Bitcoin touches $28,000 as whales, long-term holders ramp up accumulation

After spending most of May relatively flat, Bitcoin experienced a brief surge in the early hours of Monday, May 29, briefly above the $28,000 resistance level. Buying pressure eased over the weekend and bitcoin stabilized at $28,800.

Bitcoin’s weekend volatility left most of the market unshaken, with whales and long-term holders adding to their accumulations. Considered by many to be one of the key drivers of market sentiment, the two groups, which have focused on accumulating throughout May, have taken advantage of Bitcoin’s weekend volatility to boost their holdings. Increased.

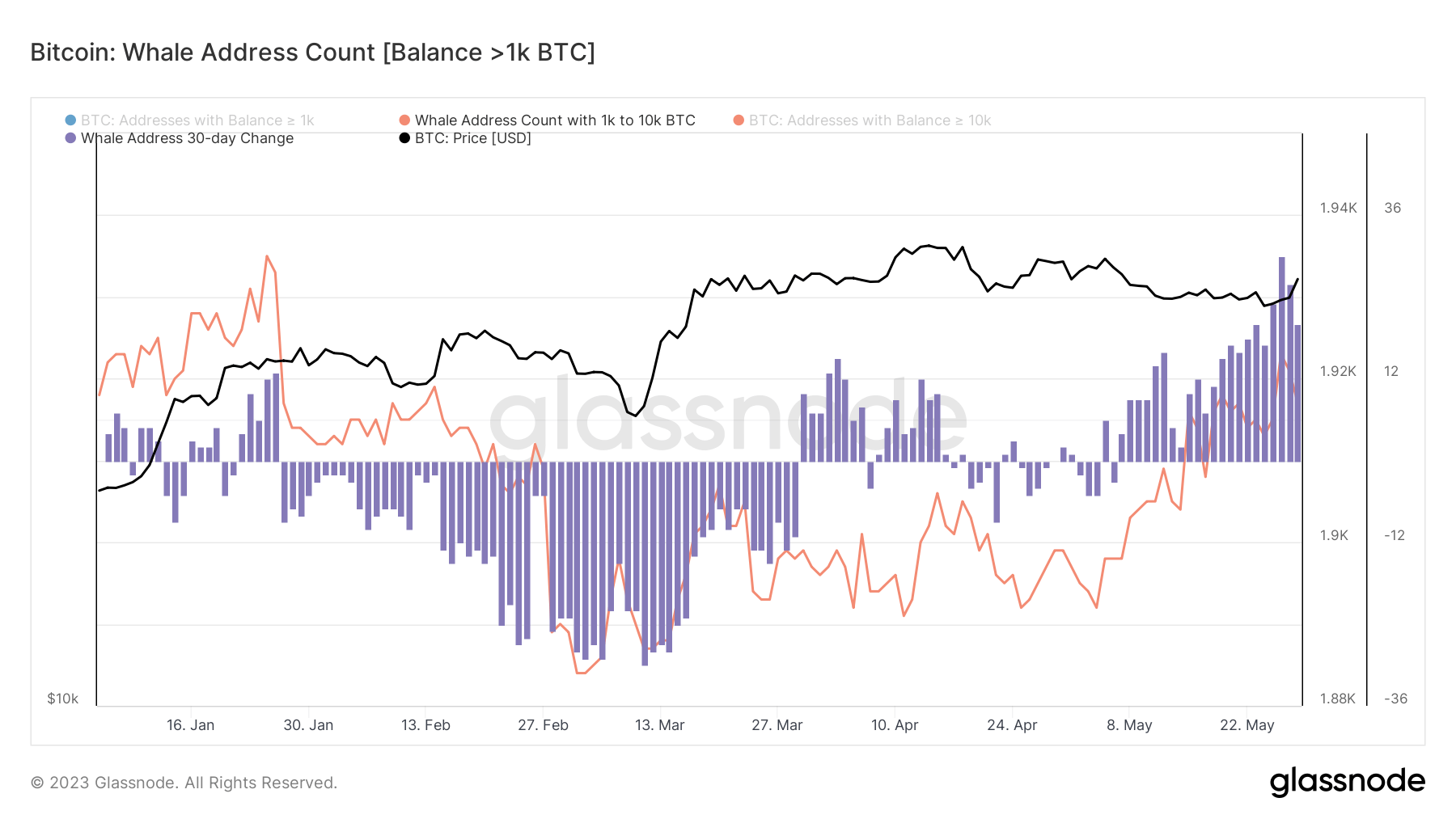

The number of whale addresses classified as addresses over 1,000 BTC increased in late May and peaked over the weekend.

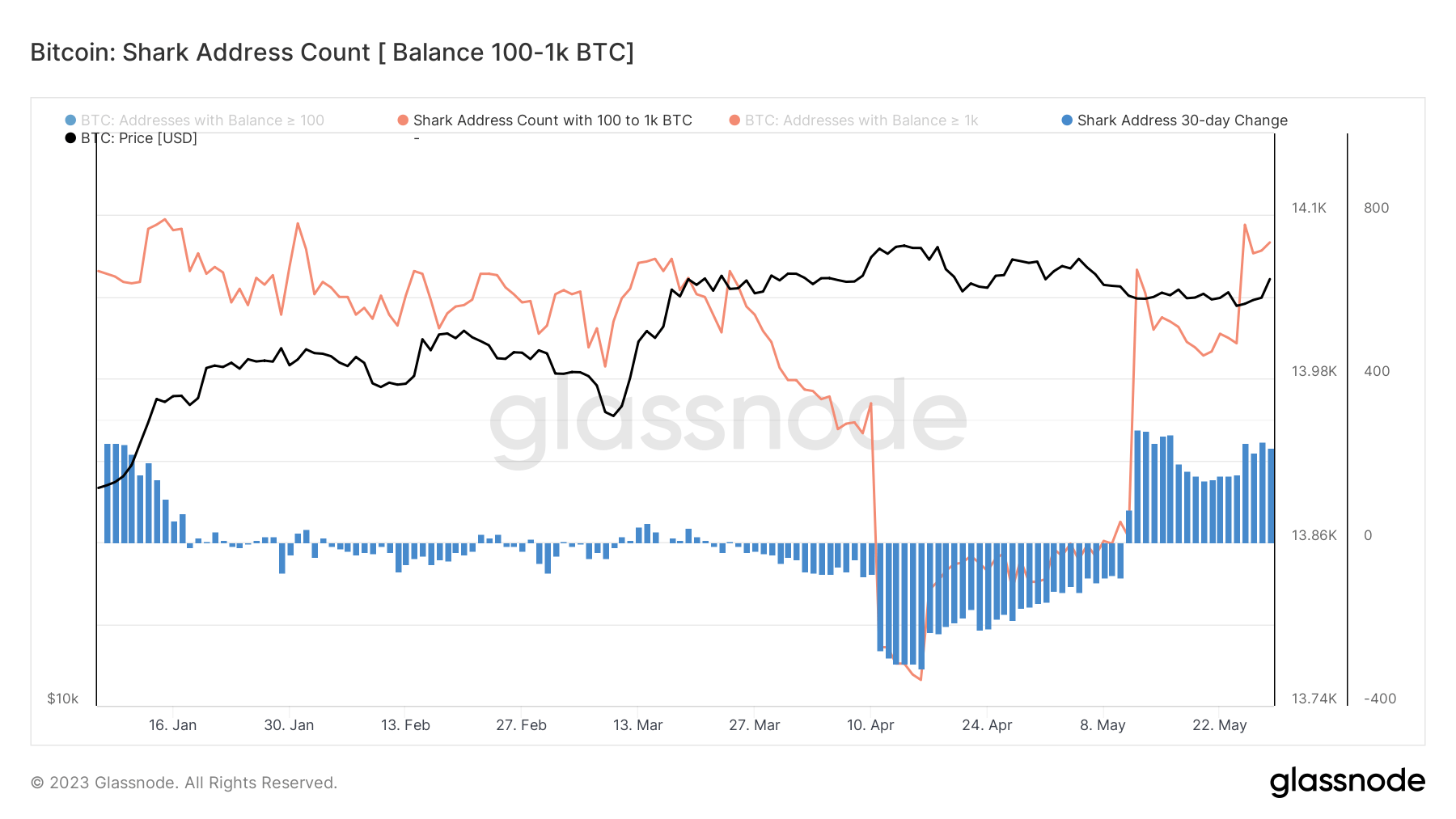

A similar trend has emerged among shark addresses holding between 100 BTC and 1,000 BTC, with a clear increase in the Glassnode data.

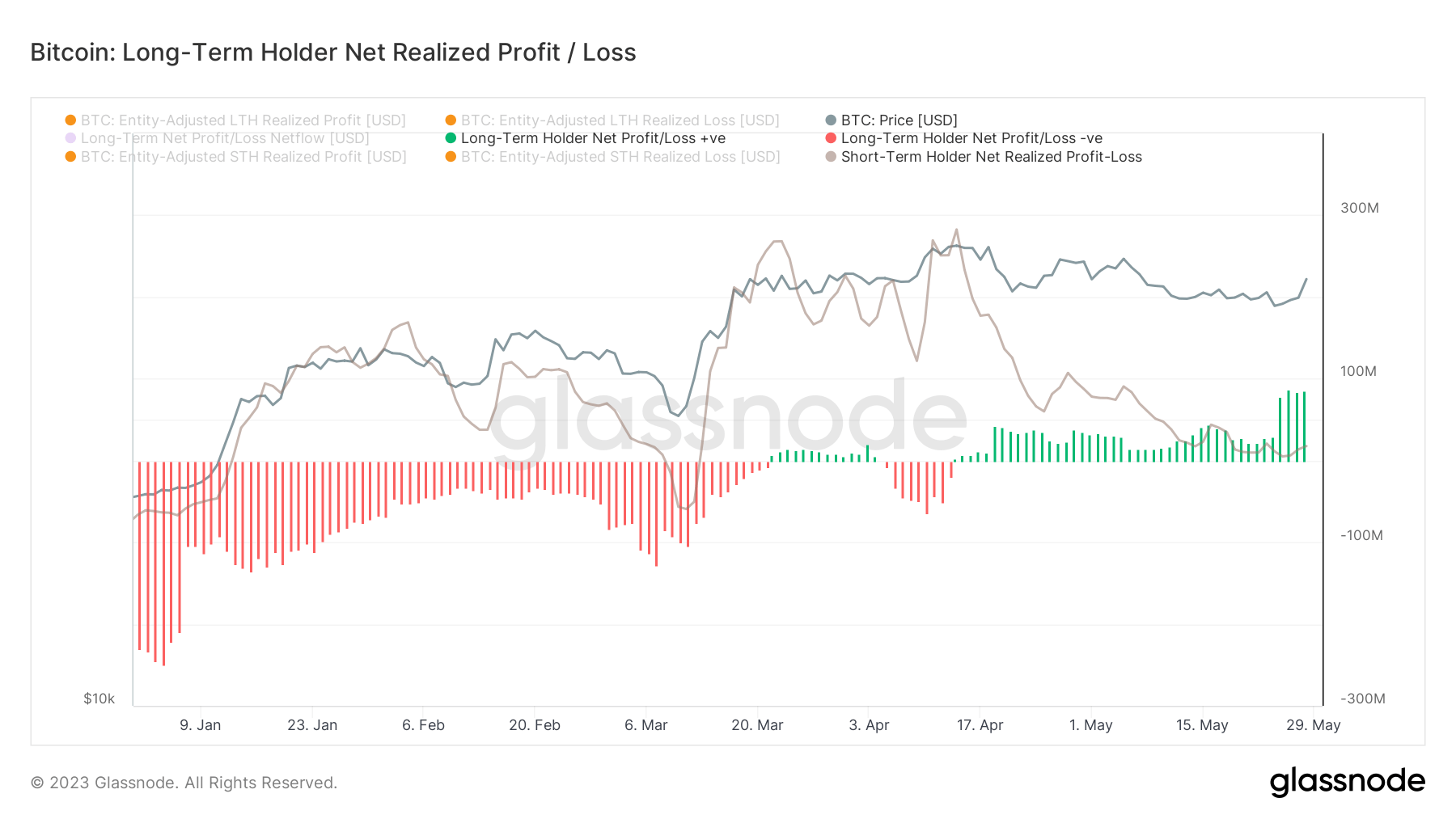

In addition, long-term holders have found their Net Realized PnL (NPL) to surge significantly. This suggests that these relentless investors spent the coin in excess of its cost of acquisition throughout May.

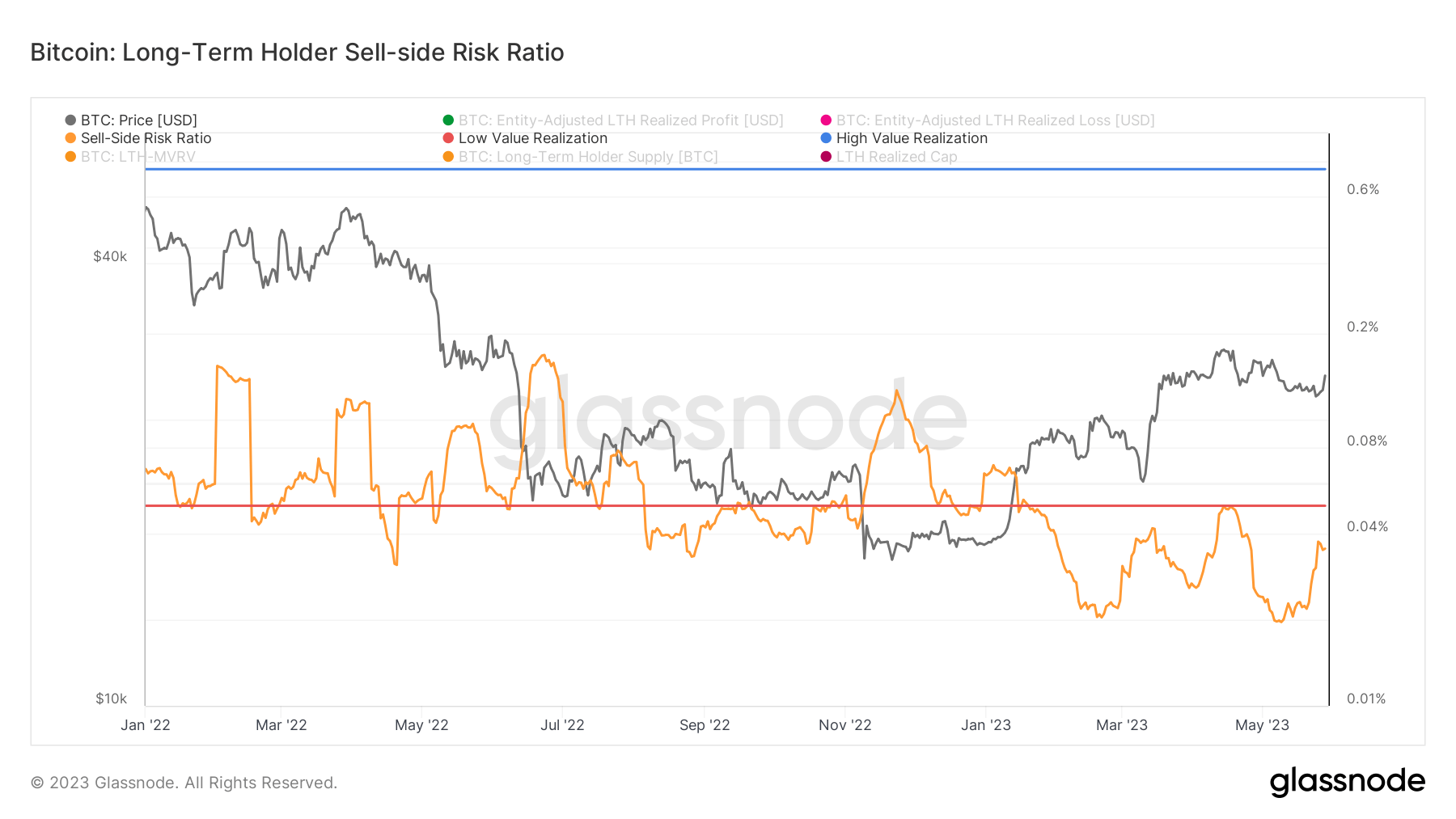

crypto slate Our analysis shows that the coins accumulated by these groups are unlikely to circulate on exchanges anytime soon. The marked decline and continued downward trend in long-term sell-side risk ratios indicates that accumulated bitcoin is being held for long-term growth potential.

Aggressive accumulation by whales and long-term holders could stabilize the market despite the mixed price dynamics seen this week. Other cohorts such as shrimp and short-term holders have also continued to accumulate, but the greater market influence of whales and long-term holders means their accumulation patterns pave the way for a stronger base for future growth. This suggests that there is a possibility of opening up the

The article first appeared on CryptoSlate after long-term holders of whales accumulated more and bitcoin reached $28,000.