Decentralized exchange trading volume grows 88% following SEC lawsuits

Volumes on decentralized exchanges (DEXs) surged 88% in 24 hours following news that the U.S. Securities and Exchange Commission (SEC) had sued centralized cryptocurrency exchange Binance.

On June 5, financial regulators filed 13 indictments against Binance and its CEO Changpeng Chao for violating federal securities laws, while the exchange facilitated the trading of cryptocurrency tokens. claimed to have.

Following the news, DEX trading volume increased from $1.2 billion on June 4 to $3.09 billion on June 5, according to data. Defilama.

Uniswap Dominates Volume

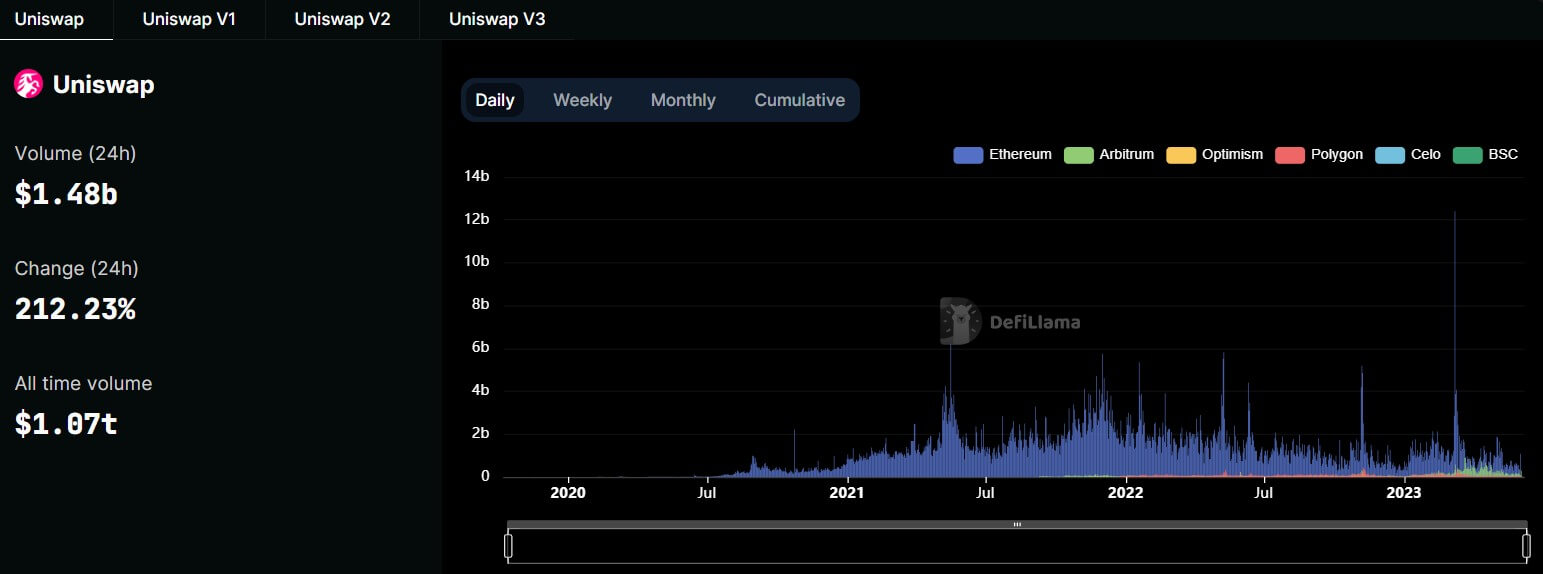

Defilama data Indicated The dominant DEX during the reporting time was Uniswap (UNI), accounting for almost 50% of total trading volume. The platform’s trading volume increased by more than 200% across multiple chains to $1.48 billion.

During the period, PancakeSwap (CAKE) transaction volume increased by 75% across Ethereum and BNB smart chains to $481.84 million.

Other protocols that registered significant changes in trading volume include Dodo with $163.92 million, Curve Finance (CRV) with $156.9 million and Level Finance with $117.55 million.

Dex trading volume is on the rise

Prior to the SEC lawsuit, the popularity of memecoins such as PEPE, WOJAK, and Turbo increased trading volumes across decentralized exchanges.

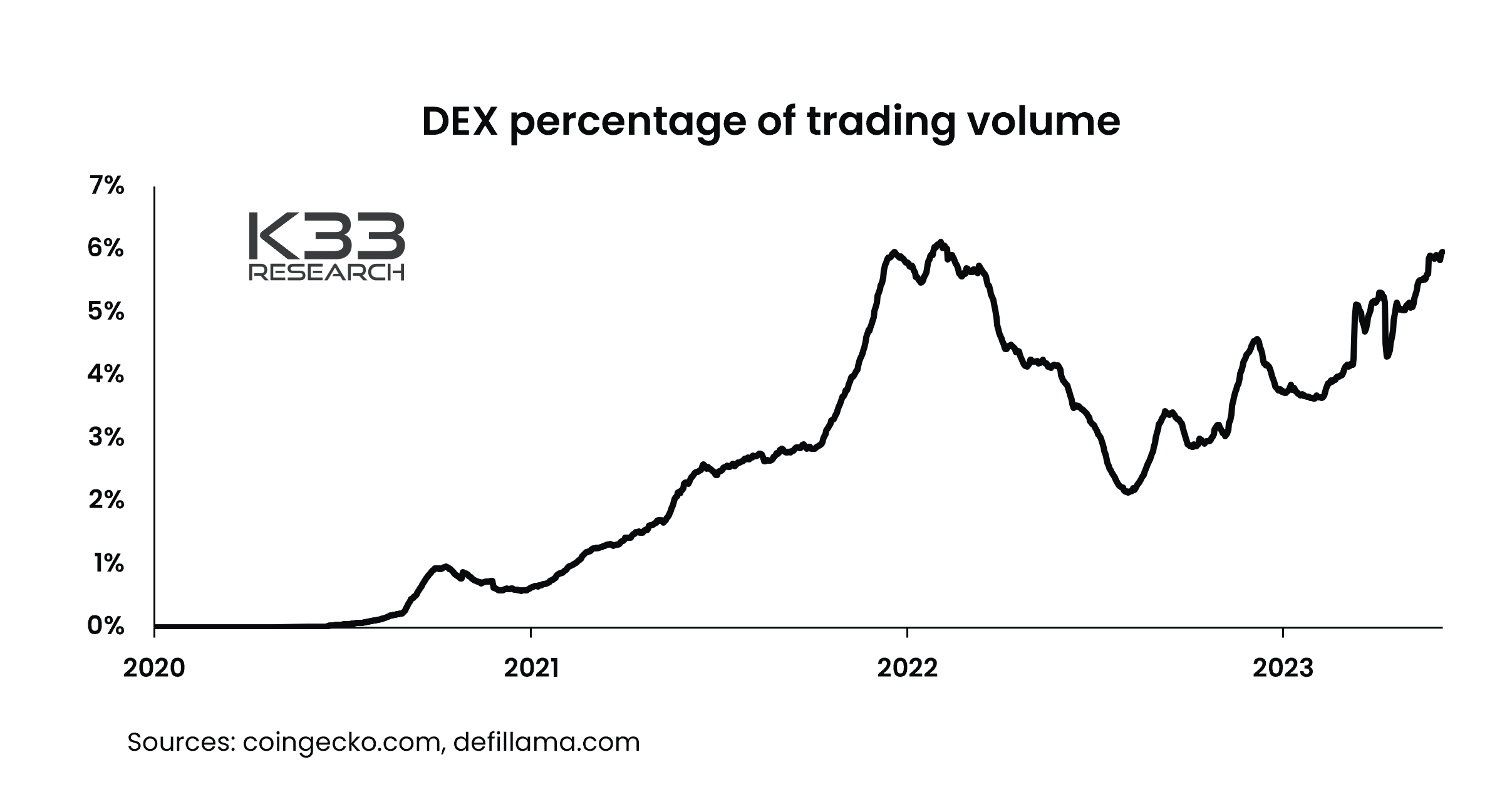

K33 research It pointed out Its DEX volume was approaching late 2021/early 2022 highs as a percentage of total volume.

Meanwhile, the rise coincided with a time when trading volumes on centralized exchanges fell to their lowest levels since 2020. Centralized platforms face intense scrutiny from regulators trying to prevent new events like the FTX bankruptcy in 2022.

Despite the increased use of decentralized exchanges, trading volumes are still relatively low compared to previous peaks. According to DeFiLlama data, overall DEX volume was $72 billion in May, well below the $234.27 billion recorded in November 2021.

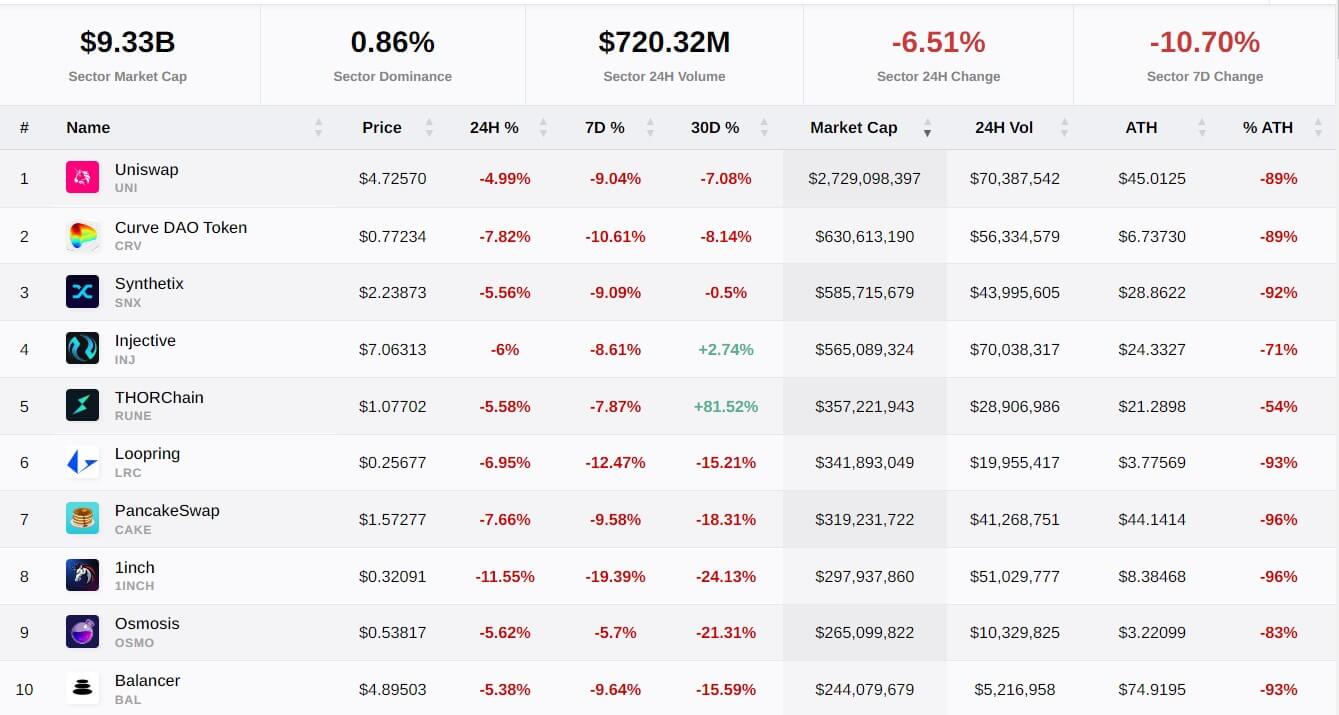

Decrease in DEX tokens

However, the move to DEXs has resulted in positive price performance for native tokens on these exchanges.according to of crypto slate Tokens in the sector have fallen 6.51% over the past 24 hours, according to data, and have fallen more than 10% in the last week.

The top 10 cryptocurrencies by market capitalization in the sector suffered losses during the reporting period, with 1 Inch falling 11% to top the loss list.

The SEC filed a lawsuit against Coinbase this morning, following yesterday’s actions.