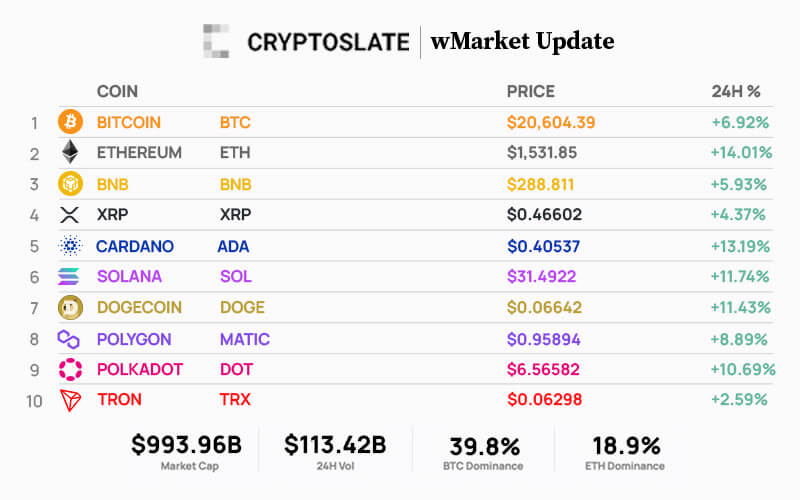

Ethereum leads gains as Bitcoin crosses $20k

The cryptocurrency market capitalization recorded a net inflow of $65.75 billion in the last 24 hours, boosting its total to $995.22 billion from $929.47 billion at the time of writing. Market capitalization increased by 7.10% over the last 24 hours.

Bitcoin’s market cap rose 6.98% to $395.99 billion during the reporting period, while Ethereum’s market cap rose 14.2% to $187.92 billion.

All of the top 10 cryptocurrencies posted gains during the reporting period, with Bitcoin surpassing $20,000 for the first time since the beginning of October. Ethereum hit a new all-time high, rising 14.01% to $1531.

Tether (USDT) market cap increased slightly from $68.47 billion to $68.52 billion. BinanceUSD (BUSD) also rose from $21.62 billion to $21.63 billion. Meanwhile, the market cap of USD Coin (USDC) remained flat at $43.8 billion.

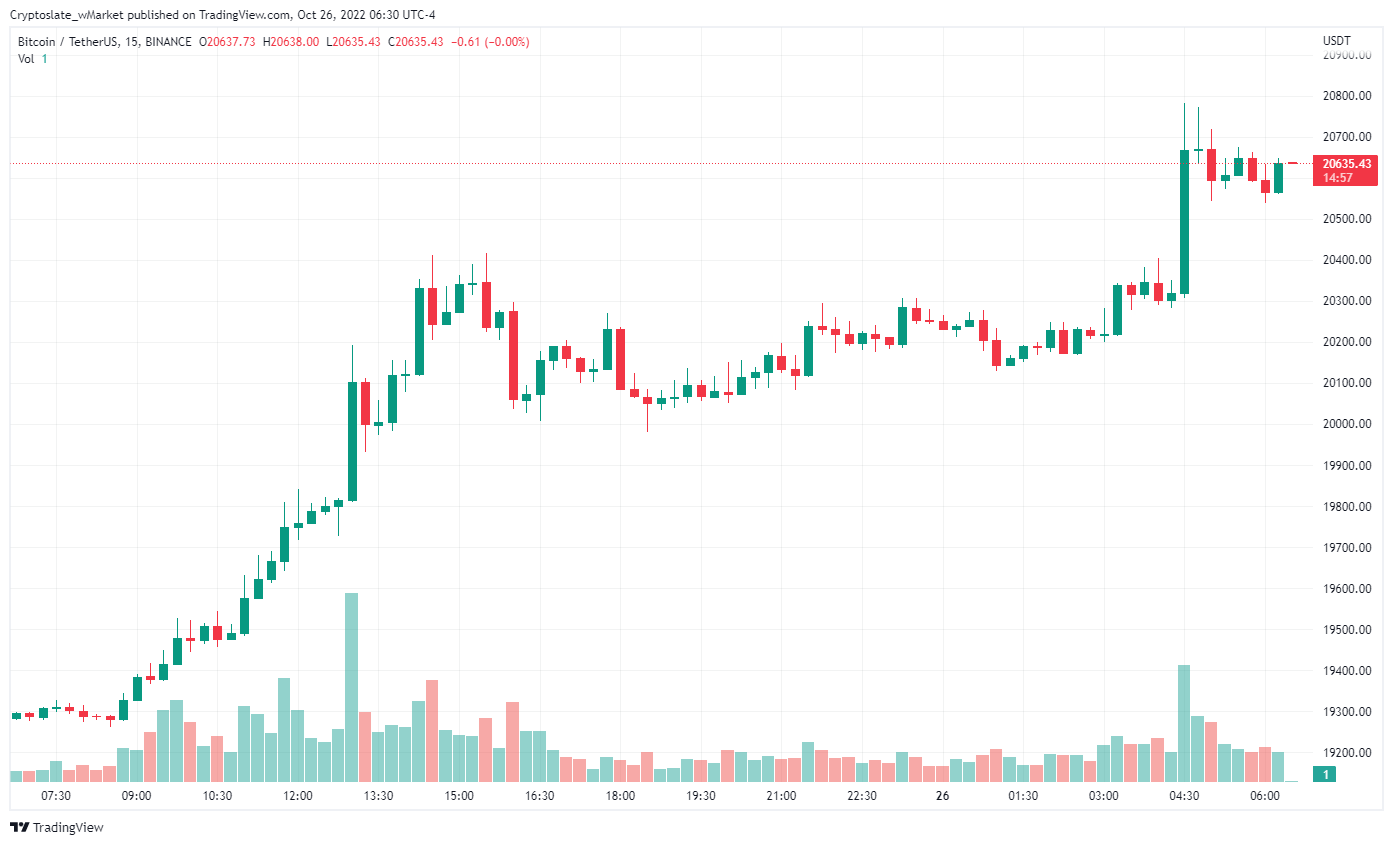

Bitcoin

Over the past 24 hours, the Bitcoin price increased by 6.92%, trading at $20,604 as of 06:30 ET. Its market dominance was 39.82% during the reporting period.

Flagship digital assets hit $20,682 in the last 24 hours. The flagship digital asset crossed $20,000 around 13:00 UTC, and in short positions he liquidated over $350 million.

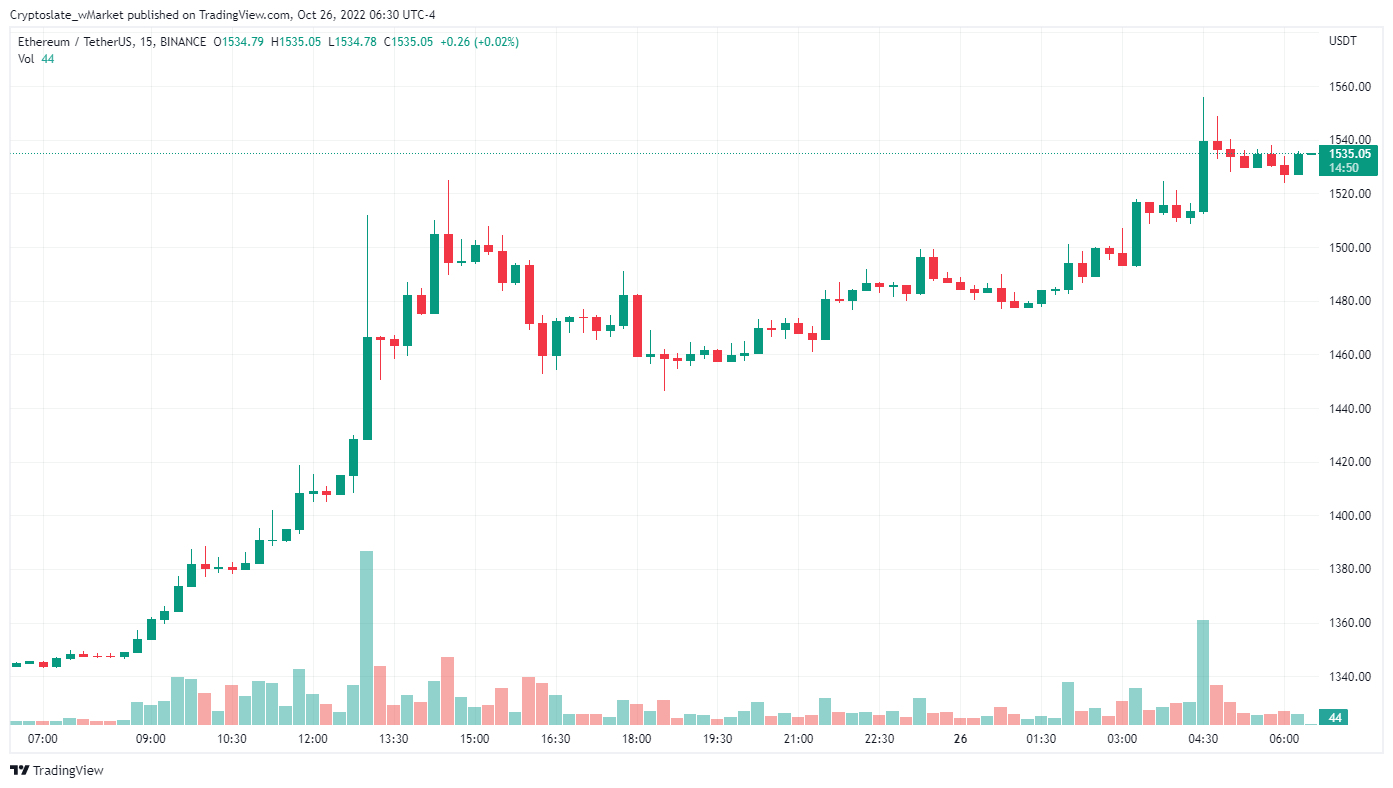

ethereum

Ethereum price recorded the highest profit among the top 10 cryptocurrencies. It rose 14.01% to trade at $1,531 at 06:30 ET. Over the last 24 hours, market dominance was 18.9%.

The second largest cryptocurrency reflects the price performance of BTC during the reporting period. ETH crossed $1500 around 13:30 UTC.

top 5 price increases

Luxo

LYXe was the biggest gainer of the day, gaining 29.54% during the reporting period and trading at $9.53 at the time of writing. The crypto token has shed tears over the past 7 days as its value increased he 64.93%. Its market cap was he $145.88 million.

SSV.Network

SSV rose 22.42% to $11.33 over the last 24 hours. The project is seeing increased demand after experiencing high volatility at the beginning of the month. Its market capitalization was $113.32 million at the time of writing.

optimism

OP, the native token of the Layer 2 network, was also one of the top gainers of the day. He was up 20.23% before trading at $1 at the time of writing. Its market capitalization was $235.72 million.

ton coin

TON continues its impressive performance this week, gaining 17.84% over the last 24 hours. It’s up more than 45% this week. Its market capitalization was $2.2 billion.

rocket pool

RPL has registered a 15.83% gain over the past 24 hours and is trading around $24.93 at the time of writing. The staking protocol’s token saw its price rise after Ethereum staked surpassed his 14 million mark in Q3. Its market cap was he $256.37 million.

top 5 losers

APENFT

NFT was the biggest loser of the day, trading at 0.000000638484 at the time of writing, losing 2.46% of its value. NFT related tokens have increased by over 22% over the last 30 days. Its market capitalization was $176.55 million.

Mdex

MDX plummeted 2.37% to $0.17 over the past 24 hours. The decentralized exchange token is one of the best performing digital assets over the last 30 days, up 171%. Its market capitalization was $157.96 million.

sorogenic

SOLO has fallen 1.54% during the reporting period and is trading at $0.36 at the time of writing. Liquidity offering protocols have increased by 161% over the last 30 days. Its market capitalization was $146.18 million.

Quants

After an impressive move that pushed its value above $200, QNT is trading at $176 after losing 1.17% of its value over the past 24 hours. Its market capitalization was $2.12 billion.

ribbon finance

RBN is down 1.1% and is trading at $0.366 at the time of writing. The token is up 28.3% over the last 30 days. Its market capitalization was $207.06 million.