Miners are increasing their Bitcoin balances again

Bitcoin miners are the backbone of the cryptocurrency ecosystem due to their dual role of validating transactions and securing the blockchain. Their operational decisions, especially those related to Bitcoin reserves, can have a significant impact on market dynamics.

Strategic choices by miners to hold or liquidate their Bitcoin earnings can have a significant impact on the supply and demand balance of the market.

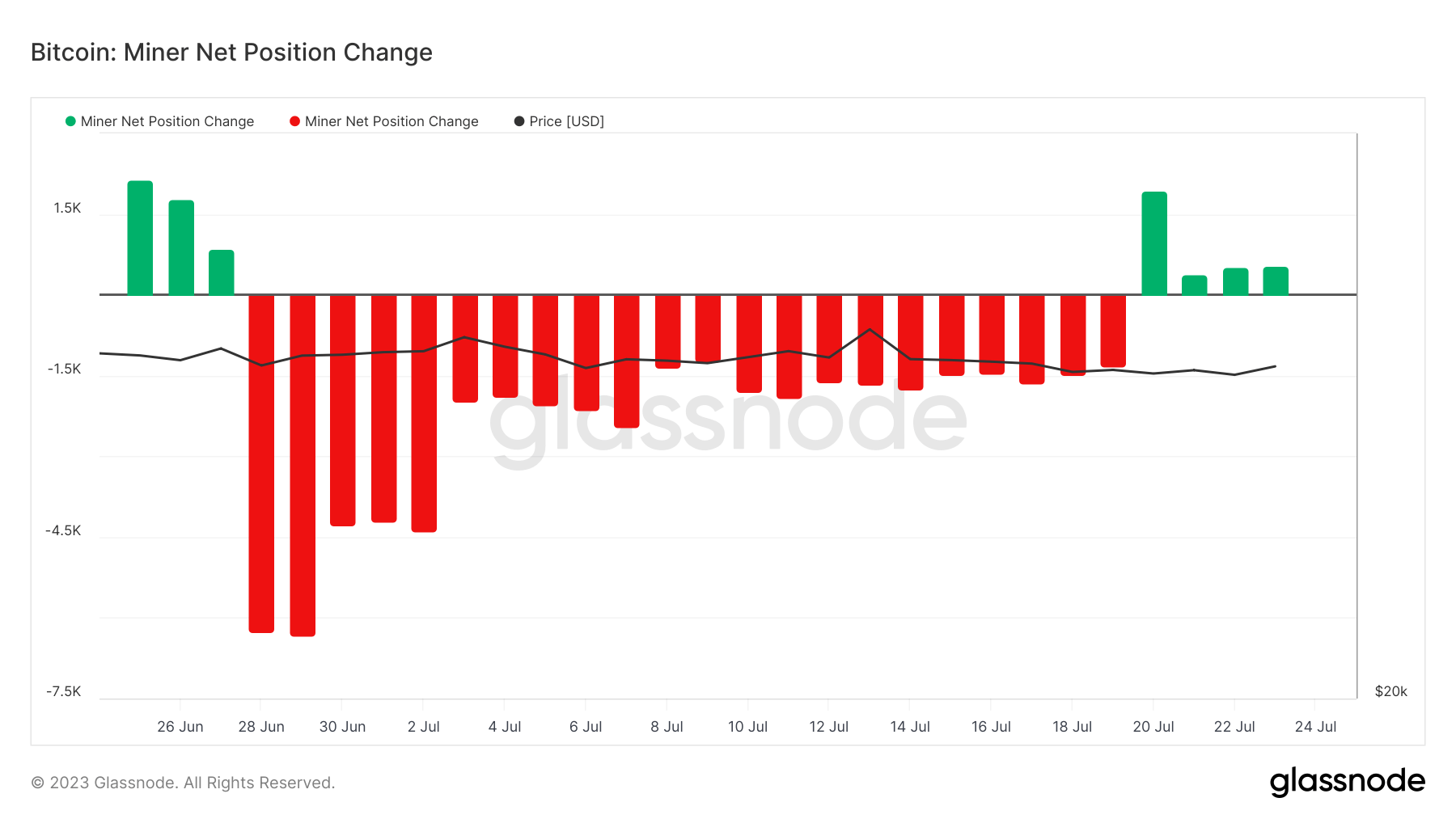

Historically, changes in minor positions have been closely tied to Bitcoin price volatility. Negative changes, where miners sell more Bitcoin than they earn, are often correlated with short-term price stagnation and long-term downtrends or bear markets. This is probably because such selling increases the supply of Bitcoin in the market, putting downward pressure on the price.

On the one hand, a positive change in miners accumulating more bitcoins than they sell could support price increases. This is because accumulation reduces the supply of bitcoin in the market, leading to a sustained or higher price.

Throughout 2023, miners have spent most of the year increasing their Bitcoin positions, indicating bullish sentiment. However, the market has had several periods of negative position changes, each correlated with increasing or decreasing price volatility.

In July, miners spent almost a month increasing their holdings.

This trend changed on July 20, when data from Glassnode showed a positive change in minor positions. Between July 20th and he July 24th, miners added over 451 BTC to their holdings. Accumulation of bitcoins by miners could be a bullish sign for the market as it could reduce bitcoin supply in the market and support or even increase prices.

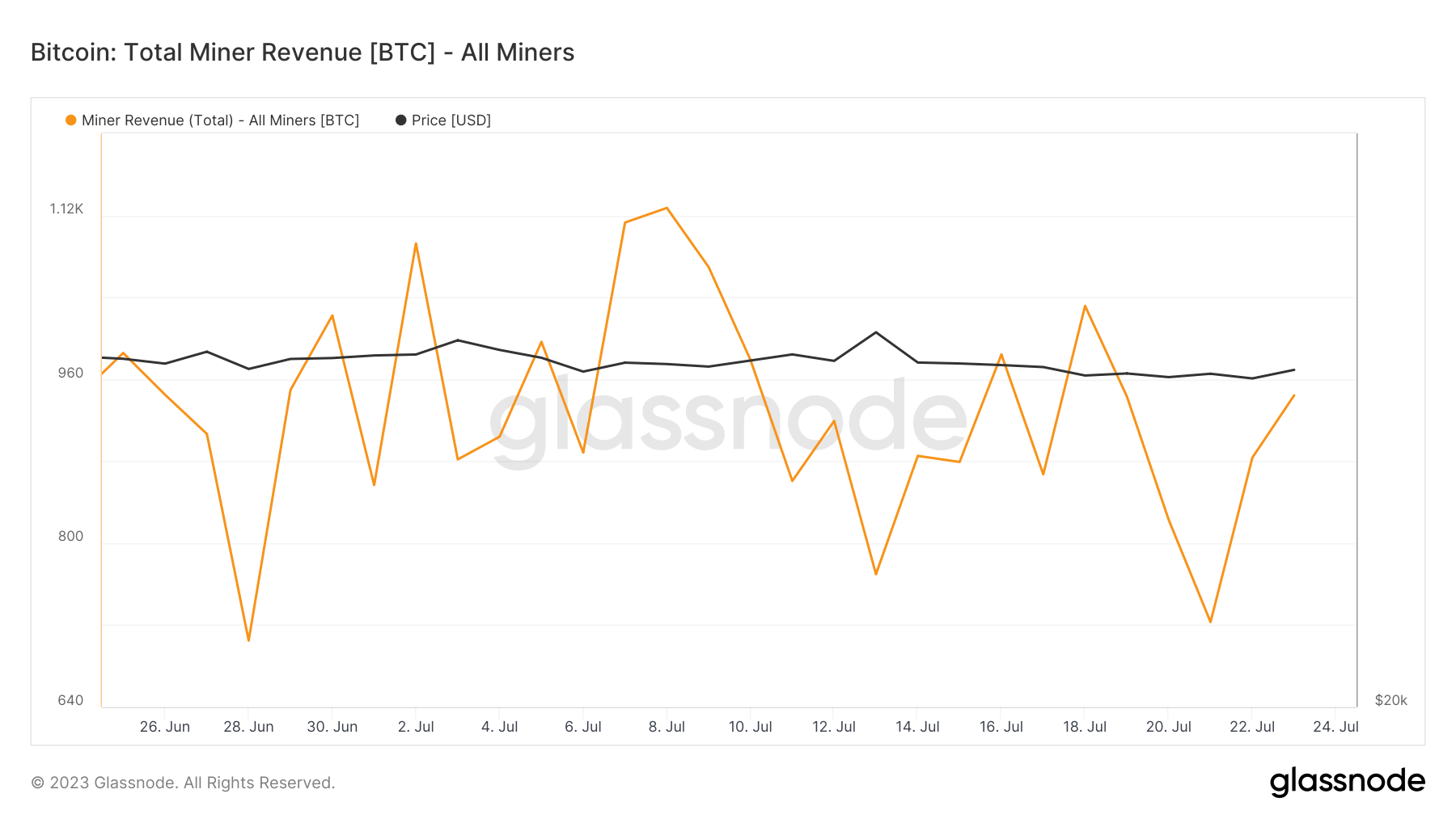

However, it is not only miner behavior that can affect the Bitcoin market, it can also affect revenue. Miner revenue combined from fees and block rewards plummeted on July 21st, but he has since recovered to the level recorded on July 19th of 944 BTC. Despite consistent fluctuations in minor earnings, the earnings recorded on July 24 are in line with the monthly average.

Interestingly, miners are increasing their holdings even though revenues have remained fairly flat. This could indicate bullish sentiment among miners who choose to hold onto Bitcoin rather than sell it for immediate profit. This action could be a reaction to market expectations or a strategic move to influence market dynamics.

Despite flat earnings, miners’ recent increase in bitcoin holdings suggests bullish sentiment in this major market group. It could have a positive impact on the Bitcoin price in the short term.

However, miner actions alone cannot exert enough pressure on the market to push the price of Bitcoin above its current level.

A post about miners increasing their bitcoin balances again first appeared on CryptoSlate.