Justin Sun sets up $100M Huobi liquidity fund following HT flash crash

Huobi launched a $100 million liquidity fund after the exchange’s Huobi Token (HT) flash crashed by 90% on March 9.

Exchange Global Advisor Justin Sun Confirmed The development adds that the funds have been transferred to the exchange.

HT has not yet fully recovered from the flash crash.according to of crypto slate Data shows that the token is down 21% and is trading in $.3.80 at time of writing.

Why Huobi Establishes 100 Million Liquidity Fund

According to Sun, HT’s sudden collapse was caused by “a small number of users”, triggering a series of forced liquidations in the spot and HT contract markets.but he Added that these fluctuations are simply the result of market behavior.

Kaiko Data Researcher Riyad Carey Said HT Token had about $2 million worth of sell orders against $600,000 buy orders five minutes before the crash. Additionally, the broader crypto market saw a massive sell-off during the same period, liquidating over $300 million in long positions.

Sun said Huobi will improve multi-currency liquidity by establishing a $100 million liquidity fund to forestall future recurrences. he added:

“We will continue to improve the liquidity depth of major cryptocurrencies and HT tokens, and enhance our leverage risk warning and liquidity features.”

On the other hand, the founder of Tron said that Huobi “Bear any position losses due to all leverage on the platform [that] resulting from this market volatility event of HT”

Outflow of funds from Huobi

According to CryptoQuant data, Huobi’s reserves fell by $72.4 million in the last 24 hours.

CryptoQuant data Indicated The exchange saw an outflow of $33.1 million in Bitcoin (BTC), $10.3 million in Ethereum (ETH), $13.9 million in other altcoins, and $14.8 million in stablecoins.

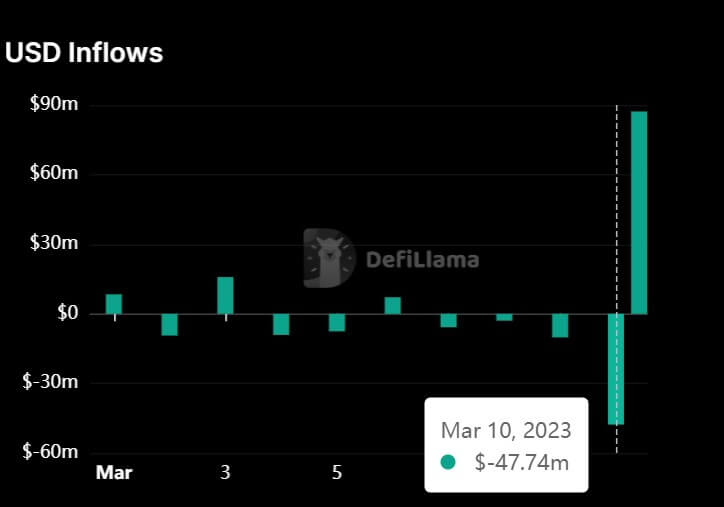

Defilama data It confirmed that Huobi confirmed the leak during the reporting period. He had $47.74 million in outflows from the exchange, according to data aggregators.

Meanwhile, the exchange received $87.22 million in inflows, with a $100 million liquidity fund having a major impact.

Nansen data Indicated Huobi holds $2.8 billion in digital assets. The exchange’s native token accounts for his 26.61% of reserves, while his TRX on Tron accounts for around 20%.