PC Shipments Drop Again in Q2, IDC Says

Global PC shipments fell 13.4% year-over-year in Q2 2023, according to the first data from . International Data Corporation (IDC). The economic slowdown marked the sixth consecutive quarter of contraction, driven by macroeconomic factors, lower demand across the consumer and commercial sectors, and a shift in IT spending away from device purchases. Still, IDC claims the market beat expectations for the quarter.

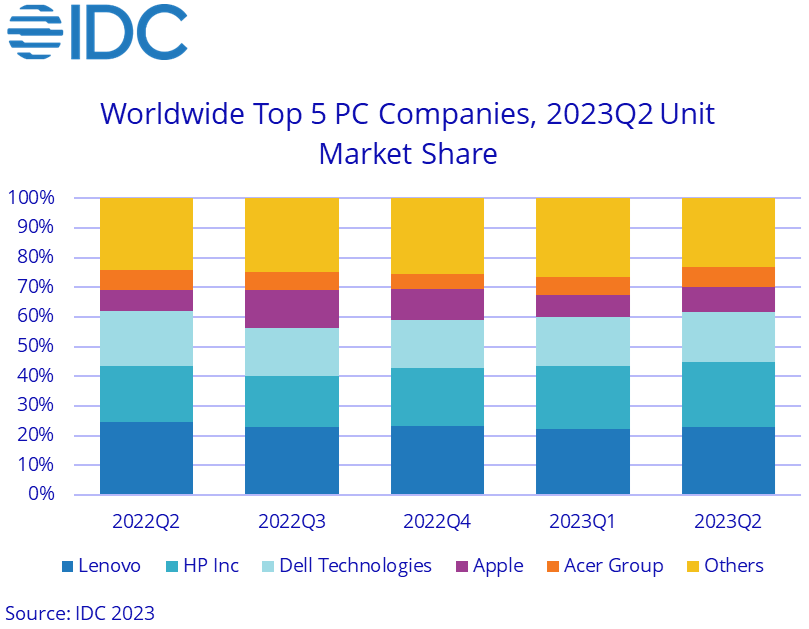

The industry shipped 61.6 million PCs in Q2 2023, down from 71.1 million in the same period last year. Lenovo remained the world’s largest computer supplier in the second quarter of 2023, shipping 14.2 million systems, but sales fell 18.4%. As a result, HP moved closer to the all-time leader, shipping his 13.4 million desktops and laptops in Q2 2023. Dell placed him third with 10.3 million PCs, while Apple sold 5.3 million of his machines in the same quarter, continuing to be his fourth-largest PC supplier in the world. Based on IDC data, Acer shipped about 4 million computers.

“The supply and demand roller coaster that the PC industry has faced over the past five years has been very difficult,” said Ryan Reith, Group Vice President, IDC Client Device Trackers. “Businesses don’t want to face a supply shortage like we have in 2020 or 2021, but they also seem hesitant to make big bets on a market recovery. We believe that consumers’ wallets will favor smartphones over PCs as the pre-pandemic habit of sharing computing needs across multiple devices changes. On the commercial side, there will be headcount reductions (in many large companies) and adoption of generative AI only. It would create even more confusion about where to put the already cut budget. “

All major PC makers except Apple and HP experienced double-digit declines during the quarter. Apple posted strong year-over-year growth as it faced supply constraints in the second quarter of 2022 as a result of COVID-19 related supply chain disruptions. Meanwhile, IDC said HP dealt with excess inventory last year and is now closer to normalizing inventory levels, resulting in better growth despite the slowdown.

Nonetheless, continued weakness in demand has resulted in inventory levels remaining elevated for extended periods of time, impacting both completed systems and supply chains at the channel level.

“Rising channel and component inventories are again dragging the market down,” said Jitesh Ubrani, research manager for mobility and consumer device trackers at IDC. “Even though these issues are gradually easing, PC makers and channels are still wary of new systems due to declining demand, while many of the components his suppliers have slashed prices to clear inventory. We continue to provide