Congressman Emmer attacks FDIC for ‘weaponizing’ bank closures to attack crypto

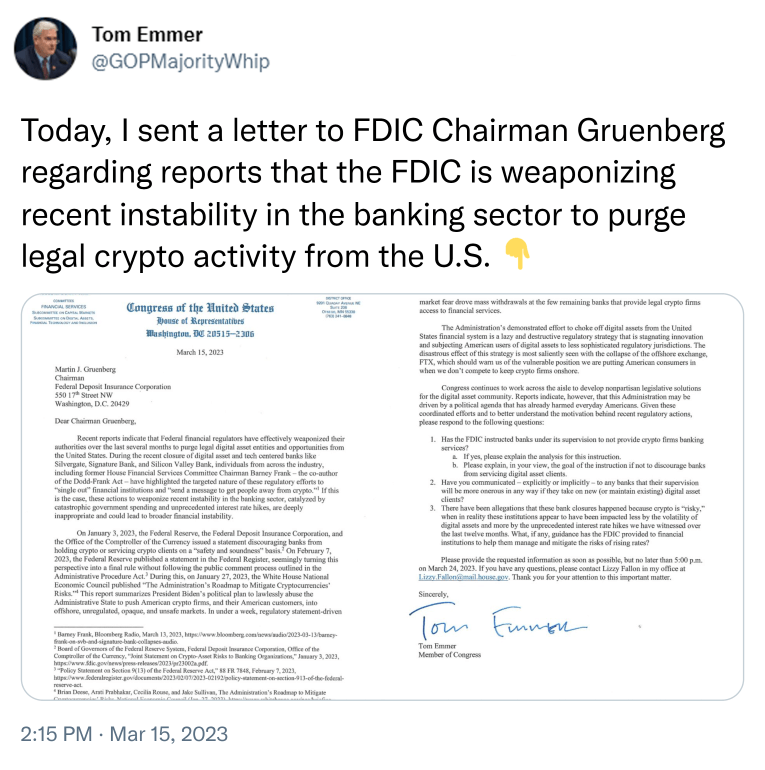

Minnesota Republican Rep. Tom Emer wrote to Federal Deposit Insurance Corporation (FDIC) Chairman Mark Gruenberg on March 15, urging him to invest in digital assets and technology-centric businesses such as Silvergate, Signature Bank, and others. I have expressed concern about the recent closure of the bank. , and Silicon Valley Bank.

FDIC Weaponized Bank

Emer shared the letter on Twitter, declaring that “the FDIC is weaponizing recent instability in the banking sector to wipe out legitimate crypto activity from the United States,” leading to broader economic instability. increase.

In the letter, he also questioned allegations that the FDIC instructed banks not to provide banking services to cryptocurrency companies, arguing that banks would not underwrite new digital assets or maintain existing digital assets. Clients were asked whether they had told their banks that bank supervision would be “more troublesome” if

He also compares the “risky” volatility of cryptocurrencies to the current state of traditional assets and how the FDIC will help financial institutions “help manage and mitigate the risk of rising interest rates.” I asked if they offer guidance.

Emmer wants answers to his questions by March 24 to better understand the motivations behind the recent regulatory action. Lawmakers have urged the FDIC to direct financial institutions to help manage and mitigate the risk of rising interest rates rather than targeting digital asset entities.

Industry reaction

Gemini co-founders Cameron and Tyler Winklevoss shared a tweet as the twins continue to push for more precise and proper crypto regulation within the United States. , and State Street Bank” to distance themselves from contagious effects from SVB, Signature, and Silivergate.

Emer’s sentiments were followed by others, as Signature Board member Bernie Frank also made multiple allegations that indicated the Signature Bank closure was cryptocurrency-related. for example, CNBC On March 13th, Frank claimed that the bank closure was trying to convey a strong stance on crypto.

Additionally, Messari founder Ryan Serkis said: said On March 13th, Signature was still a solvent.

“The signatures were healthy. The NYDFS was cheating and shutting them down to the surprise of even the FDIC. They’re being targeted.”

However, on March 14th, the New York State Department of Financial Services (NYDFS) announced that the closure of the undersigned bank had nothing to do with cryptocurrencies, directly contradicting Emer’s claims. However, around 30% of Signature’s deposits are associated with crypto companies, indicating significant exposure to the cryptocurrency market.

Additionally, other industry comments on the letter raised concerns that such tactics tend to yield nothing. As Mark Jeffrey on the Across the Chains podcast said,

“You guys don’t seem to have any real power to actually do anything about this. Meanwhile, people like Gary Gensler and this guy are running around to destroy everything on a monstrous scale.” .”

In summary

The closure of digital assets and technology-centric banks is causing concern among industry experts and lawmakers. Additionally, a letter from Rep. Tom Emer to his FDIC Chairman sheds light on the potential for regulators to weaponize to purge the U.S. of legitimate cryptocurrency activity.

Some industry insiders believe the recent closures of banks like Signatures are cryptocurrency-related, while others refute these allegations. Whether it will lead to any action remains to be seen. However, the need for more transparent and relevant crypto regulation is underscored in the United States as the industry seeks guidance from regulators to manage and mitigate risk while fostering innovation and growth.