Glassnode and CryptoSlate Deep Dive: How a cold winter is impacting Bitcoin miners and why the fear has just begun – Issue 01

Glass node special offer

See all live charts covered in this report at glass node studio.

⚡special offer⚡

What you can do for a limited time Save 40% on monthly or yearly Glassnode Advanced plans Access the data and insights that power thousands of cryptocurrency traders and investors around the world. Offer ends November 29th.

Find edges in Glassnode

prologue

The 2022 bear market will be particularly severe, with digital asset prices on a sustained downward trend, rising interest rates tightening liquidity, and serious credit spillovers taking hold in the crypto lending market.

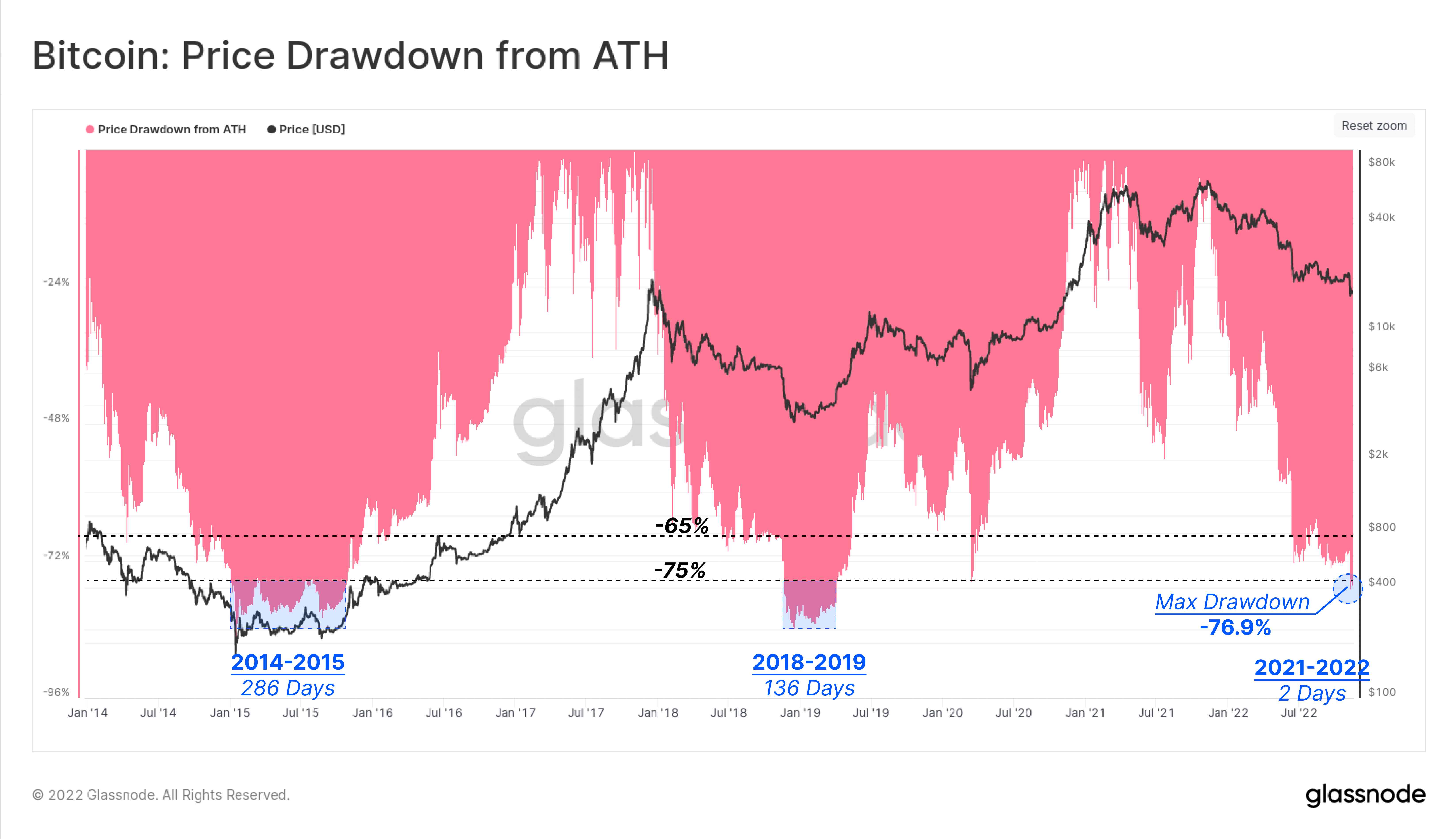

Bitcoin’s spot price fell to a multi-year low of $15,801 this week amid the FTX collapse, and BTC is now 76.9% below its cycle cap set in November 2021. The previous generation low marks a market devaluation of over 75% from the peak. , matching this bear market with previous cycle drawdowns.

BTC’s over 75% drawdown has persisted for months in previous cycles, suggesting that the period may still be ahead if history rhymes.

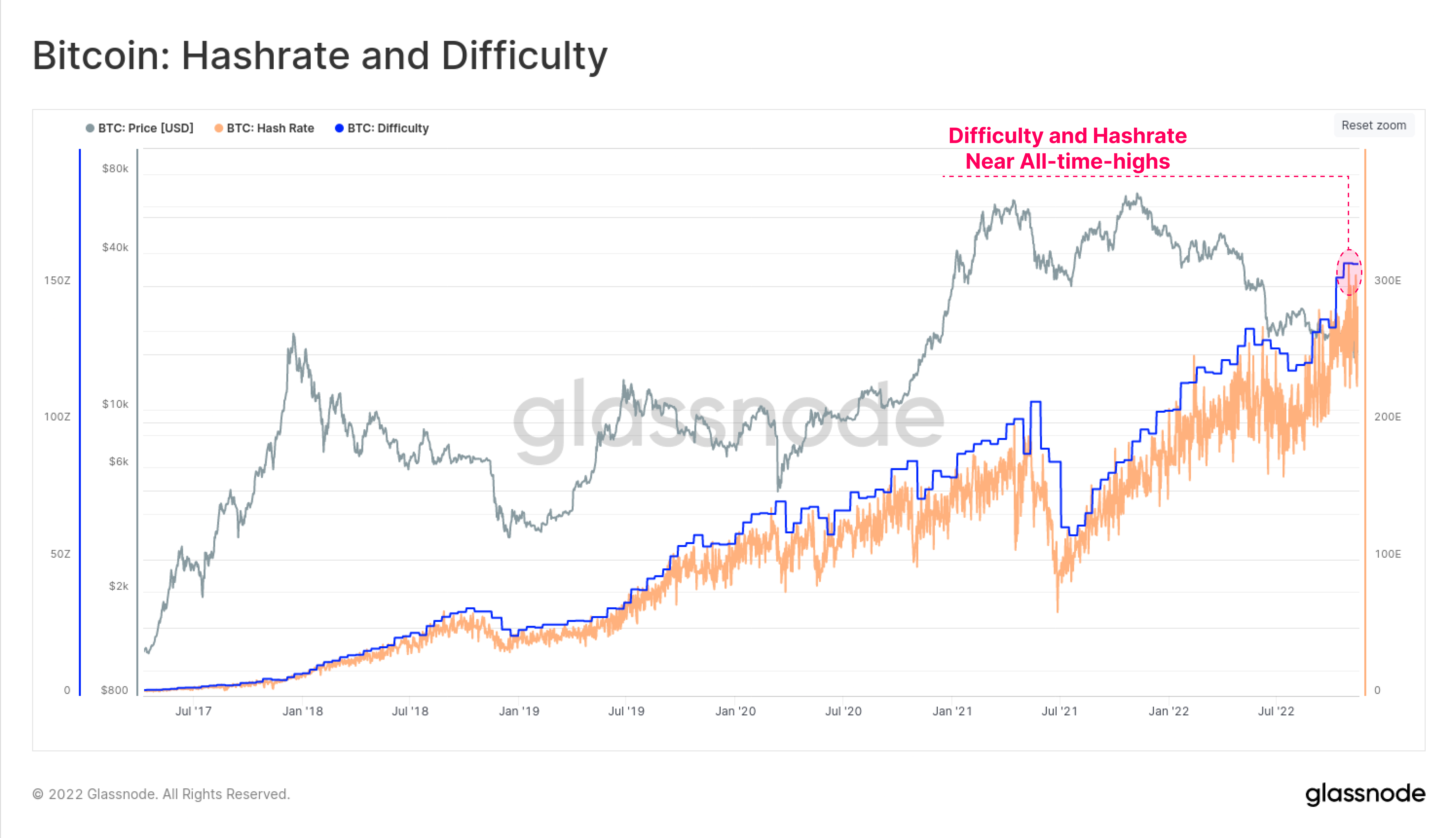

Hashrate does not slow down

Bear markets can be tough on investors, but there is one cohort that is under extreme economic stress. It’s a Bitcoin miner. Not only has the price of coins fallen and credit has shrunk, but the cost of energy going into mining has also risen due to inflation. Moreover, the hashrate continues to hit all-time highs in recent weeks.

This means that the cost of producing bitcoin has risen and at the same time it is being sold at a lower price.

Bitcoin miners are under pressure from all sides. This article focuses on the implicit stress on the industry. The goal is to assess the market risks that may arise in response to this pressure on miners.

In a prolonged bear market, it is common for the cost of Bitcoin production to exceed the spot price. This puts pressure on miner profit margins and forces the most inefficient miners to switch off unprofitable equipment. Every miner needs to sell more of his BTC that he has mined, and may eventually need to invest it in the accumulated treasury.

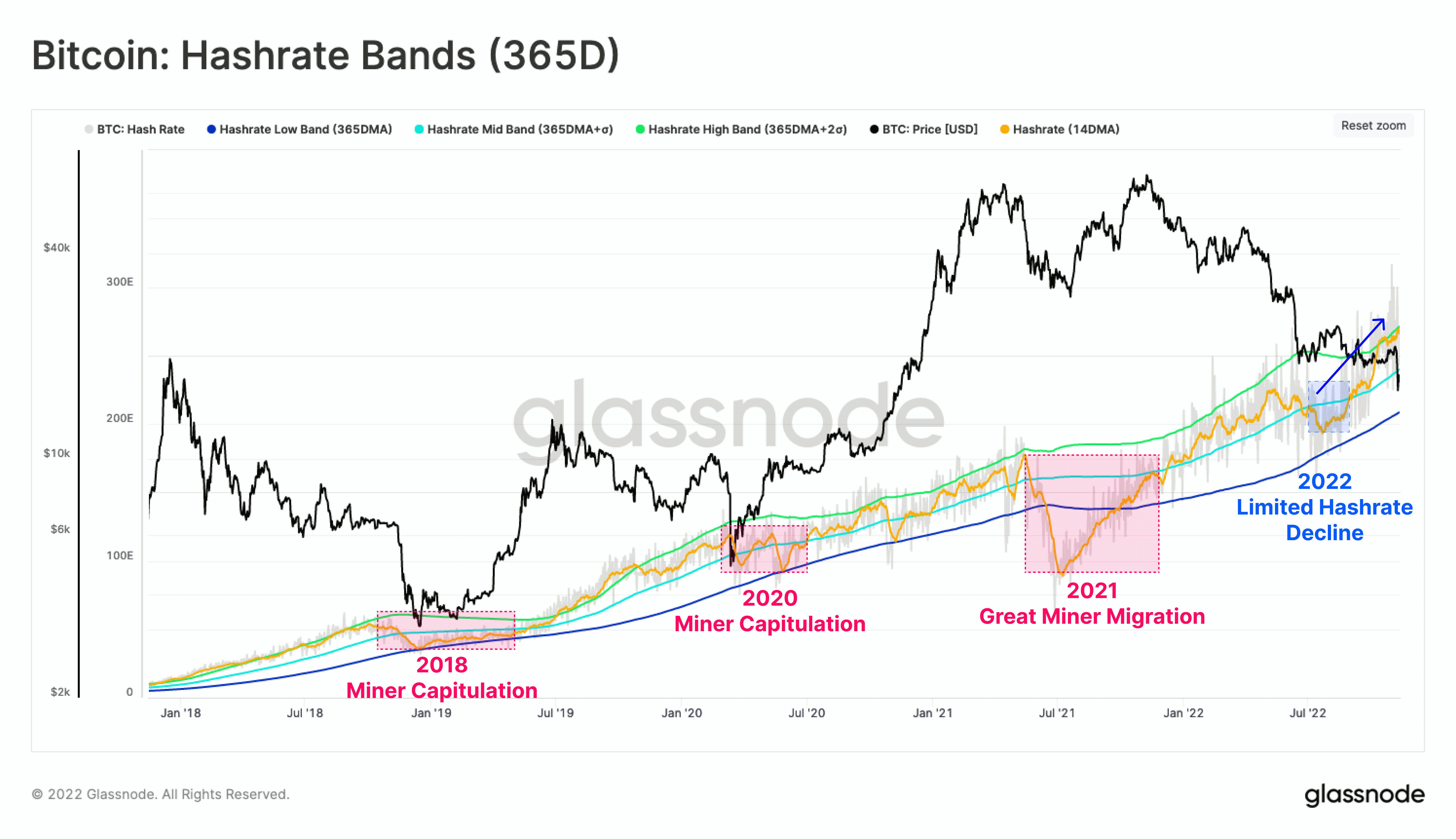

The following metric tracks this periodic behavior by defining two bands derived from hashrate.

- lower band 🔵: 1-year moving average of hashrate.

- upper band 🟢: Hashrate 1-year moving average and 2 standard deviations.

Notice how the hashrate fluctuates between the lower and upper bands over time.

One of the standout phenomena of the 2022 bear market is that the hashrate has not shown a significant decline towards the lows despite continued financial stress on the industry. We will also see a massive miner migration from May to July 2021, when about 52% of China’s hashpower shut down almost overnight.

This steady hashrate growth observed in this bear market could be a fallout from next-generation ASIC chip production and supply chain delays in 2021. Higher costs at already brutish bear market lows.

mining gets expensive

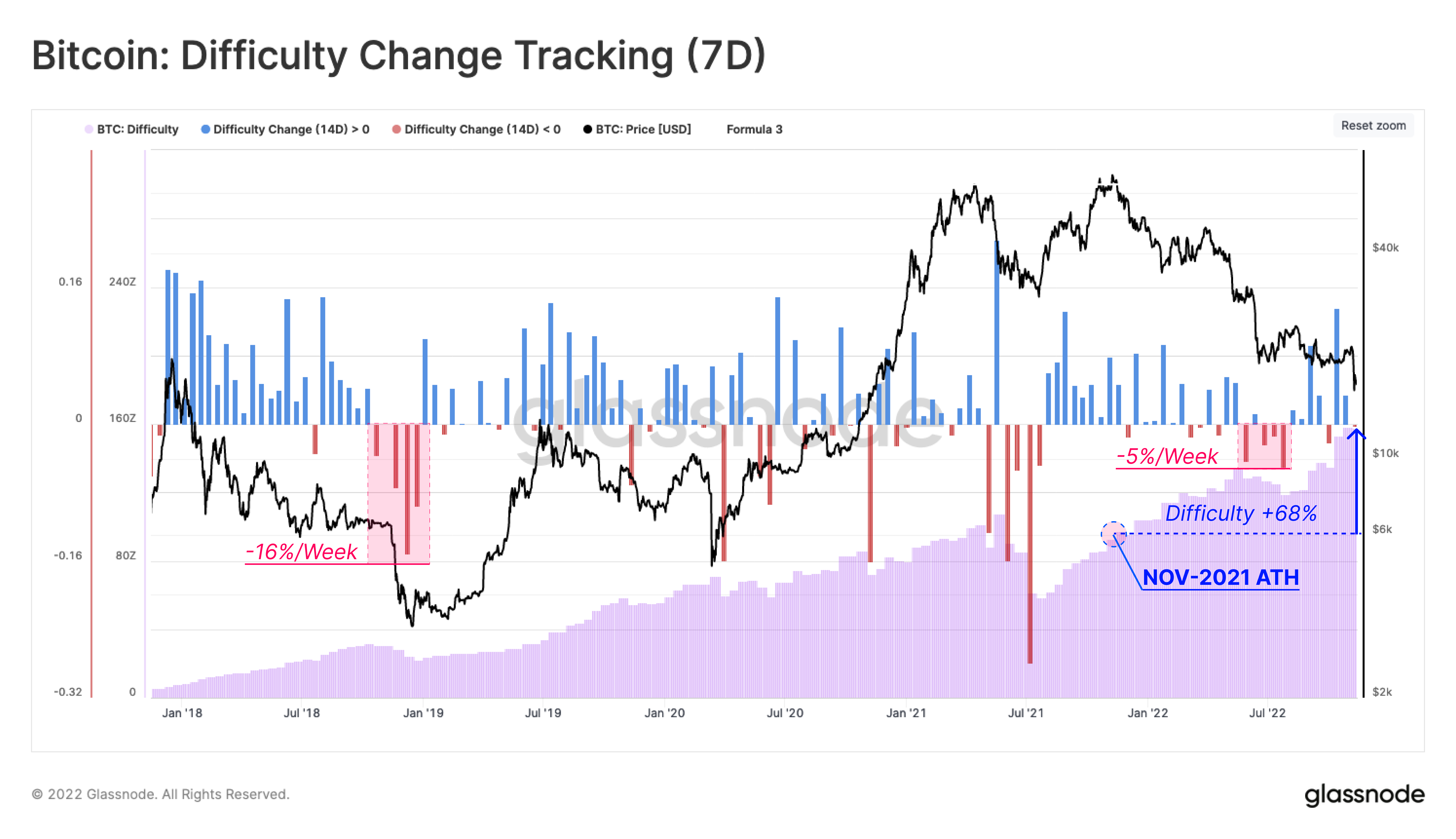

We can see that during the trough formation phase of the 2018-2019 cycle, the difficulty experienced several significant drops of up to -16% per week. This indicates that the miner has gone offline due to financial difficulties.

This pattern does not repeat this cycle. In fact, after a brief interval of slight difficulty drops during LUNA’s surrender, mining difficulty has increased, reaching a level of +68% higher than ATH in November 2021.

This means that BTC-denominated miner revenues have fallen by 68% in the last 12 months, before even factoring in the -76.9% drop in the BTC price.

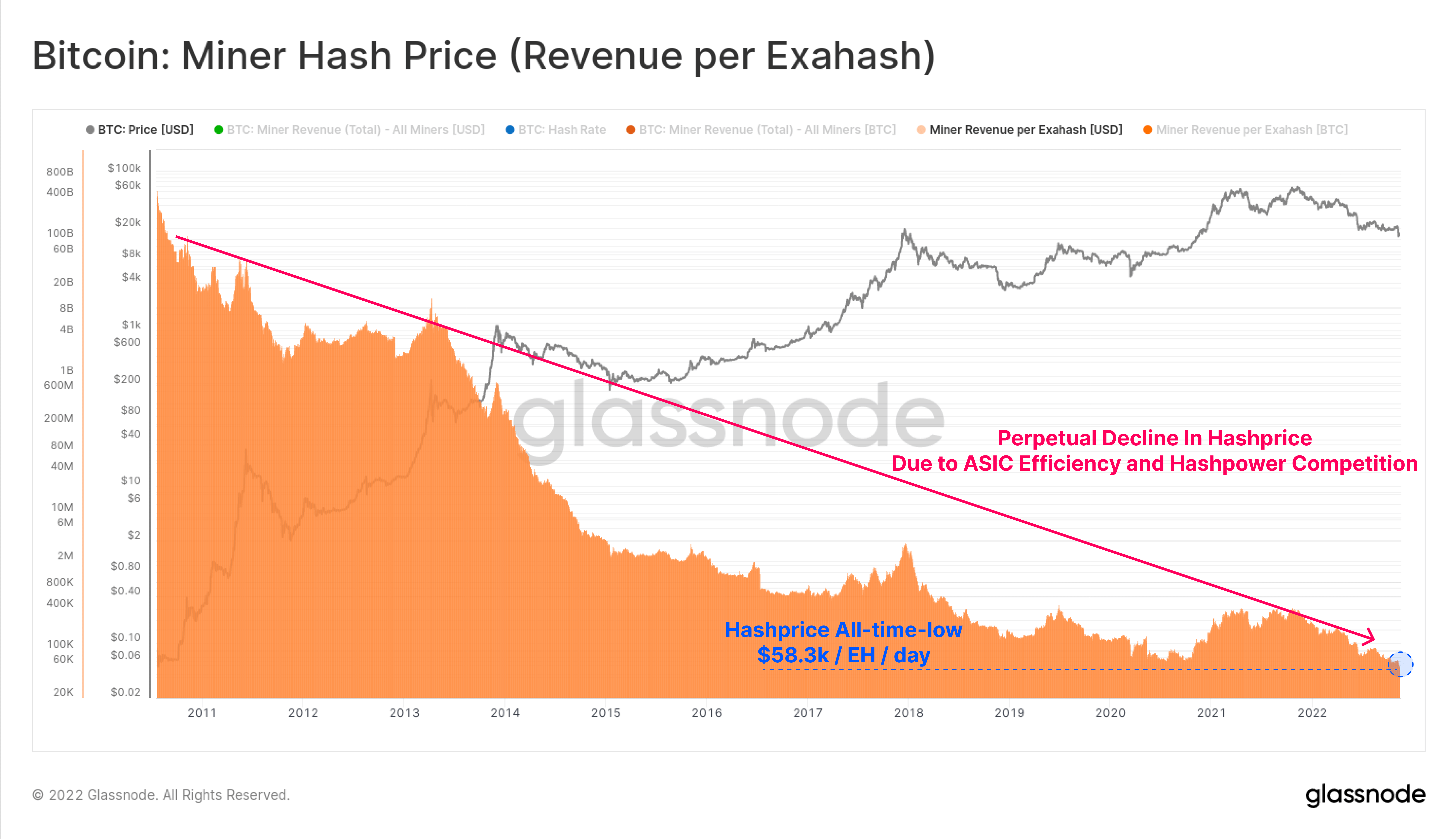

To track your earnings in USD, you can use a metric called Hash Price. This models the revenue earned per Exahash. This is now his lowest ever earnings per Exahash per day at his $58.3 thousand, indicating that mining is the most competitive ever.

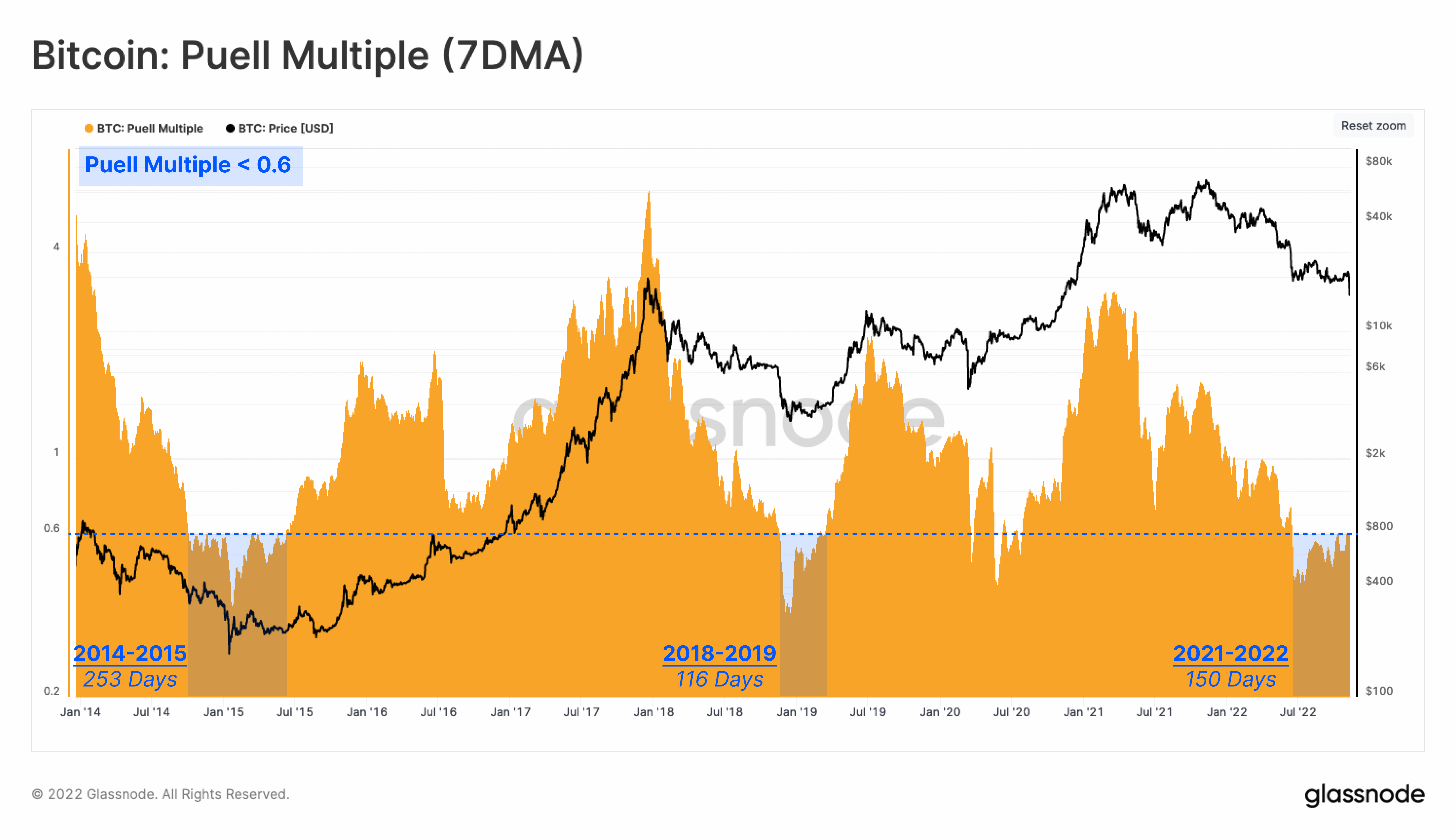

The Puell Multiple is an oscillator that tracks the USD’s minor income relative to the annual average. Bitcoin miners are now seeing a -41% reduction in revenue streams compared to last year.

Mining revenues have been under this extreme stress for the past 150 days, matching previous bear market lows.

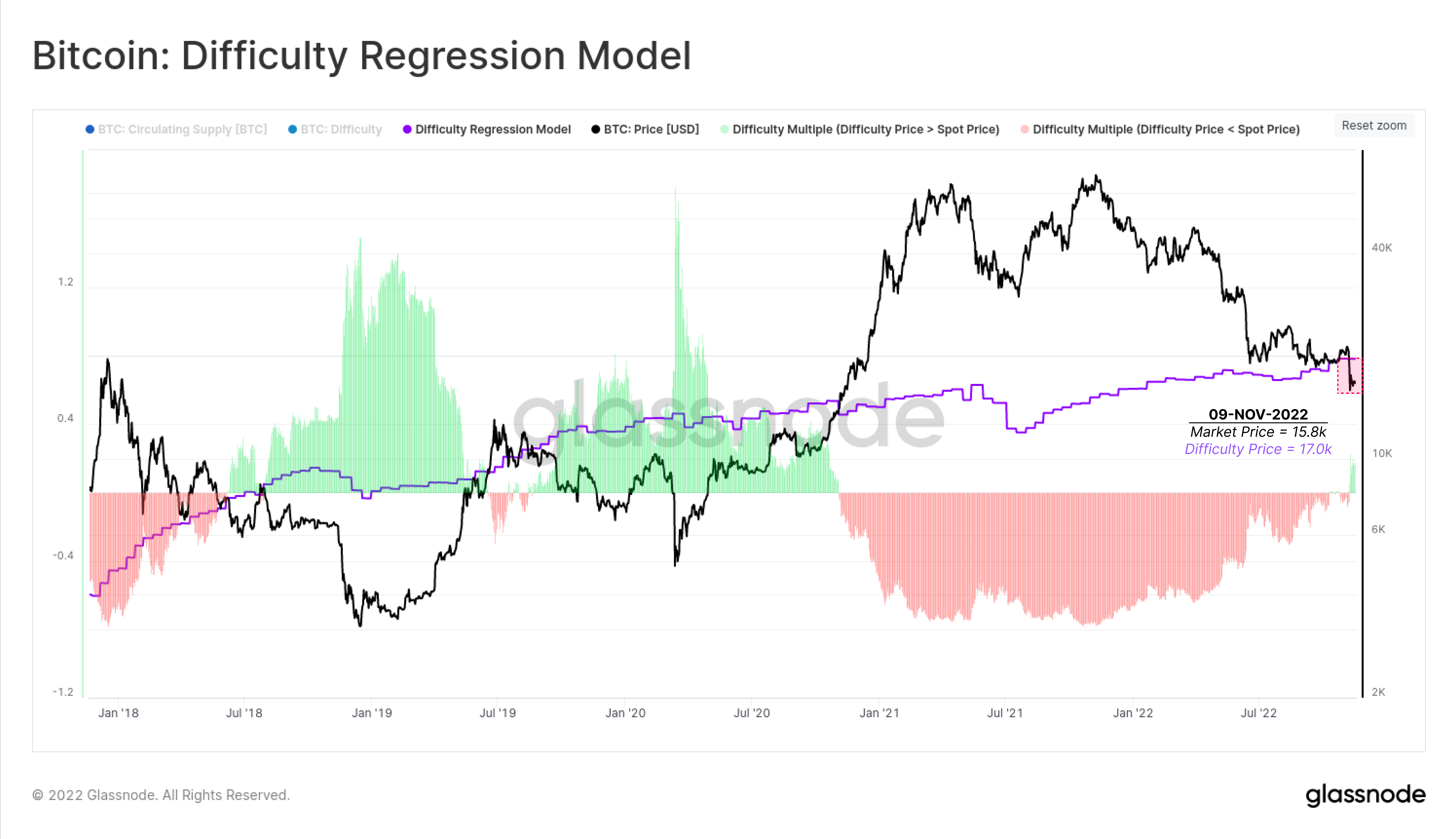

As the difficulty of mining increases, so does the cost of producing BTC. The model below derives the relationship between difficulty and market capitalization to estimate the average production cost per unit of BTC.

This production cost model is currently trading at $17,008, 7% above the spot price. As a result, the average miner is at or above the pain threshold, making it increasingly likely that hashrate will begin to stall or decline in the coming months.

Increased surrender risk

Having seen mining revenues squeezed and production costs high, we are now in a very high risk environment for a minor capitulation event. The next step is to explore the potential market impact if this happens.

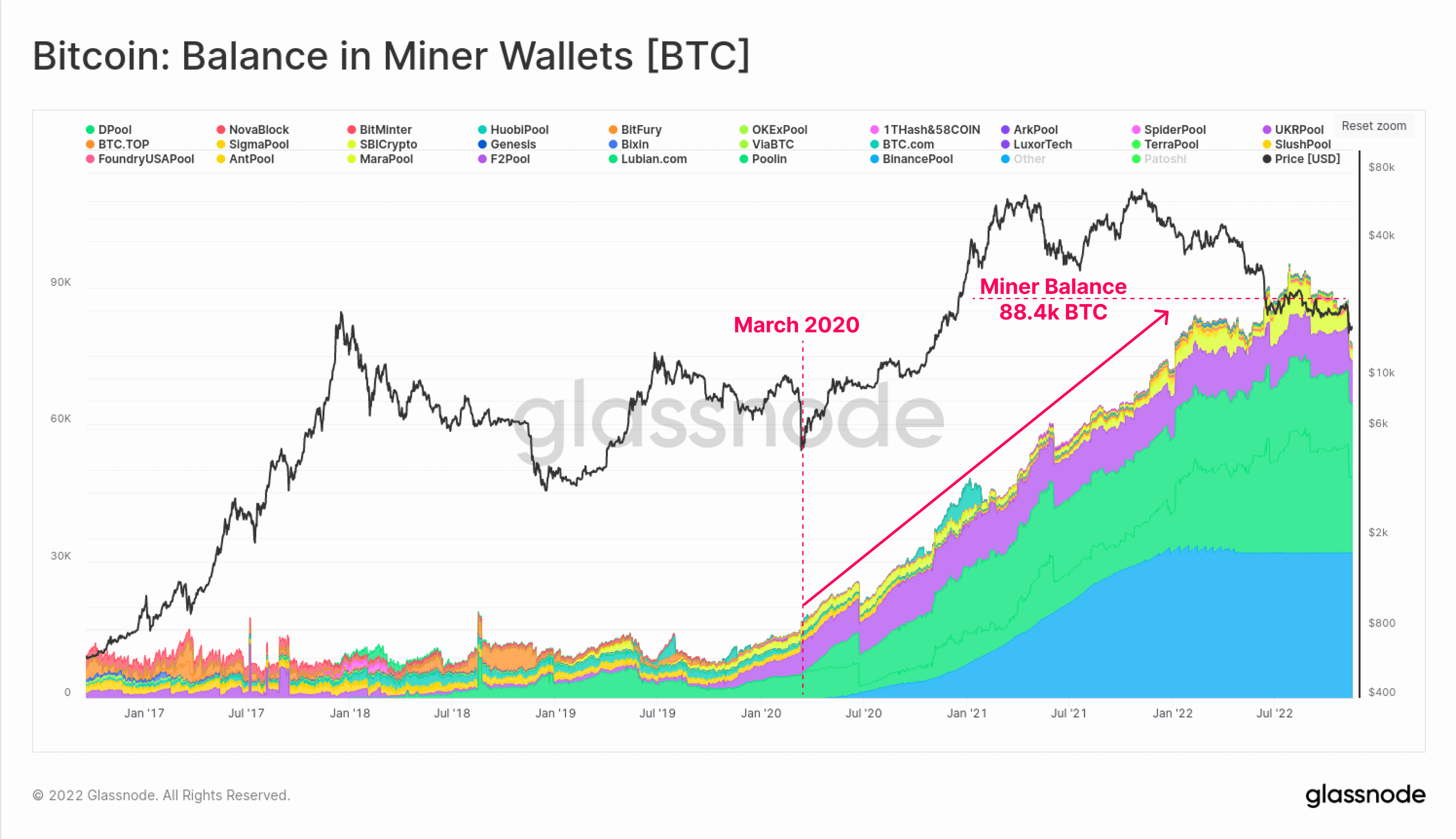

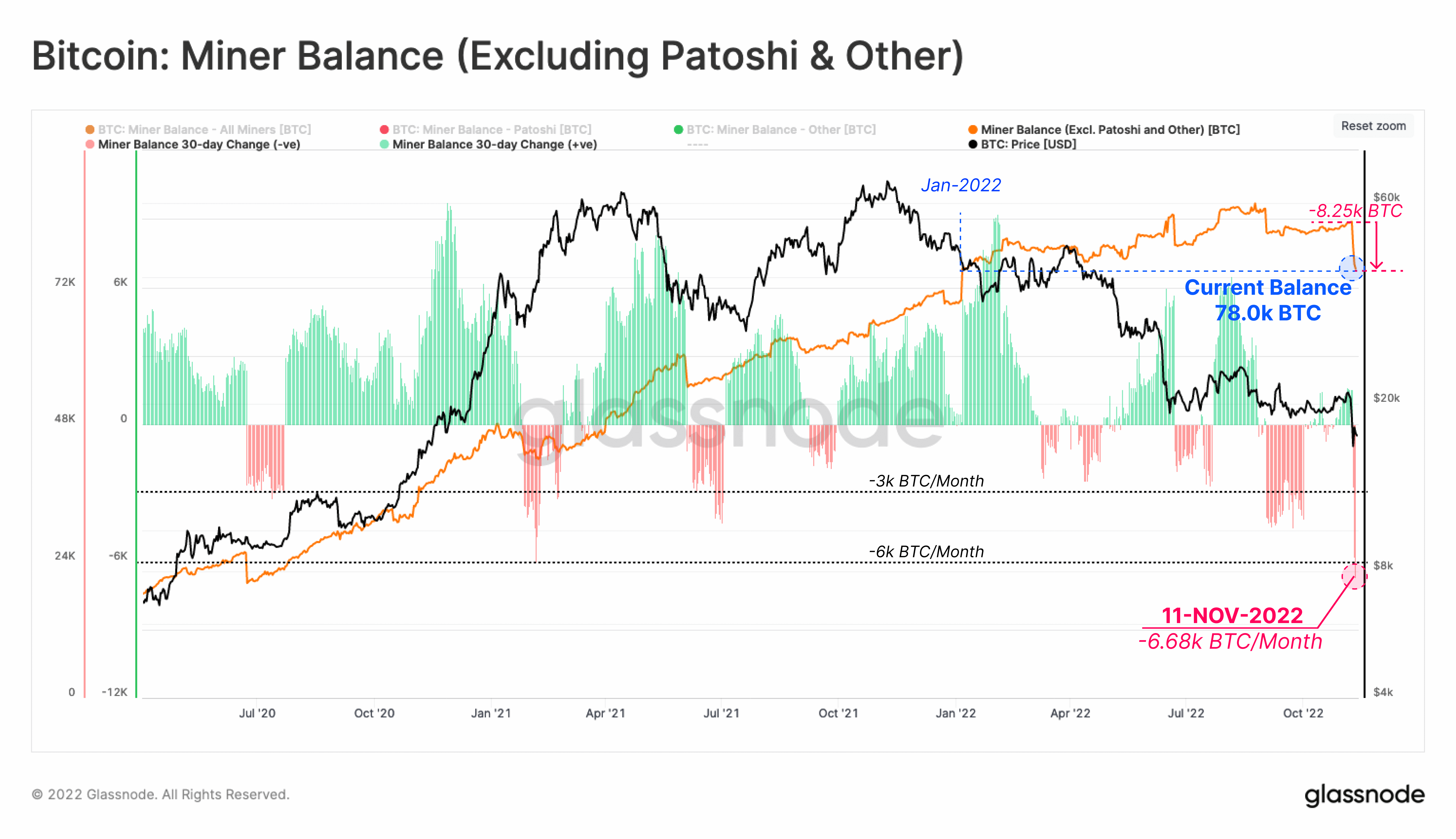

Since the March 2020 crash, miners have been significant accumulators of BTC, accumulating 88.4k BTC in the Treasury as of early November. Note, however, that the balance started to level off at the beginning of 2022. This suggests that early minor stress may have started with his BTC price of $40,000.

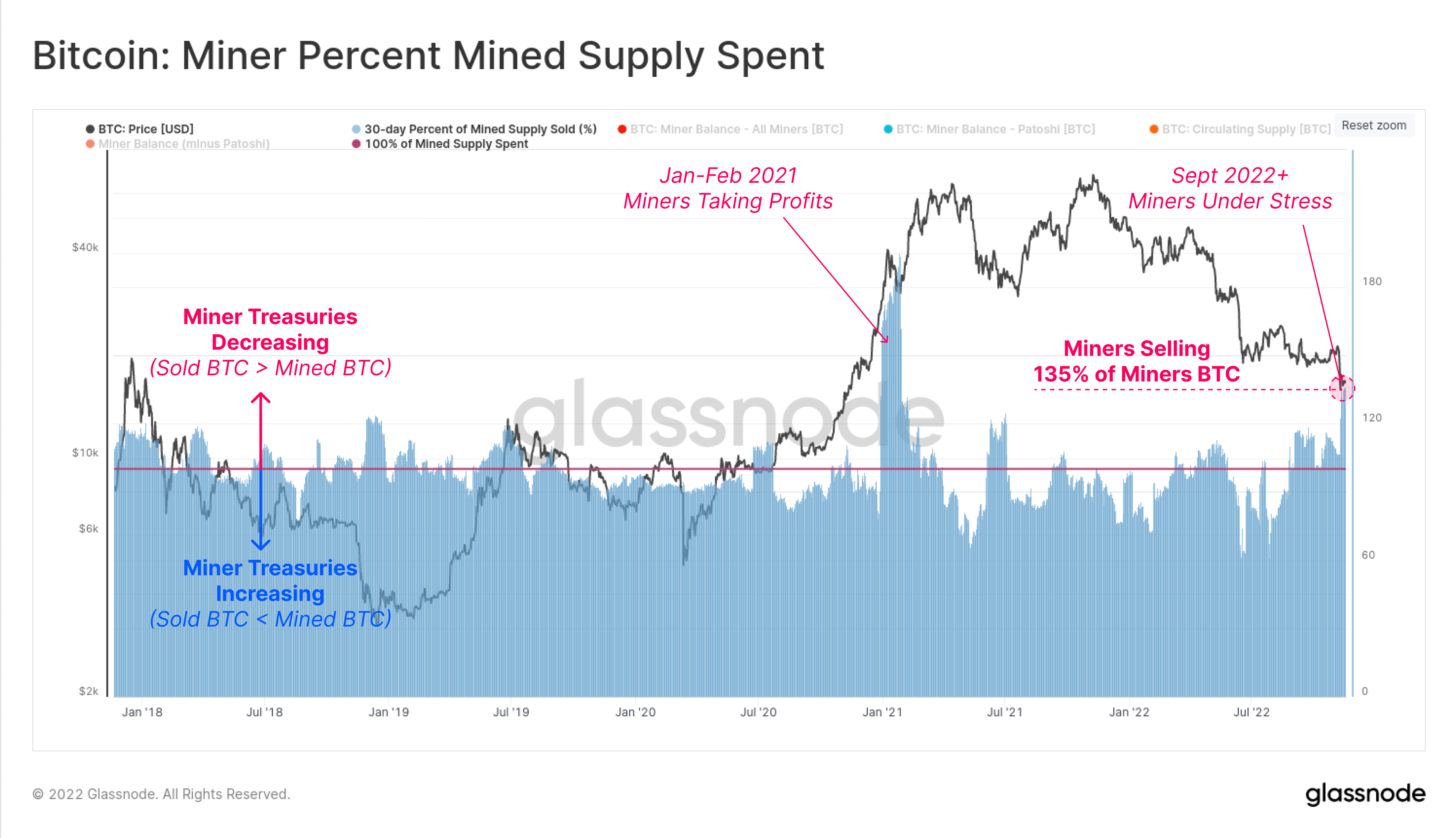

The chart below shows the percentage of daily mining supply being spent by miners, recently reaching 135%. Given that the current block reward is around 900 BTC per day, this means that miners will distribute all 900 newly minted coins in total, at a rate of 315 BTC per day (total 1,215 BTC/day). means depleting the national treasury.

Miners liquidated another 8.25k BTC in the last two weeks as news of the FTX bankruptcy broke this week. This will reduce the current holdings to 78.0k BTC, wiping out all minor balance increases for 2022.

BTC’s price is still below the average production cost of $17.0k, leaving a potential risk of a $1.287 billion oversupply supplied by miners’ treasuries unless the price recovers.

Conclusion

Amid the chaotic events surrounding the FTX bankruptcy, mining is fast becoming another area of market interest. Mining revenue has experienced a significant decline in revenue streams, with production costs up 68% and coin prices down 76% from last year.

Currently, the miner balance is around 78.0k BTC, equivalent to over $1.2 billion at the current BTC price of $16.5k. Not all of these reserves are likely to be distributed, but they do provide a measure of potential risk. Until the price of BTC rises to some extent above the estimated production cost of $17.0k, miners are likely to face severe economic stress and become net distributors of BTC.

This market report was provided by Glassnode

Glassnode brings data intelligence to the blockchain and cryptocurrency space.

learn more