Ethereum becomes most deflationary in history as activity spikes amid FTX collapse

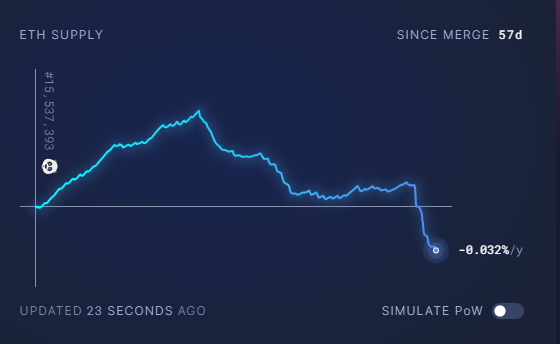

With annual supply below zero for the first time since the merger, Ethereum is at its most deflationary in its history.

According to Ultrasound Money, the annual inflation rate has fallen to -0.032/year, indicating that the network is currently consuming more Ethereum than it is issuing.

Since Ethereum switched to Proof of Stake Consensus on Sept. 15, negative inflation has reduced Ethereum’s net supply by 5,598.

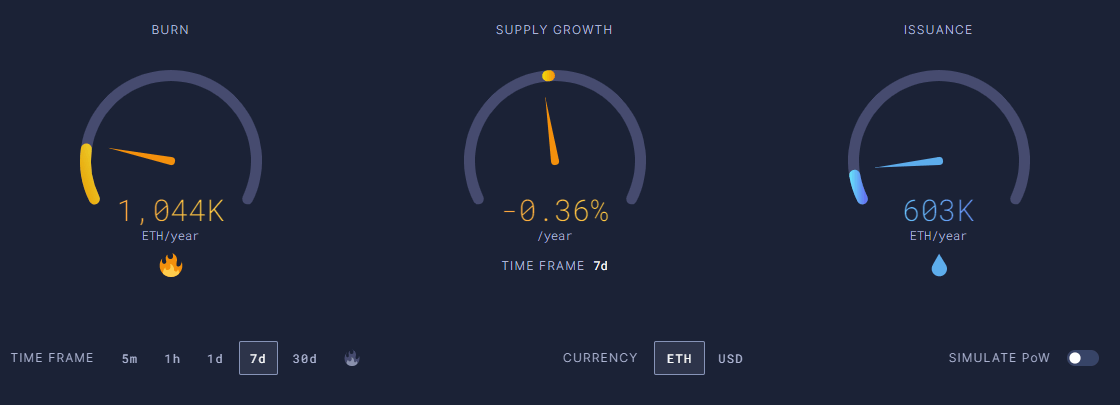

Ethereum has burned 1,044,000 tokens against 603,000 issuance in 7 days. This is at a rate of 773,000 tokens per year, indicating that the ETH supply is declining by 0.36% per year.

Recent changes can be attributed to Merge upgrades and surge in transactions due to market uncertainty.

After Ethereum was upgraded from Proof of Work (PoW) to Proof of Stake (PoS), Ethereum became a deflationary asset. This upgrade replaces the miner with a validator that was replaced at blockchain runtime, greatly reducing his newly created ETH. As a result, Ethereum’s annualized inflation rate was nearly zero after the merger, but it took a long time to reach its current level.

Additionally, the surge in Ethereum network activity during the recent FTX debacle has increased ETH burns.

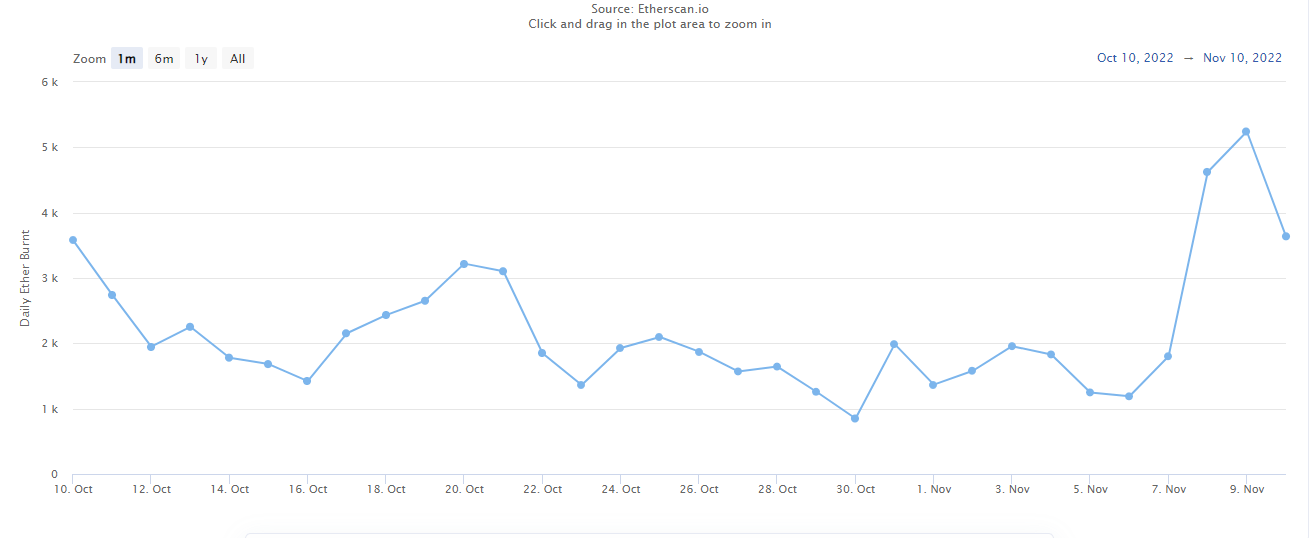

Etherscan recently reported its highest daily tally since June as 5,242 ETH burned on Wednesday. The amount of ETH consumed this week surpassed 15,305 as of Thursday.

sauce: Daily ETH Burn

A total of 2.72 million ETH have been burned on the Ethereum network since August 2021 after the Ethereum Improvement Proposal (EIP)-1559 was published. Essentially, EIP ties ETH burn to network usage.

Will Ethereum Surpass Bitcoin?

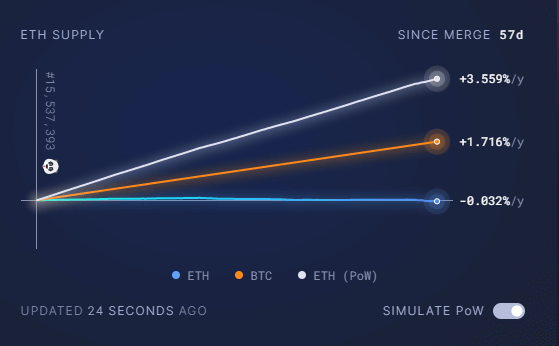

In contrast, in PoW, Ethereum inflation was 3.559% per year and 4,931,000 Ethereum was issued annually. Bitcoin, on the other hand, is growing at an annual rate of 1.716%.

Deflation Outlook for Ether increase its rarity Overall, when Once the panic caused by FTX subsides, Ether’s tokennomics could surpass Bitcoin.

Ethereum is currently trading at $1277.15, down 29.4% from its seven-day high of $1653.29.