Bitcoin worth $1.5B leaves Coinbase; Mid-cap tokens outperform Bitcoin

The biggest news in the cryptoverse on November 25th included Binance revealing BTC margin, BNB gaining 6% market power, mid-cap token surpassing Bitcoin, over $1.5 billion worth of 100,000 bitcoins left Coinbase in 48 hours, and CoinList denied bankruptcy rumors. .

$1.5 billion worth of Bitcoin withdrawn from Coinbase in 48 hours

Data from Glassnode revealed that the Coinbase BTC reserve lost about 50,000 BTC on November 24th, and another 50,000 BTC on November 25th.

As a result, Coinbase lost over $1.5 billion in Bitcoin in 48 hours.

Binance Issues BTC Proof of Reserves to Increase Customer Funding Transparency

Major cryptocurrency exchange Binance has started rolling out Proof of Reserve (PoR) starting with Bitcoin. According to Binance PoR, the customer’s exchange balance is 575,742.4228 BTC and the on-chain reserve is 582,485.9302 BTC, which is 1% higher.

Binance said it will publish PoRs for other crypto assets in the coming weeks and involve third-party auditors to audit the reserve.

Mid-Cap Token Outperforms Bitcoin in Last 7 Days as BNB Reaches 6% Market Dominance

Over the past 7 days, the market cap of mid-cap tokens (projects with a market cap of $100 million to $1 billion) surged 4%, while Bitcoin’s dominance fell from a high of 45% to 40%. .

Similarly, Binance BNB has risen more than 31% against Bitcoin since October 23rd, and its market dominance has reached an all-time high of 6% of the crypto market cap.

CoinList denies bankruptcy rumors, claims technical issues are causing withdrawal problems

Over the past seven days, CoinList has reportedly failed to process withdrawal requests, raising concerns about the risk of bankruptcy.

Addressing bankruptcy rumors, the ICO platform said it was experiencing technical issues from its custody partners affecting user deposits and withdrawals.

CoinList added that it is working to resolve the issue and will release proof of reserves soon.

Belgium Says Bitcoin, Ethereum Are Not Securities

The Belgian Financial Services and Markets Authority said assets with an issuer and investment purpose are classified as securities.

Based on this, regulators have clarified that Bitcoin and Ethereum are not securities, but are created by computer code, given the lack of an issuer.

FTX Attackers Leverage ChipMixer to Launder Tokens

The hackers who attacked FTX on November 12th sought to launder some of the stolen Bitcoins via Chipmixer. So far, the attackers have laundered around 360 BTC.

However, the ongoing discussion in the crypto community suggests that Fat Mantera The mixing protocol suggests it may have been deployed by the US government to crack Bitcoin privacy.

The Bahamas Securities Commission calls FTX CEO John Ray’s claims inaccurate.Says the action was “misunderstood”

FTX CEO John Ray III has alleged that the Bahamas Securities Commission (SCB) is behind the unauthorized move to transfer its assets to regulators.

SCB claimed that the asset transfer was carried out to protect crypto assets under FTX’s custody from potential theft and hacking.

Massive staked Ethereum withdrawals by whales could benefit arbitrageurs

In the last 24 hours, two Ethereum whales have reportedly withdrawn 84,131 ETH and 42,400 stETH respectively from the Aave V2 protocol.

As a result, the Curve’s stETH/ETH pair depegged at 0.9682, allowing arbitrageur traders to capitalize on the price gap to make huge profits.

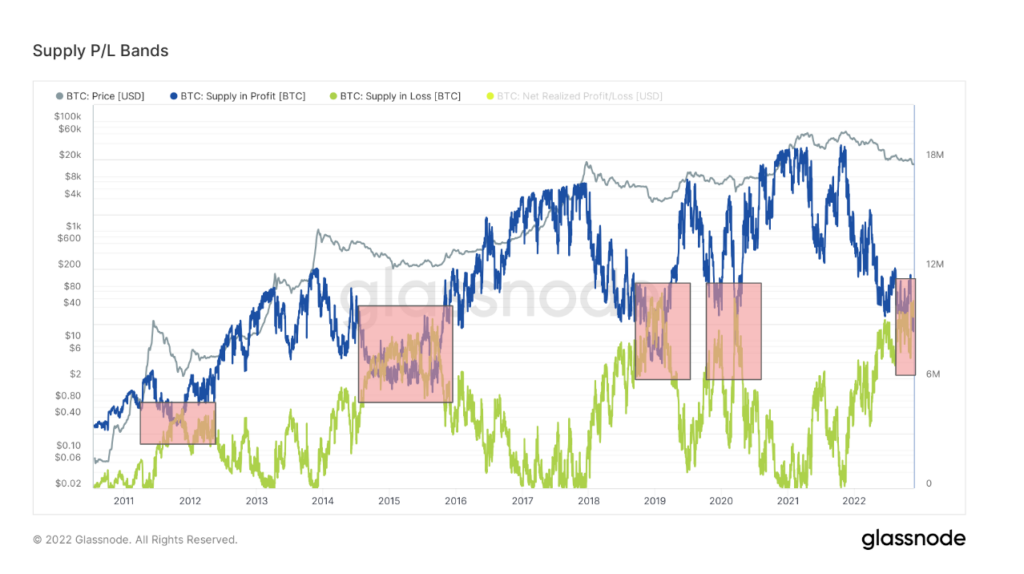

On-chain data flashes multiple bear market bottom signals

As the 2024 Bitcoin halving approaches, on-chain data analyzed by CryptoSlate shows that the bear market may be nearing its bottom.

Looking at the Supply P/L Bands, the blue (gains) and green (losses) lines converge, which coincides with previous bear market troughs. This is the fifth time in Bitcoin’s history that convergence has occurred, setting new all-time highs following previous events in 2012, 2014 and 2019.

Similarly, the short-term holders supply indicator is above 3 million coins, indicating that Bitcoin crabs are filling the bag as the market bottoms.

News around Cryptoverse

El Salvador Opens Bitcoin Office

The government of El Salvador, led by Bitcoin maximalist Nayib Bukele, established the National Bitcoin Office (ONBTC) to manage all Bitcoin-related projects.

ONBTC oversees the development of domestic bitcoin, blockchain and cryptocurrency companies.

Binance Allocates $1 Billion to Crypto Recovery Fund

Binance CEO Changpeng “CZ” Zhao Said His exchange has allocated another $1 billion to increase the size of the industry recovery fund to over $2 billion.

Other major cryptocurrency companies such as Jump Crypto and Aptos Labs have pledged about $50 million to the recovery fund.

Sam Bankman Freed Under Investigation By Turkish Authorities

Turkish Financial Crime Investigative Commission Said FTX founder Sam Bankman-Fried is under investigation for allegedly facilitating asset laundering. As a result, authorities are trying to seize “suspicious assets” from bankrupt cryptocurrency exchanges.

crypto market

Over the past 24 hours, Bitcoin (BTC) has fallen slightly -0.28% to trade at $16.526, while Ethereum (ETH) has fallen -0.5% to trade at $1,196.