Mt. Gox’s leading creditors opt for Bitcoin payment that guarantees 90% of funds owed

Mt. Gox’s two largest creditors, now defunct cryptocurrency exchanges hacked In 2014, it led to a loss of 850,000 BTC, but chose an early lump sum payment option that did not require the sale of its Bitcoin holdings.

The payment is scheduled for September 2023, CoinDesk reported on Feb. 16.

The option to wait for all Mt. Gox lawsuits to settle could offer a higher payout, but could take another five to nine years, sources said. By opting for early payments, creditors can receive payments sooner and avoid potential market impact resulting from a large Bitcoin sale.

The two largest creditors of Mt. Gox, a cryptocurrency exchange that collapsed in a hack nearly a decade ago, have mostly opted for bankruptcy recovery in bitcoin (BTC), according to sources.

These creditors, Bitcoinica, the now-defunct New Zealand-based cryptocurrency exchange, and the MtGox Investment Funds (MGIF), which accounted for about one-fifth of all Mt. Receive 90%. It is estimated to be around 21% of its original holdings on the platform at the time of the hack.

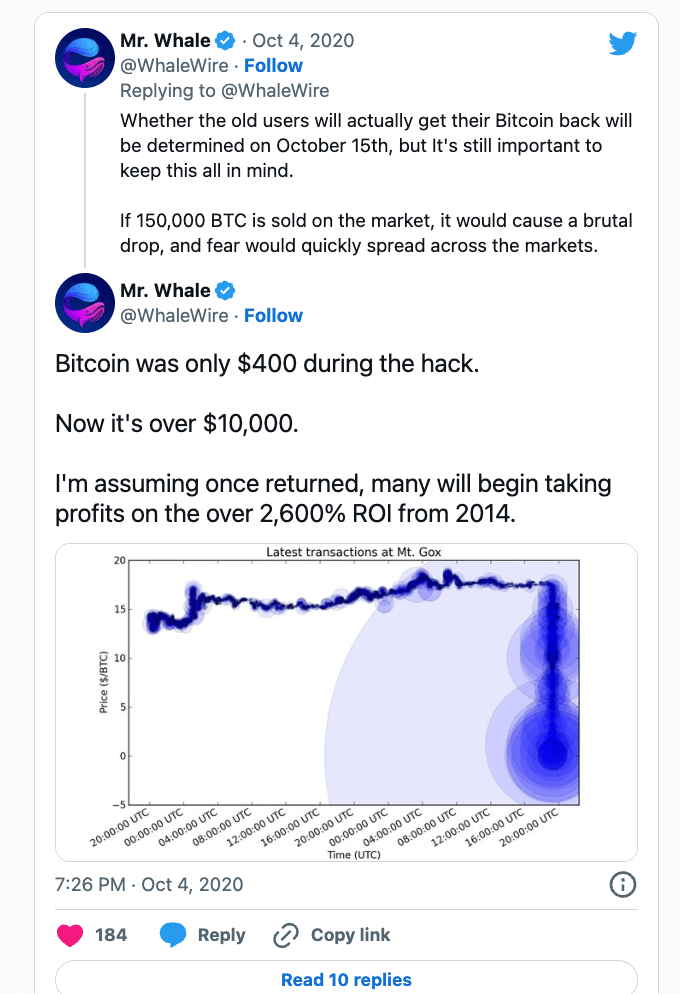

In 2014, hackers stole 850,000 BTC worth $460 million at the time. After the hack, Mt. Gox was left with about 142,000 BTC, 143,000 Bitcoin Cash (BCH), and 69 billion yen.

According to CoinDesk sources, creditors who opt for the lump sum payment option can choose to receive payments in a combination of BTC, BCH and Yen, or request to receive the full amount in fiat currency. By opting for early payment, Bitcoinica and MGIF have also decided to receive crypto options. This means that the majority of payments are made in his BTC.

If the creditor refuses to make an early lump sum payment, the only remaining recourse is to wait for the conclusion of the civil rehabilitation proceedings. This includes a lawsuit against Mt. Gox’s property by Coinlabs. While this option may result in a slightly higher recovery rate, there is no guarantee that the creditor will not fall below his 90% of recoverable holdings guaranteed by the lump sum payment.

Additionally, a legal analysis by a Japanese law firm suggests that holdouts can wait years for their money to be returned.

Creditors have until March 10, 2023 to decide whether to accept the early lump sum offered or wait for potentially larger payments at an unspecified time in the future.

Analysts are concerned that the big Bitcoin sell-off could continue as expected payouts are likely months away.