CME sees Bitcoin open interest grow by over 5k

quick take

Bitcoin open interest hits four-month high

With around 418,000 bitcoins held in open interest contracts, open interest in bitcoin has climbed to a four-month peak and investor engagement has surged significantly.

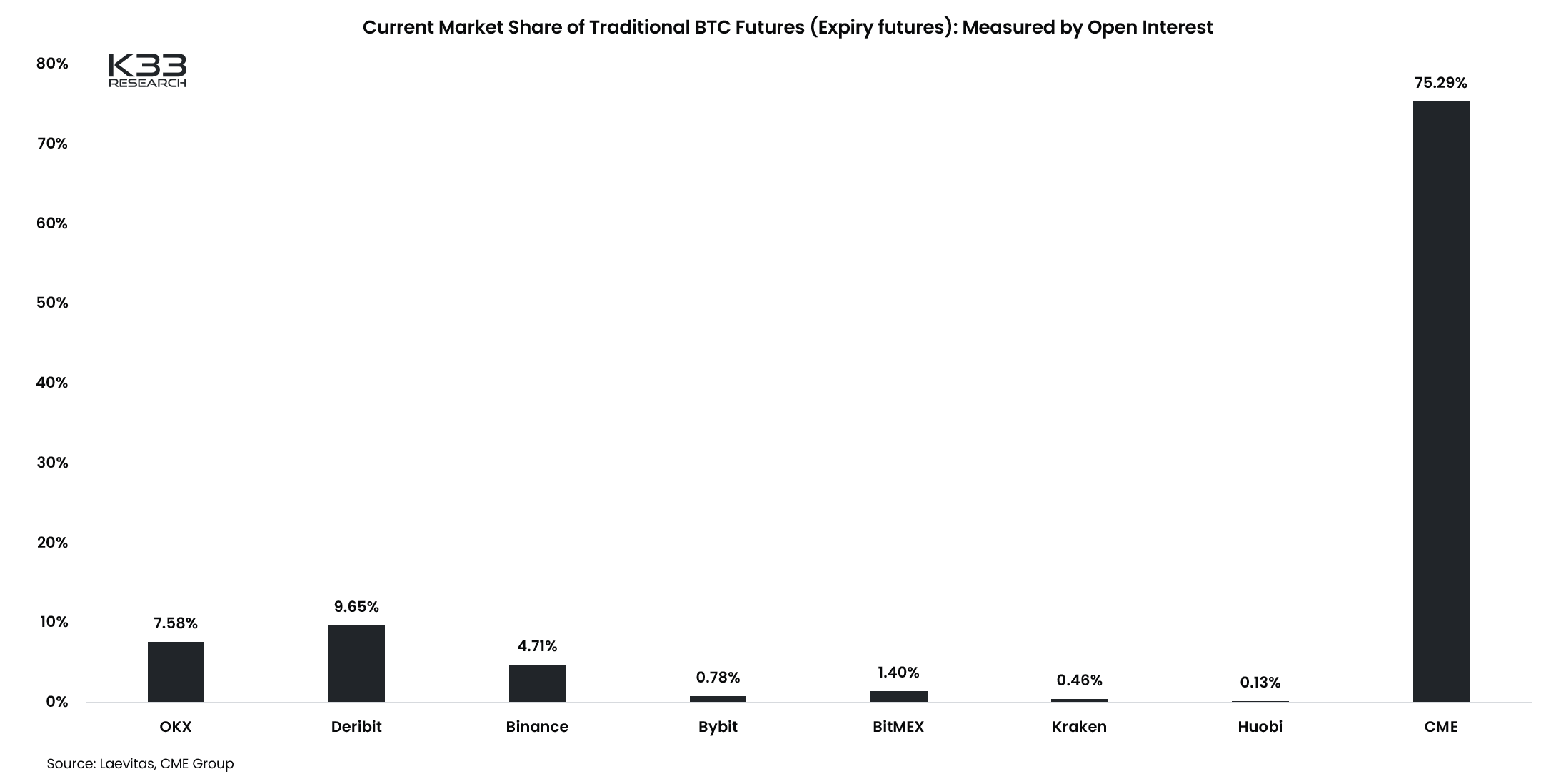

CME emerges as a major player

A key catalyst behind this growth appears to be the Chicago Mercantile Exchange (CME). Currently, CME holds 83,560 open interest contract futures. This level of engagement is his highest since January, indicating a significant return of investor interest in Bitcoin futures.

Analyst insights on current market conditions

Vetl RundeA research analyst at K33, he supports this view, highlighting that despite recent growth on an annualized basis, profit margins are still comfortably above 10%.

Expanding on the topic, Runde noted that of all derivatives exchanges, CME is experiencing the most significant daily increases in Bitcoin open interest. In terms of overall open interest, Binance is still the largest exchange, followed by him, Bybit, and CME.

But when it comes to expiring futures, the situation is quite different. CME boasts his 75% market share, and offshore futures are relatively unimportant.

Market impact

Given that CME is one of the largest derivatives exchanges in the world and is primarily used by institutional investors, this surge in activity marks a notable entry into the Bitcoin market by large companies. increase.

This impact could be significant, suggesting the potential for stabilization and increased acceptance of Bitcoin in traditional financial institutions.

Our article on Bitcoin open interest growth by CME first appeared on CryptoSlate.