FTX took $3.7B loss in 2021; Coinbase reveals Grayscale Bitcoin reserves

The biggest news in the cryptoverse on Nov. 21 included FTX calling on other exchanges to hopefully prevent hackers from cashing out, and Coinbase disclosing Grayscale’s 635,000 bitcoin reserves. , including claims by the Bank of England that the FTX crash was due to the FTT token run.

CryptoSlate Top Stories

FTX pre-warns exchanges to freeze stolen funds to prevent hackers from cashing out

On November 20th, bankruptcy FTX announced that all cryptocurrency exchanges should be on high alert regarding unauthorized transfers of funds from FTX Global to related debtors.

(1/2) Exchanges should be aware that certain funds transferred from FTX Global and related debtors without permission on 11/11/2022 were transferred through an intermediary wallet.

—FTX (@FTX_Official) November 20, 2022

According to FTX, the funds were transferred via an intermediate wallet. The exchange has warned all other exchanges to take the necessary precautions to seize and return the funds given that they will somehow be transferred through the system.

Grayscale Holds 635K BTC As Coinbase Custody Reveals Holdings

Grayscale’s custodian partner, Coinbase, stepped in to address concerns about the fund’s financial health. Coinbase has published a report disclosing assets it holds on behalf of Greyscale.

According to reports, Greyscale currently owns about $10 billion worth of Bitcoin. This amount puts him closer to $43.8 billion at the height of the bull market. Grayscale also holds 3,056,833 Ethereum.

BoE speculates FTT token fire sale may have caused FTX collapse, calls for broad regulation

In a speech on November 17, Bank of England Deputy Governor John Cunliffe said the FTX crash was caused by the run of the FTX Token token. he said:

“Certainly, there are indications that in the case of FTX, it may have been the FTT scramble that triggered the collapse.”

Cunliffe also said the past year has proven volatile in the crypto space. Cunliff argued that the crypto industry needs to be regulated in order to stabilize it.

‘Boring’ Litecoin Takes Top 10 Among Market Meltdowns

Litecoin (Litecoin) is skyrocketing and currently ranks 15th by market capitalization. That’s six places above LTC’s ranking, where he was 21st as of October 30th.

Alan Austin, managing director of the Litecoin Foundation, tweeted to share LTC’s rise by shouting at those who called Litecoin “boring.”

To those who have called me for many years #Litecoin Too boring:

Are you all excited enough yet?

— Alan Austin (@alangaustin) November 17, 2022

FTX exploiter ups the ante with 200K ETH move

The attacked FTX moved 50,000 Ether (ETH) on November 20th, before moving another 195,000 on November 21st.

Ren Bridge announces open-source community-driven Ren 2.0 in response to the Alameda fallout.

The Ren Bridge project announced Ren 2.0, also known as “Ren Community”, on its Medium account on November 18th. Ren 2.0 will be a fully decentralized, community-owned cross-chain network.

Singapore watchdog says Binance has been placed on the Investor Alert List via FTX for unauthorized activity.

The Monetary Authority of Singapore (MAS) has listed Binance on its Investor Alert List (IAL) and explained why it excluded FTX. Binance was actively looking for users to onboard in Singapore, but FTX was not. MAS also added that neither exchange is licensed to operate in the country.

Hedge Fund Investor Bill Ackman Invests in Cryptocurrencies, Reveals Investments

Hedge fund investor and billionaire Bill Ackman has announced that an exciting crypto project he discovered has changed his skepticism about cryptocurrencies.

Ackman announced a change of heart on his Twitter account. He did not disclose the projects, but said they enabled the formation of useful businesses and technologies.

research highlights

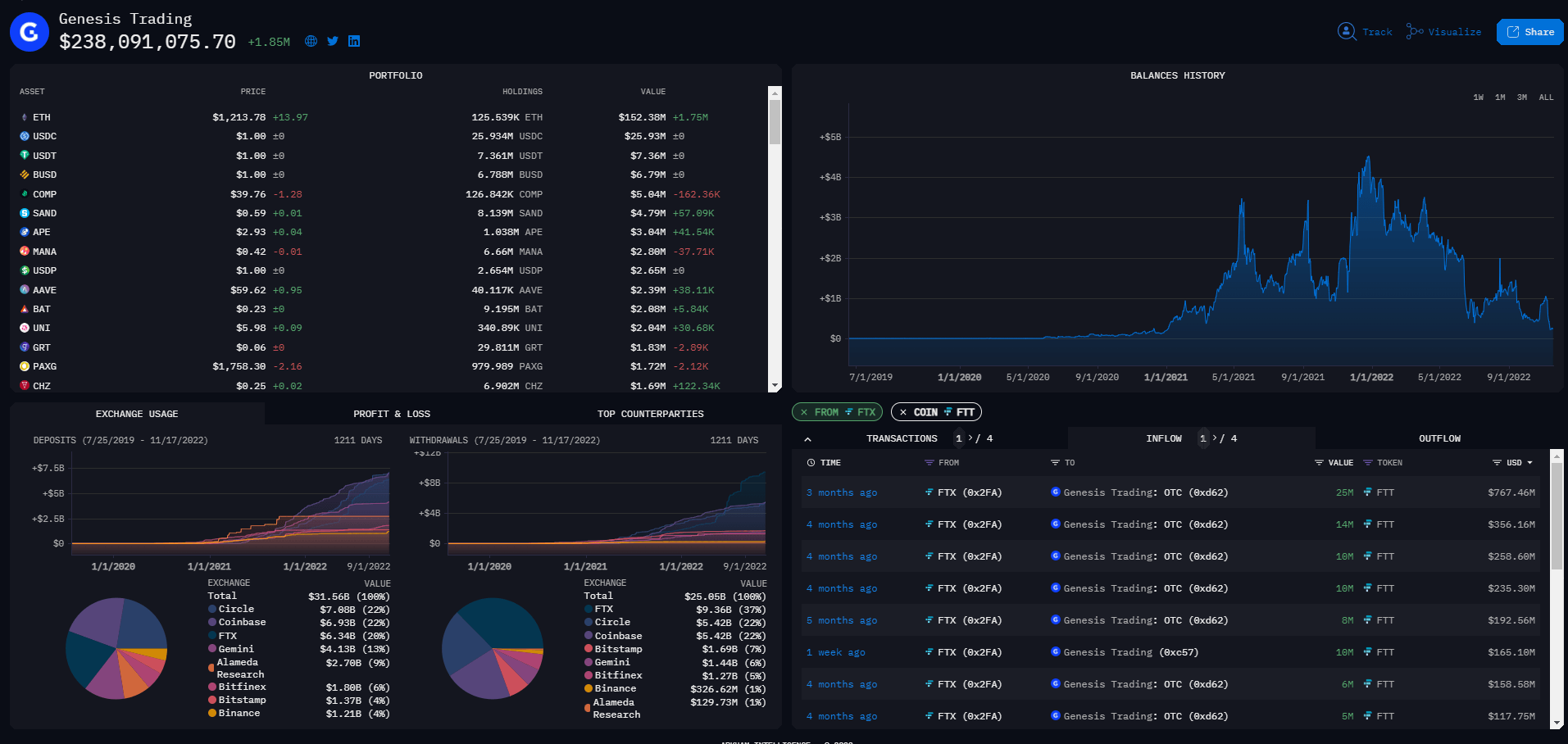

Study: Genesis received $1 billion worth of FTT from FTX’s Alameda in last 3 months

CryptoSlate analysts analyzing Arkham Intelligence’s dashboard revealed that cryptocurrency lender Genesis has received billions of dollars worth of FTT tokens from FTX and Alameda Research.

Genesis received $932.56 million worth of FTT tokens from FTX and $141.1 million worth of FTT from Alameda in the last three months.

News around Cryptoverse

FTX, Alameda suffered a loss of $3.7 billion in 2021

Based on its 2021 tax returns, FTX companies had net operating loss carryforwards of at least $3.7 billion to the federal government and at least about $715 million to the states, according to the latest filings in the FTX bankruptcy case. is indicated by

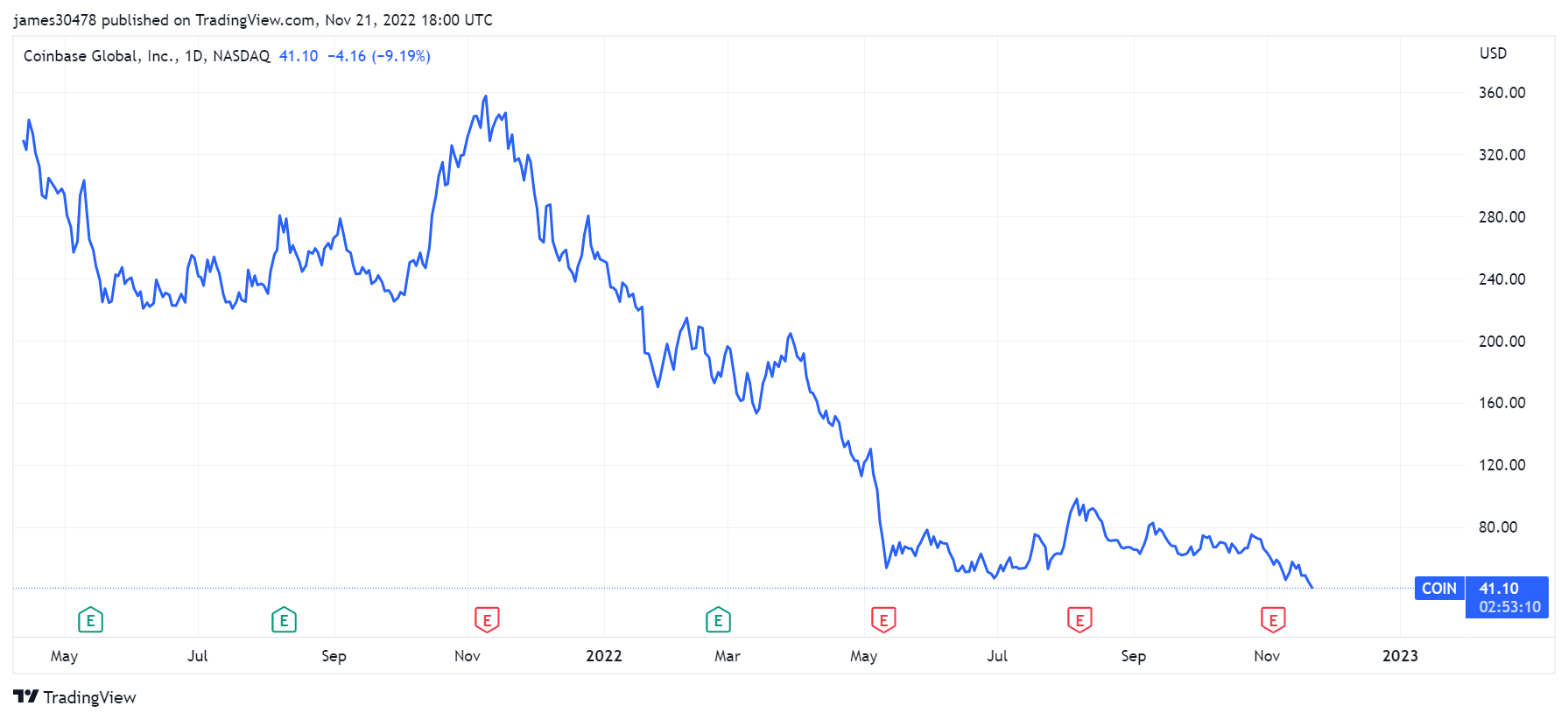

Coinbase stock price hits all-time low

Coinbase’s stock price hit a record low of $40.81 on November 21st. At the time of writing, the stock is trading at around $41.10.

Uniswap collects users’ on-chain data

Uniswap, a leading decentralized exchange, has updated its commitment to privacy, announcing that it is now collecting users’ on-chain data. The exchange said it decided to do so “to make data-driven decisions that improve the user experience.”

crypto market

Over the past 24 hours, Bitcoin (BTC) has fallen 4.14% to trade at $15.835, while Ethereum (ETH) has fallen 5.94% to trade at $1,106.