Hut8, Riot, Marathon increase BTC holdings in November after large declines

Mining companies are releasing production rates for November throughout the week. crypto slate Analysts have compiled the numbers and revealed that only Hut8, Riot and Marathon increased their BTC holdings in November.

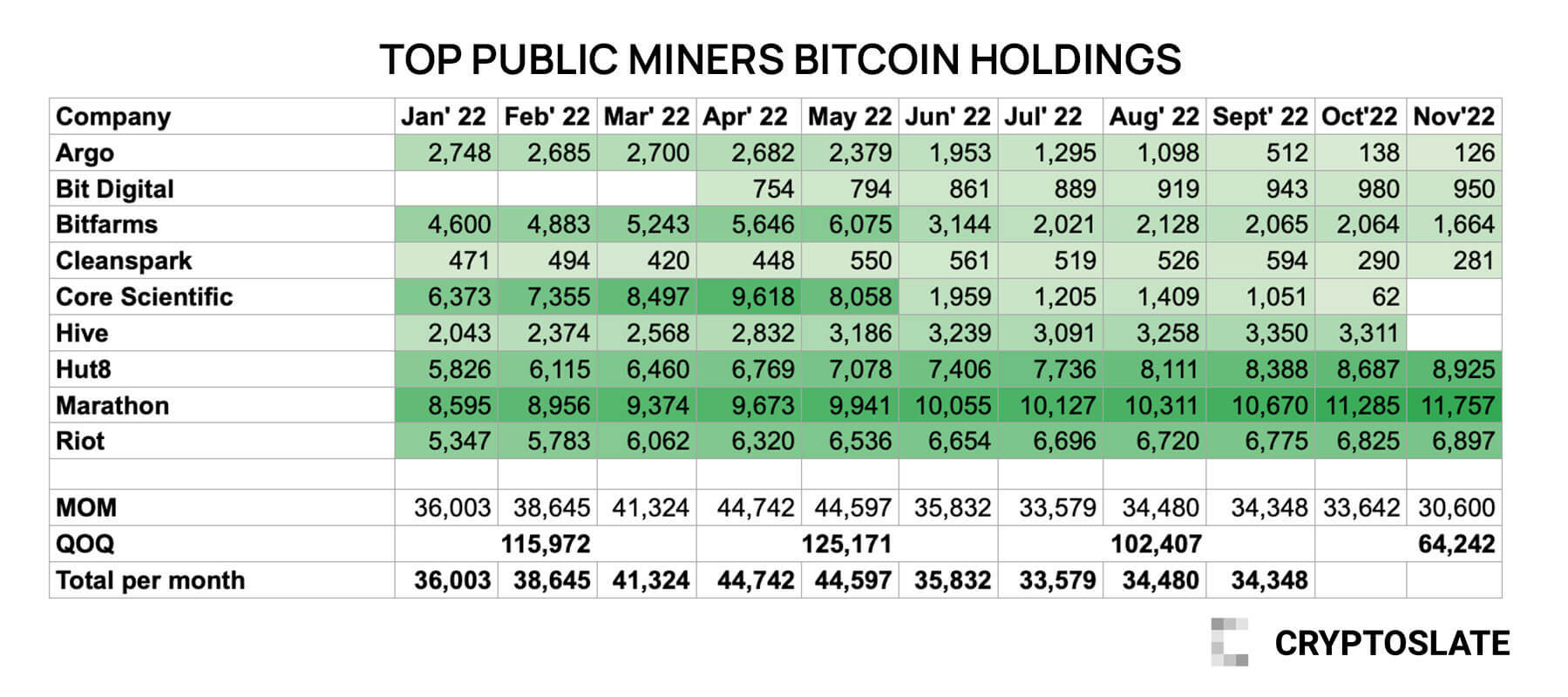

The chart above contains the monthly reserves of the top 9 BTC miners since January 2022. The numbers show that Hut 8, Riot and Marathon added 238, 472 and 72 BTC respectively to their reserves in his November.

Meanwhile, Argo, Bit Digital, Bitfarms, and Cleanspark have shrunk, losing 12, 30, 400, and 9 BTC in the same month.

Meanwhile, Hive release November numbers. Unfortunately, the announcement mentions his 264 BTC in November, but it is unclear if this amount is what he has been mining throughout the month or the size of his BTC reserves as of November. not stated in So, in the chart above, his November data in Hive is left blank.

Growth rate since January

Marathon currently holds the largest BTC pool, while Hut8 has emerged as the fastest growing miner since the beginning of the year.

Hut8 increased its reserves from 5,826 BTC to 8,925 BTC, marking a 53.1% growth since January. Riot recorded his second-largest growth of 28.9% after Hut8, up from 5,347 BTC in January to 6,897 BTC.

Marathon, on the other hand, ranks third in terms of growth. The company grew by 16.7% by increasing its reserves to 11.757 BTC from his 8,595 BTC in January.

Argo and Core Scientific Announce Bankruptcy

Core Scientific claims first place on the list when it comes to the most depleted reserves.

Core Scientific shrunk from 6,373 BTC in January to 62 BTC in October. This represents a 99% drop in reserves, and the company has not released his November figure. On October 26th, Core Scientific had 24 BTC and about $26.6 million in cash. On November 23, the company released its quarterly report, acknowledging that it may not be ready until the end of the year.

Argo was the second mining company to see the biggest drop in its bitcoin holdings, after Core Scientific. Argo recorded a drop of 95.4% in his 11 months from 2,748 BTC to 126 BTC. In addition, the company has revealed that it is facing liquidity problems after failing to secure a $27 million strategic investment that was supposed to provide liquidity. said it would sell 15% of its shares to private investors.

Bitfarms has lost more than half of its BTC reserves since January, ranking third on the list. The company recorded a 63.8% drop in 11 months, dropping from 4,600 BTC to 1,664 BTC. Finally, Cleanspark disclosed his November count as 281 BTC, down from 471 BTC in January, down 40.3%.