Bitcoin’s illiquid supply hits all-time high as hodlers continue to accumulate

The cryptocurrency market has been relatively flat over the past month, even though Bitcoin recently broke through the $28,000 resistance level. The lack of volatility in historically aggressive markets is an underlying trend evident in several on-chain indicators.

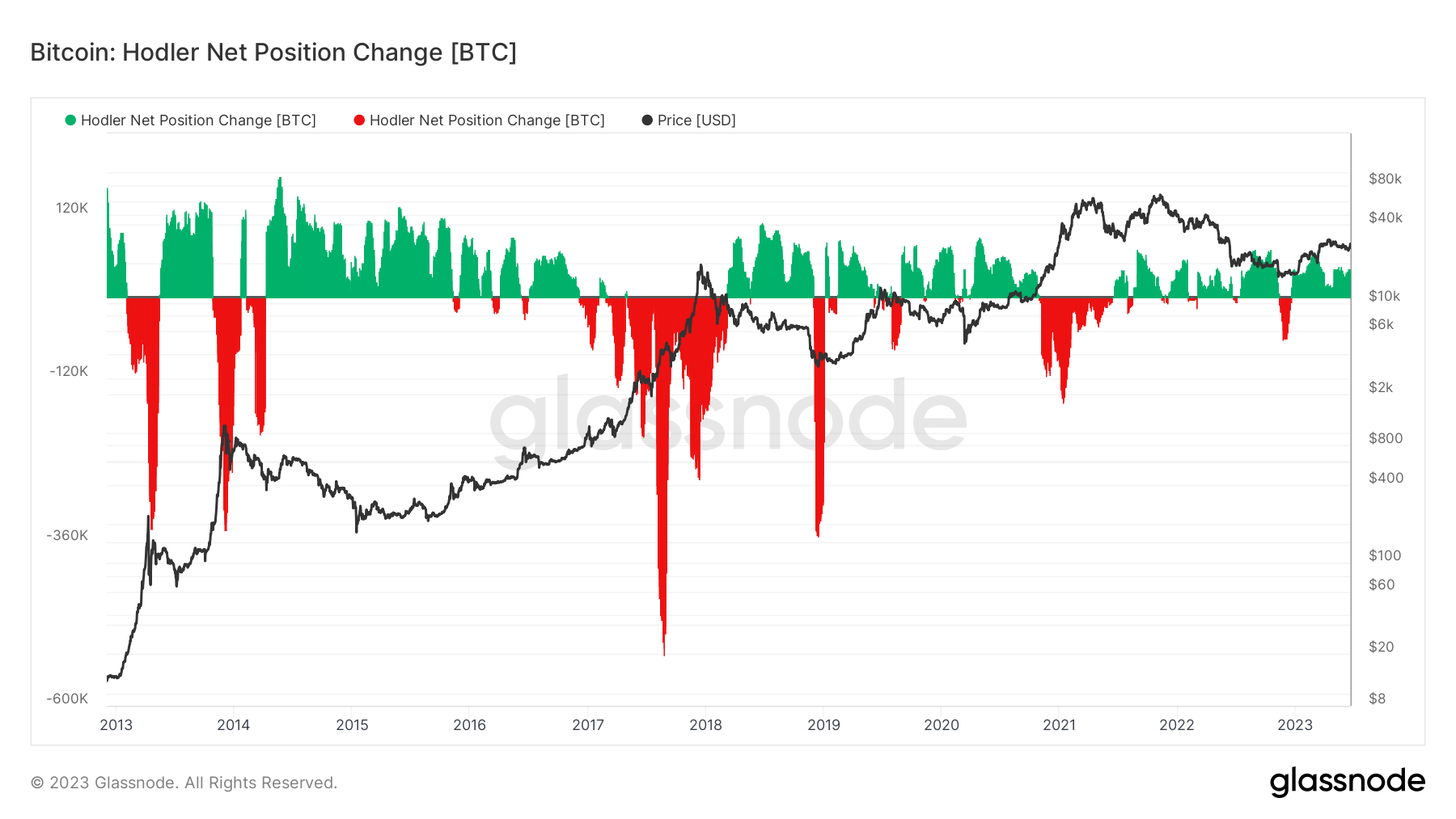

Bitcoin Hodler has capitalized on this flat price volatility to continue its steady accumulation, the main trend of the year. According to Glassnode data, Hodler’s net position continues to grow, with an average of 36,500 BTC added to his balance each month.

This accumulation phase is not a new development. Instead, it continues a slow and steady march starting in June 2021. Historical data indicate two similar accumulation periods. One from April 2014 to December 2016 and the other from March 2018 to October 2020. Both periods lasted approximately 2 years and 7 months. , past patterns suggest it could be at least six months before the market experiences another Hodler distribution cycle.

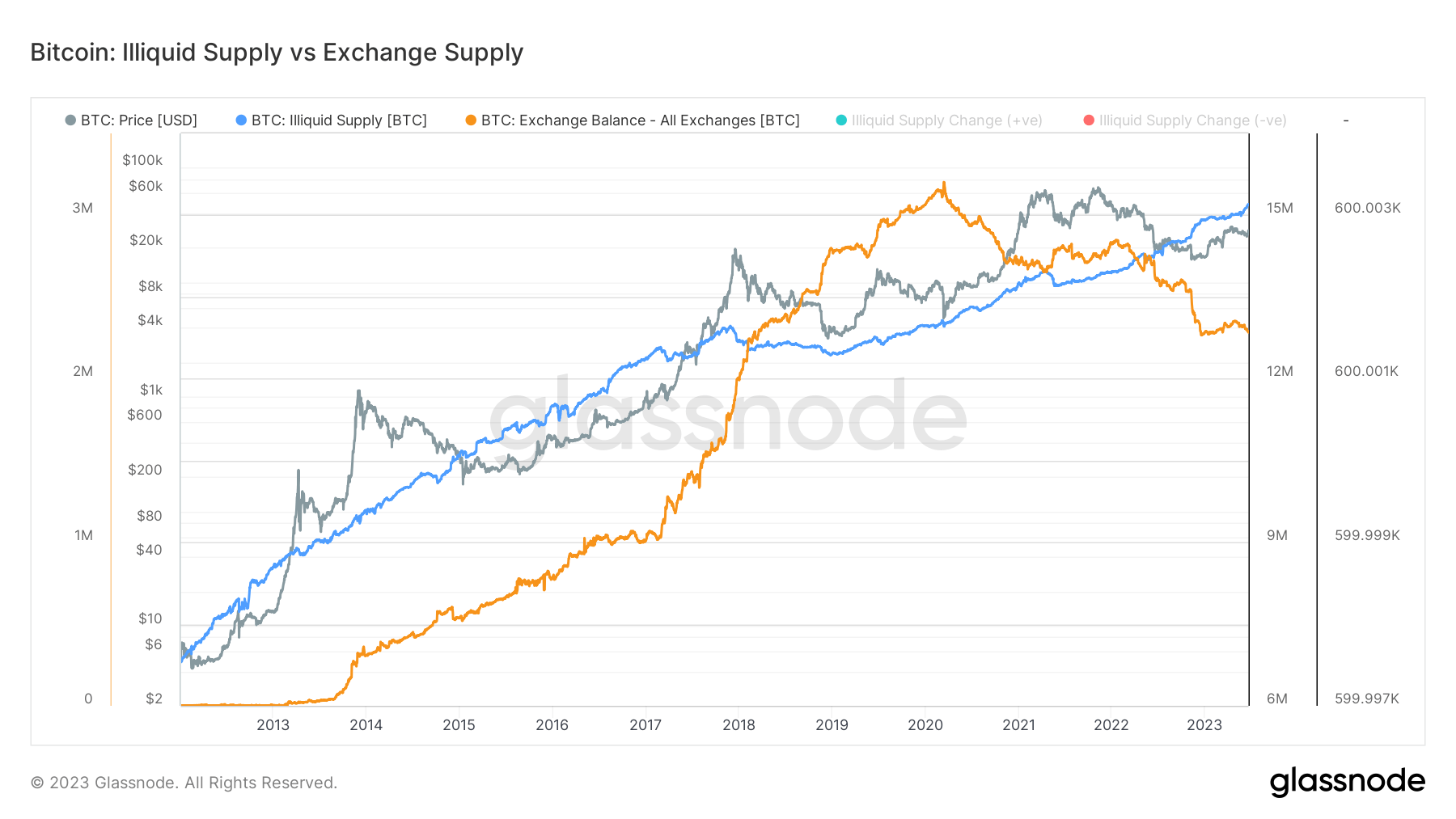

This increase in hodler accumulation is also seen in the illiquid supply of bitcoin, i.e. the amount of bitcoin that is not readily available for buying, selling or trading. On June 20th, the illiquid supply of Bitcoin hit a record high of 15.2 million BTC. This represents 78% of Bitcoin’s circulating supply on June 20.

Since the beginning of 2020, the illiquid supply has increased by 2.2 million BTC, representing an increase of 17%. Although the illiquidity supply has increased by only 2% this year, the seemingly small number equates to over 298,600 BTC added to illiquidity wallets.

The amount of Bitcoin held on exchanges has been relatively flat since the beginning of the year, down 0.85%. However, when you zoom out, the drop becomes even steeper. Since the beginning of 2020, the amount of Bitcoin held on exchanges has decreased by 25%.

An article about Bitcoin’s illiquid supply reaching an all-time high as Hodler continues to accumulate first appeared on CryptoSlate.