Retail begins accumulating Bitcoin while whales continue to sell

According to data analyzed by , retail investors holding less than 1 BTC are accumulating bitcoins, while whales holding more than 10,000 BTC are selling. crypto slate.

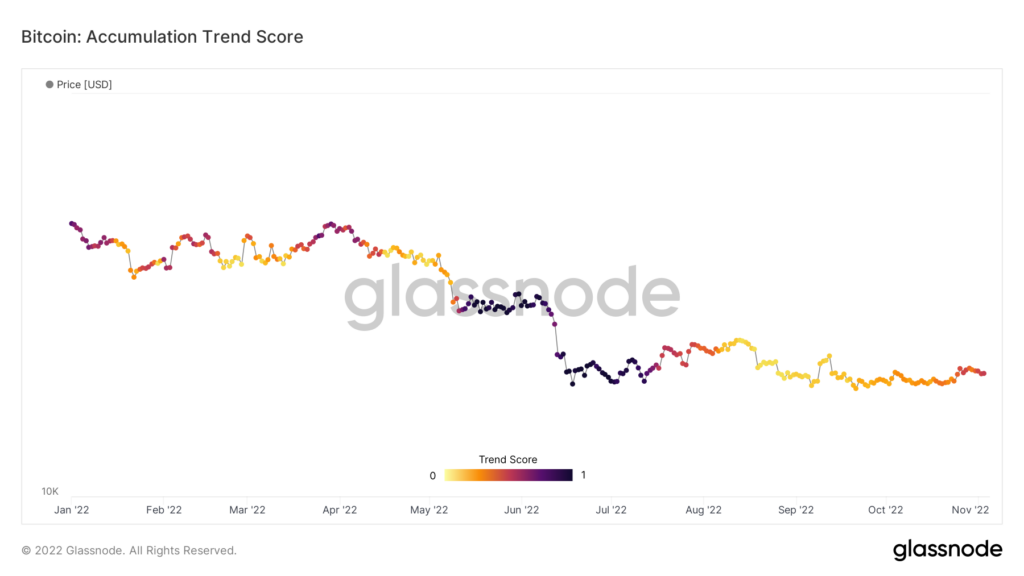

Bitcoin has been in circulation since August, as indicated by the lighter colors in the chart below. Darker colors indicate accumulation periods seen throughout May, June and July. The first graph below shows Bitcoin’s cumulative trend score for all coin holders.

During the May recession started by the Terra Luna collapse, investors continued to accumulate bitcoin and buy dips. However, that trend ended in August as sentiment turned bearish and bitcoin remained flat throughout the third quarter. It seems that wasn’t enough to keep it below $18,000 over the years.

Bitcoin’s ability to hold around $20,000 throughout the third quarter underscores strong support at this level as selling pressure continues. The top cryptocurrency by market capitalization has been range bound since mid-August, trading between $18,000 and $22,000 across the board.

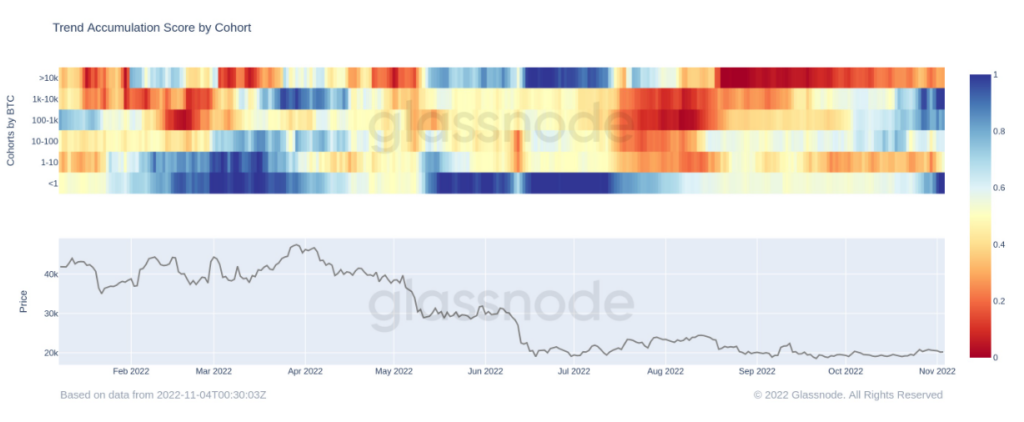

However, analyzing bitcoin holders divided into cohorts based on the amount of BTC held in their wallets reveals more detailed insights into trends. Bitcoin holders below 1 BTC entered the accumulation phase again in late October, similar to holders of 10,000 BTC from 1,000 BTC. Holders of 10,000 BTC and above continue to sell as they have since mid-July.

The chart below clearly shows different trends among different cohorts of bitcoin holdings. Investors with less than 1 BTC have historically purchased larger whales at different times.

In March, small retail investors bought a lot of bitcoin, but whales started selling around the same time. It was only his June and his July this year that there was a clear similarity between retailers and whales.

Bitcoin whales may still be distributing coins through consistent sales, but there have been signs of a reversal in recent weeks. suggests a more neutral position.

Given the lack of volatility in bitcoin prices since the summer, both whales and retail investors who bought bitcoin in June and July may be profitable or close to breakeven. Over the past week, Bitcoin has risen 11% after testing the $18,500 support several times.

While the larger whale is still in circulation, it has also started accumulating bitcoin worth less than 10,000 BTC but over 1,000 BTC as of the end of October.