Polygon (MATIC) price soared 233% in one month, what brought it out of the bear market?

Polygon TVL and market capitalization are gradually recovering as a result of exchange rate movements. This rise is out of the circle with its own advantages. The advantages of technical architecture, expansion plans and strategic layout have led many partners and contracts to settle on his Polygon. This includes Reddit’s recent announcement on his Polygon about the launch of his NFT’s avatar marketplace, and his collaboration with tech company Nothing to bring his Web3 to smartphones. Pushing him to be one of the few dark horses in the bear market.

Why is Polygon out of a bear market and why are its numbers showing signs of recovery?

Polygon: Connect Ethereum-compatible Blockchain Networks

Polygon is a protocol and framework for building and connecting Ethereum-compatible blockchain networks. Polygon is one of the sidechain solutions to make Ethereum more efficient and aims to solve some of Ethereum’s many problems, such as:

- low throughput

- Low UX (gas, PoW finality delay)

- No sovereignty (shared throughput/clogging risk, non-customizable tech stack, reliance on governance)

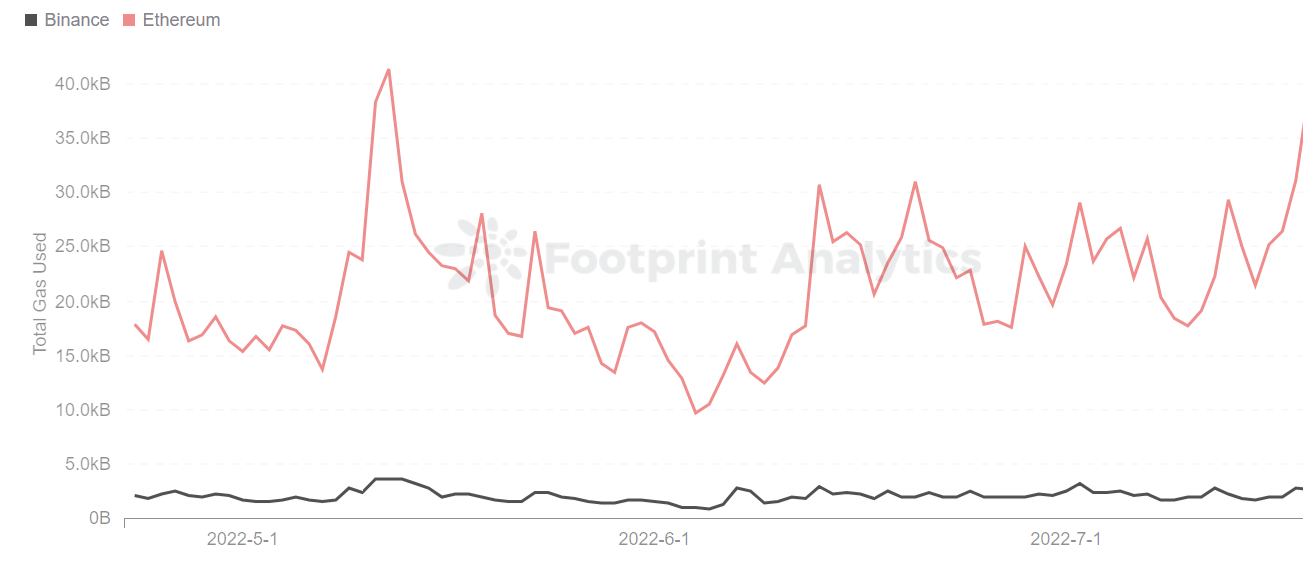

Polygon cross-chains assets on mainnet to Polygon and establishes sidechains for processing. Alleviate issues such as high gas prices and low throughput. This is why most project stakeholders use it as their preferred blockchain.

Benefits of Polygon’s 5 Solutions

Let’s take a look at some of Polygon’s most compelling features.

- Scalability: Polygon has a dedicated Wasm execution environment, a customized blockchain, and a scalable consensus algorithm. As a result, shorter transaction speeds and lower gas fees benefit both developers and participants.

- Ethereum compatibility: With an industry-leading and well-established technology stack, tools, languages, standards, and enterprise acceptance, Polygon is interoperable with Ethereum and other blockchain networks for exchanging arbitrary messages. .

- modular design: Polygon’s modularity enables customization, upgradability, faster time to market, and community collaboration. Community participation has led to a growing collection of modules for developing custom networks that allow greater customizability, scalability, upgradability, and faster access to market.

- Interoperability: Polygon uses a technology called Plasma to process transactions off-chain before confirming them on Ethereum. Polygon aims to be a complete framework for developing interoperable blockchains. It has built-in support for arbitrary message passing (tokens, contract calls, etc.) so you can connect to external systems.

- User experience: Polygon requires no protocol knowledge, token deposits, or approvals. Modular design also makes it easy to create customized solutions and add new features. It also has low transaction costs (about 10,000 times less than Ethereum per transaction) and fast transaction speeds (up to 7,000 tx/s).

These advantages are enough to promote the development of DeFi, NFT, Web3, and GameFi projects on Polygon’s chain, making Polygon stand out among many blockchains.

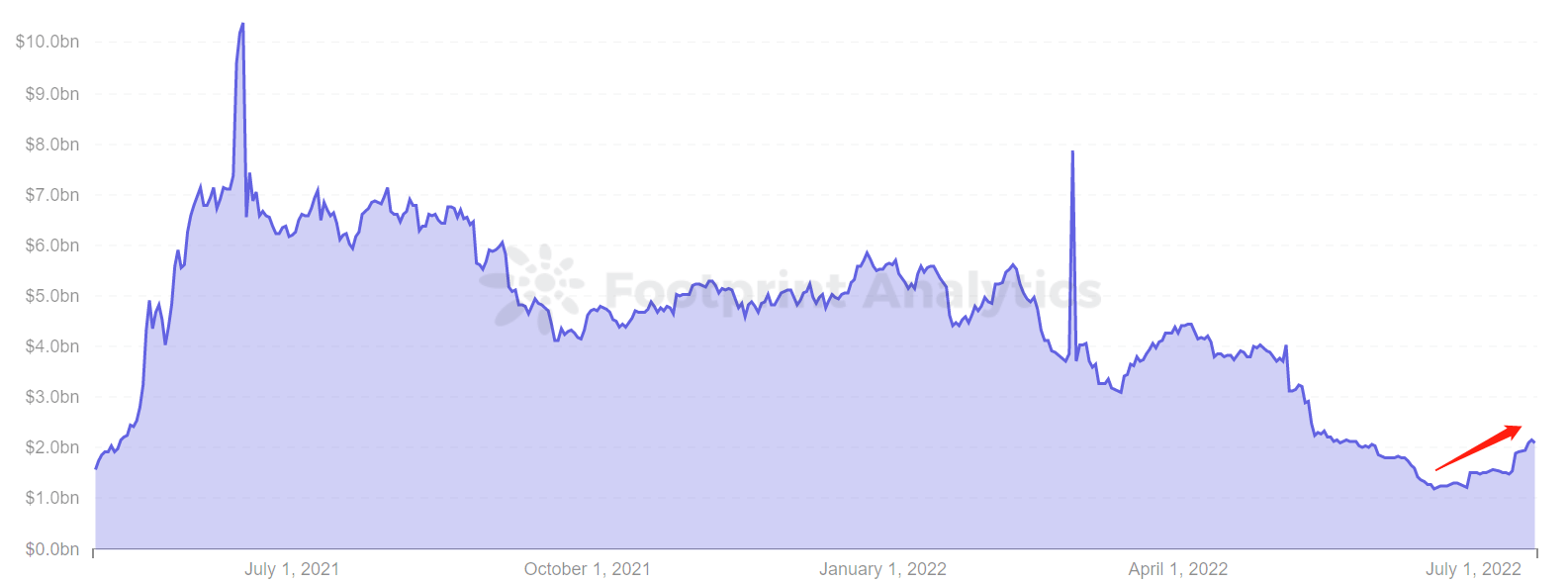

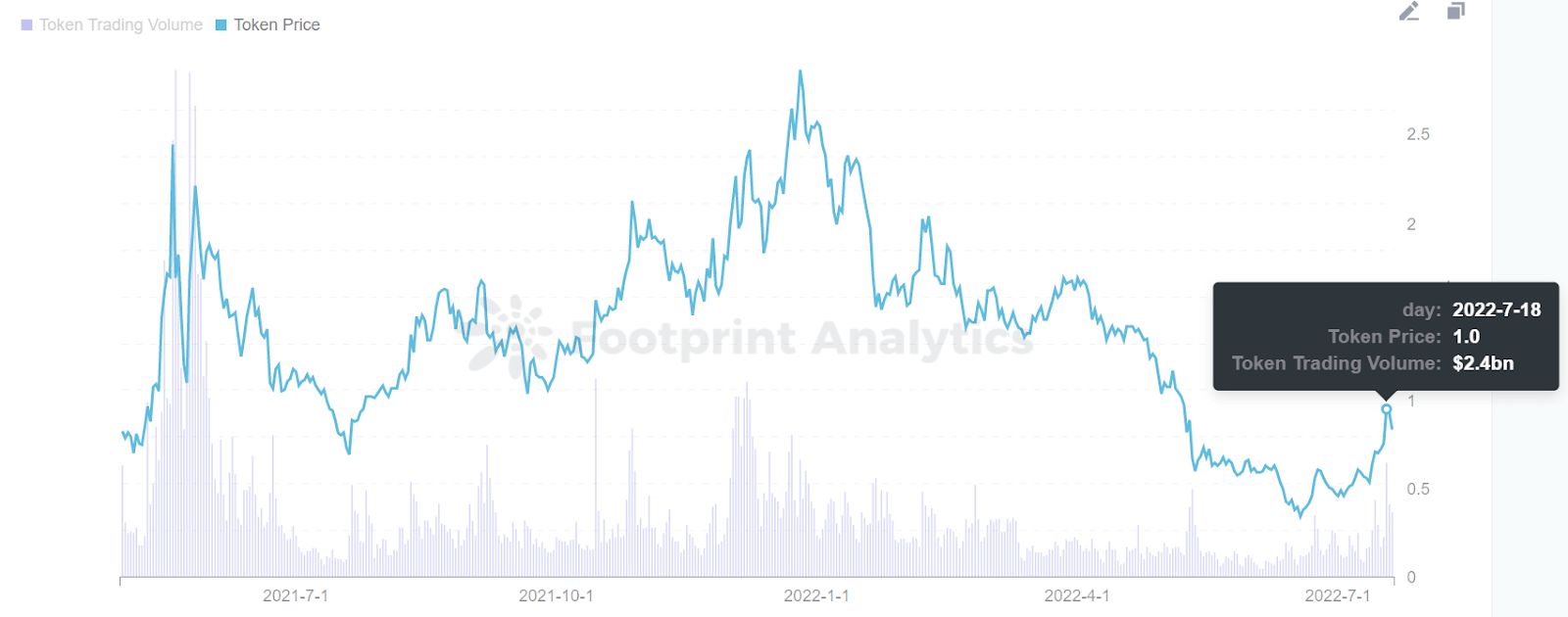

According to Footprint Analytics, Polygon’s TVL and MATIC are showing signs of recovery, with TVL up 75% from $1.2 billion on June 20th to $2.1 billion on July 20th. among many blockchains.

Polygon’s ecosystem expands from DeFi to NFT and more

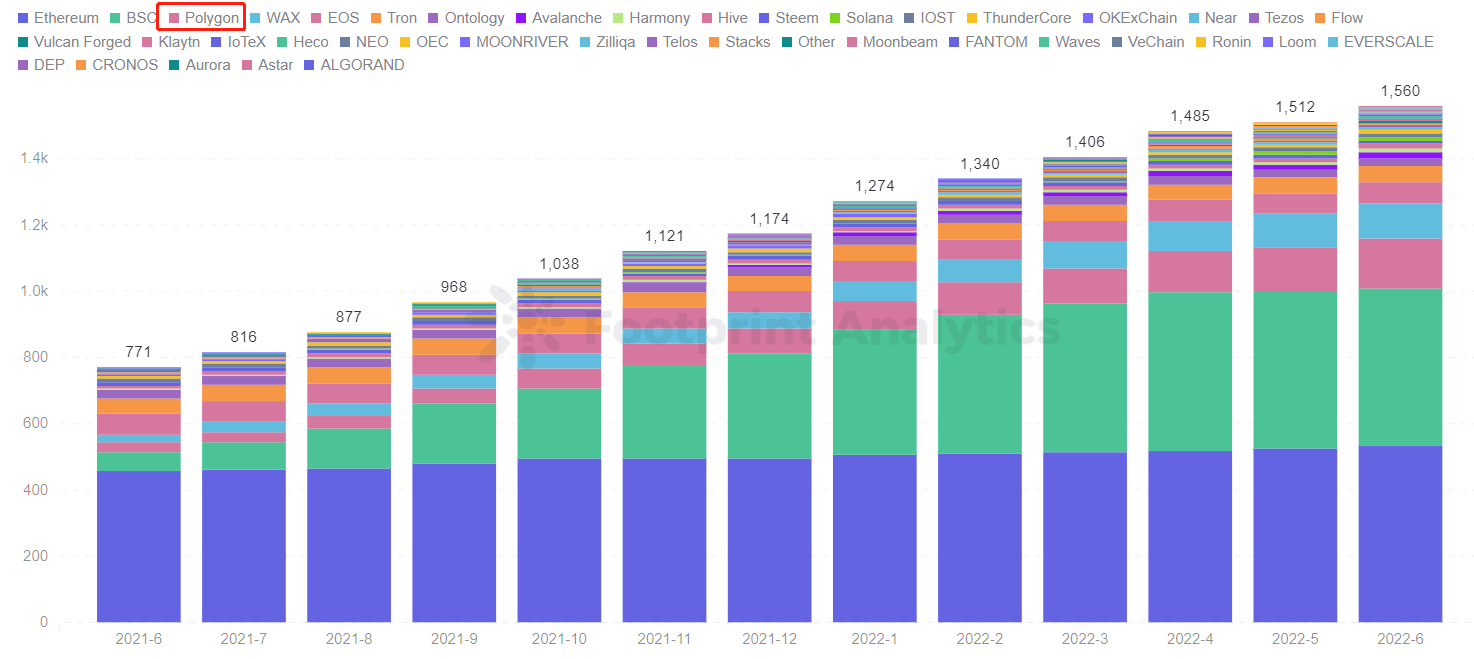

Last year, the protocols on the Polygon network were mostly from various blue chip DeFi projects on Ethereum, including giants like Curve and Aave. However, since the beginning of the year, with the rise of GameFi, NFTs and Web3, Polygon’s cheap and fast advantage has been vividly reflected in these sectors.especially game phi By sector, Polygon jumped to number three in WAX for number of projects.

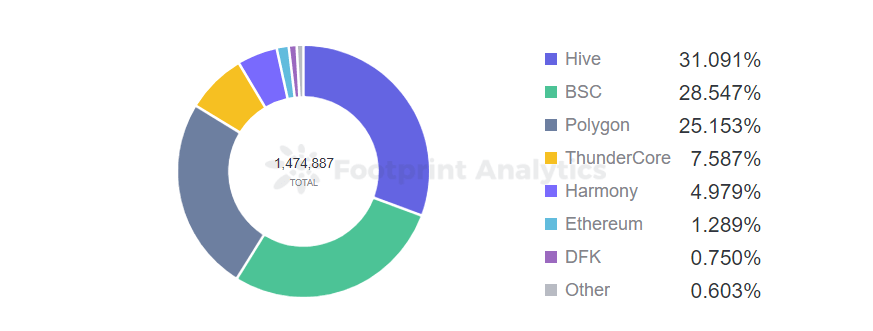

Additionally, Polygon accounts for 25% of GameFi’s total active users, gradually splitting the number of Ethereum and BSC chains. The reason for this phenomenon is that, on the one hand, frequent exchanges between the game and the chain lead to a surge in transactions, and low fees may be more attractive to users. It depends greatly. Polygons therefore have edges.

Not only that, Reddit recently announced the launch of an NFT-based avatar marketplace on Polygon. The move has awakened whales and increased holdings of MATIC, whose price has shown a small rise to help Polygon emerge from the bear market.

Overview

Polygon’s arrival was actually to provide more support for the Ethereum network, and it is destined for a strong position in some areas due to its advantages of low transaction fees and high throughput.

With GameFi’s active users and Reddit’s timely launch of a new NFT avatar marketplace, Polygon is showing signs of recovery from the bear market.

The footprint analysis community considers this work July 2022 By Vincy.

Data Source: Footprint Analysis – polygon dashboard

The Footprint Community is a place to help data and crypto enthusiasts around the world understand and gain insights about Web3, the Metaverse, DeFi, GameFi, or any other area of the emerging blockchain world. Here you’ll find vibrant and diverse voices who support each other and move the community forward.