Metrics indicate bullish sentiment as illiquid Bitcoin supply reaches 80%

crypto slate An analysis of the Bitcoin (BTC) indicator reveals that the market may have hit a bottom as investors continue to accumulate BTC, pushing the illiquid supply up to 80%.

Analysts have reviewed the indicators, including the MVRV-Z and realized price indicators, and found that both point to bullish sentiment.

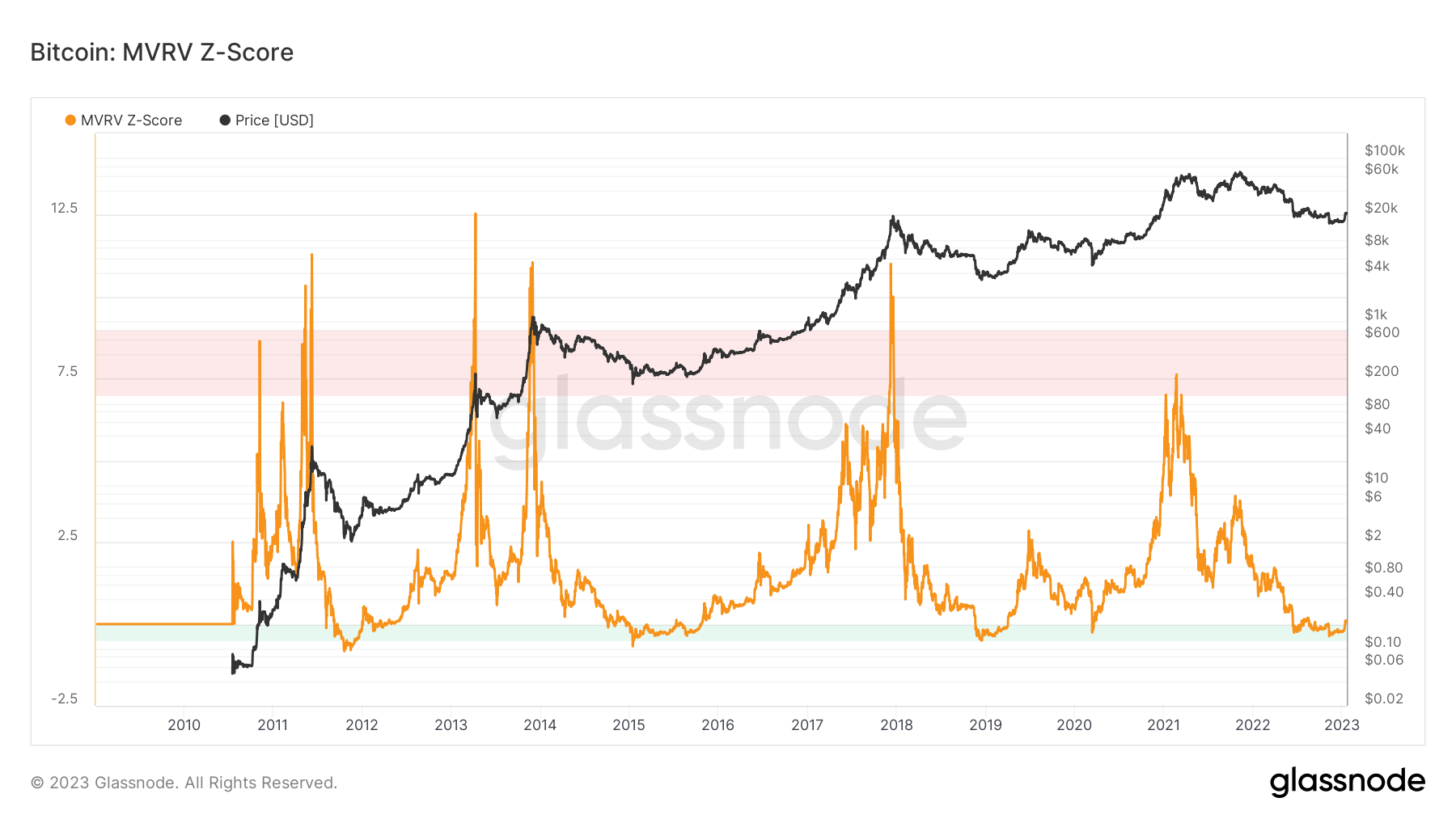

MVRV-Z metric

MVRV-Z score is used to assess whether BTC is overvalued or undervalued. If the market value is significantly higher than BTC’s “fair value”, the indicator stays in the red zone. On the other hand, if the price is lower than BTC’s realized value, the indicator stays in the green area. The chart below depicts the MVRV-Z indicator with the orange line.

The indicator entered the green zone in mid-2022, immediately after the collapse of LUNA, and has remained within the green zone since then. A very recent breakthrough may indicate that the market has reached a bottom.

Historically, the price of Bitcoin dropped significantly whenever the MVRV-Z indicator hit the red zone. According to the chart, this correlation has appeared six times since 2010. Therefore, we can conclude that if the MVRV-Z metric is in the red zone, it indicates the top of the market.

Similarly, historical evidence also shows that the price of Bitcoin rose after the metric reached the green zone, indicating a market bottom.Early 2012, 2015, 2019, 2020 The price movements recorded in the year correspond to the bottom of the market.

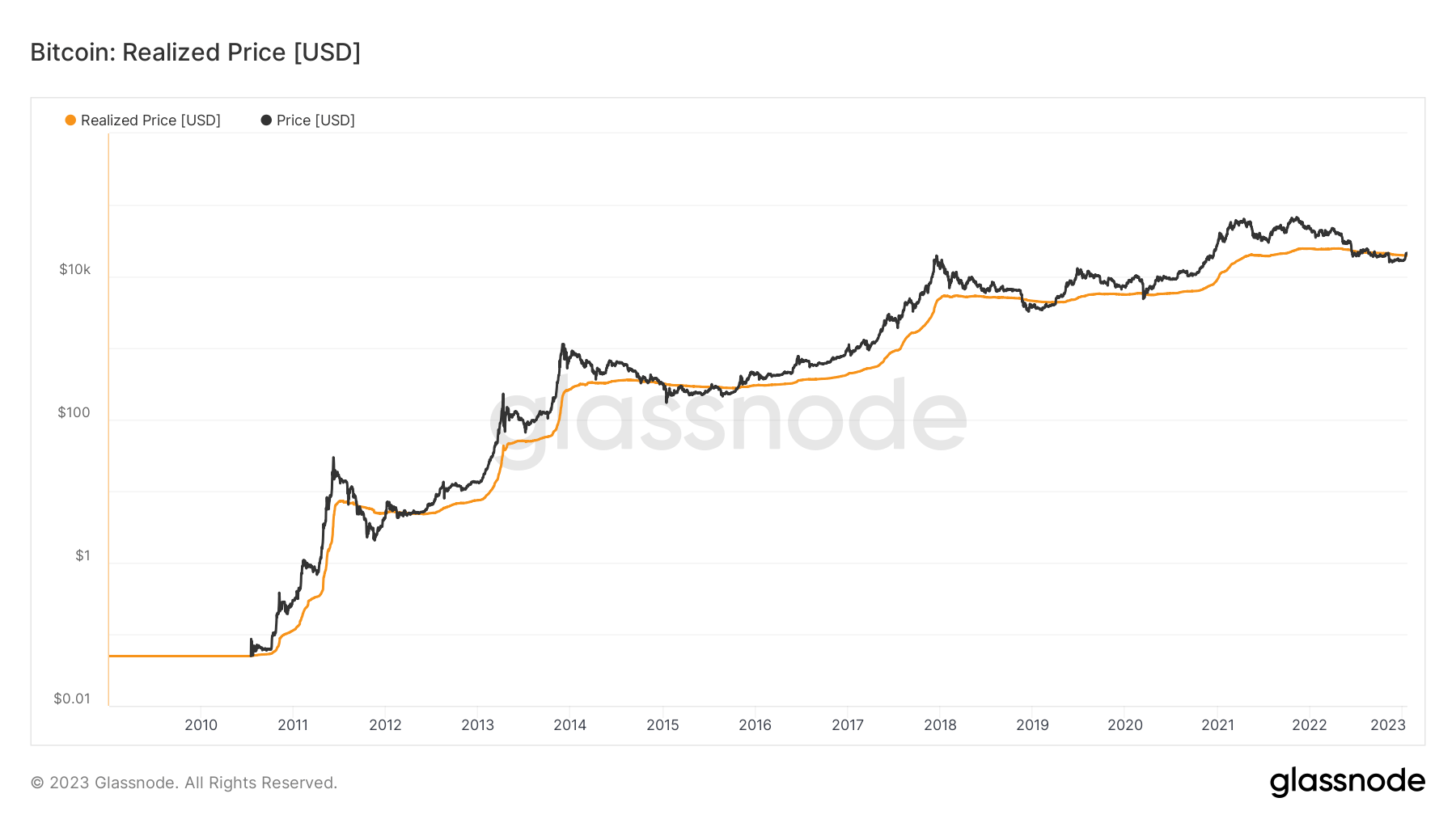

BTC realization price

The realized price is calculated by dividing the realized cap by the current supply. This indicator shows a bear market when the actual price falls below the realized price. Conversely, when the real price is above the realized price, it indicates a bull market.

The chart above shows the relationship between BTC realized price and actual price since 2010. His actual BTC price has been below the realized price since mid-2022. However, this balance has changed quite recently as the actual price exceeded the realized price. This shows the bull market sentiment.

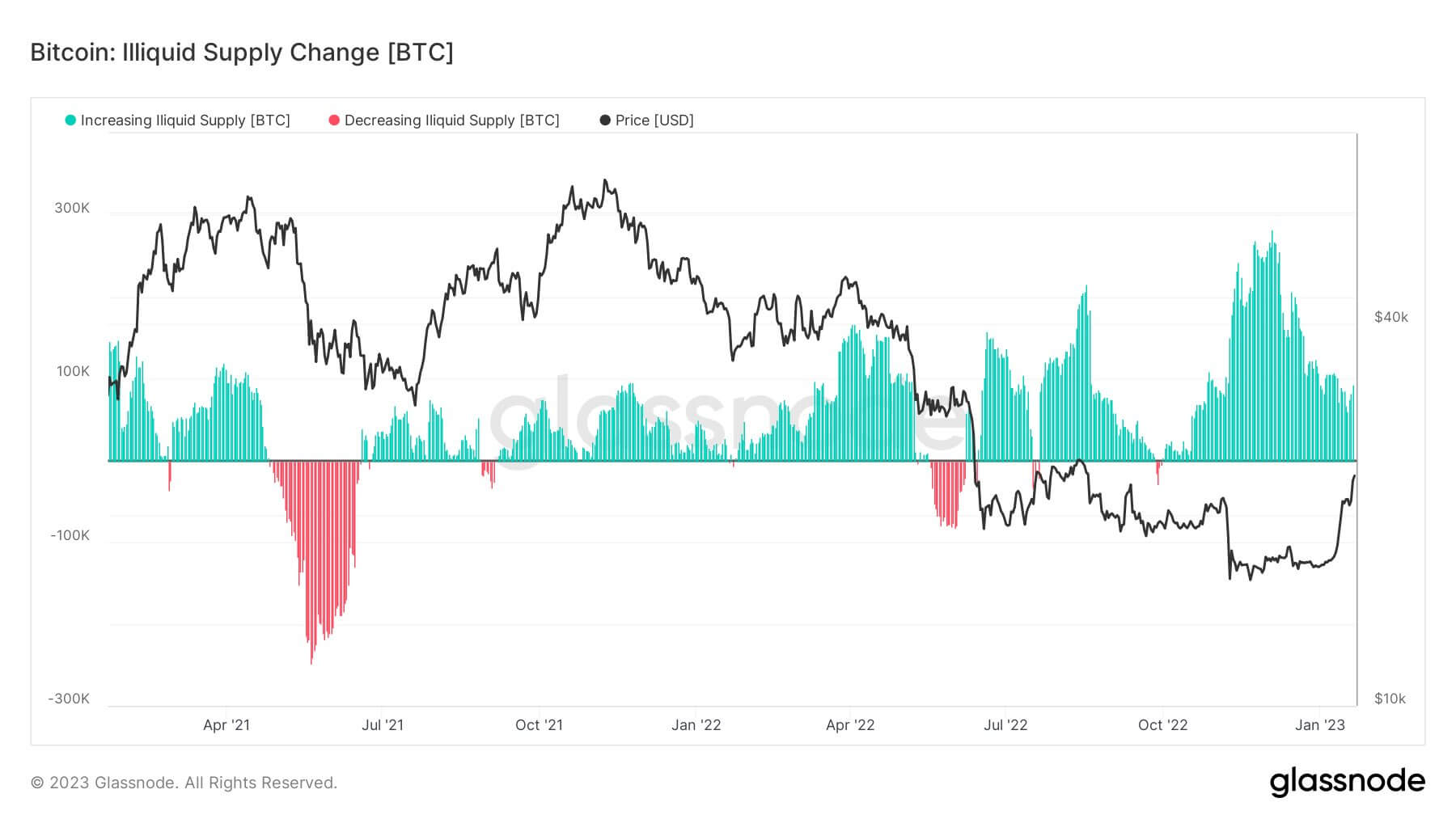

80% of BTC is illiquid

Investors have been accumulating BTC over the past few months. However, cCyptoSlate An analysis on December 13, 2022 revealed that the amount of BTC present on exchanges reached its lowest level since 2018.

Withdrawals have also been massive, with over $2 billion in BTC withdrawn from Coinbase at the end of November. On December 23rd, Binance lost his 90,000 BTC from its reserves in one week. In his first 10 days of 2023, another $120 million worth of his Bitcoin was withdrawn from various exchanges.

Current indicators show BTC bottoming out since January 19. On January 21, BTC broke through the $23,000 level, registering a 50% increase from the bear market low of $15,400. bottom. However, the price increase did not stop BTC withdrawals. A0,000 BTC was withdrawn from the exchange on January 20th, with the majority of it being withdrawn from Binance.

The data also shows that large amounts of BTC withdrawn are being sent to cold storage. For example, 450,000 BTC held in hot wallets or exchanges was moved to cold storage in 2022.

In 2023, another 110,000 BTC has been sent to cold storage so far. This brings the amount of illiquid BTC held in cold wallets to a record high of 15.1 million coins. This volume accounts for 80% of the total BTC circulation.

The chart above shows the less liquid BTC supply in the green zone and the liquid supply in red. BTC accumulation has led to a significant increase in illiquid supply since July 2022, except for brief periods in July and October.