Midas reveals $60M deficit, announces closure of operations

Crypto platform Midas Investment plans to close its business in 2022 due to significant losses incurred, according to Dec. 27. statement.

CEO Iakov “Trevor” Levin said the Midas DeFi portfolio lost 20% of its $250 million ($50 million) in assets under management. Trevor added that users have withdrawn about 60% of his AUM following the bankruptcies of crypto companies such as FTX and Celsius.

More than $100 million in debt

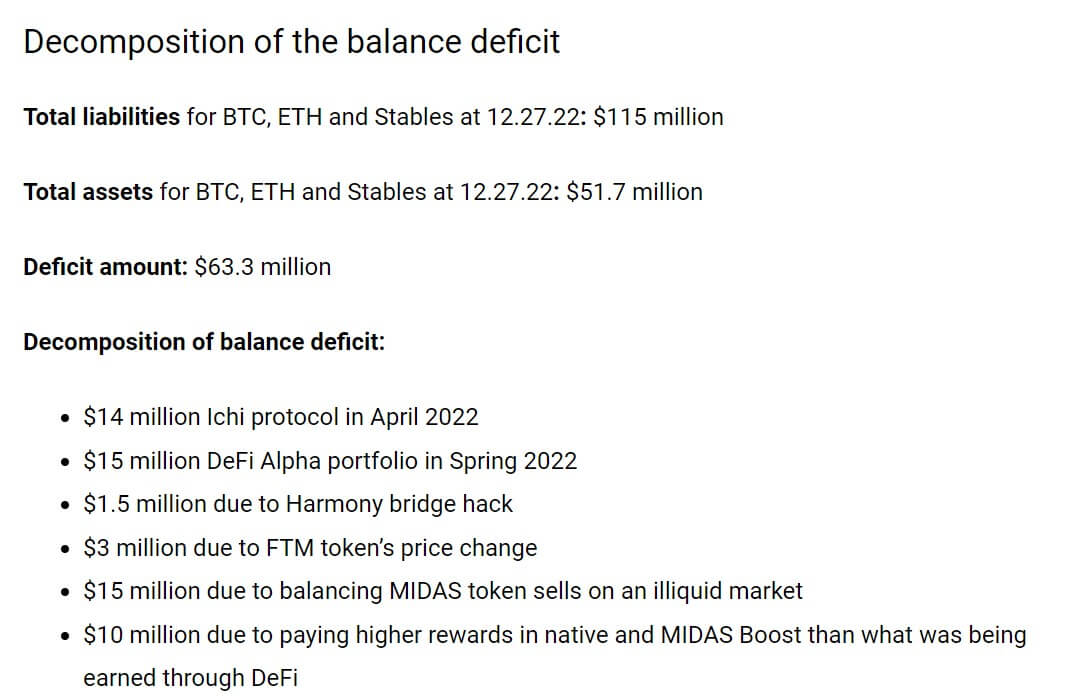

As of December 27, Midas had $115 million in total debt in Bitcoin (BTC), Ethereum (ETH), and stablecoins. However, the platform holds about $51.7 million of those assets, creating a deficit of $63.3 million. He added that only the company’s chief executive officer was aware of the asset shortfall.

“The asset shortfall was caused by the long-term risks of DeFi investments, the instability of business models after the loss of assets, and the illiquidity of the Midas token.”

Meanwhile, Trevor emphasized that Midas lost $58.5 million to multiple DeFi-related security breaches and overpaid interest on its native MIDAS token.

What next?

CEO Trevor said Midas will deduct 55% from user accounts to balance user accounts and earned rewards. The move will allow the user to withdraw his 45% of the assets.

According to him, only the earnings are deducted for users with a balance of less than $5000. He added that Midas will pay the difference between his native tokens to be exchanged for the new project’s tokens.

The Midas CEO wrote that the platform aims to transform its business into centralized decentralized finance (CeDeFi). He said:

“This project is completely transparent, on-chain and built with the goal of providing a new and improved investment experience.”