Oldest Bitcoin holders start selling; FTX court filing reveals SBF’s $1B loans from Alameda

Biggest news in the cryptoverse on November 17th included high selling tendencies among Bitcoin holders aged 10+, SBF’s $1.6 billion personal loan from Alameda Research, Bitcoin and Ethereum second and third including appearing as a crypto asset sold short on

CryptoSlate Top Stories

Who sold the most BTC in the aftermath of the FTX collapse? 10-year holders sell at record rates

While the price of Bitcoin (BTC) plunged to $15,000, the collapse of FTX put a lot of pressure on investors.

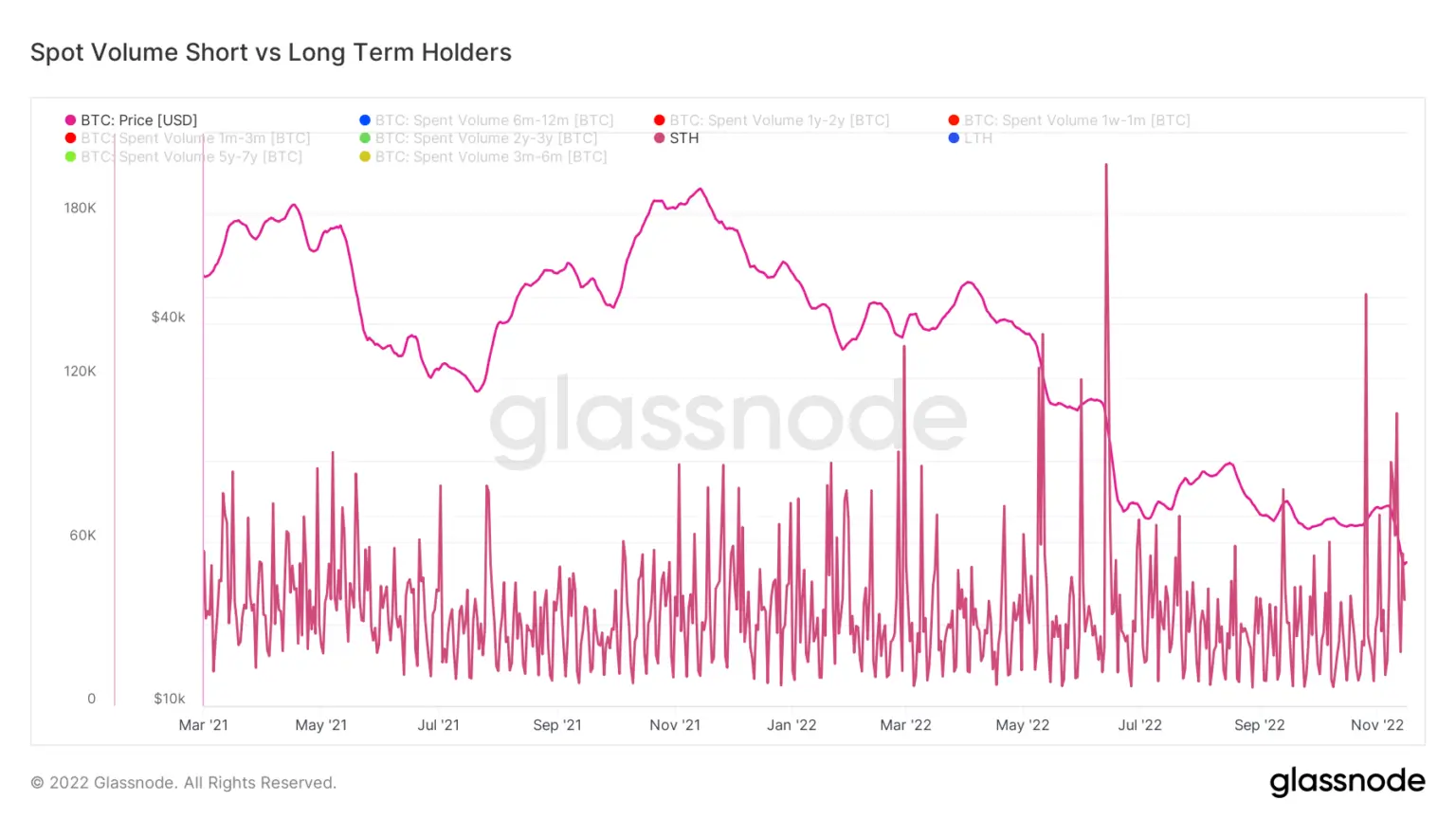

To uncover where the selling pressure is coming from, CryptoSlate analysts examined short-term (STH) and long-term holders (LTH).

As history shows, LTH was the first to sell the coin when numbers began to decline, but the turmoil that followed FTX’s demise did nothing to shake the confidence of long-term holders.

Instead, the market recorded the fifth highest number of STH sellers since March 2021. This equates to around 400,000 bitcoins sold by STH between November 10th and November 17th.

FTX Bankruptcy Court Filing Reveals Alameda Offered $1.6 Billion Loans To SBF And Others

FTX’s new CEO John Ray III’s court filings reveal that Sam Bankman Fried (SBF) has acquired a $1 billion personal loan from Alameda Research.

Ray called the situation “a total failure of corporate control and a total lack of reliable financial information.”

The filing also reveals that Alameda has lent FTX engineering director Nishad Singh $543 million and FTX co-CEO Ryan Salame $55 million.

Bitcoin, Ethereum Shorts Second and Third Most Due to FTX Collapse

After the FTX demise, Ethereum (ETH) became the second shorted cryptocurrency on the market, followed by Bitcoin in third place.

According to the average funding rate set by the exchange for perpetual futures contracts, long positions are paid out periodically, while shorts are paid out whenever the percentage of the rate is positive. The recent severely negative fund rates indicate that a recession is on the horizon before the market begins to recover.

Genesis seeks $1 billion emergency loan but fails

As reported by The Wall Street Journal, crypto lender Genesis sought a $1 billion emergency loan from investors but failed to get one.

The report noted that Genesis sought funding due to a “liquidity crisis due to certain illiquid assets on its balance sheet.”

FTX attackers continue to exchange tokens. Exchange $7.95 Million BNB to BUSD, ETH

FTX attackers were swamped on November 17th, losing about $600 million in a single day. I exchanged 30,000 BNB tokens for Ethereum and Binance USD (BUSD) in 3 transactions.

The exploiters currently hold $11.8 million in BNB and ETH, worth approximately $346.8 million at current price levels.

President Bukele Reveals El Salvador Will Buy 1 Bitcoin Every Day

El Salvador President Naive Bukele has announced that he will start buying 1 bitcoin every day starting November 18th.

i am buying one #bitcoin Every day from tomorrow.

— Nayib Bukele (@nayibbukele) November 17, 2022

El Salvador has been heavily criticized for investing in Bitcoin. However, the country did not give in and continued to express its confidence in cryptocurrencies. El Salvador spent over $100 million to acquire her 2,381 bitcoin he currently holds.

Mainstream media called for gaslighting Sam Bankman-Fried’s good man story

The cryptocurrency community reacted to mainstream media outlets for publishing articles supporting SBF even after the demise of FTX.

The community recalled the imprisonment of Tornado Cash developer Alexey Pertsev and expressed frustration that SBF is free.

Yen reduces yield rate to 0%

Circle, the issuer of USD Coin (USDC), has cut its yield product’s APY rate to 0%, saying its yield product is over-collateralized and protected by a “strong collateral agreement.” .

Circle’s official Twitter announcement also details an over-collateralized fixed-term yield product.

1/ Circle Yield is an overcollateralized fixed term yield product. Genesis is Circle’s counterpart in this product. As of November 16, 2022, Circle Yield has $2.6 million in outstanding customer loans, protected by strong collateral agreements.

— Circle (@circle) November 16, 2022

Singapore’s Temasek Cancels $275M FTX Investment, Miscalculates Trust in Sam Bankman-Fried

Singapore-based investment fund Temasek said it was canceling its $275 million investment in FTX, saying it had misjudged its “behavior, judgment and leadership beliefs” by investing in SBF.

The company said:

“The theme of investing in FTX was to invest in a major digital asset exchange. Protocol agnostic, with a fee income model, market-neutral exposure to the crypto market with no trading or balance sheet risk. will provide you.”

News around Cryptoverse

research highlights

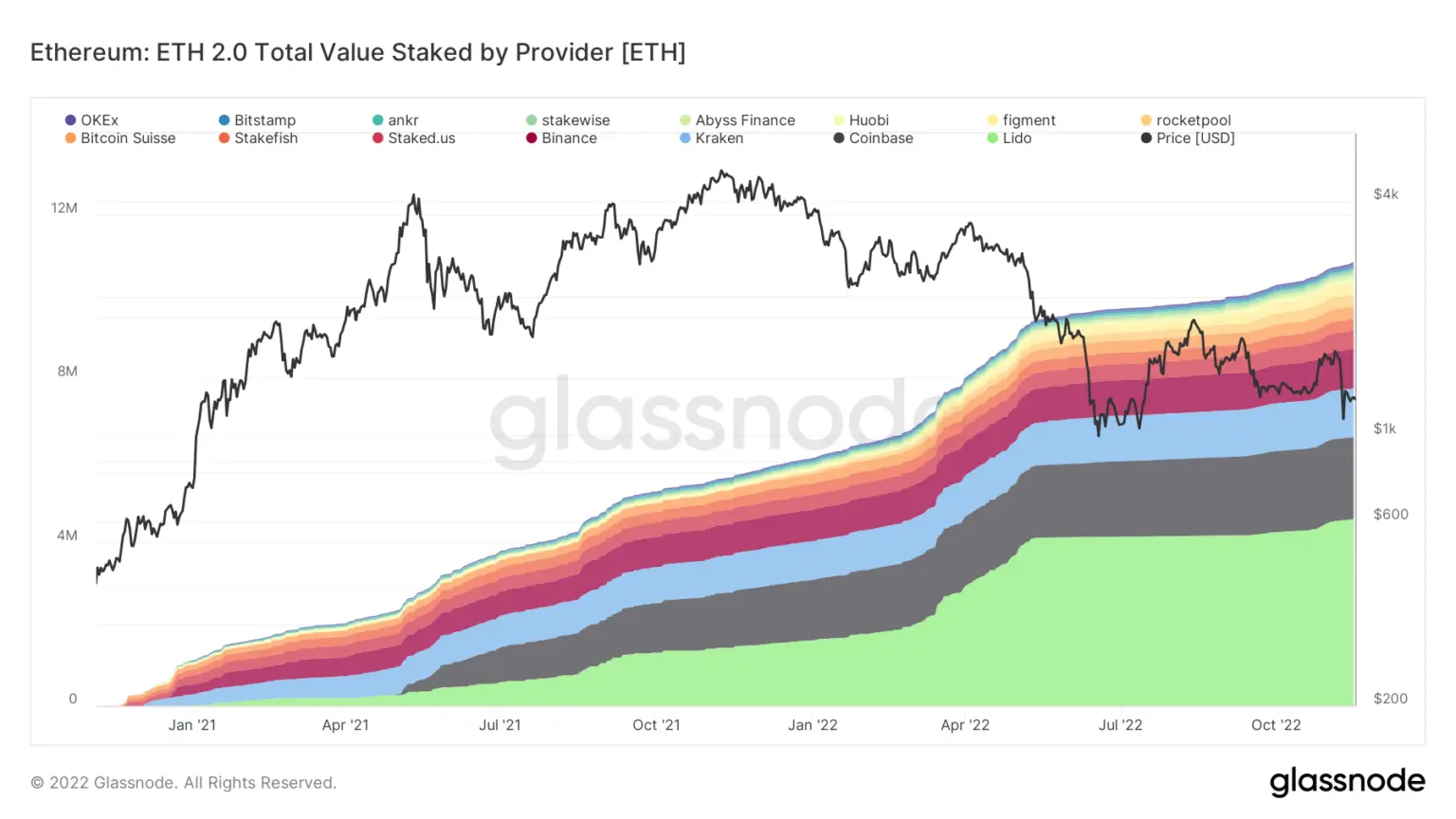

Research: 78% of all ETH staked is spread across four centralized providers.74% of all blocks are OFAC compliant

Analysts at CryptoSlate have examined Ethereum staking on-chain data, revealing that approximately 78% of all staked Ethereum is spread across four centralized providers.

There are currently 8-9 million Ethereum at stake on Lido (4.5 million), Coinbase (2 million), Kraken (1.2 million), and Binance (1 million).

Nearly 75% of all Ethereum blocks are considered OFAC compliant. 15% of all blocks generated by Ethereum are still not OFAC compliant and the remaining 11% are non-MEV-Boost blocks.

crypto market

Over the past 24 hours, Bitcoin (BTC) is up 0.58% to trade at $16,678, while Ethereum (ETH) is down 0.73% to trade at $1,202.