Bitcoin traders willing to go long but sentiment remains firmly bearish

Since bottoming out at $17,700 on June 18, Bitcoin has been trading within a relatively tight band, with the upper end of the channel at $25,100.

Over the past week or so, BTC has posted six consecutive green closes each day, but the upward momentum was halted when CPI inflation data released on September 13 came out better than expected. BTC dropped 13% on him that day to $19,800.

Price uncertainty is the dominant narrative as macro pressures continue to weigh on market leaders. According to the Option 25 Delta Skew and the Option Volume Put/Call ratio, this shows willingness to go long even in the slightest sign of price recovery. However, the overall sentiment is bearish.

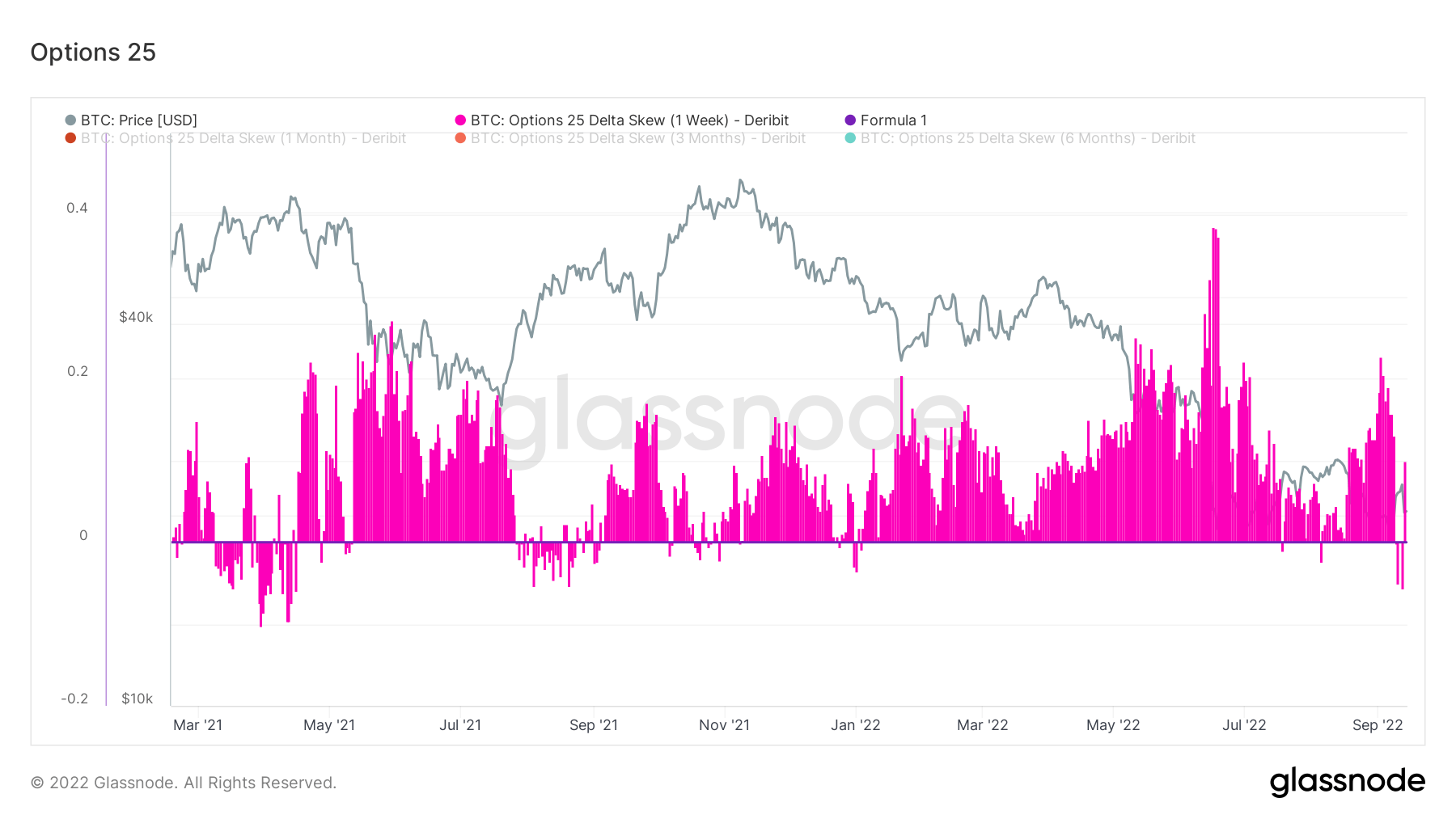

Option 25 delta skew

The Option 25 Delta Skew metric looks at the ratio of put and call options expressed in terms of implied volatility (IV). A put is the right to sell a contract at a specific price and a call is the right to buy.

For options with a specific expiration date, 25 Delta Skew refers to a put with a delta of -25% and a call with a delta of +25%, netting off to reach the data point. In other words, this is a measure of an option’s price sensitivity to changes in the Bitcoin spot price.

Individual terms refer to option contracts that expire 1 week, 1 month, 3 months, and 6 months from now, respectively.

Less than 0 indicates calls are higher than puts. This situation has only happened six times this year. When Bitcoin bottomed out recently, traders scrambled for puts before returning to calls at local tops.

This volatile behavior can be explained by a prolonged bear market that encourages traders to react quickly to even the slightest sign of price recovery.

As Bitcoin oscillated above and below $20,000 in recent weeks, traders requested net long positions four times, but the market moved against them. Since the end of last year, I have not received consecutive calls.

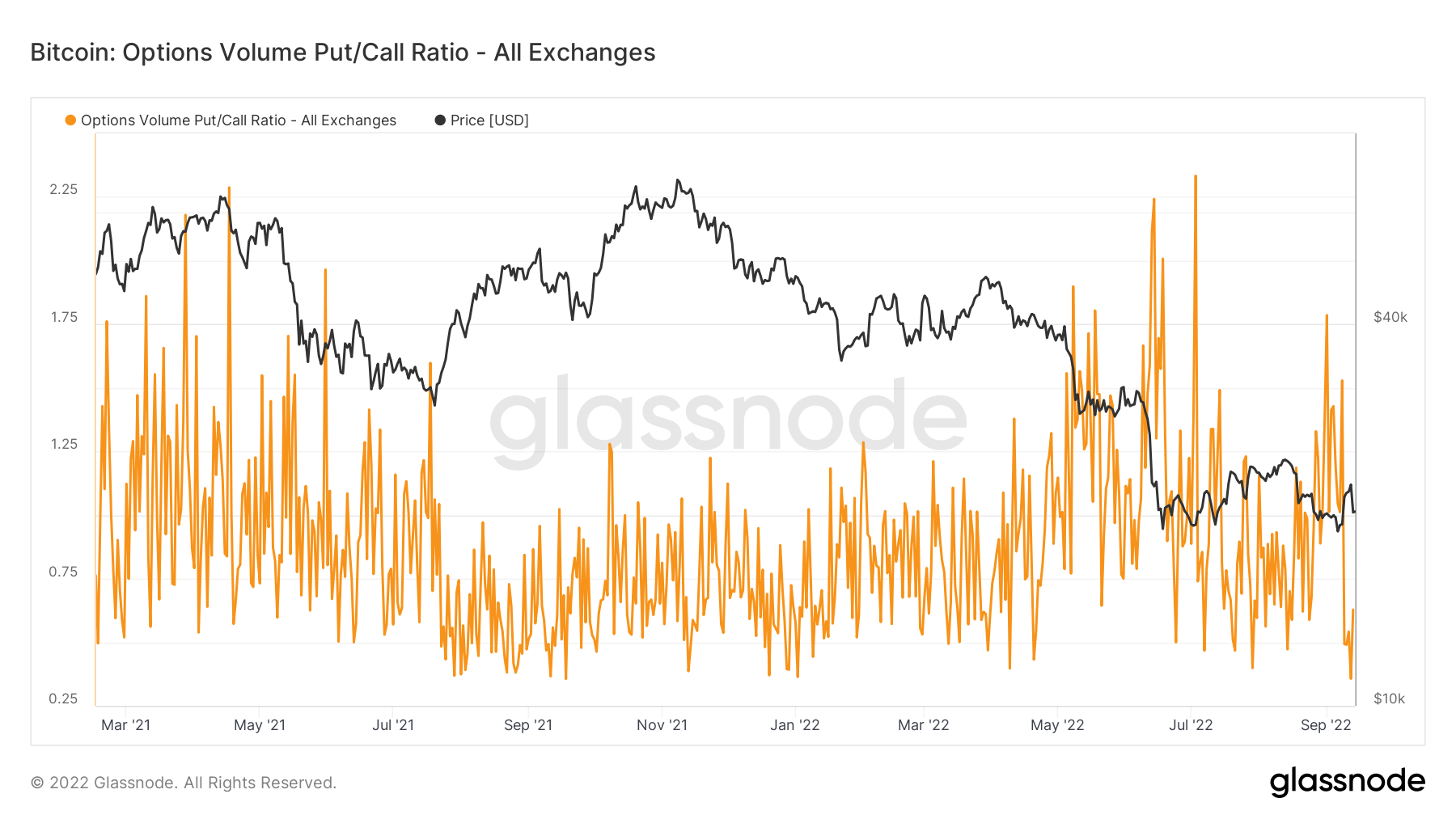

Option Volume Put/Call Ratio

The option volume put/call ratio is the put volume divided by the call volume traded in the options contract over the last 24 hours. Used to measure the overall mood of the market.

The chart below shows a significant bias towards puts, as evidenced by the sharp rise in ratios when prices bottom out.

This suggests that bearish sentiment is firmly entrenched. However, similar to the option 25 delta skew data, the trader will take his position long if there is any indication of price recovery.