NFT lending hits all-time high in loan volume, users, quantity

NFT lending was the strongest month through January with monthly transaction volume of $444 million.

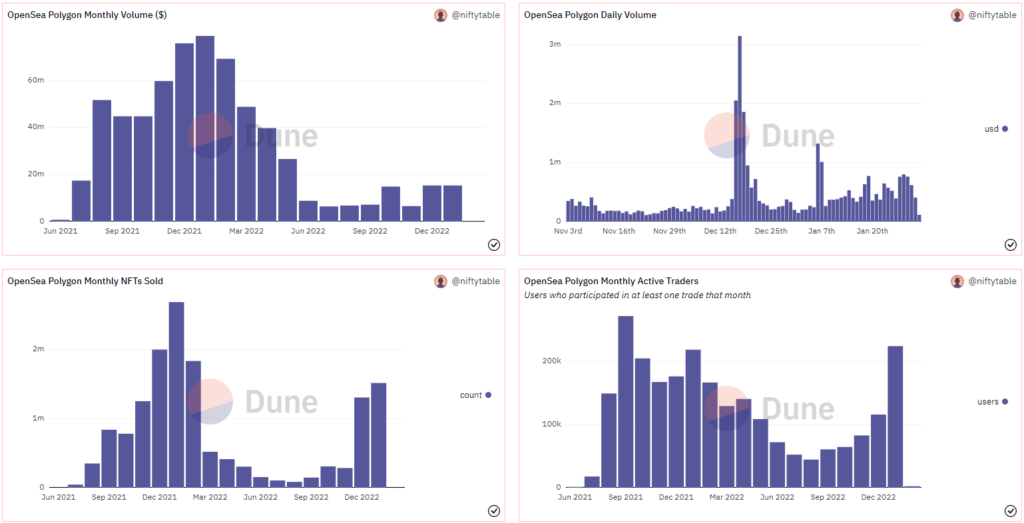

new report From NFTGators, they noted a “significant spike in NFT activity” as Polygon NFTs once again surpassed Ethereum by volume. An increase in NFT lending is partly responsible for the increase in activity. BendDAO hit its biggest trading volume in January with $36 million.

NFT activity increases

The increase in NFT lending is part of a broader NFT resurgence. OpenSea activity increased as 319,641 Ethereum users sold 1,132,681 NFTs and 224,719 Polygon users traded 1,514,895 NFTs in January.

As a result, the average NFT on Ethereum traded at $1390 and bought an average of 3.54 NFTs. On the other hand, the selling price on Polygon was only $69 and his average of 7 NFTs per user. Thus, Ethereum traders spent an average of $4,920 while Polygon traders invested $483.

The graph below visualizes the Polygon NFT activity data and rise.

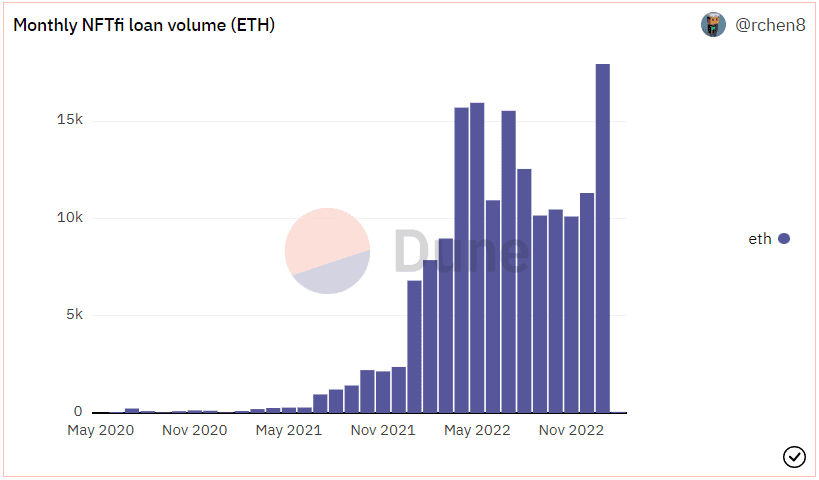

Surge in NFT lending

The report revealed that 17,900 ETH was distributed through 4,399 loans. Loans averaged 4 ETH per loan, 29 ETH per borrower and 61.5 ETH per lender.

Increased activity has also reduced the cost of NFT loans. Lenders pay an average of $90 in interest per loan.

Outside of market leader BendDAO, other platforms such as NFTfi, X2Y2 and Arcade accounted for an additional $44.8 million.

During the 2021 NFT bull market, loan volumes are below 1,000 ETH per month, having previously peaked just before the Terra Luna crash in May 2022.