IMF warns of more crypto pain ahead, including stablecoin failures

Director, Monetary and Capital Markets Department, International Monetary Fund (IMF), Tobias Adrianwarned that more crypto projects, especially stablecoins, could fail.

Comments made on the unwelcome news as investors are still green from Terra’s implosion and subsequent liquidity drain, and hold out hope that the worst is over.

In an interview with Yahoo Finance, Adrian said he expects cryptocurrencies and other risky assets to face more selling pressure if a recession hits, giving way to more pain.

Cryptocurrency stablecoin in the spotlight

Expanding on that, the IMF director said that the “coin offering” could fail due to the fallout from the recession, noting that algorithmic stablecoins are particularly vulnerable.

“Some coin offerings may fail further, especially some of the hardest-hit algorithmic stablecoins, some of which may fail.”

Algorithmic stablecoins achieve price stability through an automated process that issues tokens when the price rises above the peg and burns tokens when the price falls below the peg.

Important algorithmic stablecoins currently in operation are Tron’s USDD, Near Protocol’s USDN, and Ethereum’s Frax, which is partly collateralized.

However, according to Adrian, collateralized stablecoin offerings are also at risk. In particular, Tether, as Adrian puts it, is vulnerable “because it’s not 1:1 supported.”

“”[Some fiat-backed stablecoins] It is indeed a vulnerability that some stablecoins are not fully backed by assets like cash. “

Tether has been ordered by the New York State Attorney General to file mandatory quarterly reports on its reserve assets. February 2021Subsequent reports indicated that the reserve consisted of material illiquid assets such as “commercial paper,” raising questions about the company’s ability to meet its obligations.

Since then, Tether has reduced its commercial paper holdings by $5 billion to $3.5 billion.

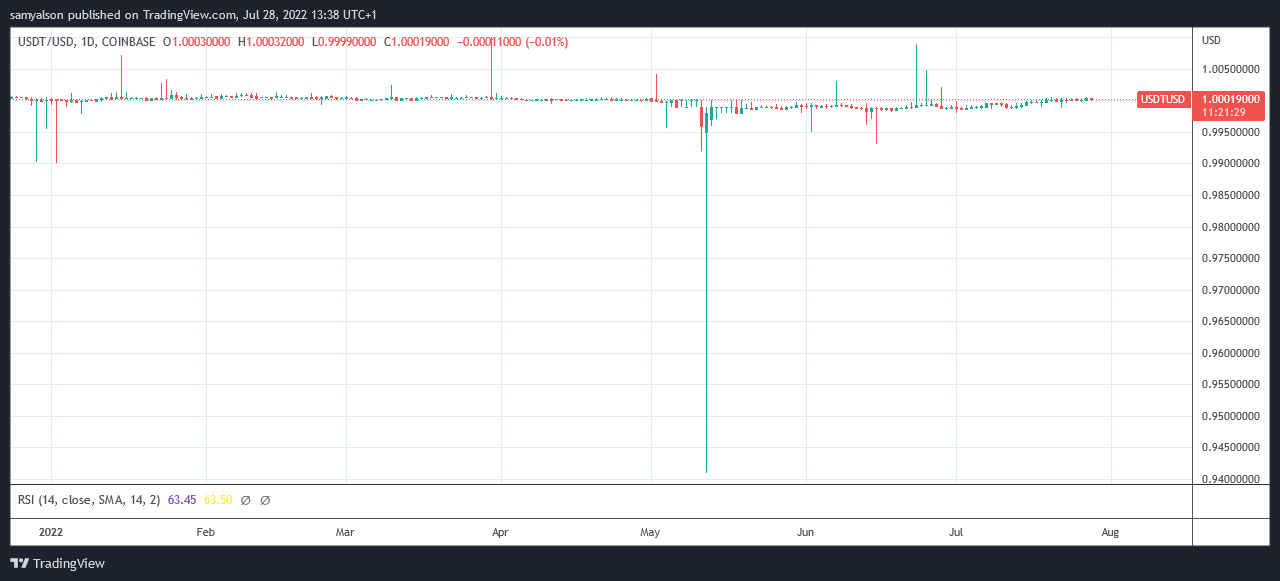

Tether fell well below the $1 price peg during Terra’s collapse, dropping to $0.94. At the time, his CTO of Bitfinex, Paolo Ardoino, said that the peg would be pegged because holders could always redeem it for face value directly from the company at any time. I downplayed the importance of the price drop by stating it wasn’t broken.

what recession?

Previously, a recession was defined as two consecutive quarters of negative GDP growth. However, policymakers have redefined the term as “a holistic view of data that includes the labor market, consumer and business spending, industrial production and income.”

The move was widely derided as an incredulous play by the current US administration.political commentator Glenbeck Called it a weak ploy to win a losing argument while bringing in many other political hot potatoes.

Under Biden alone, the Left sought to redefine women, fetuses, domestic terrorists, riots, voter suppression, illegal aliens, anti-police, and the current recession. What a strategy! If you lose the argument, just change the dictionary!

— Glenn Beck (@glennbeck) July 27, 2022

On July 28, the Bureau of Economic Analysis reported that second-quarter U.S. GDP was 0.9%indicating two consecutive quarters of recession.

Despite the current administration’s denial of a recession, crypto investors would be wise to heed Adrian’s words.