Coinbase wants to give MakerDAO $24M per year in yield; Ripple has ‘several pilots’ in works on CBDCs

The biggest news in the cryptoverse on Sept. 7 included Signature Bank confirming a total outflow of $4.27 billion in the digital asset banking space, Ripple’s CBDC initiative, and an annual passive investment of up to $24 million to MakerDAO. Includes Coinbase offers that may generate substantial income.

CryptoSlate Top Stories

Signatory Banks Suffer $42.7 Billion Deposit Outflow As Crypto Uncertainty Takes Hold

Signature Bank Mid-Q3 Report Shows Spot Deposit Balances Decline at Crypto-friendly Banks

The decline in deposit balances in the quarter was due to an outflow of the digital asset banking space totaling $4.27 billion, according to the bank.

Ripple hints at new CBDC announcement

Anthony Welfare, Ripple’s central bank digital currency (CBDC) advisor, said the company has several partnerships on CBDC, including participation in the Digital Dollar Project.

He pointed out that several pilot programs have been designed to bring CBDCs to the public. These pilots will be published in the coming weeks.

Coinbase Submits Proposal That MakerDAO Could Earn $24 Million Per Year

Coinbase has submitted a new proposal to MakerDAO (MKR) to move 33% of its $1.6 billion Peg Stability Module (PSM) into Coinbase Prime’s custody account for an annual yield of 1.5%.

This will allow MakerDAO to generate up to $24 million in passive income annually. Some MakerDAO members objected to the proposal, saying it would impact decentralization and add another layer of regulatory attack.

Crypto Industry ‘Mature’ But Expects Slower Growth in H2 – KPMG

A recent report by KPMG concluded that Bitcoin performance and risk are correlated with traditional assets. Global investment in crypto hit $32.1 billion and $14.2 billion in the first half of 2021 and 2022 respectively.

The report concluded that crypto market growth could slow down in the second half of the year.

Law firm calls for removal of Rosh Friedman in Tether case over allegations made in viral video

Law firms Kirby Mcclnerney LLP (“Kirby”) and Radice Law Firm PC (“Radice”) dismiss Roche Freedman as co-counsel in lawsuit against Tether after Kyle Roche scandalous video posted online I filed a petition.

The law firm argued that Friedman’s involvement in the lawsuit affected plaintiffs’ rights due to the failure of the team’s leadership.

Singapore’s Largest Bank DBS Offers Cryptocurrency Services to 300,000 Investors

The CEO of DBS Bank has confirmed that the bank will soon start offering cryptocurrency services to over 300,000 accredited investors in the region.

Singapore’s largest bank has revealed that it will choose 300,000 of Asia’s richest individuals to offer cryptocurrency services without disclosing detailed descriptions of these services.

Bankrupt crypto lender Voyager to auction assets Sept. 13

Voyager said it had received bids from 22 parties interested in purchasing the property. The cryptocurrency lender had scheduled an auction on Sept. 13 to liquidate all its assets.

Dear Voyagers, We are pleased to inform you that several bids have been submitted as part of the company’s restructuring process. As a result, the auction is scheduled for September 13th. (1/3)

— Voyager (@investvoyager) September 7, 2022

Not much is known about the mysterious 22 bidders, but FTX and Binance said they are actively pursuing the acquisition of Voyager.

Aave Voted to Pause ETH Borrowing Following User Concerns Trying to Maximize ETHPoW Airdrops

The Aave community has passed a new governance proposal to suspend Ethereum (ETH) borrowing. The proposal passed with his 77.8% approval of the community. It also said that ETH borrowing was halted prior to The Merge to protect against “high utilization in the ETH market.”

Algorand mainnet performance boosted by 5x after new upgrade

Algorand, a proof-of-stake network, recently upgraded its network mainnet, increasing transaction capacity to 6,000 transactions per second (tps). The old version was able to issue 1,200 tps, representing a 5x increase in capacity.

This upgrade also added state proof to the network, enabling trustless cross-chain communication by securely connecting multiple blockchains without the need for a third party.

U.S. Banks Must Maintain A Cautious Approach To Cryptocurrencies, Says Acting Head Of OCC

OCC Deputy Comptroller Michael Hsu maintains a critical view of the crypto space. warning At a recent conference, the bank called for maintaining a “prudent and cautious” approach to the industry to prevent a contagion that would undermine the US economy.

research highlights

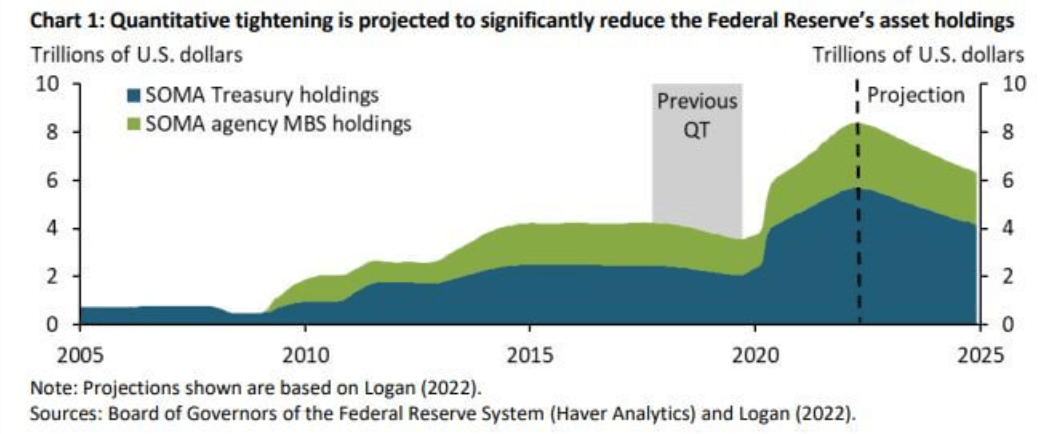

Quantitative tightening could be the most disruptive yet

Quantitative Tightening (QT) is a tool used by the Federal Reserve to combat inflation. QT shrinks the Reserve’s balance sheet by transferring large amounts of money to securities and investors.

CryptoSlate’s macro analysis on the topic shows that the upcoming QT period could be the most tumultuous period yet.

QT has been US policy to combat inflation since 2017. According to Macrodata, this QT will try to cut his $9 trillion off the Fed’s balance sheet, making it the most significant amount ever.

News around Cryptoverse

Reserve Bank of India Begins Working on CBDC Project

according to money control, Reserve Bank of India (RBI) is in talks with four public banks to launch CBDC projects. RBI aims to have his CBDC project established by the end of the year.

SEBA Bank Launches Ethereum Staking

Crypto-minded SEBA Bank has launched an Ethereum staking function to facilitate institutional access to the staking economy. money cab Banks want to increase customer engagement with cryptocurrencies as Ethereum turns PoS.

Brave Integrates Over 2 Million Unstoppable Domains

Encryption-enabled browser Brave has announced that it has incorporated over 2 million new Unstoppable domains for displaying decentralized websites. These integrations allow authors to build decentralized content using domains they own and manage.

The announcement said:

“We are now deepening our integration beyond .crypto to include more top-level domains, including .nft, .x, .wallet, .bitcoin, .blockchain, and .dao.”

Brazil sees record number of crypto declarations

The Brazilian Federal Revenue Service has revealed that July 2022 saw a record number of cryptocurrency declarations. live coin report.

crypto market

Bitcoin fell 2.37% to $18,936 over the past 24 hours, while Ethereum fell 4.62% to trade at $1,556.

Biggest Gainers (24 hours)

Helium: +39.88%

EOS: +18.74%

year.finance: +10.07%

Biggest Loser (24h)

OKBs: -1.97%

Clayton: -1.88%

Ravencoin: -0.78%