Is Coinbase stock undervalued? Analysts divided

As the crypto industry suffers from a record bear market, one asset that has polarized analysts is Coinbase stock, which has fallen to new lows.

Bitwise Invest Chief Investment Officer Matt Hougan I think Coinbase stock price is undervalued despite a significant drop in 2022.

According to Hougan, Coinbase raised money in 2018 at an $8 billion valuation. At the time, he had 22 million users, generated $520 million in revenue, and had $11 billion in assets on the platform.

Going back to 2022, it has $3.3 billion in revenue, 101 million users, and $101 billion in platform assets today. Despite these clear signs of growth, the company is valued at $9 billion.

Coinbase inventory is at an all-time low

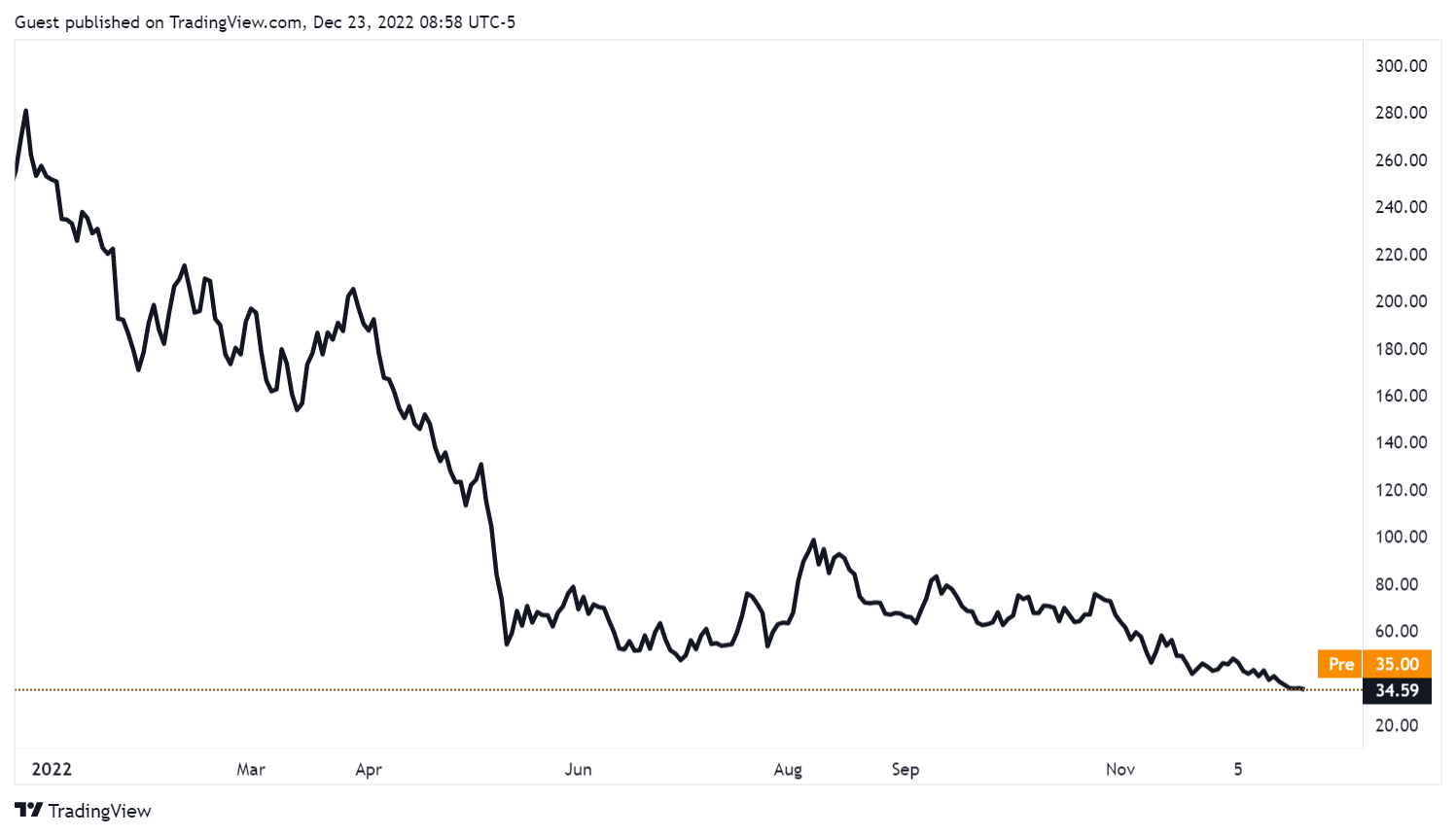

Coinbase’s stock price has fallen since the beginning of the year, trading at around $35 at the time of writing. This represents a year-to-date decline of more than 86%.

As stock prices fell, the market cap of the exchange dropped to about $8 billion, but even Dogecoin’s market cap exceeded $10 billion. While this does not reflect the intrinsic value of the exchange, it does show how current market conditions have affected the exchange.

Analysts have linked the stock price decline to several factors, including the current crypto winter and the fact that exchanges are running out of cash at a record pace. In his first three quarters of 2022, the exchange posted his loss of over $2 billion.

Coinbase’s main source of revenue is transaction fees, and the current market is impacting that. They have more customers, but their trading fees are lower because crypto assets are declining in value. Rivals like Binance.US are also trying to entice traders with new features such as: zero transaction fees For assets such as Bitcoin (BTC).

CEO Brian Armstrong Said Bloomberg expects the exchange’s revenue to drop by up to 50% this year.

industry perspective

Some believe that Coinbase is overrated. They cite cash burn, lack of significant improvement over the years, and employee stock compensation. Several market analysts lowered the stock price. Mizuho Recent Downgraded Underperform with a price target of $30.

Prior to that, Bank of America Downgraded Buy to Neutral shares with a price target of $50. The exchange is nothing like FTX, but noted that a significant drop in Bitcoin’s value would affect its shares.

Many in the cryptocurrency community also share this view, noting that Coinbase was overvalued in 2018. murmured E*Trade sold at 2.5% of assets under management, while JP Morgan is valued at about 10% of AUM.

Wolf added that he was a Series C investor in the exchange and sold all its shares last year for $340.

bullish view continues

On the other hand, some analysts share pessimism, while others share Hougan’s view.

21.co CEO Honey Rashwan expressed The belief that Coinbase stock is undervalued. According to him, Coinbase has suffered heavy losses this year, but its fiat market share has doubled since September.

Rashwan said that anyone who believes in the long-term potential of cryptocurrencies and appreciates Coinbase’s recent growth rate and market share would see a year or two of market slump as an exception. he added:

“They’re losing a lot of money, yes. They should obviously cut these losses, but I see a fundamentally good business underlying.”

Coinbase CEO Brian Armstrong, on the other hand, claims that the company will be around for the next 20 years and believes investors should buy COIN shares the same way they buy crypto assets.Armstrong Said:

“We will also benefit from increased regulation and diversification of revenue streams away from transaction fees.”