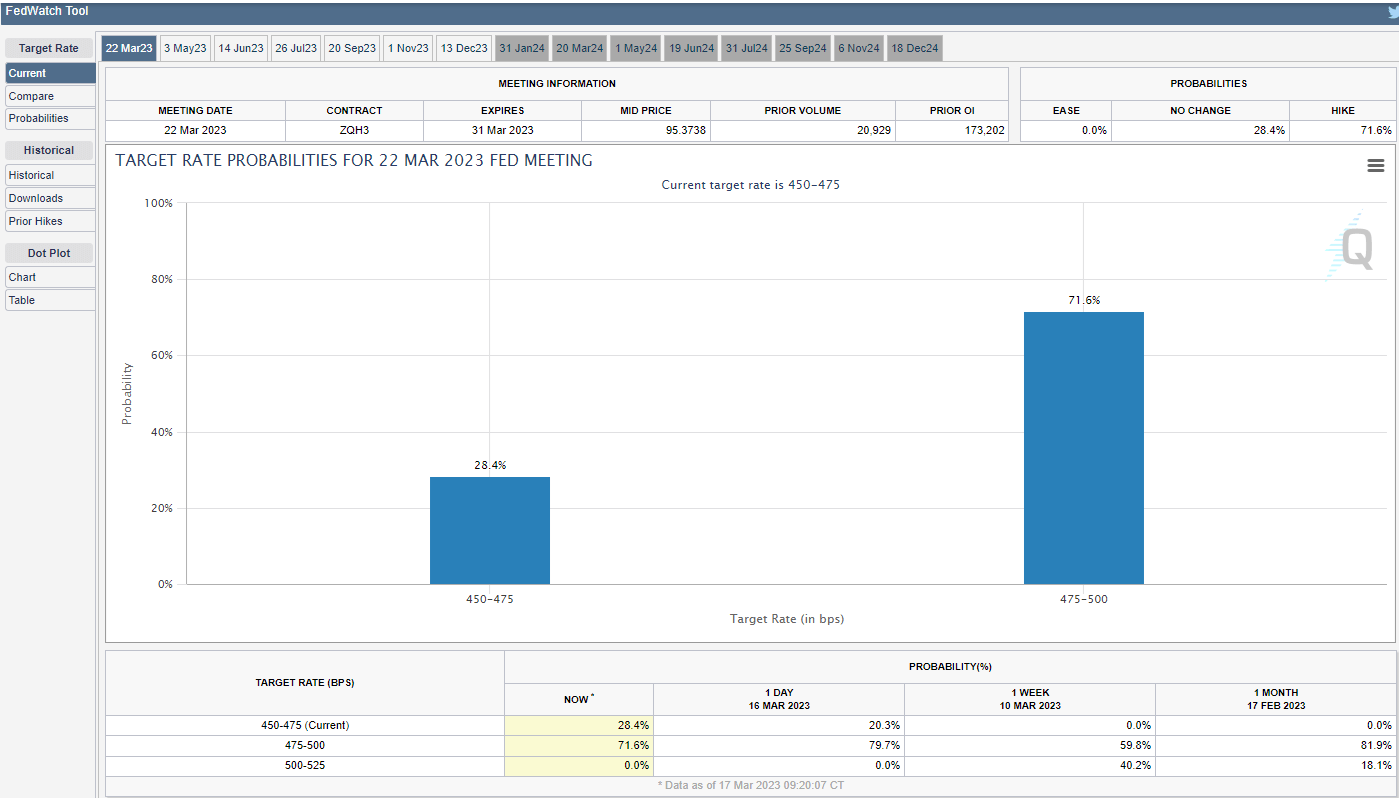

The next FOMC meeting is scheduled for March 22nd and the market expects a 25bps rate hike, which I believe will happen barring other major changes. After that, no one knows what the Federal Fund will do next.

Powell comes to the meeting with a big choice: try to keep inflation under control or save a fragile financial system.