Crypto downturn sees electricity consumption on Ethereum plunge by 50%

The power consumption of some of the largest crypto networks has dropped by as much as 50% as miners have been forced to close their stores due to lower token prices. Guardian.

Cryptographic miners are feeling a pinch

The recent sale was a cruel reminder of how volatile crypto investments were. But investors aren’t the only ones in a pinch. Miners who have to balance overheads and token prices are also facing difficulties.

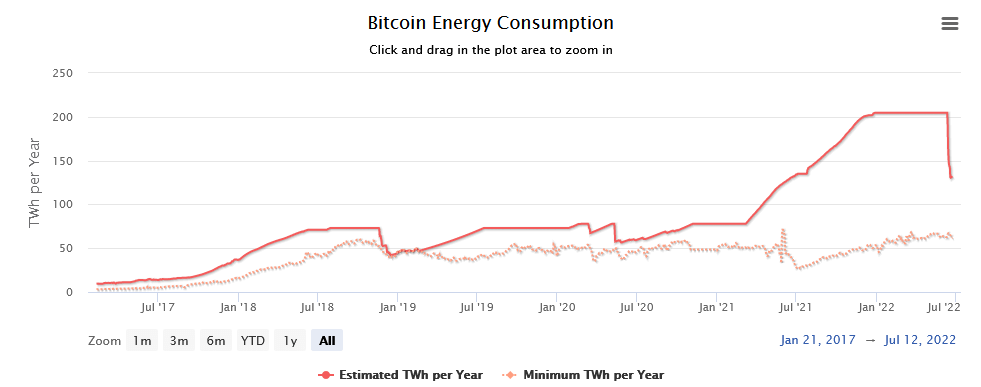

It shows the power consumption used in the mining process.Estimate from Digiconomist Bitcoin (BTC), the most energy-consuming network, has seen a sharp drop in electricity consumption, dropping from a high of 204.5 TW / h per year on June 11 to 132.07 TW / h per year on Thursday. It will decrease by% within 3 weeks.

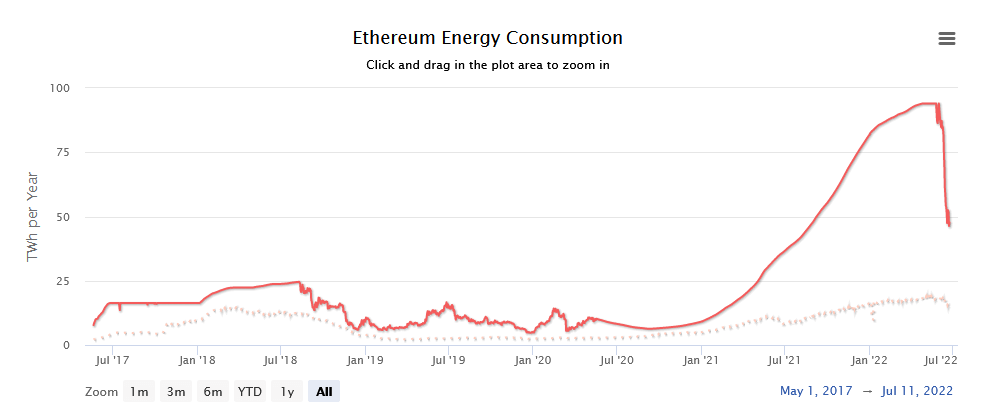

The decline in power consumption of Ethereum (ETH) networks is more pronounced. The annual high of 93.98 TW / h on May 23, followed by a sharp decline in the number of days thereafter. Currently, network consumption is 47.73 TW / h per year, a 49% decrease in 32 days.

The plunge in token prices drives inefficient miners out of business

Falling token prices put pressure on the most costly and most inefficient miners, forcing them to switch off machines or operate at loss.

The profitability of Bitcoin mining $ 0.0715 / day At 1THash / s on June 19, we recorded the lowest price in 20 months.

Similarly, Ethereum’s mining profitability is declining, $ 0.0135 / day June 18th 1MHash / d – 26 months low.

Comment on the situation and Alex de VriesThe founder of Digiconomist, said miners with “second-best equipment” operating under “second-best situations” have been forced out of business.

“It’s literally starting with non-optimal equipment or something that works in sub-optimal situations (such as inefficient cooling) and getting them out of business.”

de Vries went on to distinguish between Bitcoin ASIC mining equipment and Ethereum GPU-based mining equipment, stating that Bitcoin mining machines cannot be reused. GPUs, on the other hand, have a market with PC gamers.

“In the case of Bitcoin mining equipment, these machines are a big problem because they can’t be reused to do other things. When they’re unprofitable, they’re useless machines. Will the price recover? , You can keep them in the hope that they will be sold as scrap. “

If token prices continue to decline, it won’t be long before only the most efficient miners can afford to keep their machines running.