Massachusetts bill for special blockchain commission to assess government usage

Two bills related to cryptocurrencies were introduced in the Massachusetts House of Representatives on January 19th.

Given the recent publicity received by the collapse of FTX, it’s no surprise that authorities are looking to tighten up consumer protections. The creation of a “special commission” on blockchain could be a bullish indicator for Massachusetts, provided the commission receives enough information for analysis.

special committee

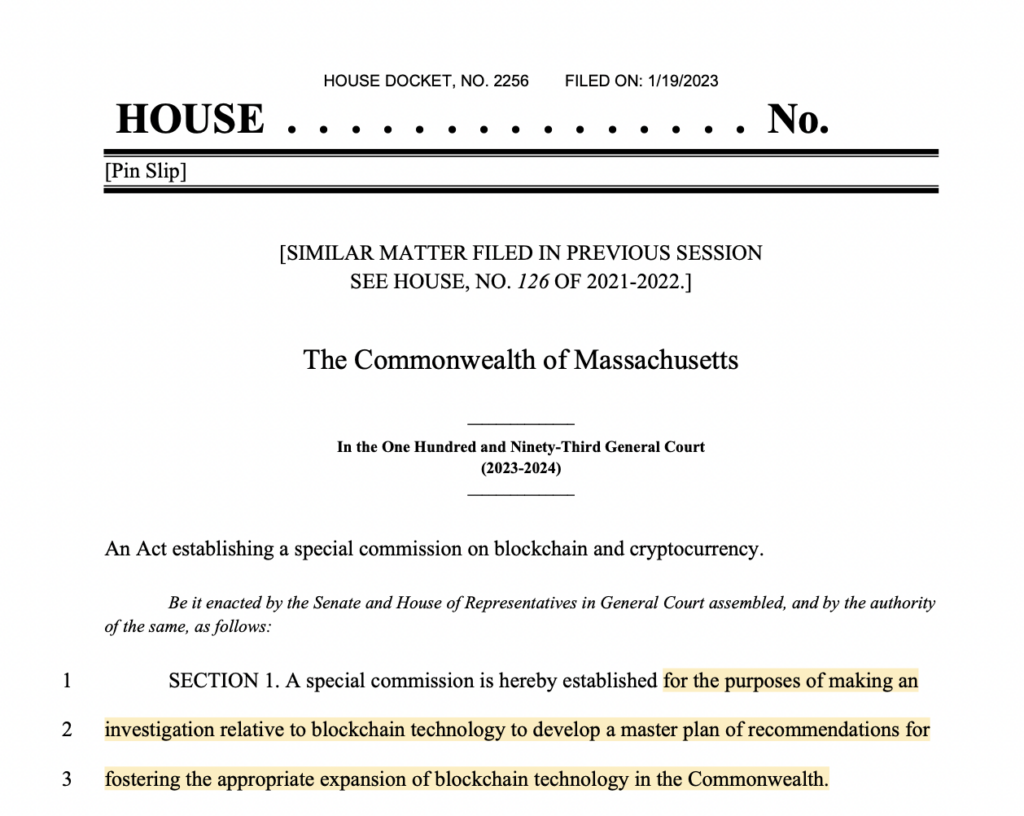

Massachusetts Representatives Josh S. Cutler and Kate Ripper Garabedian introduced a bill titled “Acts Establishing a Special Committee on Blockchain and Cryptocurrencies” on January 19, to enter the Massachusetts Legislature. Established a steering group to study blockchain technology.

“For the purpose of conducting research related to blockchain technology in order to develop a master plan of recommendations to facilitate the appropriate expansion of blockchain technology in the Commonwealth.”

The committee is expected to have 25 members, including the Speaker of the House, the Minority Leader and the Speaker of the Senate, suggesting the committee would be taken seriously if passed.

The Commission is designed to focus on several key areas

- the feasibility, effectiveness, acceptability, and risks associated with using blockchain technology for governmental use within Massachusetts;

- Is the definition of blockchain sufficient in terms of enforceable law?

- The potential impact on Massachusetts digital assets and cryptocurrency revenues.

- Availability of government and corporate advice, with a focus on cannabis retailers.

- How should energy consumption be regulated?

- Additional consumer protection needed for crypto retail users.

- “Best Practices for Blockchain Technology to Benefit the Commonwealth.”

- A state entity responsible for enforcing blockchain regulations.

- Other blockchain-related topics proposed by the committee.

“The Commission should draw on a wide range of stakeholders with diverse interests affected by emerging technologies, privacy, business, finance, courts, the legal community, and state policies governing state and local government. Hmm.”

According to the bill, the commission aims to “promote a positive blockchain technology environment” and will report its findings within a year of its approval.

consumer protection

A further bill was titled “Law to Protect Consumers of Virtual Currency Exchanges”. The bill was introduced by Rep. Susan L. Moran to “protect” consumers involved in cryptocurrency exchanges.

The bill targets companies that offer cryptocurrency trading or conversion in Massachusetts or with customers in Massachusetts.

However, given the specific wording of the bill, the new rules do not apply to decentralized exchanges (DEXs) within Massachusetts. The bill describes a Massachusetts customer as “a person who uses a virtual currency exchange service and whose information on record or available to that exchange service indicates a Massachusetts home address.”

Therefore, sites that can operate within the United States without KYC requirements will not be affected.

A key aspect of the bill is that it requires cryptocurrency exchanges operating in Massachusetts to pay the state an annual “registration fee” of 5% of their gross revenue.

Additionally, companies must retain advertising materials used to promote crypto for a minimum of seven years. All marketing must also include the legal name of the business and confirmation of registration to operate a cryptocurrency business.

To combat incidents such as the recurring collapse of FTX, the bill would also require companies to “clearly and conspicuously disclose in writing all material risks to persons associated with any particular cryptocurrency business activity in which they are involved.” I am asking companies to

Virtual Currency Insurance Fund

The bill also introduced the concept of a cryptocurrency insurance fund to protect customers from fraud. The insurance pool will be funded through payments related to violations of the newly proposed regulations. Fines of up to $5,000 per violation apply.

Customers can receive subsidies from the Fund if they have crypto assets held on an exchange that “cannot meet any financial obligations to any of its customers.”