Fed will keep hiking interest rates longer than you can stay solvent

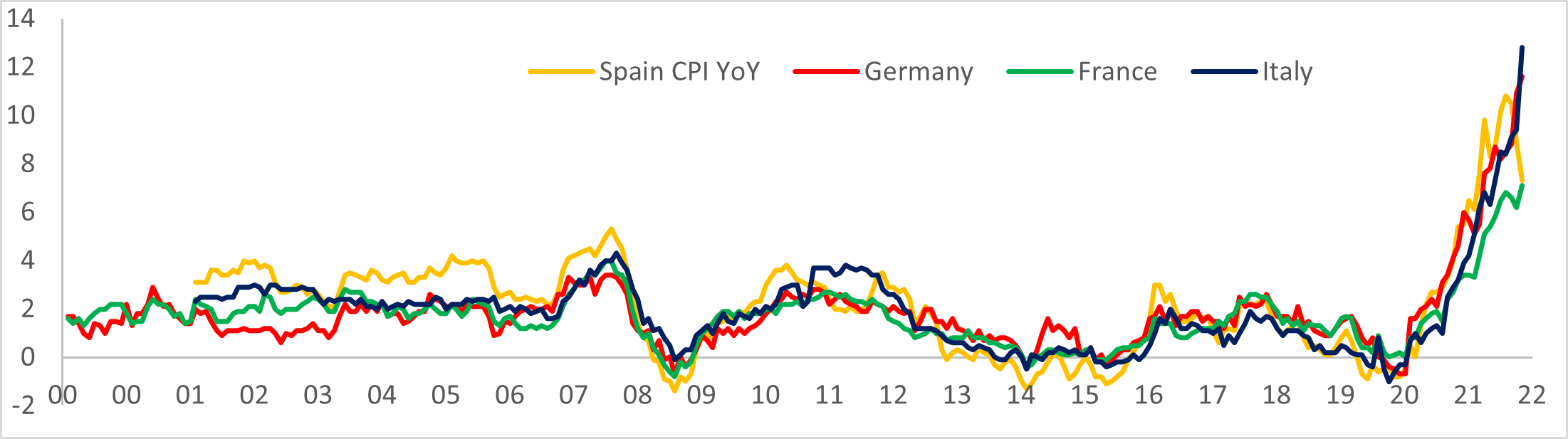

Rapid inflation and slow growth have plagued the global economy for months, but the rise in CPI and devaluation first seen in the US has now spread to Europe.

The European Central Bank (ECB) has raised its benchmark interest rate by 75 bps for the second time in a row, making deposit rates the highest in more than a decade. The ECB hopes aggressive rate hikes will help contain eurozone inflation, which reached 10.7% ATH in October.

Germany, France, Italy and Spain, Europe’s four largest economies, all provided painful upside surprises.german inflation reached Last month it was 11.6%, the highest level in more than 70 years. Italy’s 12.8% inflation rate is the eurozone leader, with France and Spain trailing behind her at 7.1% and 7.3%.

Some eurozone countries have managed to avoid an immediate recession by posting unexpected GDP growth over the past month, but the danger is far from over.

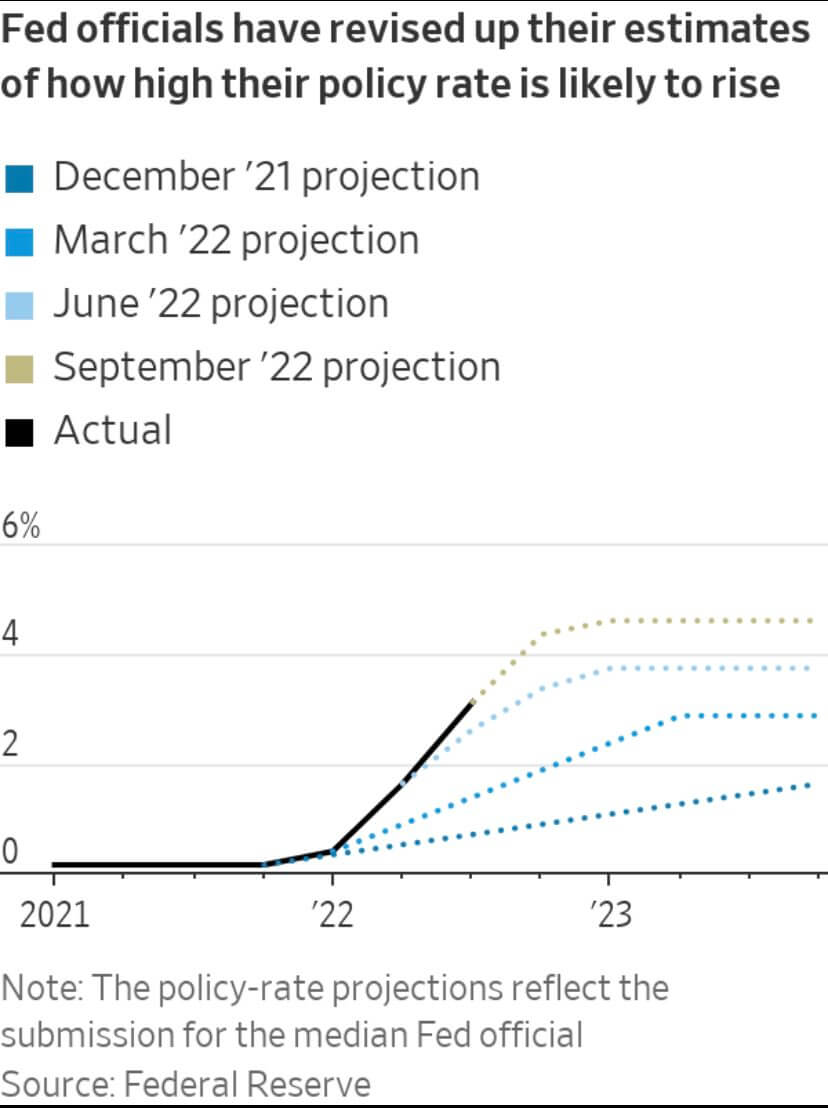

Rising interest rates in the US have strengthened the US dollar and weakened both the euro and British pound. Europe’s two largest currencies are likely to continue declining further as the Fed expects he will raise interest rates by 75 bps from Nov. 1 at its meeting on Nov. 2.

With 75 bps of rate hikes in place, we expect the Fed to keep raising interest rates from 3.75% to 4% until it hits its target. However, some economists have argued that the Fed is considering slowing the pace of rate hikes and that in December he could announce a 50 bps hike.

Kansas City Federal Reserve Bank President Esther George believes rate hikes could continue next year. She thinks Federal Reserve Chairman Jerome Powell could suggest that the Fed may need a higher end-of-term interest rate than the expected 4.6% next spring.

Higher interest rates may be needed to keep inflation in check, which could rise further as households tap into cash savings. George noted that using savings would allow households to spend in a way that sustains demand despite skyrocketing interest rates, which could continue to fuel rising inflation. .

According to Stifel’s report, U.S. consumer spending is 0.6% increase

September 0.4 or more% gain expected according to bloomberg, and followed a similar rise in August. Year-on-year, private consumption he increased by 8.2%.

“It suggests that we may have to keep this up for a while,” George said. not.”

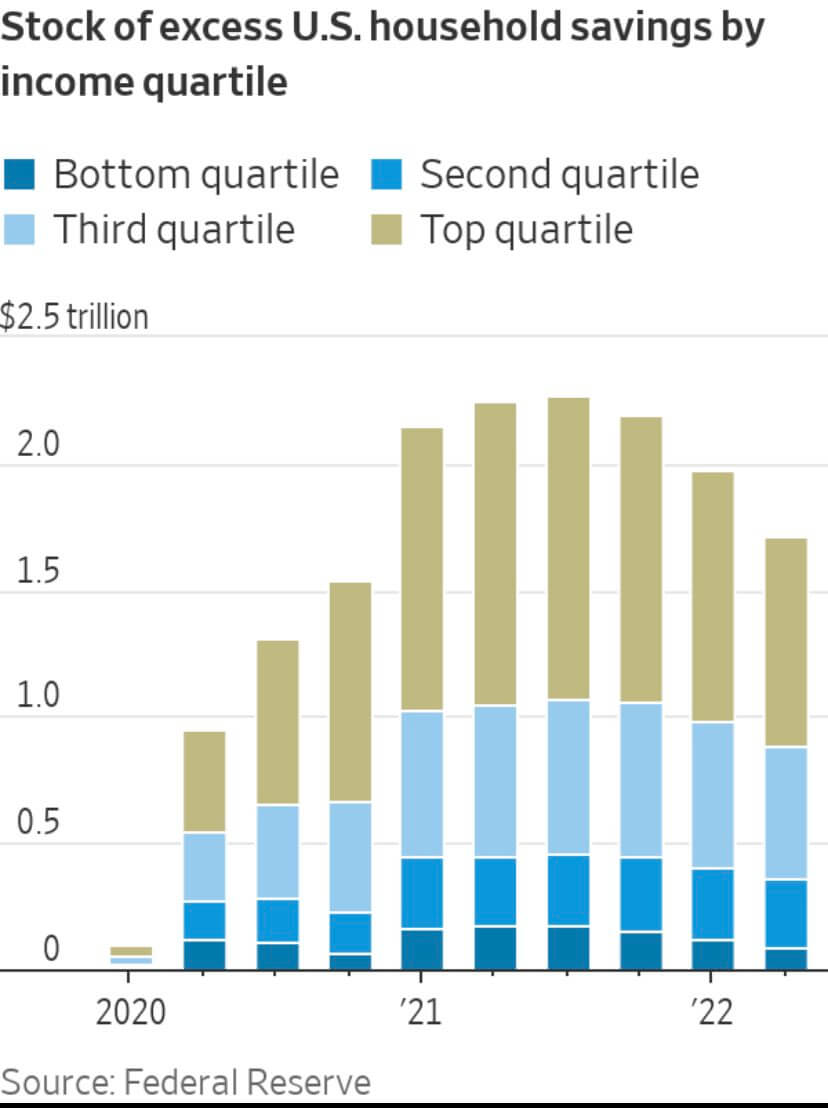

As of the end of the second quarter of 2022, US households had $1.7 trillion in savings, according to the Federal Reserve. That’s down from her $2.3 trillion high recorded in the second quarter of 2021, but still an almost 17-fold increase. From figures recorded in early 2020.

$1.7 trillion in household savings represents a significant increase in the Fed’s attempts to curb demand. Rising interest rates have reduced household savings by at least $2 trillion since the beginning of the year, but that number is still higher than the Fed would like.

Most of that loss was accounted for by the top and bottom quartiles of income. The second and third income quartiles, which represent the upper and lower middle classes, will keep their savings largely unchanged from 2021 onwards.

The battle between solvency and rising interest rates is expected to continue into 2023.