De-dollarization: Do all roads eventually lead to Bitcoin?

prologue

The US dollar’s dominance as a global reserve currency may be coming to an end. CryptoSlate’s latest market report explores the global de-dollarization and what role Bitcoin will play in the global economy.

The US dollar has been the world’s reserve currency of choice for 79 years as the medium of international trade. The Bretton Woods Agreement of 1944 established gold as the basis of the US dollar and pegged other currencies to the value of the dollar.

It was the first time in history that a group of nations negotiated a global financial order, and it was a success in the years following World War II. The system was secure because the US owned more than half of the world’s gold reserves.

However, the economic recovery in Europe and Japan has reduced US dominance in global trade. In addition, the US suspended her dollar-to-gold convertibility in 1971 due to the dollar’s overvaluation due to inflation and mounting public debt.

With the value of the dollar no longer tied to gold, the Federal Reserve was tasked with maintaining the value of the currency. But as the central bank failed to preserve the dollar’s value and began increasing the money supply, the currency lost his two-thirds of its value over the next decade.

The devaluation of the dollar continues into the 21st century.

By 2023, the dollar’s position as the world’s reserve currency will be at stake. The dollar’s dominance in global markets has been shaken in the past, but the dangers have never been greater.

This report examines the macroeconomic events that triggered the dollar’s vulnerability, and Bitcoin’s place in the de-dollarizing global economy as a result of the weaker dollar.

Hot Potatoes: Nobody Wants Dollars

The global financial crisis of 2007 reinforced the trend toward de-dollarization. In 2007, China launched the China International Payment System (CIPS). With this, cross-border payments can now be settled in RMB. In 2010, China and Russia signed a bilateral currency swap agreement, allowing trading in their own currencies.

In 2014, BRICS countries including Brazil, Russia, India, China and South Africa established a new development bank. This new financial institution was set up to provide developing countries with an alternative source of funding and reduce their reliance on the dollar. Additionally, the EU created an SPV to circumvent US sanctions against Iran and facilitate trade with Iran in euros.

Last month, China and Russia reaffirmed their 2020 agreement to increase trade use of the ruble and yuan. The deal aims to expand the use of the ruble and the yuan, which already account for two-thirds of his trade deal payments between the two countries.

Foreign trade isn’t the only area where countries are ditching the dollar.

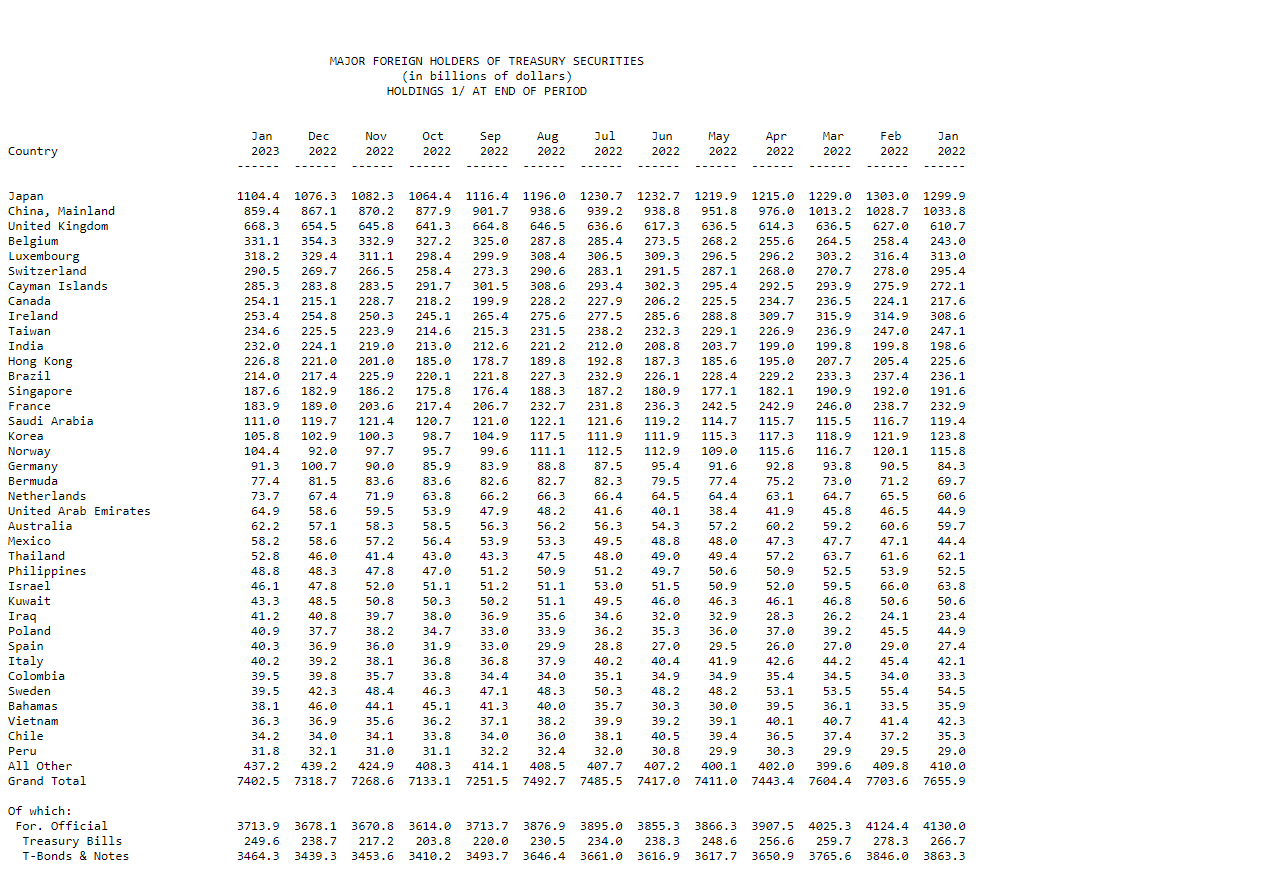

Once considered the world’s safest and most liquid asset, the US Treasury’s holdings have become a geopolitical issue.

Foreign demand for government bonds fell about 6% last year. This represents a marked drop in demand following his two years of aggressive buying after the COVID-19 pandemic.

However, rising interest rates have reduced the profitability of these bonds. Nearly all major countries sold their treasuries last year.

Foreign holders have sold $253 billion worth of Treasuries over the past year, according to Federal Reserve data.

Bloating balance sheets bring trouble to the dollar

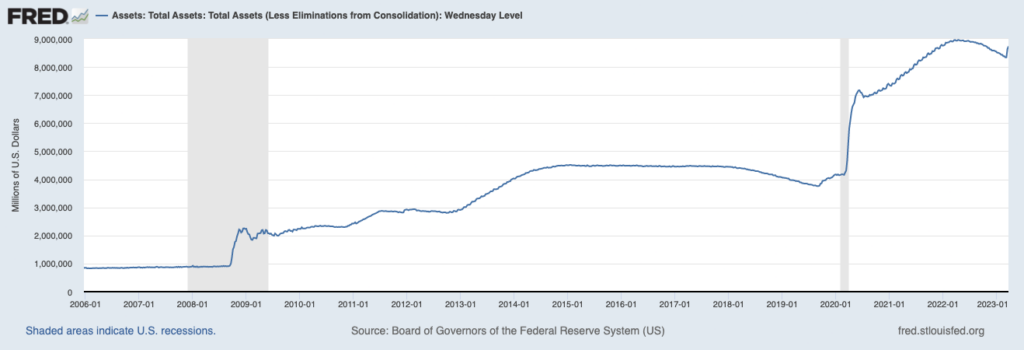

Central banks around the world have expanded their balance sheets in response to the COVID-19 pandemic, but none has been as aggressive and dangerous as the United States.

In the four months since the pandemic began in March 2020, the Federal Reserve has increased its balance sheet by over 72% and added over $3 trillion to its assets.

Aggressive liquidity injections into the financial system have failed. It took less than two years for quantitative easing to turn into inflation, and US goods and services saw record growth heading into his 2023. In a country as indebted as the United States, inflation can quickly depreciate the value of government bonds and cause interest rates to rise. rate soars.

When the value of government bonds declines, domestic and foreign bondholders will sell their holdings, incurring losses and redirecting their capital to more profitable investments.

Foreign holders of U.S. Treasuries have sold their holdings and switched to other currencies such as the yuan and rubles to cut their reliance on the dollar. Meanwhile, domestic holders shifted from long-term government bonds to short-term bonds.

all roads lead to bitcoin

Bitcoin has long been touted as a safe-haven asset.

But it wasn’t until a full-blown banking crisis loomed over the United States that global markets began to wake up.

Bitcoin’s fixed supply and decentralized infrastructure give holders control over their funds. Slowly becoming the asset of choice for many seeking to avoid government interference due to their ability to independently verify transactions, self-custody their coins, and facilitate censorship-free cross-border transactions. I have.

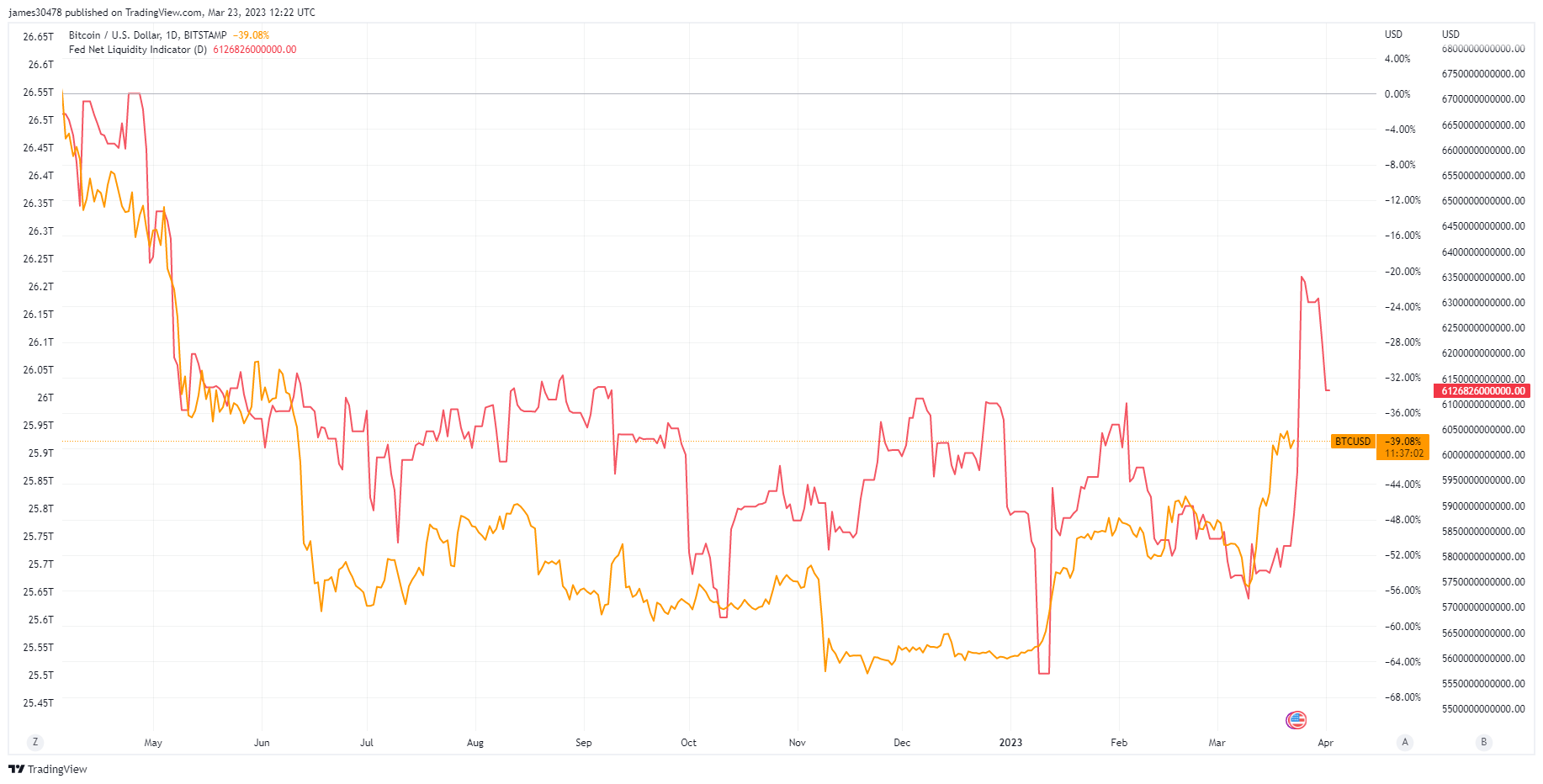

That volatility seems worth the cost for many investors. This is evident in the increasing correlation with market liquidity. Data analyzed by CryptoSlate showed that the price of Bitcoin followed the rise and fall of the Federal Reserve’s net liquidity. This means that a significant portion of the newly injected liquidity in the market continues to flow into Bitcoin.

Bitcoin’s role in the global economy will grow as the weaknesses of traditional markets become apparent. However, while it has already proven its use in developing countries, developed markets like the US have yet to see its value.

Continued dollar erosion is pushing many retail and institutional investors to Bitcoin. However, whether this asset dominates the market depends on regulatory pressure from the US government, and we expect a fierce battle to curb its spread.

As inflation picks up, all roads really lead to Bitcoin. The question is, how long will it take for the market to reach its goal?